Understanding invoice requirements can help drive efficient cash flow and foster transparent client relationships for all businesses.

Invoices are more than requests for payment. They’re legal documents, historical records of sales, and an important part of your financial workflow. By refining your invoicing process and understanding what an invoice should entail, your business can avoid common pitfalls of unclear or incomplete invoices, such as delayed payments or disputed charges.

We’ll cover the important elements businesses should include in their invoices to help you streamline your operations and boost your bottom line.

What’s in this article?

- What is an invoice?

- What are invoices used for?

- Invoice requirements: What to include on an invoice

- Invoice best practices: How to write an invoice

- Benefits of upholding strong invoicing practices

What is an invoice?

An invoice is a formal document that a business sends to a customer. It serves as a record of goods or services that the business has provided and includes a calculated total that the customer is obligated to pay. The transaction may be for products, services, or a combination of both.

An invoice acts as a bill of sale, receipt, and a legal and fiscal verification of a transaction. An indispensable part of business, an invoice is a key component of the sales and payment process.

What are invoices used for?

The key purpose of an invoice is to provide a detailed account of the transaction between two parties, establishing the customer’s obligation to pay the amount due. It also facilitates accurate bookkeeping for both parties, improving financial management and increasing transparency. Invoices play many important roles for businesses:

Payment requests

An invoice is a formal request for payment from the customer. It outlines the amount due for the goods or services provided by the business, facilitating the payment process.Revenue tracking

Invoices are important tools for tracking sales and revenue. They provide a chronological record of business transactions, making it easier to monitor sales over time, identify seasonal trends, and evaluate the performance of specific products or services.Financial management

Accurate and timely invoicing is necessary for managing a company’s cash flow. By issuing invoices promptly and following up on outstanding payments, businesses can maintain healthy liquidity levels.Record keeping

Invoices serve as an official record of a sale. They help businesses keep track of inventory, monitor client purchasing habits, and manage account balances.Tax purposes

Invoices are a central part of tax filing for businesses. They provide the necessary documentation to calculate revenue, apply tax deductions, and substantiate expenses claimed on tax returns.Legal protection

Invoices can also serve as a legal document in the event of disputes or audits. They provide a detailed account of transactions, which can be used to resolve payment disagreements or to verify financial activity during an audit.Customer communication

Businesses often use invoices to communicate with their customers. They can be used to convey information about payment terms, contact details, or even to upsell or cross-promote other products or services.

Invoice requirements: What to include on an invoice

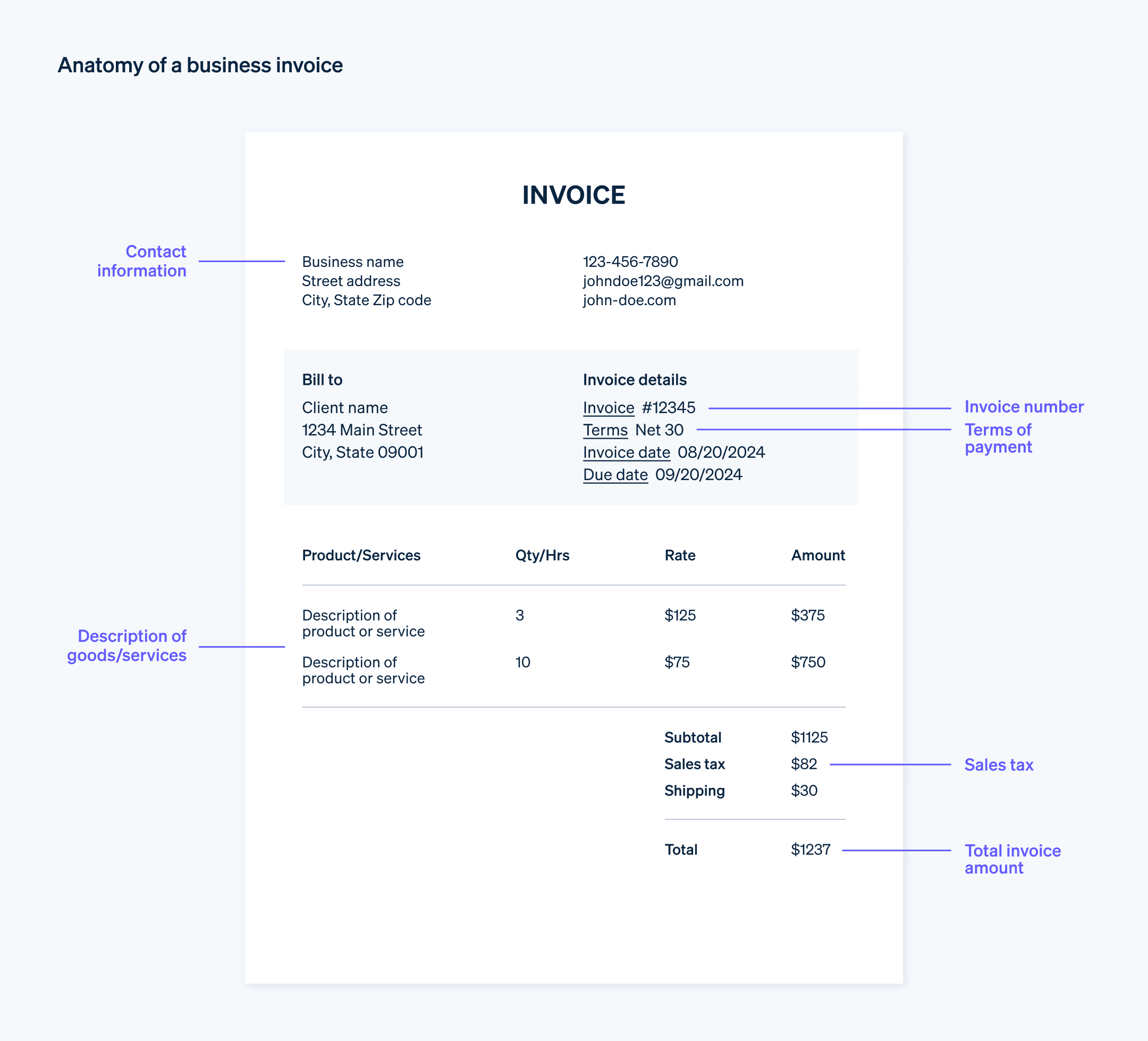

Effective invoices contain specific elements that fulfill legal requirements and make it easy for your clients to understand and pay. Here are the main components that businesses should include on an invoice:

Header

Make the word “invoice” clear and prominent at the top of the document to quickly identify it as such.Your business information

Include your company name, business address, contact details (such as phone number or email), and any other relevant information. If you have a company logo, display this in a professional way.Customer’s business information

Similar to your business information, you’ll need to include the name, address, and contact details of the client or business you’re billing.Invoice number

Assign a unique identification number to each invoice. This helps both parties reference the transaction in the future, in case of a dispute.Invoice date

State the invoice date, which is the date on which the invoice is issued. It’s an important component in managing the payment schedule and understanding cash flow.Payment terms

Clearly state the terms of payment. This could include the due date for payment, any early payment incentives, late payment penalties, and the payment methods that you accept.Itemized list of goods or services

Detail what the customer is being charged for. List each item or service separately, along with its description, quantity or hours, rate, and total amount for that line item.Subtotal

Calculate and list the subtotal, which is the total amount due before any taxes or additional fees. It is the sum of all the line item amounts.Taxes, fees, and discounts

If applicable, list any sales tax, VAT, shipping fees, or discounts. Each should be listed separately and added to or subtracted from the subtotal.Total amount due

List the total amount due. This is the final amount that the client owes you, after adding taxes and fees to the subtotal, and subtracting any discounts.Notes

You can use this optional section to provide additional information such as thank you notes, reminders, or other information pertinent to the transaction.

By including these elements, your invoice will meet professional standards and also provide your clients with all the information they need to pay you promptly and accurately. It also ensures you have a detailed record of all your transactions for future reference, bookkeeping, tax filing, and any potential legal needs.

Invoice best practices: How to write an invoice

Writing an effective invoice involves more than simply adding the required elements. Here are some best practices to consider when creating an invoice:

Be clear and concise: Each component of your invoice should be simple and easy to understand. Ambiguity can lead to payment delays, so be as clear as possible about what each charge is for.

Use professional formatting: Your invoice should not only be functional but also professional. This speaks to the credibility of your business. Consistent spacing, readable fonts, and a logical layout all contribute to an invoice’s overall effectiveness.

Employ unique invoice numbers: Each invoice should have a unique number to make tracking easier. A common practice is to use sequential numbers, or you could incorporate dates or customer codes.

Set clear payment terms: Specify when the payment is due (for instance, upon receipt, 30 days, 60 days, etc.) and the accepted forms of payment. The more convenient you make it for your customers, the faster you’re likely to be paid.

Itemize services or products: Detailing each service or product on a separate line makes it easier for customers to understand what they are paying for, and less likely for them to dispute the charges.

Apply taxes and discounts correctly: If applicable, calculate taxes, fees, and discounts carefully, and add or subtract them from the subtotal to determine the total amount due.

Be polite: A little courtesy can go a long way. Include a brief thank you note or message to your customer. A polite gesture like this can foster better relationships and potentially prompt quicker payments.

Send promptly: Send your invoices as soon as possible after providing goods or services. The quicker an invoice is sent, the sooner you are likely to be paid.

Follow up: If payment is not received by the due date, follow up with a friendly reminder. This can be done through an email, call, or another reminder invoice.

Keep copies: It’s good practice to keep copies of all invoices. This can be useful for financial management, tax purposes, and in case of any transaction disputes.

Benefits of upholding strong invoicing practices

Invoicing practices are an important part of business operations. They contribute to a company’s financial health and successful customer relationships. Upholding strong invoicing practices offers many benefits:

Improving cash flow management

Strong invoicing practices directly increase cash flow, which matters for any business. By issuing invoices promptly and with clear payment terms, companies can expect faster payment turnaround, reducing the gap between expenditure on goods or services provided and income received. This ensures that businesses have the necessary funds to cover operational costs, pay employees, and invest in inventory or resources. It also reduces the need for credit lines or loans, which can save on interest and increase financial stability.Increasing customer satisfaction

Clear, accurate, and professional invoicing practices can increase customer satisfaction. Include a detailed breakdown of costs, taxes, and the total amount due, as well as multiple payment options for added convenience. Providing customers with all the information they need to process payments shows respect for their time and money and strengthens their trust in the company, leading to repeat business and referrals. Satisfied customers are more likely to pay promptly, which further improves cash flow and reduces the administrative burden of following up on late payments.Enhancing your professional image

In the business world, details matter. The design, clarity, and precision of your invoice reflects on your overall business. Customers will perceive a well-crafted invoice as a sign of a well-run organization, reinforcing your professional image. This can boost customer confidence in your business and set a high standard for your transactions. And a consistent invoice format that includes your branding (logo, brand colors, business name, etc.) helps enhance your brand identity and visibility.Facilitating timely payments

A clear and comprehensive invoice reduces the likelihood of misunderstandings or queries from your customers, which are often reasons for payment delays. By specifying the payment terms, due dates, and accepted payment methods, you can set clear expectations for when and how you expect to be paid. Prompt invoice issuance after a sale, along with polite reminders for overdue payments, also encourages your clients to prioritize settling their dues.Managing your financial records

A well-prepared invoice is an important record of your sales. Unique invoice numbers help you easily reference and track transactions. Detailed itemization of goods or services enables better oversight of your revenue streams, helping you identify which products or services are most profitable. In addition, keeping copies of all invoices can simplify bookkeeping, making it easier to track income, reconcile accounts, and prepare financial statements or tax returns.

To learn more about how Stripe Invoicing can help reduce the workload of invoicing for your business, go here.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.