En règle générale, les entreprises soumises à la taxe sur la valeur ajoutée (TVA) doivent la faire figurer sur leurs factures de biens et de services vendus. Cependant, il convient d'examiner de plus près le cas des clients à l'étranger. Des réglementations fiscales individuelles s’appliquent, notamment pour les livraisons et autres transactions effectuées dans des pays tiers. Cet article présente la définition d'un pays tiers et précise la réglementation en matière de TVA applicable aux services et aux livraisons effectués dans ces pays. Nous expliquons également la différence entre la gestion de la TVA en Allemagne et sur le territoire communautaire européen.

Sommaire de cet article

- Qu’est-ce qu’un pays tiers ?

- Quelle est la réglementation en matière de TVA applicable en Allemagne et sur le territoire communautaire ?

- Quelle est la réglementation en matière de TVA applicable dans les pays tiers ?

- Que faut-il savoir sur l'importation et l'exportation de biens vers et depuis des pays tiers ?

- Que faut-il savoir sur la prestation de services dans des pays tiers ?

Qu’est-ce qu’un pays tiers ?

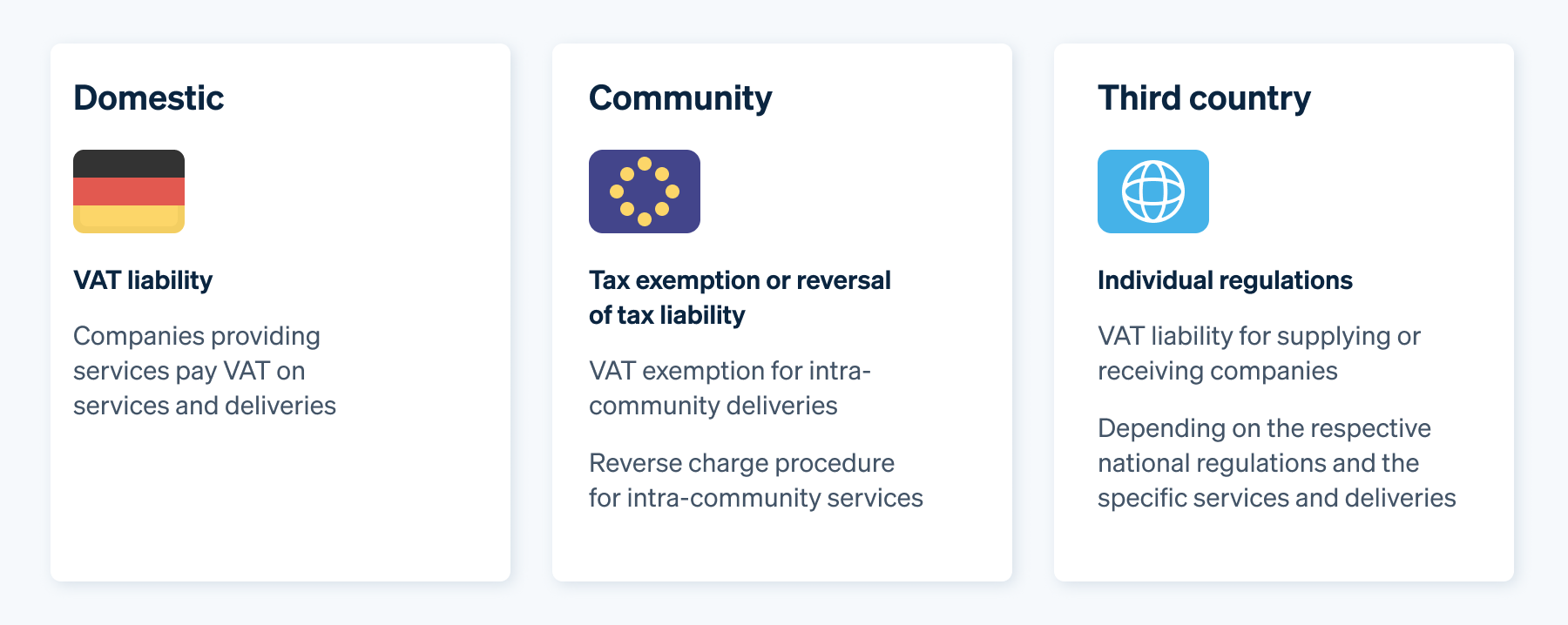

Lorsque les entreprises allemandes vendent des biens et des services, elles doivent faire la distinction entre trois zones de TVA : l’Allemagne, les autres pays européens et les pays non européens.

Selon l'article 1, paragraphe 2 de la loi allemande sur la TVA (UStG), la République fédérale d’Allemagne est un territoire national. Sont exclues et soumises à des réglementations particulières, entre autres, la région de Büsingen, l’île d’Heligoland et les zones franches définies au sens de l'article 243 du code des douanes de l’Union.

L'article 1, paragraphe 2a de l’UStG décrit le territoire communautaire comme étant distinct de celui-ci. Ce territoire comprend, outre l'Allemagne, les territoires des autres États membres de l'Union européenne. Les États membres de l’UE sont les suivants :

- Autriche

- Belgique

- Bulgarie

- Croatie

- Chypre, y compris les bases militaires britanniques d’Akrotiri et de Dhekelia

- République tchèque

- Danemark

- Estonie

- Finlande

- France

- Allemagne

- Grèce

- Hongrie

- Irlande

- Italie

- Lettonie

- Lituanie

- Luxembourg

- Malte

- Pays-Bas

- Pologne

- Portugal, y compris les Açores et Madère

- Roumanie

- Slovaquie

- Slovénie

- Espagne, y compris les îles Baléares

- Suède

Le territoire communautaire comprend également la Principauté de Monaco et les pays suivants : Islande, Liechtenstein et Norvège. Ces derniers ne sont pas membres de l’UE, mais font partie de l’Espace économique européen (EEE).

Les pays tiers sont tous les États situés en dehors du territoire communautaire, c’est-à-dire de l’UE ou de l’EEE (article 1, paragraphe 2 bis de l’UStG). Il s’agit notamment du Brésil, de la Chine, du Japon, de la Russie et des États-Unis. Néanmoins, ils peuvent également être situés sur le territoire de l’UE sans appartenir au territoire communautaire, comme Andorre, Saint-Marin ou la Cité du Vatican.

En raison de leur sortie de l'UE, l'UStG considère généralement la Grande-Bretagne et l'Irlande du Nord comme des pays tiers depuis 2021. Toutefois, l'Irlande du Nord bénéficie d'un statut particulier : pour les échanges de services, elle est considérée comme un pays tiers, mais pour les échanges de marchandises, elle fait partie du territoire communautaire.

Quelle est la réglementation en matière de TVA applicable en Allemagne et sur le territoire communautaire ?

Trois taux de TVA s’appliquent en Allemagne : le taux d’imposition normal sur la plupart des biens et services est de 19 % ; certains biens de consommation courante sont soumis à un taux d’imposition réduit de 7 % (voir article 12 de l’UStG), et quelques services sont totalement exonérés de TVA avec un taux de 0 % (voir article 4 de l’UStG).

L’assujettissement à la TVA s’applique généralement à toutes les entreprises allemandes qui facturent les biens et les services qu'elles délivrent. Elle s'applique également aux professionnels indépendants s'ils exercent une activité commerciale ou professionnelle libérale contre rémunération. Néanmoins, les entreprises qui revendiquent volontairement le statut de petite entreprise en deçà des limites de vente définies par la loi sont exonérées de TVA (voir article 19 de l’UStG).

D’autres dispositions en matière de TVA s’appliquent si une entreprise allemande vend des biens ou des services au-delà des frontières nationales sur le territoire communautaire. Pour les livraisons transfrontalières de biens et de produits entre entités européennes, on parle de livraison intracommunautaire. Sous certaines conditions, ces livraisons sont exonérées de TVA.

Lorsque des entreprises allemandes effectuent des opérations pour des clients situés dans un autre pays membre de l'UE, il s'agit d'un service intracommunautaire. Comme l'activité n'a pas lieu en Allemagne, elle n'est pas taxée dans ce pays, mais dans celui du bénéficiaire. Dans ce cas, la procédure dite d'autoliquidation s'applique.

Qu’est-ce que la procédure d’autoliquidation ?

Dans cette procédure, c’est le destinataire de la transaction qui collecte la TVA, et non le prestataire. L'article 196 de la directive européenne sur la TVA autorise l'autoliquidation pour les livraisons transfrontalières de biens et de services. Dans ce cas, les entreprises allemandes ne peuvent faire figurer que des montants nets sur leurs factures. Elles doivent également faire figurer sur leurs factures la mention « Tax Liability of the Service Recipient » (obligation fiscale du bénéficiaire du service). La procédure d’autoliquidation est applicable dans tous les États membres de l’UE sous certaines conditions. La base juridique est la directive sur la TVA, contraignante pour tous les pays de l'UE (directive 2006/112/CE) et l'article 13b de la loi allemande sur les ventes (UStG).

Quelle est la réglementation en matière de TVA applicable dans les pays tiers ?

Contrairement à l'impôt sur le territoire national et communautaire, la TVA dans les pays tiers est soumise à des réglementations individuelles. Il n’existe pas de réglementation générale transfrontalière. De nombreux pays, dont l’Autriche, le Canada, la Chine, la Grande-Bretagne, Singapour, la Suisse et les États-Unis, ont recours à la procédure d'autoliquidation pour collecter la TVA. En outre, l'Allemagne a conclu des accords fiscaux comparables avec certains pays. Toutefois, dans certains cas, les entreprises allemandes doivent également s’immatriculer à la TVA dans le pays en question ou désigner un « représentant fiscal » pour les représenter en matière fiscale.

Avant d’envoyer une facture vers un pays non européen, vous devez comprendre les exigences légales. Utilisez Stripe Tax pour simplifier la fiscalité et vous consacrer aux tâches fondamentales de votre entreprise. Avec Stripe Tax, le montant exact des taxes est automatiquement calculé et collecté, quel que soit le pays dans lequel vous vendez vos biens et services. Vous n'avez donc plus besoin de faire des recherches fastidieuses pour vous renseigner sur la manière dont la réglementation en matière de TVA s’applique dans un pays tiers spécifique. Stripe gère vos immatriculations fiscales et les paiements associés, afin que vous puissiez calculer, collecter et déclarer la TVA pour les paiements internationaux en toute simplicité.

TVA sur le territoire national, sur le territoire communautaire et dans les pays tiers

Que faut-il savoir sur l'importation et l'exportation de biens vers et depuis des pays tiers ?

Selon l’article 4, paragraphe 1a et l'article 6 de l’UStG, les livraisons effectuées par des entreprises allemandes à des entités situées dans des pays tiers sont des livraisons à l'exportation exonérées de taxes. Les entreprises allemandes ne sont pas tenues de faire figurer la TVA sur leurs factures, la condition préalable étant que les marchandises atteignent physiquement le pays tiers. Une entreprise peut le prouver, par exemple, au moyen de documents d'exportation ou de confirmations écrites des douanes. Pour bénéficier de l'exonération, les entreprises allemandes doivent fournir la preuve de l'exportation. Dès que les marchandises arrivent dans le pays tiers, elles sont soumises aux réglementations douanières et à la TVA à l'importation du pays concerné. En général, c'est l'entité destinataire qui s'en acquitte.

Si des entreprises de pays tiers importent des marchandises en Allemagne, les douanes doivent les dédouaner et les soumettre à la TVA à l’importation. L’entreprise importatrice collecte généralement la TVA à l’importation. Le taux d'imposition normal de 19 % s’applique, sauf pour les marchandises qui bénéficient du taux d'imposition réduit de 7 %. Si l'entreprise destinataire utilise les biens à des fins professionnelles, elle peut les déclarer en tant que taxe en amont dans le cadre de sa déclaration de TVA.

Que faut-il savoir sur la prestation de services dans des pays tiers ?

Si une entreprise allemande offre un service à un client dans un pays tiers, ce service est généralement imposable dans le pays du destinataire. Comme indiqué à l’article 3a, paragraphe 2 de l’UStG, le lieu de prestation est soit le siège social du client destinataire, soit le lieu de l’établissement stable si l’activité s’y déroule. Cependant, cette réglementation ne s’applique qu’aux transactions interentreprises. Pour les services fournis à des particuliers dans des pays tiers, l’administration fiscale perçoit généralement la TVA en Allemagne (voir article 3a, paragraphe 1 de l’UStG). Par conséquent, les bénéficiaires des prestations doivent prouver leur statut d’entrepreneur, par exemple à l’aide d'un certificat délivré par l'autorité fiscale compétente. Les exceptions sont les services dits de catalogue au sens de l’article 3a, paragraphe 4 de l’UStG : dans ces cas, il n’est pas nécessaire de fournir une preuve, car ils sont généralement imposables dans le pays tiers, quel que soit le statut du bénéficiaire de la prestation.

Cela dit, des règles particulières s’appliquent pour déterminer le lieu de prestation de certains services. Par exemple, les activités immobilières sont imposables à l’endroit où le bien est situé. La condition préalable est que la propriété soit un élément central de la prestation. Dans le cas de la location à court terme de moyens de transport, le lieu de prestation est celui où les moyens de transport sont mis à disposition. Les services de restauration sont également imposables à l'endroit où ils sont fournis. Des exceptions s'appliquent uniquement si ces services sont fournis à bord d'un navire, d'un train ou d'un avion.

Si une entité étrangère établie dans un pays tiers fournit des services à une entreprise allemande, la procédure d’autoliquidation s’applique. Cela signifie que l’entreprise allemande, en tant que bénéficiaire, devient redevable et doit payer la TVA.

Le contenu de cet article est fourni à des fins informatives et pédagogiques uniquement. Il ne saurait constituer un conseil juridique ou fiscal. Stripe ne garantit pas l'exactitude, l'exhaustivité, la pertinence, ni l'actualité des informations contenues dans cet article. Nous vous conseillons de solliciter l'avis d'un avocat compétent ou d'un comptable agréé dans le ou les territoires concernés pour obtenir des conseils adaptés à votre situation.