ตั้งแต่ปี 2024 เป็นต้นไป การออกใบแจ้งหนี้ทางอิเล็กทรอนิกส์มีผลบังคับใช้กับผู้จ่ายภาษีมูลค่าเพิ่มส่วนใหญ่ในอิตาลี ธุรกิจและผู้ประกอบอาชีพอิสระต้องปรับตัวตามระเบียบข้อบังคับใหม่เกี่ยวกับการออกใบแจ้งหนี้โดยใช้เครื่องมือการจัดการใบแจ้งหนี้อิเล็กทรอนิกส์เพื่อให้มั่นใจว่าจะปฏิบัติตามข้อกําหนดได้

แต่เครื่องมือการจัดการใบแจ้งหนี้อิเล็กทรอนิกส์คืออะไร เครื่องมือการจัดการใบแจ้งหนี้อิเล็กทรอนิกส์มีหลายประเภท โดยมีทั้งซอฟต์แวร์ที่ดาวน์โหลดได้สําหรับคอมพิวเตอร์ส่วนบุคคล (พีซี) โซลูชันบนคลาวด์ แอปพลิเคชันเดสก์ท็อปหรืออุปกรณ์เคลื่อนที่ ทั้งแบบฟรีและจ่ายเงิน บทความนี้จะให้ข้อมูลเกี่ยวกับการจัดการใบแจ้งหนี้อิเล็กทรอนิกส์ รวมถึงฟีเจอร์ซอฟต์แวร์หลักๆ ที่ควรพิจารณา หากคุณต้องการประมวลผลและจัดเก็บใบแจ้งหนี้อิเล็กทรอนิกส์อย่างมีประสิทธิภาพ

บทความนี้ให้ข้อมูลอะไรบ้าง

- ฟีเจอร์สําคัญของซอฟต์แวร์การจัดการใบแจ้งหนี้อิเล็กทรอนิกส์

- วิธีเลือกเครื่องมือการจัดการใบแจ้งหนี้อิเล็กทรอนิกส์ที่ดีที่สุด

- เครื่องมือจัดการใบแจ้งหนี้อิเล็กทรอนิกส์แบบฟรีกับแบบชําระเงิน

- ข้อกําหนดสําหรับการจัดเก็บใบแจ้งหนี้อิเล็กทรอนิกส์

- การเชื่อมต่อซอฟต์แวร์การจัดการใบแจ้งหนี้อิเล็กทรอนิกส์กับระบบธุรกิจอื่นๆ

ฟีเจอร์สําคัญของซอฟต์แวร์การจัดการใบแจ้งหนี้อิเล็กทรอนิกส์

ซอฟต์แวร์การจัดการใบแจ้งหนี้อิเล็กทรอนิกส์สามารถทําให้วงจรใบแจ้งหนี้ทั้งหมดทํางานโดยอัตโนมัติ ตั้งแต่สร้างและการส่งใบแจ้งหนี้ไปยังระบบการแลกเปลี่ยนของ Agenzia delle Entrate ไปจนถึงการกระทบยอดใบแจ้งหนี้และการจัดเก็บทางกฎหมาย ซอฟต์แวร์สามารถช่วยคุณปรับแต่งใบแจ้งหนี้ได้ตามความต้องการของธุรกิจ พร้อมทั้งป้อนรายละเอียดที่จําเป็น คําอธิบายผลิตภัณฑ์หรือบริการ และภาษีที่เกี่ยวข้อง และในบางกรณียังมีฟีเจอร์เพิ่มเติม เช่น การกําหนดเวลาหรือการวิเคราะห์ข้อมูลธุรกิจ

โดยทั่วไปแล้ว ซอฟต์แวร์การจัดการใบแจ้งหนี้อิเล็กทรอนิกส์จะนําเข้าใบแจ้งหนี้อิเล็กทรอนิกส์ขาเข้าโดยอัตโนมัติ ทําให้การกระทบยอดง่ายขึ้น และจัดเก็บใบแจ้งหนี้เหล่านั้นไว้ในระบบดิจิทัลตามนโยบายการเก็บรักษาข้อมูล

ฟีเจอร์สําคัญที่โซลูชันการจัดการใบแจ้งหนี้อิเล็กทรอนิกส์ควรมีได้แก่

- อินเทอร์เฟซที่สะดวกและใช้งานง่าย

- การันตีการปฏิบัติตามข้อกําหนด

- การรักษาความปลอดภัยข้อมูล

- การเชื่อมต่อระบบกับระบบธุรกิจอื่นๆ

- ความยืดหยุ่นและการขยายระบบเพื่อรองรับการเติบโตของธุรกิจ

- ทีมสนับสนุนลูกค้าโดยเฉพาะ

วิธีเลือกเครื่องมือการจัดการใบแจ้งหนี้อิเล็กทรอนิกส์ที่ดีที่สุด

การเลือกซอฟต์แวร์การจัดการใบแจ้งหนี้อิเล็กทรอนิกส์อาจทำให้รู้สึกยุ่งยาก โดยเฉพาะอย่างยิ่งหากคุณเพิ่งเริ่มหันมาใช้ระบบออกใบแจ้งหนี้อิเล็กทรอนิกส์ เรามาดูฟีเจอร์สําคัญที่สุดที่ควรพิจารณาในการเลือกซอฟต์แวร์การจัดการใบแจ้งหนี้อิเล็กทรอนิกส์กัน

- การเข้าถึงใบแจ้งหนี้ได้ทุกที่แบบออนดีมานด์ (กล่าวคือโซลูชันบนคลาวด์)

- การเข้าถึงด้วยอุปกรณ์เคลื่อนที่

- การจัดการวงจรการออกใบแจ้งหนี้อิเล็กทรอนิกส์ที่ครอบคลุมทั้งแบบแอคทีฟและพาสซีฟ

- ความสามารถในการจัดการเอกสารชนิดอื่นๆ เช่น เอกสารประมาณ Pro forma invoice (ใบแจ้งราคา) และเอกสารการจัดส่ง

- การจัดการข้อมูลมาสเตอร์ของลูกค้าและซัพพลายเออร์

- การกระทบยอดอัตโนมัติ

- นักบัญชีเข้าถึงใบแจ้งหนี้ได้โดยตรงเพื่อให้ติดตามใบแจ้งหนี้ได้อย่างง่ายดาย

- ตัวเลือกในการวิเคราะห์ข้อมูลเพื่อดูภาพรวมของต้นทุน ยอดขาย และกําไร

- การผสานการทำงานกับซอฟต์แวร์การจัดการธุรกิจอื่นๆ

- ฟังก์ชันการกําหนดเวลาเพื่อติดตามวันครบกําหนดชําระใบแจ้งหนี้อยู่เสมอ

- ความสามารถในการส่งการแจ้งเตือนการชําระเงิน

เครื่องมือจัดการใบแจ้งหนี้อิเล็กทรอนิกส์แบบฟรีกับแบบชําระเงิน

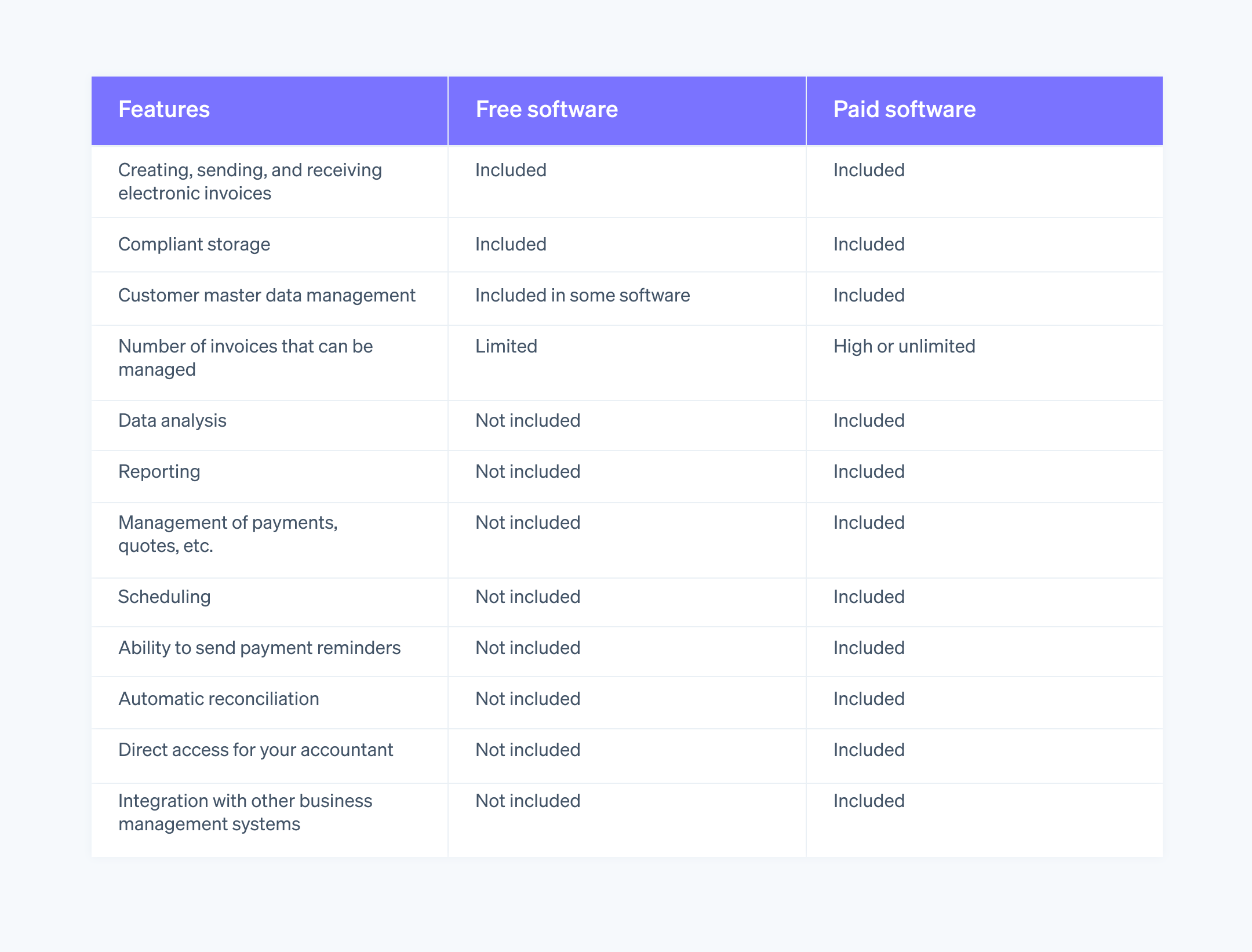

มีซอฟต์แวร์การจัดการใบแจ้งหนี้อิเล็กทรอนิกส์มากมาย ทั้งแบบฟรีและแบบชําระเงิน แล้วคุณสงสัยไหมว่าโซลูชันฟรีเป็นทางเลือกที่ดีที่สุด หรือควรลงทุนใช้เครื่องมือแบบเสียค่าใช้จ่ายดี เรามาดูข้อแตกต่างที่สําคัญๆ ระหว่างโซลูชันทั้งสองแบบกัน

เครื่องมือฟรีส่วนใหญ่มีเพียงฟังก์ชันพื้นฐาน เช่น ความสามารถในการออกและรับใบแจ้งหนี้ ส่งใบแจ้งหนี้ไปที่ระบบแลกเปลี่ยน และจัดเก็บใบแจ้งหนี้ตามข้อบังคับในการออกใบแจ้งหนี้ แต่บางโซลูชันอาจจะมีฟีเจอร์การจัดการข้อมูลมาสเตอร์ของลูกค้าเช่นกัน เครื่องมือการออกใบแจ้งหนี้อิเล็กทรอนิกส์ฟรีหลายตัวยังจํากัดจํานวนใบแจ้งหนี้ที่จะจัดการด้วย เครื่องมือเหล่านี้จึงมีประโยชน์ในระยะแรกของธุรกิจตอนที่ยังมีธุรกรรมจำนวนไม่มาก อย่างไรก็ตาม หากคุณต้องการใช้ฟีเจอร์ขั้นสูง ปกติแล้วคุณต้องใช้เครื่องมือการออกใบแจ้งหนี้แบบอิเล็กทรอนิกส์แบบชำระเงิน เนื่องจากเครื่องมือฟรีมักจะไม่มีฟีเจอร์อย่างเช่นการผสานการทํางานกับระบบธุรกิจอื่น ๆ และตัวเลือกในการจัดการการชําระเงิน ข้อมูลประมาณ และวันครบกําหนด นอกจากนี้ ซอฟต์แวร์ฟรียังต้องป้อนข้อมูลด้วยตนเอง ทำให้เพิ่มความเสี่ยงที่จะเกิดข้อผิดพลาดและมักจะไม่อนุญาตให้นักบัญชีของคุณเข้าถึงใบแจ้งหนี้โดยตรง

ต่อไปนี้เป็นรายละเอียดเพิ่มเติมเกี่ยวกับข้อแตกต่างทั่วไปของฟังก์ชันการทํางานในเครื่องมือการจัดการใบแจ้งหนี้อิเล็กทรอนิกส์แบบฟรีและแบบชําระเงิน

ข้อกําหนดสําหรับการจัดเก็บใบแจ้งหนี้อิเล็กทรอนิกส์

ใบแจ้งหนี้อิเล็กทรอนิกส์ต้องเป็นไปตามข้อกําหนดการเก็บรักษาข้อมูลทั้งสําหรับผู้ออกและผู้รับใบแจ้งหนี้ การปฏิบัติตามข้อกําหนดเหล่านี้ไม่ใช่อาศัยแค่การจัดเก็บใบแจ้งหนี้ไว้ในคอมพิวเตอร์เท่านั้น เช่น ในรูปแบบ PDF แต่การเก็บรักษาข้อมูลเป็นกระบวนการที่อยู่ภายใต้การกำกับดูแลของประมวลกฎหมายการบริหารจัดการระบบดิจิทัล (CAD) และต้องเก็บรักษาไว้เป็นเวลาขั้นต่ำ 10 ปี เพื่อให้มั่นใจว่าใบแจ้งหนี้จะไม่สูญหายและยังคงอ่านได้ชัดเจนและเข้าถึงได้ทุกเมื่อ

คุณสามารถใช้ซอฟต์แวร์การจัดการใบแจ้งหนี้อิเล็กทรอนิกส์ที่มีฟังก์ชันการจัดเก็บข้อมูลตามกฎหมายเพื่อเก็บใบกํากับภาษีอิเล็กทรอนิกส์ที่ออกและได้รับทั้งหมดได้ นอกจากนี้ Agenzia delle Entrate ยังให้บริการพื้นที่เก็บข้อมูลตามข้อกําหนดฟรีอีกด้วย และเข้าถึงได้ผ่านส่วน “Invoices and Receipts” บนพอร์ทัลเฉพาะของหน่วยงาน

การเชื่อมต่อซอฟต์แวร์การจัดการใบแจ้งหนี้อิเล็กทรอนิกส์กับระบบธุรกิจอื่นๆ

ซอฟต์แวร์การจัดการใบแจ้งหนี้อิเล็กทรอนิกส์ที่เหมาะสมจะเชื่อมต่อกับแอปพลิเคชันธุรกิจอื่นๆ เช่น แพลตฟอร์มอีคอมเมิร์ซ ระบบการจัดการลูกค้าสัมพันธ์ (CRM) เครื่องมือการตลาด และระบบการจัดการทางการเงินได้อย่างราบรื่น การเชื่อมต่อการทํางานนี้จะทําผ่านส่วนต่อประสานโปรแกรมประยุกต์ (API) ซึ่งทําหน้าที่เป็นสะพานเชื่อมระบบการออกใบแจ้งหนี้อิเล็กทรอนิกส์เข้ากับซอฟต์แวร์อื่นๆ ที่ธุรกิจใช้ ทําให้สามารถสื่อสารและแลกเปลี่ยนข้อมูลระหว่างเครื่องมือได้อย่างปลอดภัย

การผสานการทํางานซอฟต์แวร์การจัดการใบแจ้งหนี้อิเล็กทรอนิกส์กับระบบธุรกิจอื่นๆ มีประโยชน์หลายประการ ต่อไปนี้คือตัวอย่างประโยชน์หลักๆ ที่คุณควรคำนึงถึง

- เพิ่มประสิทธิภาพในการปฏิบัติงาน: เนื่องจากมีการจัดการข้อมูลโดยใช้ระบบส่วนกลาง จึงลดงานที่ทําด้วยตัวเองจนเหลือน้อยที่สุดและดูข้อมูลของบริษัทได้อย่างครอบคลุม

- เปลี่ยนการทำงานซ้ำๆ ให้เป็นระบบอัตโนมัติ: วิธีนี้จะช่วยลดความผิดพลาดที่เกิดจากมนุษย์ได้

- ปรับปรุงกระแสเงินสด: เนื่องจากการจัดการใบแจ้งหนี้ได้รับการปรับปรุง

- ประหยัดเวลา: เนื่องจากขั้นตอนทางธุรกิจที่ง่ายขึ้น

เมื่อธุรกิจของคุณเติบโตขึ้น การจัดการการออกใบแจ้งหนี้อาจมีความซับซ้อนมากขึ้น เครื่องมือบางอย่างสามารถช่วยทําให้กระบวนการนี้ทํางานอัตโนมัติ ตัวอย่างเช่น Stripe Invoicing ซึ่งเป็นแพลตฟอร์มออกใบแจ้งหนี้ที่มีฟังก์ชันครอบคลุมและเติบโตไปพร้อมกับธุรกิจของคุณ เครื่องมือนี้ช่วยให้คุณสร้างและส่งใบแจ้งหนี้สําหรับทั้งการชําระเงินครั้งเดียวและการชําระเงินตามแบบแผนล่วงหน้าได้โดยไม่ต้องเขียนโค้ดใดๆ Stripe Invoicing ช่วยให้คุณประหยัดเวลาและรับเงินได้เร็วขึ้น เนื่องจาก 87% ของใบแจ้งหนี้ Stripe เรียกเก็บภายใน 24 ชั่วโมง นอกจากนี้ คุณยังสามารถใช้ Stripe Invoicing เพื่อจัดการใบแจ้งหนี้อิเล็กทรอนิกส์ได้โดยการเป็นพาร์ทเนอร์กับบุคคลที่สาม

เนื้อหาในบทความนี้มีไว้เพื่อให้ข้อมูลทั่วไปและมีจุดประสงค์เพื่อการศึกษาเท่านั้น ไม่ควรใช้เป็นคําแนะนําทางกฎหมายหรือภาษี Stripe ไม่รับประกันหรือรับประกันความถูกต้อง ความสมบูรณ์ ความไม่เพียงพอ หรือความเป็นปัจจุบันของข้อมูลในบทความ คุณควรขอคําแนะนําจากทนายความที่มีอํานาจหรือนักบัญชีที่ได้รับใบอนุญาตให้ประกอบกิจการในเขตอํานาจศาลเพื่อรับคําแนะนําที่ตรงกับสถานการณ์ของคุณ