As empresas entendem que a transação do cliente não termina após a venda. Muitas vezes, surgem problemas, como cobrança a maior ou devoluções, que exigem ajustes financeiros. As notas de crédito e débito são ferramentas simples usadas pelas empresas para garantir que o cliente está pagando o valor correto.

Uma nota de crédito funciona como um vale, comunicando quando uma empresa deve dinheiro a um cliente. Por exemplo, quando o cliente foi cobrado a maior ou decide devolver um produto. As empresas usam notas de débito para indicar que os clientes devem mais dinheiro a elas, geralmente por causa cobrança a menor ou prestação de serviços adicionais.

Este artigo explica os detalhes das notas de crédito e débito e como elas permitem manterem sua integridade financeira. Também fornecemos modelos para uso pelas empresas. Seja para emitir uma nota de crédito ou débito, você saberá gerenciar isso de forma profissional e eficiente.

Neste artigo:

- O que são notas de crédito?

- O que são notas de débito?

- Por que as notas de crédito e débito são importantes para as empresas?

- Quando emitir notas de crédito?

- Quando emitir notas de débito?

- Notas de crédito x notas de débito: principais diferenças

- Práticas recomendadas para gerenciar notas de crédito e débito

- Modelo de nota de crédito para empresas

- Modelo de nota de débito para empresas

O que são notas de crédito?

Notas de crédito são documentos emitidos por um vendedor para um comprador. Elas corrigem ou ajustam uma fatura emitida anteriormente para corrigir um erro ou fornecer um crédito.

As notas de crédito são comuns em transações entre empresas (B2B). Eles servem a várias finalidades e vêm com vários recursos que desempenham um papel na contabilidade no e atendimento ao cliente. Compreender esses recursos é importante para quem trabalha em operações comerciais, finanças ou contabilidade. Principais características e finalidades das notas de crédito:

Correção de erros de faturamento

As notas de crédito corrigem principalmente erros de faturamento, como cobranças a maior ou faturamento de produtos ou serviços que não foram entregues. Quando a empresa identifica um erro, emite uma nota de crédito para ajustar o valor da fatura original. Isso garante que os registros financeiros reflitam o valor real da transação, mantendo a integridade dos registros contábeis.Gestão de devoluções e reembolsos

Quando um cliente devolve mercadorias por causa de defeitos, insatisfação ou envio incorreto, a empresa emite uma nota de crédito. Este documento ajusta as contas a receber, refletindo que a empresa deve um determinado valor ao cliente. A empresa pode emitir esse pagamento como vale para aplicar em compras futuras.Documentação de descontos e abonos

As notas de crédito também podem ser usadas para documentar quaisquer descontos ou licenças subsequentes que o vendedor conceda ao comprador após a transação original. Esses ajustes podem referir-se a descontos de compra em lote, ofertas promocionais ou compensação por problemas menores que não valem uma devolução.Manter o relacionamento com os clientes

Emitir uma nota de crédito em resposta a um problema é um gesto de boa vontade. Ele mostra ao cliente que o vendedor reconhece o erro e compromete-se a corrigi-lo. Essa prática pode manter e fortalecer o relacionamento com o cliente, pois demonstra o compromisso do vendedor com a satisfação do cliente e a justiça.Ajuste de estoque

As notas de crédito ajudam no gerenciamento de estoque durante a devolução de um produto. Elas rastreiam os itens devolvidos para que as empresas possam ajustar os níveis de estoque, evitando discrepâncias nos níveis de estoque e nos relatórios financeiros.Conformidade e registros

As notas de crédito fazem parte da conformidade regulatória e da auditoria financeira. Elas criam a trilha para auditores e autoridades fiscais verificarem a precisão das demonstrações financeiras. Manter registros detalhados das notas de crédito ajuda a demonstrar transparência e conformidade com os padrões de relatórios financeiros.Flexibilidade nos ajustes financeiros

Se um cliente estiver um pouco insatisfeito com um serviço, a empresa pode emitir um crédito parcial em vez de um crédito total.

O que são notas de débito?

As notas de débito têm a finalidade oposta das notas de crédito: elas indicam e processam aumentos no valor que deve ser pago. Visão geral dos recursos e funções das notas de débito:

Ajuste de cobrança a menor

Se o vendedor cobrar a menor do comprador por bens ou serviços por erro no preço, quantidade ou cálculo, ele pode emitir uma nota de débito em vez de uma nova fatura. A nota de débito aumenta o valor a pagar na conta do vendedor, corrigindo a discrepância de faturamento.Penalidades ou encargos adicionais

Às vezes, as empresas usam notas de débito para aplicar cobranças ou penalidades. Por exemplo, se o vendedor em uma transação B2B não cumprir os termos do contrato por atraso na entrega ou não cumprir as especificações, o comprador pode emitir uma nota de débito no valor da multa. Às vezes, as notas de débito são usadas para aplicar cobranças ou penalidades adicionais para que quaisquer obrigações contratuais ou termos acordados sejam financeiramente cumpridos — por exemplo, um atraso ou uma falta de pagamento.Manutenção e conformidade de registros

As notas de débito são importantes para manter registros financeiros precisos. Elas mantém a trilha para auditorias financeiras e garantem a conformidade com as normas contábeis. O gerenciamento adequado das notas de débito é importante para a contabilidade e os relatórios financeiros precisos.Facilitar a comunicação clara

As notas de débito ajudam compradores e vendedores a se comunicarem claramente sobre ajustes financeiros. Elas formalizam a solicitação e o processamento desses ajustes. Essa clareza ajuda a evitar mal-entendidos.

As notas de débito permitem gerenciarem com precisão as contas a pagar, manterem a conformidade e os relacionamentos saudáveis com os clientes. Elas permitem coordenar ajustes monetários de forma sistemática e profissional.

Por que as notas de crédito e débito são importantes para as empresas?

As notas de crédito e débito são ferramentas essenciais para gerenciar transações financeiras e relacionamento com clientes. As duas afetam significativamente a precisão financeira interna, a conformidade regulatória e a comunicação eficaz com os clientes. Elas fornecem trilhas claras e documentadas para auditorias financeiras e permitem gerenciar a contabilidade com precisão.

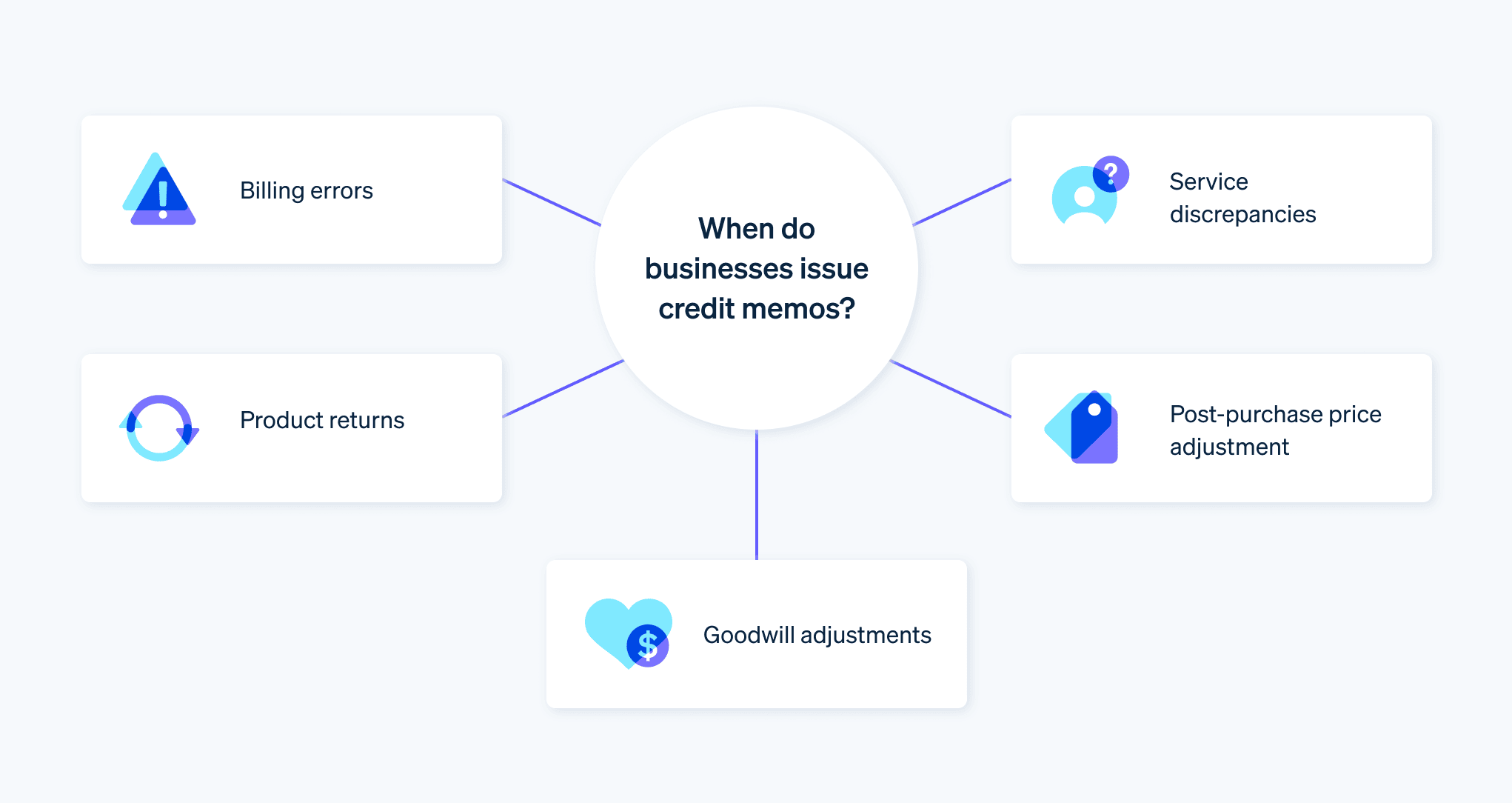

Quando as empresas emitem notas de crédito?

As notas de crédito permitem manter registros financeiros precisos e promovem relacionamentos sólidos com os clientes. Estas são as situações típicas em que uma empresa pode emitir uma nota de crédito:

Erros de faturamento

Quando a empresa faz uma fatura errada (por exemplo, cobrança a maior por erro de precificação ou erro administrativo de quantidade), ela emite uma nota de crédito. O erro é reconhecido e processo de correção é iniciado. A precisão da contabilidade é mantida e os clientes sabem que a empresa tem um compromisso com práticas justas de cobrança. Por exemplo, uma empresa vende 100 unidades de um produto por US$ 10 cada. Mas um erro na fatura acaba cobrando 110 unidades do comprador. Percebendo o erro, a empresa emite uma nota de crédito pelas 10 unidades extras, reduzindo a conta do comprador ou creditando sua conta.Devoluções de produtos

Se o cliente devolver mercadorias devido a defeitos, insatisfação ou divergência do pedido, uma nota de crédito ajusta o valor faturado, reduzindo o saldo a pagar do cliente. Nessa situação, a nota de crédito mantém seus registros de vendas e estoque sob controle, acompanhando com precisão as devoluções e as vendas. Por exemplo, um cliente devolve um produto defeituoso no valor de R$ 200. A empresa emite uma nota de crédito para o produto devolvido, que pode compensar compras futuras.Discrepâncias de serviço

Às vezes, o serviço prestado pode não atender às expectativas do cliente ou não cumprir o contrato. Nesses casos, uma nota de crédito pode ajustar o valor faturado pelo serviço. Isso retifica a conta e ajuda a manter um relacionamento positivo com o cliente, mostrando que você é entende o problema dele. Por exemplo, o cliente recebe uma fatura de US$ 1.000 por um serviço, mas o serviço entregue não estava no padrão contratado. A empresa reconhece e emite uma nota de crédito de US$ 200 como crédito parcial para compensar a discrepância.Ajustes de preço pós-compra

Após uma venda, pode haver situações em que você precisa ajustar o preço, por exemplo, devido a um desconto posterior ou uma contraprestação especial para um cliente fiel. A emissão de uma nota de crédito aplica esses ajustes retroativamente, para que seus clientes sejam faturados corretamente de acordo com as últimas decisões de preços. Por exemplo, após uma compra, um cliente declara que se qualificava para um desconto promocional que não foi aplicado. A empresa emite uma nota de crédito para aplicar o desconto retroativamente, ajustando o saldo da conta do cliente.Ajustes de boa vontade

Às vezes, sua empresa pode decidir oferecer uma concessão ou ajuste como um gesto de boa vontade. A emissão de uma nota de crédito nesses casos serve como um reconhecimento formal desse ajuste. Por exemplo, um cliente antigo expressa uma pequena insatisfação com uma compra recente. Para manter boas relações, a empresa emite uma pequena nota de crédito como um gesto de boa vontade, incentivando futuros negócios.

Cada uma dessas situações demonstra a importância das notas de crédito em múltiplos aspectos das operações de negócios, da precisão contábil à gestão do relacionamento com o cliente. As notas de crédito também são importantes para a empresa demonstrar compromisso com práticas éticas e satisfação do cliente.

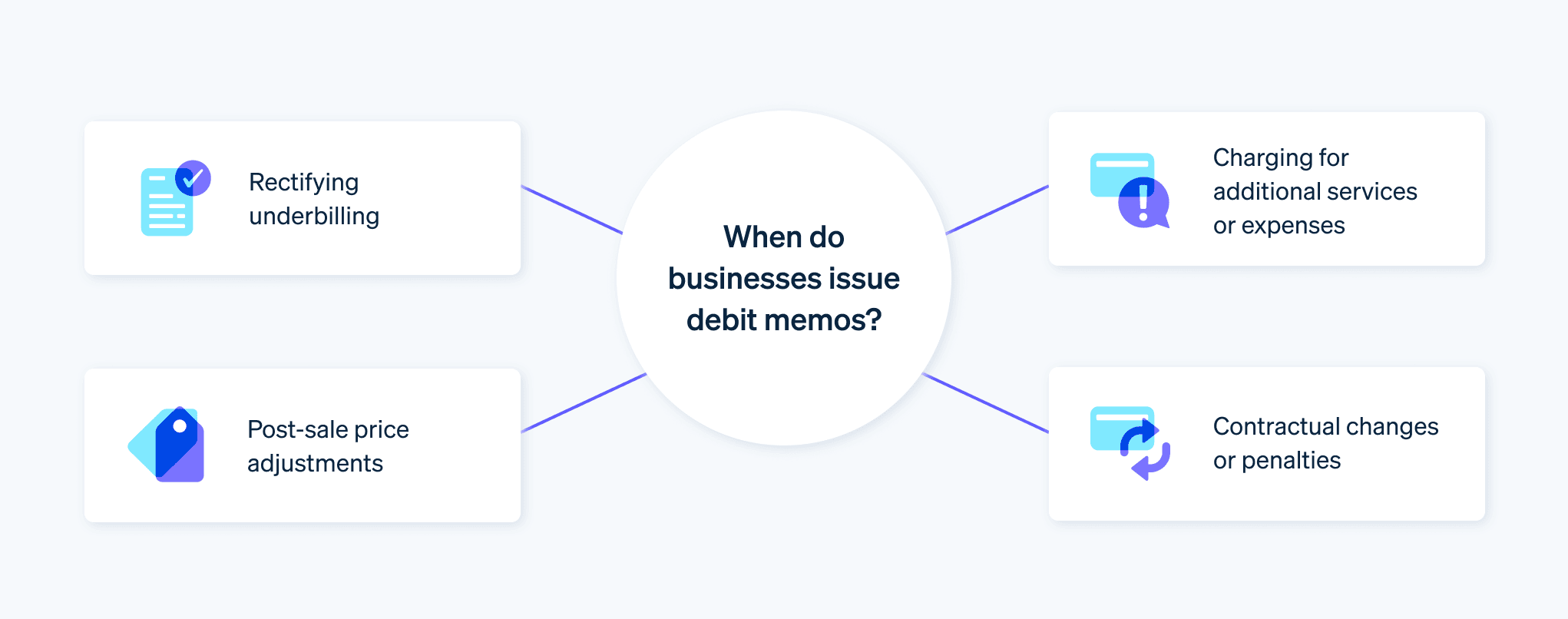

Quando as empresas emitem notas de débito?

As empresas usam notas de débito para ajustar contas financeiras. Esta é uma lista de circunstâncias específicas em que uma nota de débito pode ser emitida:

Corrigir cobranças a menor

Se a empresa perceber que você cobrou muito pouco de um cliente, uma nota de débito ajuda a corrigir o erro. Isso pode acontecer se você precificou incorretamente, cometeu um erro de cálculo ou esqueceu de faturar parte de um serviço. A nota avisa educadamente que o cliente deve um pouco mais. Por exemplo, uma empresa percebe que cobrou pouco de um cliente por um serviço, devido a um erro de cálculo. Se a fatura original foi de US$ 1.000, mas deveria ter sido de US$ 1.200, a empresa emite uma nota de débito pelos US$ 200 adicionais para corrigir a conta.Cobrança de serviços ou despesas adicionais

Às vezes, despesas inesperadas ocorrem após o faturamento inicial. Talvez o cliente tenha solicitado trabalho extra, ou houve custos imprevistos do seu lado. Uma nota de débito permite adicionar essas cobranças à conta do cliente, mantendo as finanças organizadas e atualizadas. Por exemplo, depois de concluir um serviço, um cliente solicita trabalho adicional que não estava incluído no contrato inicial. Se o serviço extra custar US$ 300, a empresa emite uma nota de débito de US$ 300, adicionando-a à conta existente do cliente.Reajustes de preços pós-venda

Os preços podem mudar depois que um acordo é fechado. Se precisar cobrar mais do que o acordado inicialmente, uma nota de débito comunica essa alteração ao cliente. Por exemplo, um contrato pode permitir ajustes de preços com base nas condições de mercado. Quando essas condições levam a um aumento de preço, a empresa emite uma nota de débito para o cliente referente ao valor adicional devido pelos novos preços.Alterações contratuais ou penalidades

Às vezes, os contratos têm cláusulas que exigem ajustes de faturamento em uma data posterior, como aumentos anuais de preços. Na hora de aplicar essas alterações, você usa uma nota de débito para informar o cliente sobre as novas cobranças previstas em contrato. Por exemplo, o cliente deixa de pagar dentro do prazo acordado. Pelos termos do contrato, a empresa impõe uma taxa de atraso de US$ 50. A empresa emite uma nota de débito com a multa por atraso de US$ 50, adicionando-a ao saldo pendente do cliente.

As notas de débito garantem que seus registros financeiros estejam corretos e que os clientes sejam faturados corretamente pelos serviços ou mercadorias que receberem.

Notas de crédito x notas de débito: principais diferenças

As notas de crédito e débito têm propósitos distintos na contabilidade empresarial. Vamos analisar de perto nas principais diferenças:

Direção de ajuste

A empresa emite uma nota de crédito quando precisa reduzir o valor devido pelo cliente. Isso geralmente acontece quando houve uma cobrança a maior, uma devolução de produto ou um problema no serviço. A empresa usa uma nota de débito quando para cobrar a mais do cliente deve. Isso pode ocorrer por erro no faturamento, cobranças adicionais ou ajustes de preço pós-venda.Motivos para emissão

As empresas enviam notas de crédito principalmente para corrigir cobranças a maior, gerenciar devoluções ou fazer ajustes para serviços insatisfatórios. É uma forma de dizer: "Devemos a você", em forma de um crédito para compras futuras. As empresas emitem notas de débito para corrigir uma cobrança a menor, adicionar cobranças pós-transação ou revisar uma fatura para cima devido a termos contratuais ou alterações de preço.Impacto nas demonstrações financeiras

Com uma nota de crédito, as contas a receber da empresa são descontadas porque a empresa deve dinheiro ao cliente ou reduziu o saldo pendente do cliente. Ela subtrai dinheiro do que você espera receber. No entanto, uma nota de débito aumenta as contas a receber. Isso indica que o cliente deve mais, somando ao que você espera receber.Dinâmica de relacionamento com o cliente

Muitas vezes, a emissão de uma nota de crédito reflete o compromisso da empresa com o atendimento ao cliente e a imparcialidade, especialmente quando a observação aborda cobranças excessivas ou insatisfação. Embora a emissão de uma nota de débito seja uma prática comercial padrão, ela exige uma comunicação clara para garantir que os clientes entendam por que devem pagar mais.Processos comerciais internos

O processo de emissão de notas de crédito geralmente envolve departamentos de atendimento ao cliente e controle de qualidade, especialmente em casos de devoluções ou problemas com o serviço. As notas de débito podem exigir mais interação com as equipes de vendas ou gestão de contratos, especialmente quando em caso de faturamento a menor ou ajustes de preços em contratos.

As notas de crédito e débito ajustam o faturamento, mas em direções opostas e por motivos diferentes. Entender essas nuances ajuda a gerenciar as finanças com precisão e manter relacionamentos saudáveis com os clientes.

Práticas recomendadas para gerenciar notas de crédito e débito

Gerenciar notas de crédito e débito com eficiência é importante para manter registros financeiros precisos e relacionamentos saudáveis com os clientes. Algumas práticas recomendadas para as empresas:

Documentação e justificativas claras

Toda nota de crédito ou débito deve estar respaldada por documentação. Isso significa manter registros detalhados da transação original, do motivo do ajuste e de quaisquer comunicações com o cliente relacionadas ao ajuste. A justificativa cria transparência e facilita a referência em caso de litígios ou auditorias.Emissão e processamento pontual

Emita e processe esses notas pontualmente. Atrasos na emissão podem causar confusão e afetar os relatórios financeiros. O processamento rápido de notas de crédito, especialmente aquelas relacionadas a devoluções, é fundamental para manter um bom relacionamento com o cliente. Para notas de débito, a emissão oportuna ajuda a garantir que as empresas recebam cobranças adicionais imediatamente.Lançamentos contábeis precisos

As notas de crédito reduzem a receita e as contas a receber, enquanto as notas de débito aumentam. A contabilidade correta dos lançamentos significa que suas demonstrações financeiras refletem o verdadeiro estado das finanças da empresa.Comunicação eficaz com os clientes

Explique o motivo da nota, como ela afeta a conta do cliente e as providências que ele precisa realizar. Uma boa comunicação pode evitar mal-entendidos e manter a confiança.Integração com sistemas contábeis

O gerenciamento de notas de crédito e débito no sistema contábil ajuda você a gerenciá-las com eficiência. Sistemas automatizados podem sinalizar discrepâncias, enviar lembretes para emissão ou processamento e refletir esses ajustes em suas demonstrações financeiras.Auditorias e revisões periódicas

Revise e audite regularmente transações de notas de crédito e débito para identificar erros, entender as preocupações dos clientes e cumprir normas e políticas de contabilidade.Treinamentos e orientações para a equipe

A equipe deve ser bem treinada para gerenciar notas de crédito e débito. Diretrizes claras sobre quando e como emiti-las, treinamento em comunicação com clientes e manutenção de registros, podem reduzir erros e aumentar a eficiência.Manter a confidencialidade

A confidencialidade é importante ao gerenciar dados sigilosos do cliente. Gerencie com segurança as notas de crédito e débito, bem como os dados nelas contidos, para proteger sua empresa e seus clientes.

Modelo de nota de crédito para empresas

Abaixo está um modelo para uma nota de crédito. É organizado em formato claro e profissional que comunica efetivamente todas as informações necessárias para o cliente. Você pode personalizar este modelo com os dados específicos da sua empresa e as particularidades de cada situação.

[Nome da sua empresa]

[Endereço da sua empresa]

[Cidade, Estado, CEP]

[Telefone] | [Endereço de e-mail]

Nota de crédito

Data: [Data de emissão]

Número da observação de crédito: [ID exclusivo da observação de crédito]

Para:

[Nome do cliente]

[Endereço do cliente]

[Cidade, Estado, CEP]

Referência:

Número da fatura original: [ID da fatura original]

Data da fatura original: [Data da fatura original]

Detalhes do crédito:

|

Descrição do item

|

Quantidade

|

Preço unitário

|

Valor total

|

|---|---|---|---|

| [Item ou serviço] | [Quantidade] | $[Preço unitário] | $[Valor total] |

| [Item adicional] | [Quantidade] | $[Preço unitário] | $[Valor total] |

| Valor total do crédito: | $[Total] |

Motivo do crédito:

[Explique detalhadamente a nota de crédito, como cobrança a maior, devolução de produto, discrepância de serviço etc.]

Outras observações:

[Inclua outras informações ou instruções relevantes, como a forma como o crédito será aplicado (por exemplo, crédito de compra futura), outras ações etc.]

Autorizado por: [Nome e cargo da pessoa autorizante]

Informações de contato para consultas:

[Forneça contatos para os clientes que tiverem dúvidas sobre a nota de crédito.]

[Nome da sua empresa]

Modelo de nota de débito para empresas

Este é um modelo de nota de débito. Este modelo comunica efetivamente cobranças adicionais ou ajustes para um cliente. Você pode personalizá-lo com os dados da sua empresa e outras informações específicas.

[Nome da sua empresa]

[Endereço da sua empresa]

[Cidade, Estado, CEP]

[Telefone] | [Endereço de e-mail]

Nota de débito

Data: [Data de emissão]

Número da nota de débito: [ID exclusivo de nota de débito]

Para:

[Nome do cliente]

[Endereço do cliente]

[Cidade, Estado, CEP]

Referência:

Número da fatura original: [ID da fatura original]

Data da fatura original: [Data da fatura original]

Detalhes do débito:

|

Descrição do item

|

Quantidade

|

Preço unitário

|

Valor total

|

|---|---|---|---|

| [Item ou serviço] | [Quantidade] | $[Preço unitário] | $[Valor total] |

| [Item adicional] | [Quantidade] | $[Preço unitário] | $[Valor total] |

| Valor total do débito: | $[Total] |

Motivo do débito:

[Explique detalhadamente o motivo da nota de débito, como faturamento a menor, cobranças adicionais por serviços ou produtos adicionais, ajustes de preço pós-venda etc.]

Outras observações:

[Inclua outras informações ou instruções relevantes, como data de vencimento, como liquidar o valor adicional, outras ações etc.]

Autorizado por: [Nome e cargo da pessoa autorizante]

Informações de contato para consultas:

[Forneça dados de contato para os clientes que tiverem dúvidas sobre a nota de débito.]

[Nome da sua empresa]

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.