As of 2024, electronic invoicing is mandatory for most VAT payers in Italy. Businesses and freelancers have had to adapt to new invoicing regulations by using e-invoice management tools that ensure compliance.

But what exactly are e-invoice management tools? There are several types, including downloadable software for personal computers (PCs), cloud-based solutions, desktop or mobile applications, and both free and paid options. This article explores e-invoice management, including key software features to consider if you want to efficiently process and store e-invoices.

What’s in this article?

- Key features of electronic invoice management software

- How to choose the best e-invoice management tool

- Free vs. paid e-invoice management tools

- Requirements for storing electronic invoices

- Integration of e-invoice management software with other business systems

Key features of electronic invoice management software

E-invoice management software can automate the entire lifecycle of an invoice, from its creation and transmission to the Agenzia delle Entrate’s exchange system, to invoice reconciliation and legal storage. Software can help you customise invoices according to your business needs, entering essential details, product or service descriptions, and applicable taxes. In some cases, it can also provide additional features, such as scheduling or business data analysis.

Typically, electronic invoice management software automatically imports incoming e-invoices, simplifies their reconciliation, and digitally archives them according to retention policies.

The key features that an electronic invoice management solution should have are:

- An intuitive, user-friendly interface

- Guaranteed compliance

- Data security

- Integration with other business systems

- Flexibility and the ability to grow with a business

- Dedicated customer support

How to choose the best e-invoice management tool

Choosing e-invoice management software can feel overwhelming, especially if you are new to e-invoicing. Let’s look at the most important features to consider when choosing e-invoice management software:

- On-demand access to invoices wherever you are (i.e. a cloud-based solution)

- Mobile device accessibility

- Comprehensive management of both active and passive e-invoicing cycles

- The ability to handle other document types, such as estimates, pro forma invoices, and shipping documents

- Customer and supplier master data management

- Automatic reconciliation

- The ability to give your accountant direct access to your invoices for easy tracking

- The option to perform data analysis to get an overview of costs, sales, and profits

- Integration with other business management software

- Scheduling functionality to keep track of invoice due dates at all times

- The ability to send payment reminders

Free vs. paid e-invoice management tools

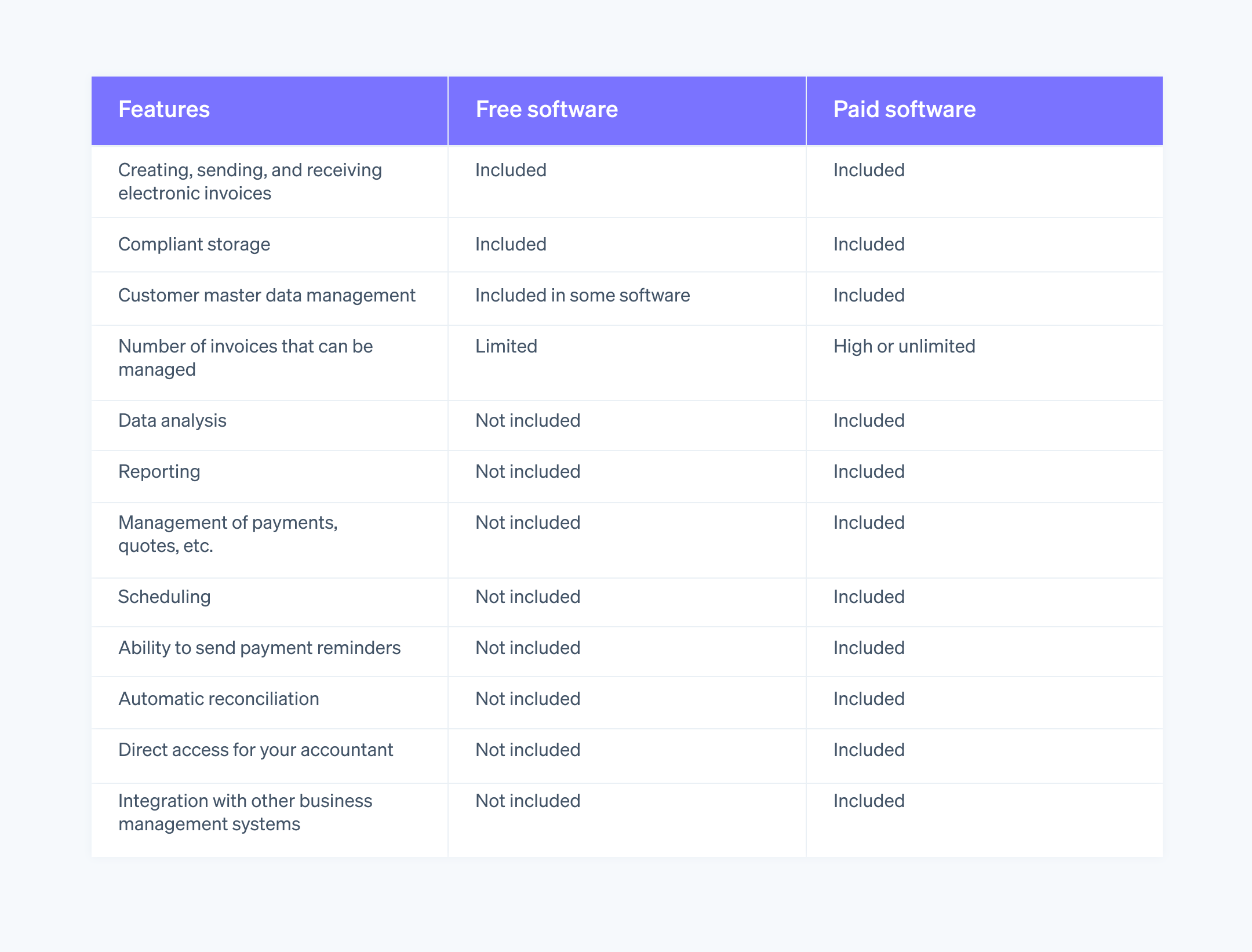

There is a wide range of e-invoice management software available, including both free and paid options. Wondering whether a free solution is the best choice, or if is it’s better to invest in a paid tool? Let’s take a look at the key differences between the two.

Most free tools offer only basic functionality, such as the ability to issue and receive invoices, send them to the exchange system, and store them in compliance with invoicing regulations; some might offer client master data management, as well. Many free e-invoicing tools also limit the number of invoices that can be managed. These tools can therefore be helpful in the early stages of your business, when transactions are limited. However, if you require any advanced features, you’ll typically need a paid e-invoicing tool. This is because free tools often lack features such as integration with other business systems and the option to manage payments, estimates, and due dates. Free software can also require manual data entry, increasing the risk of errors, and it usually does not offer your accountant direct access to your invoices.

Here’s a closer look at some of the typical differences in functionality between free and paid electronic invoice management tools.

Requirements for storing electronic invoices

Electronic invoices must meet specific retention requirements for both issuers and recipients. Compliance with these requirements goes beyond simply storing invoices on your computer, such as in PDF format. Retention is a process governed by the Digital Administration Code (CAD) and must be maintained for a minimum of 10 years. This ensures that invoices are never lost and that they remain legible and can be accessed at any time.

E-invoice management software with legal storage functionality can be used to store all e-invoices that are issued and received. Compliant storage is also provided for free by the Agenzia delle Entrate and is accessible through the “Invoices and Receipts” section of the agency’s dedicated portal.

Integration of e-invoice management software with other business systems

An ideal e-invoice management software will seamlessly integrate with other business applications, such as ecommerce platforms, Customer Relationship Management (CRM) systems, marketing tools, and financial management systems. This integration is achieved through Application Programming Interfaces (APIs), which act as a bridge between the e-invoicing system and other software used by the business, enabling secure communication and data exchange between tools.

There are many benefits to integrating electronic invoice management software with other business systems. Here are a few important benefits to keep in mind.:

- Enhanced operational efficiency: This is achieved through centralised data management, minimisation of manual tasks, and a comprehensive view of the company’s data.

- Automation of repetitive tasks: This can reduce the likelihood of human errors.

- Improvement of cash flow: This is due to enhanced invoice management.

- Time savings: This is due to simplified business procedures.

As your business grows, managing invoicing can become increasingly complex. Certain tools can help automate this process. Stripe Invoicing, for example, is a comprehensive invoicing platform that can grow with your business. This tool lets you create and send invoices for both one-time and recurring payments without writing any code. With Stripe Invoicing, you can save time and get paid faster, as 87% of Stripe invoices are collected within 24 hours. Additionally, you can use Stripe Invoicing to manage electronic invoices by partnering with a third party.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.