Inzicht in de factuurvereisten kan voor alle ondernemingen een stimulans voor een efficiënte cashflow en transparante klantrelaties betekenen.

Een factuur is meer dan een verzoek om betaling. Het zijn juridische documenten, belangrijk voor je financiële workflow, die samen een geschiedenis van de verkoopgegevens vormen. Door het facturatieproces te verfijnen en te begrijpen wat een factuur precies moet inhouden, kan je onderneming veelvoorkomende valkuilen door onduidelijke of onvolledige facturen vermijden, zoals uitgestelde betalingen of omstreden kosten.

Om je te helpen je activiteiten te stroomlijnen en je resultaten te verbeteren gaan we in op belangrijke elementen die ondernemingen op hun facturen moeten vermelden.

Wat staat er in dit artikel?

- Wat is een factuur?

- Waar zijn facturen voor nodig?

- Factuurvereisten: Wat moet er op een factuur staan?

- Beproefde werkwijzen bij facturatie: Hoe schrijf je een factuur?

- Voordelen van solide facturatie

Wat is een factuur?

Een factuur is een formeel document dat een onderneming naar een klant stuurt. Het dient als registratie van goederen of diensten die de onderneming heeft geleverd en omvat een bepaald totaalbedrag, dat de klant moet betalen. De transactie betreft doorgaans producten, diensten of een combinatie van beide.

Een factuur fungeert als verkoopdocument, ontvangstbewijs en als juridische en fiscale verificatie van een transactie. Een factuur vormt een onmisbaar zakelijk onderdeel bij het verkoop- en betalingsproces.

Waar zijn facturen voor nodig?

Het belangrijkste oogmerk van een factuur is om een gedetailleerd verslag te geven van een transactie tussen twee partijen, waarbij de verplichting van de klant om het verschuldigde bedrag te betalen wordt vastgelegd. Het vereenvoudigt ook een nauwkeurige boekhouding voor beide partijen, waardoor het financieel beheer verbetert en de transparantie toeneemt. Facturen spelen een belangrijke rol voor ondernemingen:

Betaalverzoeken

Een factuur is een formeel verzoek om betaling van de klant. Om het betalingsproces te vereenvoudigen beschrijft deze het verschuldigde bedrag voor de goederen of diensten die door de onderneming zijn geleverd.Omzet bijhouden

Facturen zijn belangrijk om je omzet en verkoop bij te houden. Ze bieden een chronologisch overzicht van commerciële transacties, waardoor het eenvoudiger wordt om de verkoop in de tijd te volgen, seizoensgebonden trends te identificeren en de prestaties van specifieke producten of diensten te controleren.Financieel beheer

Nauwkeurige en tijdige facturering is noodzakelijk voor het beheer van de cashflow van een onderneming. Door snel te factureren en openstaande betalingen te traceren, kunnen ondernemingen hun liquiditeitsniveau op peil houden.Bijhouden van gegevens

Een factuur dient als officiële registratie van een verkoop. Ondernemingen kunnen hun voorraad ermee bijhouden, het koopgedrag van klanten volgen en rekeningsaldo's beheren.Fiscale doeleinden

Facturen vormen een belangrijk onderdeel bij de belastingaangifte van ondernemingen. Ze leveren documentatie voor de berekening van omzet, toepassing van belastingaftrek en onderbouwing van uitgaven, zoals benodigd bij belastingaangifte.Rechtsbescherming

Een factuur dient soms als juridisch document bij geschillen of audits. Deze vormt een gedetailleerd overzicht van transacties, waarmee een meningsverschil over een betaling kan worden opgelost, dan wel financiële activiteiten tijdens een audit geverifieerd.Communicatie met de klant

Ondernemingen gebruiken facturen vaak in de communicatie met hun klanten. Ze kunnen worden gebruikt voor informatie over betalingsvoorwaarden, contactgegevens, of zelfs om andere producten of diensten aan te prijzen.

Factuurvereisten: Wat moet er op een factuur staan?

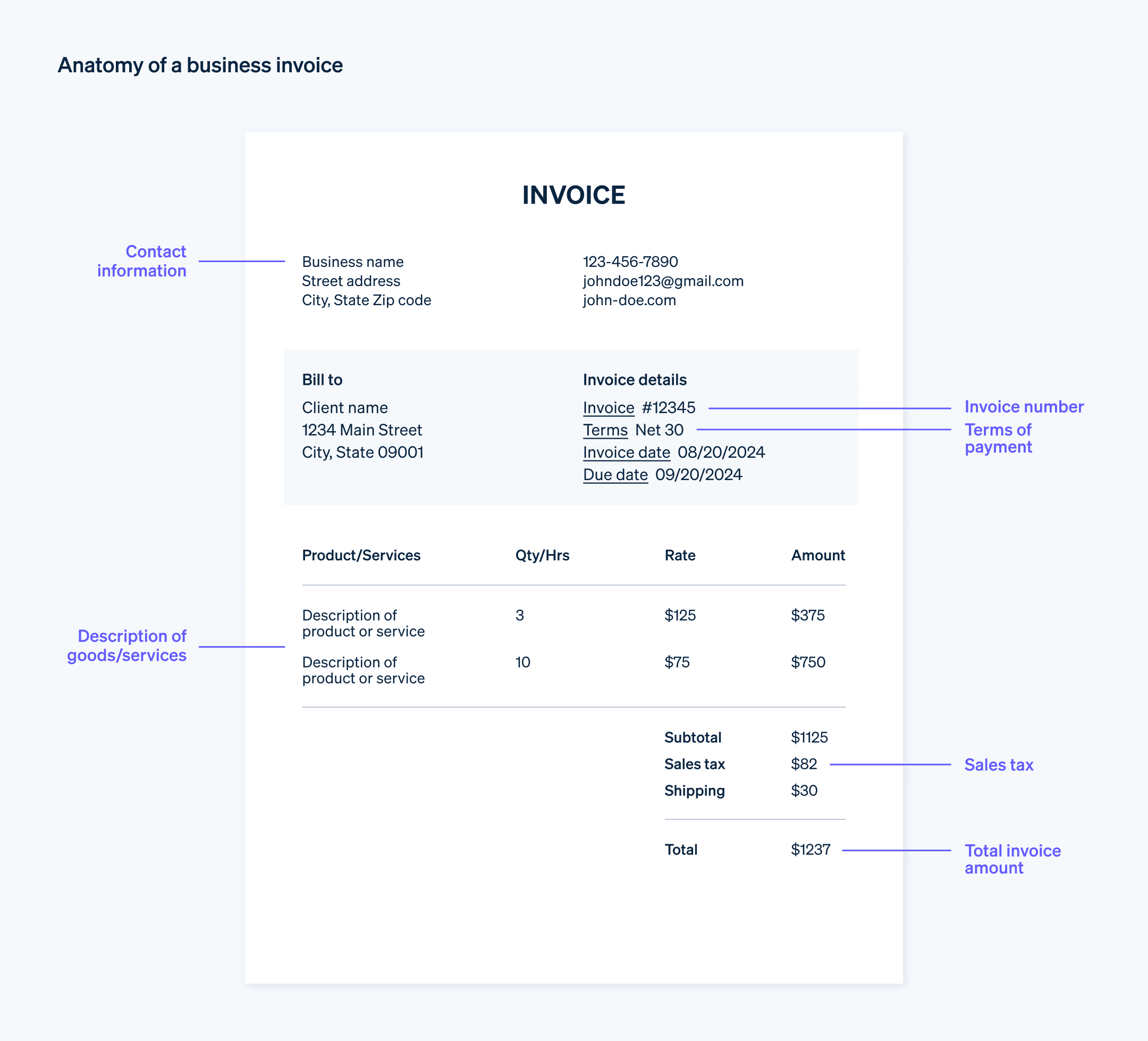

Effectieve facturen bevatten specifieke elementen die voldoen aan wettelijke vereisten en maken het voor je klanten eenvoudiger om te begrijpen en te betalen. Dit zijn de belangrijkste onderdelen die ondernemingen op een factuur moeten vermelden:

Koptekst

Vermeld het woord 'factuur' duidelijk bovenaan het document om het snel als zodanig te kunnen herkennen.Je bedrijfsgegevens

Vermeld naam, adres, en contactgegevens (zoals telefoonnummer of e-mail) van je onderneming en andere relevante informatie. Als je een bedrijfslogo hebt, geef dit dan op een professionele manier weer.Bedrijfsgegevens van de klant

Zoals bij je bedrijfsgegevens moet je de naam, het adres en contactgegevens vermelden van de klant of de onderneming die je factureert.Factuurnummer

Wijs een uniek identificatienummer toe aan elke factuur. Dit helpt beide partijen om later, bij een geschil, naar de transactie te verwijzen.Factuurdatum

Vermeld de factuurdatum, dit is de datum waarop de factuur is uitgegeven. Dit is belangrijk voor het beheer van het betalingsproces en begrip van de cashflow.Betalingsvoorwaarden

Vermeld duidelijk de betalingsvoorwaarden. Het kan hierbij gaan om de uiterste betaaldatum, eventuele prikkels voor vroegtijdige betaling, boetes bij te late betaling en de betaalmethoden die je accepteert.Gespecificeerde lijst van goederen of diensten

Vermeld wat er bij de klant in rekening wordt gebracht. Vermeld elk item of elke dienst afzonderlijk, inclusief beschrijving, het aantal of de uren, het tarief en het totaalbedrag voor dat regelitem.Subtotaal

Bereken en vermeld het subtotaal, dat is het totale verschuldigde bedrag vóór belastingen of bijkomende kosten. Het vormt de som van alle bedragen van alle regelitems.Belastingen, toeslagen en kortingen

Vermeld eventuele omzetbelasting, btw, verzendkosten of kortingen indien van toepassing. Elk moet afzonderlijk worden vermeld en opgeteld bij of afgetrokken van het subtotaal.Totaal verschuldigd bedrag

Vermeld het totale verschuldigde bedrag. Dit is het uiteindelijke bedrag dat de klant verschuldigd is, na aftrek van belastingen en toeslagen bij het subtotaal en aftrek van eventuele kortingen.Opmerkingen

Je kunt dit onderdeel desgewenst gebruiken om aanvullende informatie te verstrekken, zoals dankzeggingen, herinneringen of andere informatie die relevant is voor de transactie.

Door vermelding van deze elementen voldoet je factuur aan professionele normen en lever je zo alle benodigde informatie aan je klanten om snel en accuraat te betalen. Het voorziet je ook van een gedetailleerde registratie van al je transacties voor toekomstige verwijzing, boekhouding, belastingaangifte en eventuele juridische behoeften.

Beproefde werkwijzen bij facturatie: Hoe schrijf je een factuur?

Bij het schrijven van een effectieve factuur komt meer kijken dan het toevoegen van de vereiste elementen. Hier volgen enkele beproefde werkwijzen om rekening mee te houden bij het aanmaken van een factuur:

Wees duidelijk en beknopt: Elk onderdeel van je factuur moet duidelijk en eenvoudig te begrijpen zijn. Onduidelijkheid kan leiden tot betalingsachterstanden, dus wees duidelijk over waar elke betaling voor is.

Gebruik professionele opmaak: Je factuur moet niet alleen functioneel zijn, maar ook professioneel. Dit zegt iets over de geloofwaardigheid van je bedrijf. Consistente spatiëring, leesbare lettertypen en een logische lay-out dragen allemaal bij aan de algehele effectiviteit van een factuur.

Gebruik unieke factuurnummers: Elke factuur moet een uniek nummer hebben om tracering eenvoudiger te maken. Het beste is om opeenvolgende nummers te gebruiken, dan wel om datums of klantcodes te integreren.

Vermeld duidelijke betalingsvoorwaarden: Geef aan wanneer de betaling verschuldigd is (bijvoorbeeld bij ontvangst, 30 dagen, 60 dagen, enz.) en welke betaalmethoden zijn geaccepteerd. Naarmate je het je klanten eenvoudiger maakt, zul je waarschijnlijk sneller betaald worden.

Specificeer diensten of producten: Door elke dienst of elk product op een aparte regel te vermelden, begrijpen klanten beter waarvoor ze betalen en wordt de kans op een geschil kleiner.

Pas belastingen en kortingen correct toe: Bereken, voor zover van toepassing, belastingen, toeslagen en kortingen zorgvuldig en tel ze bij het subtotaal op of trek ze ervan af om het totaal verschuldigde bedrag te bepalen.

Wees beleefd: Met een beetje beleefdheid kom je een heel eind. Voeg een kort bedankbriefje of bericht aan je klant toe. Een beleefd gebaar kan een stimulans voor betere relaties zijn en mogelijk leiden tot snellere betalingen.

Verzend onmiddellijk: Verstuur je facturen zo snel mogelijk na het leveren van goederen of diensten. Hoe sneller een factuur wordt verstuurd, des te eerder de kans dat je wordt betaald.

Follow-up: Als de betaling niet op de vervaldatum is ontvangen, stuur dan een vriendelijke herinnering. Dit kan via een e-mail, telefonisch of met een herinneringsfactuur.

Kopieën bewaren: Het wordt aanbevolen om kopieën van alle facturen te bewaren. Dit kan praktisch zijn voor financieel beheer, belastingdoeleinden en in het geval van transactiegeschillen.

Voordelen van solide facturatie

Facturatie vormt een belangrijk onderdeel van de bedrijfsvoering. Deze draagt bij aan de financiële gezondheid van een onderneming en aan succesvolle klantrelaties. Het toepassen van solide facturatie biedt vele voordelen:

Verbetering van het cashflowbeheer

Een goede facturatiemethode verhoogt direct de cashflow en dat geldt voor elke onderneming. Door facturen snel en met duidelijke betalingsvoorwaarden uit te geven, kunnen ondernemingen een snellere betalingsdoorlooptijd verwachten, waardoor de kloof tussen uitgaven voor geleverde goederen of diensten en ontvangen inkomsten wordt verkleind. Ondernemingen beschikken zo over de nodige middelen om de operationele kosten te dekken, werknemers te betalen en te investeren in inventaris of bedrijfsmiddelen. Het vermindert tevens de behoefte aan kredietlijnen of leningen, wat besparingen op rente kan opleveren en zo de financiële stabiliteit vergroten.Verhogen van de klanttevredenheid

Duidelijke, nauwkeurige en professionele facturatie kan de klanttevredenheid verhogen. Voeg een gedetailleerd overzicht van kosten, belastingen en het totale verschuldigde bedrag toe, evenals meerdere betalingsopties voor extra gemak. Door klanten alle informatie te leveren die ze nodig hebben om betalingen te verwerken, toon je respect voor hun tijd en geld en versterk je hun vertrouwen in jouw onderneming, wat weer leidt tot nieuwe bedrijvigheid en verwijzingen. Tevreden klanten zijn sneller geneigd om snel te betalen, wat de cashflow verder verbetert en de administratieve last van het opvolgen van achterstallige betalingen vermindert.Verbetering van jouw professionele imago

In de zakenwereld zijn details van belang. Het ontwerp, de duidelijkheid en de nauwkeurigheid van je factuur reflecteren op jouw algehele dienstverlening. Klanten zien een goed opgestelde factuur doorgaans als een teken van een goed geleide organisatie, wat je professionele imago versterkt. Dit kan het vertrouwen van klanten in je onderneming vergroten en een hoge norm voor transacties bevestigen. En een consistent factuurformaat met jouw branding (logo, merkkleuren, bedrijfsnaam, enz.) helpt om je merkidentiteit en zichtbaarheid te verbeteren.Faciliteren van tijdige betalingen

Een duidelijke en volledige factuur verkleint de kans op misverstanden of vragen van je klanten, die vaak een reden blijken voor betalingsachterstanden. Door de betaaltermijnen, vervaldatums en geaccepteerde betaalmethoden te vermelden, kun je duidelijke verwachtingen stellen over wanneer en hoe je verwacht te worden betaald. Met een snelle uitgifte van facturen na een transactie, samen met beleefde herinneringen bij achterstallige betalingen, moedig je je klanten ook aan om prioriteit te geven aan tijdige betalingen.Het beheren van je financiële administratie

Een solide factuur vormt een belangrijke vastlegging van je verkopen. Met unieke factuurnummers kun je transacties eenvoudig terugvinden en traceren. Gedetailleerde specificatie van goederen of diensten zorgt voor een beter overzicht van inkomstenstromen, zodat je kunt bepalen welke producten of diensten het meest winstgevend zijn. Bovendien kan het bewaren van kopieën van alle facturen de boekhouding vereenvoudigen, waardoor het eenvoudiger wordt om inkomsten bij te houden, rekeningen af te stemmen en financiële overzichten of belastingaangiften op te stellen.

Wil je meer informatie over hoe Stripe Invoicing je kan helpen om de facturatiedruk voor je onderneming te verminderen? Ga dan hier naar 'Invoicing'.

De inhoud van dit artikel is uitsluitend bedoeld voor algemene informatieve en educatieve doeleinden en mag niet worden opgevat als juridisch of fiscaal advies. Stripe verklaart of garandeert niet dat de informatie in dit artikel nauwkeurig, volledig, adequaat of actueel is. Voor aanbevelingen voor jouw specifieke situatie moet je het advies inwinnen van een bekwame, in je rechtsgebied bevoegde advocaat of accountant.