Businesses understand that a customer transaction doesn’t end after the sale. There are often issues that arise, such as overcharging or returned items, which require financial adjustments. Credit and debit memos are simple tools businesses use to ensure the customer is paying the correct amount.

A credit memo acts like a voucher, communicating when a business owes a customer money—for example, when a customer has been overcharged or decides to return a product. Businesses use debit memos to indicate that customers owe them more money, usually because of the business undercharging or providing additional services.

This article will explain the details of credit and debit memos and how they help businesses maintain financial integrity. We’ll also provide templates for businesses to use. Whether you need to issue a credit or debit memo, you’ll know how to handle it professionally and efficiently.

What’s in this article?

- What are credit memos?

- What are debit memos?

- Why are credit and debit memos important for businesses?

- When do businesses issue credit memos?

- When do businesses issue debit memos?

- Credit memos vs. debit memos: Key differences

- Best practices for managing credit and debit memos

- Credit memo template for businesses

- Debit memo template for businesses

What are credit memos?

Credit memos are documents issued by a seller to a buyer. They correct or adjust a previously issued invoice to fix a mistake or provide a credit.

Credit memos are common in business-to-business (B2B) transactions. They serve multiple purposes and come with various features that play a role in accounting and customer service processes. Understanding these features is important for anyone involved in business operations, finance, or accounting. Here are the key features and purposes of credit memos:

Correction of billing errors

Credit memos primarily correct mistakes in billing, such as overcharging or billing for products or services that weren’t delivered. When a business identifies a mistake, it issues a credit memo to adjust the original invoice amount. This guarantees that the financial records reflect the actual transaction value, maintaining the integrity of accounting records.Handling returns and refunds

When a customer returns goods because of defects, dissatisfaction, or incorrect shipments, the business issues a credit memo. This document adjusts the accounts receivable, reflecting that the business owes the customer a certain amount. The business can issue this payment as a voucher for applying to future purchases.Documenting discounts and allowances

Credit memos can also be used to document any subsequent discounts or allowances that the seller gives to the buyer after the original transaction. Such adjustments might be due to bulk purchase discounts, promotional offers, or compensation for minor issues that don’t warrant a return.Maintaining customer relationships

Issuing a credit memo in response to a problem is a gesture of goodwill. It shows the customer that the seller acknowledges the error and is committed to fixing it. This practice can maintain and strengthen customer relationships, as it demonstrates the seller’s commitment to customer satisfaction and fairness.Inventory adjustment

Credit memos help with inventory management during a product return. They track returned items so that businesses can adjust inventory levels accordingly, preventing discrepancies in stock levels and financial reporting.Compliance and recordkeeping

Credit memos are a part of regulatory compliance and financial auditing. They provide a paper trail for auditors and tax authorities to verify the accuracy of financial statements. Keeping detailed records of credit memos helps businesses demonstrate transparency and compliance with financial reporting standards.Flexibility in financial adjustments

If a customer is slightly dissatisfied with a service, the business can issue a partial credit instead of a full credit.

What are debit memos?

Debit memos serve the opposite purpose of credit memos: they indicate and process increases in the amount that must be paid. Here’s an overview of the features and functions of debit memos:

Adjustment for undercharging

If a seller undercharges a buyer for goods or services because of an error in pricing, quantity, or calculation, it can issue a debit memo rather than a new invoice. The debit memo increases the payable amount to the seller’s account, correcting the billing discrepancy.Penalties or additional charges

Sometimes businesses use debit memos to apply charges or penalties. For example, if a seller in a B2B transaction fails to meet the terms of a contract by delivering late or not complying with specifications, the buyer might issue a debit memo for the penalty amount. And sometimes, debit memos are used to apply additional charges or penalties so that any contractual obligations or agreed-upon terms are financially enforced—for example, with a late or missing payment.Recordkeeping and compliance

Debit memos are important for maintaining accurate financial records. They provide a paper trail for financial audits and ensure compliance with accounting standards. Proper management of debit memos is important for accurate bookkeeping and financial reporting.Facilitating clear communication

Debit memos help buyers and sellers communicate clearly about financial adjustments. They provide a formal way of requesting and processing these adjustments. This clarity helps prevent misunderstandings.

Debit memos help businesses accurately manage accounts payable, stay compliant, and maintain healthy customer relationships. They enable businesses to handle monetary adjustments systematically and professionally.

Why are credit and debit memos important for businesses?

Credit and debit memos are key tools that businesses use to manage financial transactions and customer relations. Both types of memos significantly impact internal financial accuracy, regulatory compliance, and effective communication with customers. They provide clear, documented trails for financial audits and help businesses manage their accounts with precision.

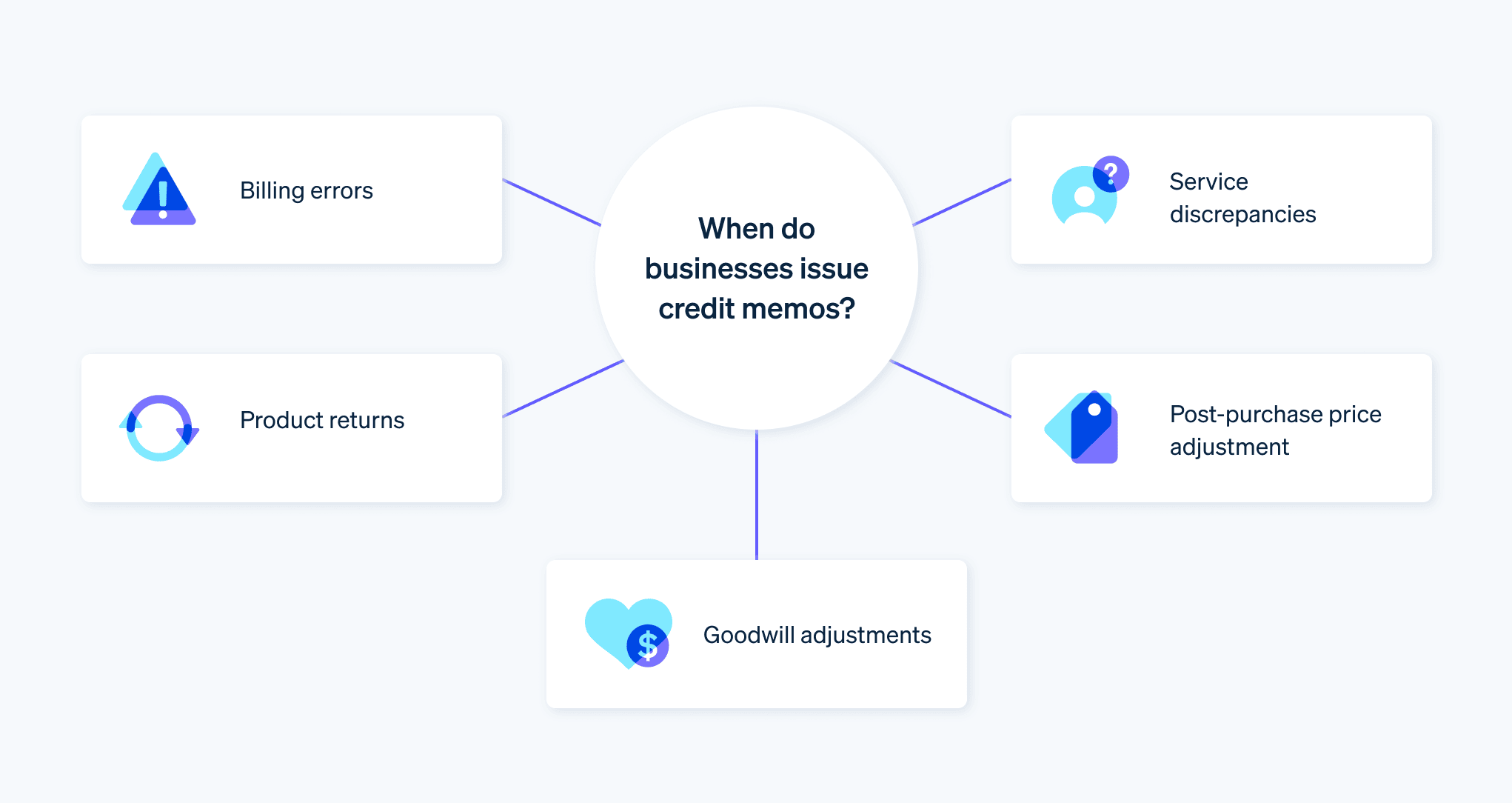

When do businesses issue credit memos?

Credit memos help businesses maintain accurate financial records and foster strong customer relationships. Here are the typical situations where a business might issue a credit memo:

Billing errors

When your business makes an invoice error, such as overcharging a client because of a pricing mistake or a clerical error in quantity, you issue a credit memo. It acknowledges the error and begins the process to rectify the balance due. This keeps your accounting accurate and shows your clients that you’re committed to fair billing practices. For example, a business sells 100 units of a product at $10 each, but due to an error, the business invoices the buyer for 110 units. Realizing the mistake, the business issues a credit memo for the 10 extra units charged, reducing the buyer’s bill or crediting their account.Product returns

If a client returns goods because of defects, dissatisfaction, or a mismatch with their order, a credit memo adjusts the invoiced amount—reducing the client’s payable balance. In this situation, a credit memo keeps your sales and inventory records in check so that you are accurately tracking returns against your sales. For example, a client returns a defective product worth $200. The business issues a credit memo for the returned product, which can offset future purchases.Service discrepancies

Sometimes, the service provided might not meet a client’s expectations or contractual agreements. In such instances, a credit memo can adjust the billed amount for the service. This rectifies the bill and helps maintain a positive relationship with the client, showing that you’re responsive to their concerns. For example, a client is billed $1,000 for a service, but the service delivered was not up to the agreed standard. The business acknowledges this and issues a credit memo of $200 as a partial credit to compensate for the discrepancy.Post-purchase price adjustments

After a sale, there might be situations where you need to adjust the price—for example, because of a subsequent discount offer or a special consideration for a loyal client. Issuing a credit memo applies these adjustments retroactively, so that your clients are billed fairly according to the latest pricing decisions. For example, after a purchase, a customer states that they were eligible for a promotional discount which was not applied. The business issues a credit memo to apply the discount retroactively, adjusting the customer’s account balance.Goodwill adjustments

At times, your business might decide to offer a concession or adjustment as a gesture of goodwill. Issuing a credit memo in such cases serves as a formal acknowledgment of this adjustment. For example, a longtime customer expresses minor dissatisfaction with a recent purchase. To maintain good relations, the business issues a small credit memo as a goodwill gesture, encouraging future business.

Each of these scenarios demonstrates the importance of credit memos in multiple aspects of business operations, from accounting accuracy to customer relationship management. Credit memos also play a significant role in demonstrating your business’s commitment to ethical practices and customer satisfaction.

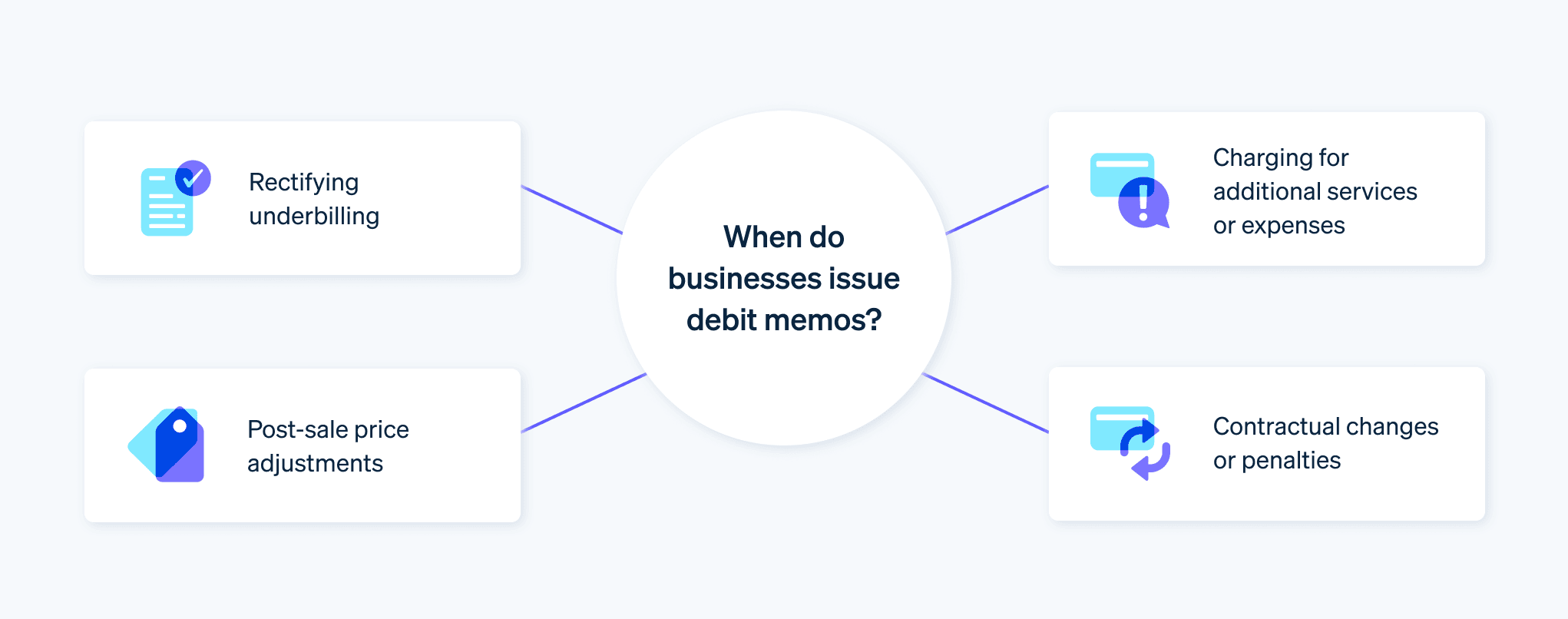

When do businesses issue debit memos?

Businesses use debit memos to adjust financial accounts. Here’s a list of specific circumstances when a debit memo might be issued:

Rectifying underbilling

If your business realizes you’ve charged a client too little, a debit memo helps correct the error. This might happen if you priced incorrectly, made a calculation error, or forgot to bill for part of a service. The memo politely lets the client know they owe a bit more. For example, a business realizes it undercharged a client for a service, due to a calculation error. If the original invoice was $1,000 but should have been $1,200, the business issues a debit memo for the additional $200 to correct the bill.Charging for additional services or expenses

Sometimes unexpected expenses occur after the initial billing. Maybe the client requested extra work, or there were unforeseen costs on your end. A debit memo lets you add these charges to the client’s account, keeping the financials tidy and up-to-date. For example, after completing a service, a client requests additional work that wasn’t included in the initial agreement. If the extra service costs $300, the business issues a debit memo for $300, adding it to the client’s existing bill.Post-sale price adjustments

Prices can change after a deal is struck. If you need to charge more than what was initially agreed upon, a debit memo communicates this change to the client. For example, a contract may allow for price adjustments based on market conditions. When such conditions lead to a price increase, the business issues a debit memo to the client for the additional amount owed under the new pricing.Contractual changes or penalties

Contracts sometimes have clauses that require billing adjustments at a later date, such as annual price increases. When it’s time to apply these changes, you use a debit memo to let the client know about the new charges as per the contract. For example, a client fails to pay by the agreed deadline. Per the contract terms, the business imposes a late fee of $50. The business issues a debit memo for the $50 late fee, adding it to the client’s outstanding balance.

Debit memos ensure that your financial records are accurate and that clients are billed correctly for the services or goods they receive.

Credit memos vs. debit memos: Key differences

Credit and debit memos serve distinct purposes in business accounting. Let’s take a closer look at the key differences between them:

Direction of adjustment

A business issues a credit memo when it needs to reduce the amount a customer owes. This usually happens when there’s been an overcharge, a product return, or a service issue. A business will use a debit memo when it needs to increase what a customer owes. This could be because of underbilling, additional charges, or post-sale price adjustments.Reasons for issuance

Businesses send out credit memos primarily to correct overcharges, handle returns, or adjust for unsatisfactory services. It’s a way to say, “We owe you,” in the form of a credit for future purchases. Businesses issue debit memos to rectify an undercharge, add post-transaction charges, or revise an invoice upward because of contractual terms or price changes.Impact on financial statements

With a credit memo, a business’s accounts receivable decreases because the business either owes the customer money or it has reduced the customer’s outstanding balance. It subtracts money from what you expect to get paid. However, a debit memo increases the accounts receivable. It indicates that the customer owes more, adding to what you expect to receive.Client relationship dynamics

Issuing a credit memo often reflects a business’s commitment to customer service and fairness, especially when the memo addresses overcharges or dissatisfaction. While issuing a debit memo is a standard business practice, it requires clear communication to ensure customers understand why they are being asked to pay more.Internal business processes

The process for issuing credit memos often involves customer service and quality control departments, especially in cases of returns or service issues. Debit memos may involve more interaction with the sales or contract management teams, particularly when dealing with underbilling or contract-related price adjustments.

Credit and debit memos both adjust billing amounts, but in opposite directions and for different reasons. Understanding these nuances helps businesses manage their finances accurately and maintain healthy customer relationships.

Best practices for managing credit and debit memos

Managing credit and debit memos effectively is important for maintaining accurate financial records and healthy customer relationships. Here are some best practices for businesses to consider:

Clear documentation and justification

Every credit or debit memo should be backed by documentation. This means keeping detailed records of the original transaction, the reason for the adjustment, and any communications with the customer related to the adjustment. Justification for the memo creates transparency and makes it easier to reference in case of disputes or audits.Timely issuance and processing

Issue and process these memos in a timely manner. Issuing delays can cause confusion and may affect financial reporting. Prompt processing of credit memos, especially those related to returns, is key to maintaining good customer relations. For debit memos, timely issuance helps ensure that businesses promptly collect additional charges.Accurate accounting entries

Credit memos reflect a reduction in revenue and accounts receivable, while debit memos reflect an increase. Accurate accounting entries mean that your financial statements reflect the true state of your business’s finances.Effective communication with customers

Explain the reason for the memo, how it affects the customer’s account, and any actions they need to take. Good communication can prevent misunderstandings and maintain trust.Integration with accounting systems

Handling credit and debit memos in your accounting system helps you manage them efficiently. Automated systems can flag discrepancies, send reminders for issuance or processing, and reflect these adjustments in your financial statements.Regular audits and reviews

Regularly review and audit credit and debit memo transactions. This will help you identify errors, understand customer concerns, and comply with accounting standards and policies.Training and guidelines for staff

Staff should be well-trained in handling credit and debit memos. Clear guidelines on when and how to issue these memos—coupled with training in customer communication and recordkeeping—can reduce errors and improve efficiency.Maintaining confidentiality

Confidentiality is important when handling sensitive customer information. Securely handle credit and debit memos—and the data they contain—to protect your business and your customers.

Credit memo template for businesses

Below is a template for a credit memo. It’s organized in a clear and professional format that effectively communicates all necessary information to the customer. You can customize this template to fit your company’s specific details and the particulars of each situation.

[Your company name]

[Your company address]

[City, State, Zip]

[Phone number] | [Email address]

Credit memo

Date: [Date of issuance]

Credit memo number: [Unique credit memo ID]

To:

[Customer’s name]

[Customer’s address]

[City, State, Zip]

Reference:

Original invoice number: [Original invoice ID]

Date of original invoice: [Date of original invoice]

Details of the credit:

|

Item description

|

Quantity

|

Unit price

|

Total amount

|

|---|---|---|---|

| [Item or service] | [Quantity] | $[Unit price] | $[Total amount] |

| [Additional item] | [Quantity] | $[Unit price] | $[Total amount] |

| Total credit amount: | $[Total] |

Reason for credit:

[Provide a detailed explanation for the credit memo, such as an overcharge, product return, service discrepancy, etc.]

Additional notes:

[Include any other relevant information or instructions, such as how the credit will be applied (e.g., future purchase credit), any follow-up actions, etc.]

Authorized by: [Name and position of the authorizing individual]

Contact information for queries:

[Provide contact information for customers to get in touch if they have questions about the credit memo.]

[Your company’s name]

Debit memo template for businesses

Here’s a template for a debit memo. This template effectively communicates additional charges or adjustments to a customer. You can customize it with your business details and other specific information.

[Your company name]

[Your company address]

[City, State, Zip]

[Phone number] | [Email address]

Debit memo

Date: [Date of issuance]

Debit memo number: [Unique debit memo ID]

To:

[Customer’s name]

[Customer’s address]

[City, State, Zip]

Reference:

Original invoice number: [Original invoice ID]

Date of original invoice: [Date of original invoice]

Details of the debit:

|

Item description

|

Quantity

|

Unit price

|

Total amount

|

|---|---|---|---|

| [Item or service] | [Quantity] | $[Unit price] | $[Total amount] |

| [Additional item] | [Quantity] | $[Unit price] | $[Total amount] |

| Total debit amount: | $[Total] |

Reason for debit:

[Provide a detailed explanation for the debit memo, such as underbilling, additional charges for extra services or products, post-sale price adjustments, etc.]

Additional notes:

[Include any other relevant information or instructions, such as payment due date, how the additional amount should be settled, any follow-up actions, etc.]

Authorized by: [Name and position of the authorizing individual]

Contact information for queries:

[Provide contact information for customers to get in touch if they have questions about the debit memo.]

[Your company’s name]

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.