Como CEO de Ramp, en los inicios de la empresa tenía que compaginar las necesidades financieras del equipo con el resto de mis responsabilidades. Funciones como la contabilidad operativa y la planificación financiera suelen ser segmentos financieros independientes. Sin embargo, yo desempeñé estas tareas durante un año y medio antes de contratar al primer empleado financiero de Ramp.

Estas responsabilidades incluían dirigir Ramp a través de una recaudación de fondos durante sus primeros meses, crear modelos financieros y gestionar las nóminas. No hubo un momento concreto en el que me diera cuenta de que Ramp se beneficiaría de contar con un empleado a tiempo completo dedicado a las finanzas. Más bien, fueron las crecientes necesidades de un negocio cada vez más complejo las que me llevaron finalmente a contratar a alguien específico para ese puesto.

Seguir haciéndolo todo yo mismo se volvió insostenible, y sabía que si creaba y gestionaba adecuadamente un equipo financiero sólido dentro de la empresa, podría centrarme en otras iniciativas que ayudarían a impulsar Ramp. Tras varios intentos, encontré la manera de crear con éxito una función financiera que funciona a la perfección y que ha sido una parte integral del éxito de nuestra empresa.

Ramp presta servicios y colabora con equipos financieros y directivos de una amplia gama de empresas, y tiene una perspectiva única sobre cómo crecen estos equipos. En esta guía, compartiremos las opiniones de algunos de nuestros propios expertos financieros, entre los que se incluyen nuestro director de finanzas y mercados de capitales, nuestro director de FP&A y nuestro controlador, además de expertos externos con una amplia experiencia en el asesoramiento a startups, como Kruze Consulting y Burkland Associates. Esta guía es especialmente relevante para las startups en crecimiento que buscan sentar las bases adecuadas para sus equipos financieros incipientes.

Fundadores: qué buscar en tu primera contratación en el área financiera

Al principio, las finanzas de cualquier empresa no son tan complicadas. Lo importante es llevar un registro, la pista de auditoría, la aprobación de la seguridad y los sistemas básicos para una buena salud. Más adelante, se vuelve mucho más interesante. Al cabo de un año, la nómina empezaba a crecer, los gastos se volvían recurrentes y ya no se trataba de «¿Podemos contabilizarlo todo?», sino más bien de «¿Qué podemos hacer para cerrar los libros más rápido?» y «¿Qué podemos hacer para ser más eficientes y obtener información útil a partir de nuestros datos financieros?».

Nos dimos cuenta de que, para que Ramp creciera y se expandiera, necesitábamos invertir en un equipo financiero. Si solo pones un sistema en piloto automático, no te va a ayudar a armar tu balance general, estado de resultados o flujo de caja, ni te va a permitir ver estratégicamente cómo está armado el negocio.

Aunque puede resultar tentador asignar tu personal a los equipos que generan ingresos, especialmente al principio, es importante invertir también en finanzas. Con la configuración adecuada, las finanzas pueden impulsar el crecimiento mientras la empresa se expande y reducir los costes cuando la empresa busca estabilidad en condiciones de mercado inciertas.

La experiencia de inversión es cada vez más crítica

Antes de profundizar en las cualidades de la primera contratación financiera ideal, es importante reconocer cómo ha evolucionado esta función en los últimos años. Debido al auge del capital riesgo, las empresas están reevaluando sus prioridades de contratación. Anteriormente, los primeros empleados procedían del ámbito de la contabilidad, ya que las empresas se preocupaban principalmente por la calidad de sus libros. Se consideraba que la recaudación de fondos y la estrategia financiera eran secundarias con respecto a esta habilidad principal. Pero esta forma de pensar ha cambiado.

Ahora es mucho más habitual que la primera persona contratada para gestionar las finanzas de una startup sea alguien con experiencia en banca de inversión o capital riesgo. Esto se debe a que esta experiencia les permite ser buenos administradores del capital, tanto para ellos mismos como para sus inversores, en lugar de centrarse exclusivamente en el orden interno de los libros contables de la empresa.

Esto es especialmente cierto en los volátiles mercados actuales, en los que las empresas compiten por un capital limitado. La primera contratación financiera ahora está más orientada al exterior que al interior, ya que las empresas se ven obligadas a dar prioridad a la obtención de capital escaso. Por lo tanto, la capacidad de crear modelos sólidos y destacar en las relaciones con los inversores es fundamental. La diferencia entre presentar a tus inversores buenos modelos financieros frente a otros mediocres puede marcar la diferencia entre que tu empresa prospere o sobreviva.

Healy Jones, vicepresidente de FP&A y marketing de Kruze Consulting, lo explica muy bien: «El modelo financiero es como tu estrategia, pero en cifras. Y es una forma de comunicarte con las fuentes de financiación. Contar con el lenguaje adecuado es extremadamente útil si estás recaudando fondos. La interfaz con un inversor de capital riesgo es a través de tu presentación y tu discurso, pero también a través de las cifras. Por eso, estas cifras son muy importantes. He visto a empresas hacerlo con éxito por su cuenta, pero suele ser útil contar con alguien que lo haya hecho antes y esté familiarizado con los KPI de tu sector y con lo que buscan los inversores de capital riesgo».

En consecuencia, se ha dejado de dar prioridad a la experiencia en el sector tradicional. A quienes provienen de Wall Street, del capital privado o de los fondos de cobertura les puede resultar más fácil entrar en lo que antes era un entorno más cerrado. El auge de la automatización financiera y la capacidad de obtener apalancamiento operativo también han abierto la puerta a estos candidatos no tradicionales.

El candidato ideal es aquel que combina experiencia en recaudación de fondos y contabilidad, y que posee las habilidades analíticas y cuantitativas inherentes a un puesto financiero. La experiencia en finanzas, como se mencionó anteriormente, puede ayudarte a recaudar fondos de inversores y prestamistas. Una buena formación en contabilidad te permite establecer tu empresa con una base interna sólida, de modo que puedas comprender mejor tus propias cifras e impresionar a los inversores que desean examinar los detalles. Sin embargo, no es fácil encontrar a estos candidatos ideales.

Los CFO a tiempo parcial están en auge

Las contrataciones financieras a tiempo parcial se están convirtiendo en una opción más viable para muchas startups a la hora de contratar por primera vez, debido a dos factores principales:

1. Mayor aceptación de la externalización de las funciones financieras: la comunidad de startups acepta cada vez más la idea de confiar en su equipo externo de contabilidad o finanzas desde el principio, si no integrarlo por completo, y apoyarse en él como un socio de confianza. Esto no era así hace 5 o 10 años, cuando una empresa en fase inicial o de serie A podía suponer que, como disponía de efectivo, necesitaba contratar a un financiero a tiempo completo, para darse cuenta seis meses después de que el nuevo miembro del equipo no estaba siendo aprovechado al máximo. Ahora, las startups están más abiertas a la idea de utilizar inicialmente recursos a tiempo parcial.

2. La tecnología que reduce el coste de los recursos financieros externalizados: el coste de obtener ayuda financiera externalizada para startups se ha reducido significativamente en los últimos años, principalmente gracias a la tecnología. Las empresas que buscan operar de forma ágil y aligerar su consumo de efectivo pueden utilizar contrataciones fraccionadas como un recurso rentable.

Arquetipos de primera contratación

Lo ideal para tu primera contratación en el ámbito financiero es una combinación de habilidades y experiencia en contabilidad y relaciones con inversores. Sin embargo, dado que estos candidatos son poco frecuentes, a continuación te presentamos algunos arquetipos comunes que puedes encontrar en tu primera contratación:

El novato combativo

Se trata de un graduado relativamente reciente (aproximadamente cinco años desde que terminó sus estudios) con formación tradicional en finanzas. Es muy ambicioso y está dispuesto a dedicar todas las horas que sean necesarias, y cuenta con una combinación de los siguientes logros y habilidades:

- Título en finanzas de una institución respetada

- Prácticas de verano en una institución financiera

- Sueños divergentes de (1) unirse a un fondo de cobertura o (2) conseguir un puesto de director financiero en una startup emocionante

- Son eficientes y analíticos

Este candidato está dispuesto a afrontar cualquier reto que se le presente. Es probable que no tenga años de experiencia en recaudación de fondos y en la interacción con inversores y prestamistas, pero lo compensa con modelos financieros detallados.

El candidato no convencional

Este es el candidato con un historial atípico:

- Licenciatura en una especialidad no financiera como literatura comparada, psicología o música

- Seguido de una carrera en periodismo o consultoría

- Más tarde fue captado por una empresa de gestión de inversiones

- Aprende rápido y tiene una gran aptitud para la lógica y la resolución de problemas

- Abierto a aprender nuevas habilidades y crecer con una empresa

Nuestro socio Kruze Consulting es experto en ayudar a las startups a organizar sus finanzas. Su fundadora y directora ejecutiva, Vanessa Kruze, ha visto todo tipo de perfiles de candidatos y destaca que ha recibido en Kruze a personas sin experiencia previa, como un candidato que se había especializado en historia japonesa. Sin embargo, fueron excelentes contrataciones porque les apasiona aprender el oficio, servir al cliente y formar parte de una empresa que realiza un trabajo basado en una misión.

Healy señala que estos dos primeros arquetipos son ideales para colaborar con una empresa de contabilidad subcontratada que comprenda los matices de los principios de contabilidad generalmente aceptados (GAAP) y los sistemas contables. Puedes dejar que la empresa de contabilidad externa se ocupe de los detalles y que el primer empleado interno se centre en tareas más estratégicas.

El profesional experimentado

Este es el candidato experimentado que lo ha visto todo:

- Trabajó en una empresa de contabilidad Big Four durante 20 años

- A continuación, trabajó en el sector del capital privado (por ejemplo, Deloitte)

- Más tarde ganó experiencia como CFO mientras trabajaba en una tecnológica respaldada por empresas

- Durante los últimos cinco años ha trabajado a tiempo parcial como consultor; ahora busca volver a tiempo completo

Según Kruze Consulting, han visto personas con entre 40 y 50 años de experiencia. Aunque técnicamente están en edad de jubilarse, buscan algo relacionado con la comunidad que les proporcione una sensación de plenitud.

Independientemente de cuál sea su trayectoria, lo fundamental para el éxito futuro de tu primera contratación es su personalidad, su capacidad de adaptación y la compatibilidad de sus valores. ¿Sus creencias están en consonancia con las de tu empresa? ¿Compartís la misma visión para los próximos 10 años? ¿Creen en tu misión? En la siguiente sección profundizaremos en las formas en que puedes evaluar si un candidato encaja en tu cultura.

Ejemplos de preguntas de entrevista

Estas son algunas de las preguntas de entrevista que he utilizado en el pasado y que pueden ayudarte a identificar al candidato correcto:

¿Qué querrías ver en esta empresa para comprender su pasado? Con esta pregunta, intentas hacerte una idea de cómo intentarían comprender las características financieras del negocio. ¿Son capaces de hacerlo de forma precisa, eficiente y analítica?

¿Cuáles son los argumentos a favor de esta empresa? Esta pregunta evalúa los conocimientos financieros y la capacidad de razonamiento del candidato, pidiéndole que haga una previsión sobre el futuro y explique sus razones. ¿Cómo prevén que esta empresa alcance un gran éxito? ¿Cuáles son las consideraciones financieras importantes? ¿Cómo podría fracasar hipotéticamente? ¿Qué problemas financieros potenciales prevén?

Cuéntame alguna ocasión reciente en la que hayas impulsado o mejorado los ingresos, los beneficios, etc. de una empresa. Esta pregunta ayuda a evaluar su impacto potencial en la empresa. ¿Cómo lo hicieron? ¿Cómo fueron capaces de identificar el impulso para este crecimiento y cómo influyeron en el cambio? ¿Se centran en establecer buenas colaboraciones o se centran exclusivamente en sí mismos?

¿Qué atributos consideras fundamentales para una cultura empresarial exitosa? Esta pregunta busca determinar si el candidato encaja en tu cultura. Tomar un atajo en la creación de la cultura de tu empresa ahora puede acabar siendo un gran lastre más adelante y puede tener un profundo efecto en la calidad y la longevidad de tus contrataciones. Tanto si estás incorporando a un empleado a tiempo completo como a tiempo parcial, este candidato debe actuar realmente como un miembro de confianza del equipo, más interesado en ayudar con las decisiones estratégicas que en cumplir con el expediente.

No olvides tener en cuenta la naturaleza de las preguntas que te hace el candidato, ya que pueden decirte mucho sobre él. Creo que es fundamental, sobre todo en la primera contratación, dejar entre un tercio y la mitad del tiempo asignado a la entrevista para que el candidato haga preguntas sobre tu negocio y ver hacia dónde se dirigen. ¿Con qué rapidez pueden captar dónde genera beneficios este negocio? ¿Cuáles son los principales aspectos a tener en cuenta? ¿Son capaces de comprender rápidamente las cuestiones estratégicas? Todos los negocios las tienen, y es importante observar con qué rapidez el candidato puede familiarizarse con ellas.

Crea un equipo: principios de contratación que debes tener en cuenta

A medida que crezcas, tu empresa experimentará diferentes necesidades. Con el tiempo, tendrás que cambiar tanto a quién contratas como cómo lo haces.

Contrata especialistas a medida que madures

Cuando la empresa madure, tu equipo financiero también crecerá y se desarrollará, y los miembros del equipo asumirán funciones más especializadas. Al principio, es fundamental contar con generalistas que estén dispuestos a desempeñar múltiples funciones y a abordar cualquier tarea que se les presente. Sin embargo, a medida que la empresa se expande, surge la necesidad de contar con especialistas. A continuación, te ofrecemos algunas pautas que puedes seguir a medida que tu empresa crece.

Cuándo empezar a contratar especialistas: una vez que tu equipo financiero crezca hasta alcanzar cinco personas o más, será el momento de avanzar hacia funciones especializadas. Esto se debe a que, una vez que llegues a cinco empleados, podrás lograr una mayor eficiencia maximizando el retorno de la inversión por cada uno de ellos. Cinco es el punto de inflexión en el que debes pensar más detenidamente en los especialistas que harán avanzar a tu organización. A continuación, ofreceré recomendaciones más específicas sobre las prácticas recomendadas de contratación.

Ten en cuenta que el momento en el que incorporas especialistas es también cuando puedes empezar a pensar en ampliar tu negocio. Estos especialistas, que cuentan con experiencia en prácticas recomendadas y conocimientos clave adquiridos en anteriores empleos, pueden ayudar a tu empresa a crecer con el tiempo.

Cuándo llega el momento de incorporar gerentes: una regla general es que un gerente no debe tener más de cuatro a seis subordinados directos. Una vez que el número de subordinados directos supera ese rango, se necesita una jerarquía gerencial más amplia dentro de la organización.

No te preocupes por ampliar tu equipo financiero demasiado pronto

Puede resultar tentador pensar en escalar desde el principio, incluso antes de contratar a especialistas. Pero la escalabilidad no debería ser una preocupación principal al principio. Céntrate en superar las fases iniciales fundamentales de bloqueo y abordaje. Una vez que lo hayas hecho, podrás preocuparte por la escalabilidad y la eficiencia y pensar en la linealidad de tus funciones más críticas (por ejemplo, cómo hacer crecer las funciones que se escalan linealmente, como la contabilidad, frente a las que se escalan exponencialmente, como la planificación y el análisis financiero (FP&A) y los mercados de capitales).

Contrata una combinación de niveles de ambición

Para alcanzar el éxito a medida que tu equipo madura, es necesario contar con una combinación de niveles de ambición complementarios. Necesitas empleados que quieran seguir una trayectoria como colaboradores individuales, que quizá sean un poco menos ambiciosos en cuanto al lugar al que quieren llegar en las últimas etapas de su carrera. Esto debe equilibrarse con empleados que quieran ascender en la escala directiva. Un equipo lleno de Tom Bradys o Megan Rapinoes, que en este escenario parece un equipo financiero al completo que aspira al puesto de director de operaciones (COO) o director financiero (CFO), estaría condenado al fracaso.

Especialmente en las startups tecnológicas de alto crecimiento, tu bolsa de candidatos está llena de empleados extremadamente ambiciosos muy centrados en sus perspectivas profesionales. Para evitar este problema, es importante comunicar claramente cuáles son las funciones y vincularlas al valor que aportan a la organización. De este modo, se pueden evitar expectativas confusas en cuanto a la movilidad laboral y garantizar una combinación óptima de aspiraciones profesionales.

Planifica con antelación el crecimiento y la contratación internacionales

Si cree que su empresa va a expandirse internacionalmente, ya sea para crecer o para acceder a una mayor reserva de talento, es fundamental establecer los sistemas adecuados desde el principio para evitar posibles complicaciones en el futuro.

Expansión para el crecimiento empresarial internacional

Si tu empresa opera o está considerando operar a nivel mundial, deberías plantearte contratar un equipo financiero in situ con experiencia local que pueda ayudarte a navegar por las normas reglamentarias y operativas de los nuevos mercados. Por ejemplo, si tienes tu sede en EE. UU. y estás pensando en operar en Europa, podrías beneficiarte enormemente de un equipo que te ayude a comprender los diferentes requisitos financieros, legales y normativos. Aunque es probable que esto se pueda externalizar en las primeras etapas, deberías considerar la posibilidad de contratar personal interno en función del alcance y la velocidad de tu expansión.

Expansión para contrataciones internacionales

Si lo que quieres es contratar personal a nivel internacional, es importante que cuentes con el apoyo de un especialista en nóminas desde el principio (se puede subcontratar si tienes menos de 150 empleados) que te ayude a gestionar las cuestiones operativas, legales y de cumplimiento normativo inherentes a las operaciones internacionales. «Es muy importante que una startup lo haga correctamente, porque vemos que puede volverse en su contra en el proceso de diligencia debida en torno a las rondas de financiación y las adquisiciones. Por lo tanto, es importante asegurarte de que todos los detalles estén bien definidos en lo que respecta a la contratación internacional», señala Kate Adams, vicepresidenta de marketing de Burkland Associates.

Si eres una empresa estrictamente nacional, considera las ventajas (más candidatos potenciales) frente a los inconvenientes (un dolor de cabeza por papeleo) antes de decidir expandir tu talento a nivel internacional.

Invierte en conocimientos sobre nóminas si estás creando un equipo a distancia

Los empleados contratados a distancia también pueden beneficiarse de los servicios de un especialista en nóminas que les ayude a gestionar los aspectos técnicos de la contratación desde diferentes estados y países. Las declaraciones de impuestos estatales y de nóminas pueden ser tediosas y complicadas, mientras que las contrataciones en diferentes estados también generan obligaciones fiscales para la entidad corporativa, que deben gestionarse.

«Hemos visto cómo las startups se han visto afectadas por la diligencia debida y en torno a las fusiones y adquisiciones y la financiación con esto. Por ejemplo, todos los empleados deben estar registrados en el estado en el que trabajan. No muchas startups lo saben», explica Kate. «Y algunos de estos estados tienen requisitos fiscales para los empleados cuando se encuentran en ese estado. Hay que tener cuidado, ya que algunos estados lo ponen muy fácil y otros lo hacen más difícil».

Implementa una estructura financiera inteligente para reducir las necesidades de personal.

Piensa en cómo la automatización cambiará el funcionamiento de tu equipo. Por ejemplo, con herramientas que te permiten emitir fácilmente tarjetas virtuales a los empleados, los responsables financieros no tienen que preocuparse ni perder tiempo con informes de gastos, persiguiendo gastos, etc. El uso de Ramp permite a los empleadores dar autonomía a sus empleados y convertirse en lugares de trabajo más flexibles. Por lo tanto, tus herramientas podrían tener un gran impacto en las funciones que necesitas contratar. Ten en cuenta que probablemente no deberías experimentar mucho con herramientas durante tus primeros tres años. Debes confiar principalmente en herramientas fiables que puedan ayudar a tu equipo financiero a tener éxito. Está bien probar nuevas herramientas, pero que sea la excepción y no la regla. Debes asegurarte de contar con un conjunto de tecnologías integrado y eficaz que prepare a tu equipo y a la organización en general para el éxito.

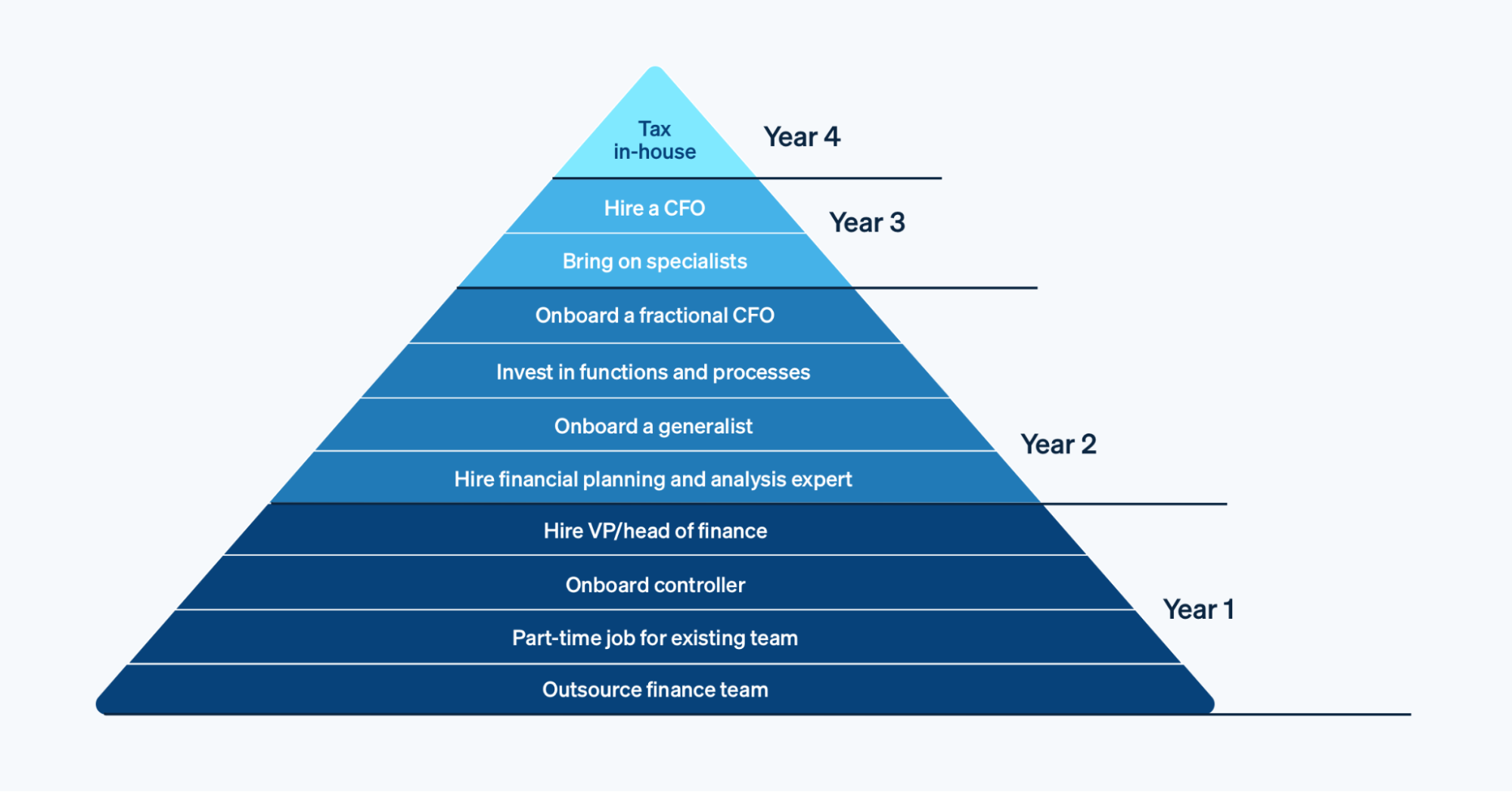

Tu plan de contratación para los primeros cuatro años

Aquí tienes un marco para estructurar tu equipo durante los primeros cuatro años. Aunque esta sección está dividida por años, también debes tener en cuenta tu nivel de financiación. Por ejemplo, la Serie A de una startup podría ser una ronda de 10 millones de dólares, mientras que la Serie A de otra startup podría alcanzar los 100 millones de dólares.

Primer año: pon en marcha tu función financiera

El primer año consiste en empezar de cero la función financiera. Hay cuatro opciones comunes:

1. Externaliza tus finanzas

Algunas startups optan por externalizar su función financiera. Las opciones fraccionadas más populares incluyen contabilidad, finanzas e impuestos. Vanessa cree que se debe pensar en contratar a un socio externo desde el primer día, tan pronto como se firmen los documentos de constitución y, posiblemente, incluso antes de abrir la primera cuenta bancaria. Aunque la mayoría de las startups y pequeñas empresas no necesitan un equipo de contabilidad o finanzas a tiempo completo hasta que alcanzan una plantilla de unas 25 personas, es importante asegurarse de que se está preparando para el éxito estableciendo las cuentas bancarias adecuadas, eligiendo las plataformas tecnológicas adecuadas y, en última instancia, no creando un lío, en caso de que decida elegir un socio contable al cabo de dos o tres años.

Vanessa considera que contratar a un socio externo, en lugar de a un empleado a tiempo completo, es una decisión financiera más inteligente para la mayoría de las startups, y explica que no suele ver rondas de financiación iniciales de entre 1 y 5 millones de dólares, ya que aún no tienen suficiente volumen en su base de clientes como para necesitar un contable a tiempo completo.

Aunque no existe un enfoque único para decidir quién debe ser tu primera contratación, existe un consenso en que buscar un CFO en las primeras etapas de una empresa es excesivo. Kate afirma que cada vez más startups se están dando cuenta de que basta con externalizar la contabilidad y contratar a un especialista en FP&A para que ayude con la modelización. Una vez que llegas a la primera ronda, es cuando definitivamente necesitas contratar a un CFO a tiempo parcial.

Si decides externalizar alguna de tus funciones, puede ser útil asignar a un miembro de tu equipo la dirección del equipo externalizado. Esta persona puede ayudar a tu equipo fraccionado a comprender mejor las necesidades específicas de la empresa.

2. Haz que los demás miembros del equipo lo traten como un trabajo a tiempo parcial

Al igual que yo gestionaba las finanzas antes de contratar a mi primer empleado para ese puesto, probablemente puedas encargar la gestión de tus finanzas a un alto ejecutivo. Ten en cuenta que se trata de una solución puramente temporal hasta que contrates a alguien a tiempo parcial o completo.

3. Incorpora a un controlador

Otra opción es incorporar a un controlador para que toda la contabilidad se realice internamente. Esto puede ayudar a garantizar que tu contabilidad y tus datos sean lo más sólidos posible. Este proceso suele comenzar con la contratación de un controlador, así como de un gerente de contabilidad o un contable. Contar con una función interna puede ser especialmente útil para respaldar tu FP&A.

Si bien la FP&A puede ayudar a impulsar las prácticas recomendadas contables en el cierre mensual y en la automatización de la presentación de informes, es necesario contar con una base contable sólida y datos fiables para que un profesional de FP&A pueda aportar un valor extraordinario a la organización.

4. Contrata a un vicepresidente o director de finanzas

Algunas startups optan por contratar a un vicepresidente o director de finanzas para dirigir el equipo. Si tienen experiencia en contabilidad, esto puede ser aún más útil para crear una función financiera exitosa. Las empresas que deciden contratar a un empleado a tiempo completo como primera contratación suelen preferir títulos como director de finanzas, que confieren antigüedad pero no están vinculados a la alta dirección.

Segundo año: establece una estrategia financiera clara sobre el rumbo de la empresa

El segundo año se centra en avanzar hacia la estrategia y establecer procesos claros y repetibles.

Contrata a FP&A: este es el momento en el que comenzará la transición hacia una función financiera dedicada mediante la contratación de un analista o gerente de FP&A a tiempo completo. Es recomendable añadir este puesto una vez que la contabilidad esté en buen estado, de modo que esta contratación pueda estar en una buena posición para aprovecharla y mejorarla. En el segundo año, el enfoque pasa de la contabilidad y la infraestructura básica de FP&A a servicios más estratégicos y de valor añadido. Este profesional dedicado a FP&A se encargará de funciones críticas como la elaboración de informes, las previsiones y la modelización de escenarios.

Incorpora a un generalista: además de FP&A, necesitarás contar con un generalista sólido que te ayude a abordar y ejecutar rápidamente las innumerables tareas que surjan, como tu función de FinOps. Como se mencionó anteriormente, esto podría suceder en el segundo año o en cualquier momento antes de que tu equipo financiero crezca hasta alcanzar las cinco personas.

Invierte en funciones y procesos: ahora se pone mayor énfasis en las funciones y los procesos. Por ejemplo, si uno de los procesos es el reembolso en efectivo, es necesario contar con un contable o un puesto similar que pueda asumir esa responsabilidad. Un ejemplo de puesto interno a tener en cuenta en este momento sería el de contable sénior para gestionar tu sistema de información de recursos humanos (HRIS).

La ciencia de datos y BizOps son otras áreas clave que las finanzas deben dominar en este momento. BizOps cubre las lagunas en términos de análisis de viabilidad financiera y asignación de recursos en toda la empresa.

Cómo mis primeros errores contribuyeron al éxito de Ramp

Con Paribus, mi última empresa, la gestión de gastos se convirtió en un gran problema cuando se preparaban para venderla. No llevábamos un buen registro. Pensábamos que con tener una tarjeta de crédito era suficiente. Pero los requisitos de auditoría decían: «Necesitas un recibo para cualquier gasto superior a 75 $, o no podremos deducirlo como beneficio imponible, lo que reduciría el beneficio del comprador». Pasé semanas rastreando años de gastos, algo realmente horrible. Eso me ayudó a dar con la idea de crear un software que ayudara a la gente a hacer eso para que pudieran evitar una experiencia similar.

Incorpora a un CFO a tiempo parcial: un director financiero a tiempo parcial puede ser una buena opción para las startups que se encuentran entre la ronda inicial y la ronda Serie A. Están preparadas para recibir la orientación de un director financiero, pero no están del todo preparadas para asumir los costes que supone contratar a uno a tiempo completo. Las startups en fase inicial no suelen necesitar un director financiero, sino que les conviene más centrarse en sus necesidades fiscales y contables.

Si crees que un CFO a tiempo parcial podría ser la opción adecuada para ti, considera trabajar con uno que comprenda tu segmento de negocio.

Tercer año: define procesos; perfecciona especializaciones

En el tercer año, te centrarás en reducir aún más tus procesos y crear funciones más especializadas.

Contrata especialistas: una vez que tu equipo financiero alcance los cinco miembros o más, considera la posibilidad de incorporar especialistas para completar y ampliar tu equipo. Un ejemplo sería un especialista en nóminas. Cuando tu organización alcance los 150-200 empleados, será el momento de incorporar a uno. Esto es necesario para gestionar las necesidades cada vez más complejas en materia de nóminas y será la primera contratación financiera con una función específica.

Contrata a un CFO: en este momento, también podrías considerar la posibilidad de contratar a un director financiero interno. Esto suele ocurrir después de que una empresa recauda su Serie D. Te interesará buscar un CFO que tenga experiencia en startups, en lugar de haber trabajado únicamente en finanzas tradicionales, y que esté familiarizado con cuestiones propias de las startups, como la conservación de la liquidez, la recaudación de fondos y la importancia de las métricas y los puntos de referencia.

Cuarto año y años posteriores: incorpora funciones internas; concéntrate en la satisfacción del cliente

A partir del cuarto año, el enfoque será incorporar más funciones internas sin descuidar lo que más importa: tus clientes.

Fiscalidad interna: probablemente hasta ahora hayas externalizado tus impuestos. Pero después de tres años o cuando tu equipo crezca hasta alcanzar las 25 personas, querrás establecer una función fiscal interna. «Creo que es seguro asumir que puedes y debes confiar en un proveedor de contabilidad externo hasta que alcances las 25 personas», explica Vanessa. «Es raro que una empresa pase de 0 a 25 personas en su primer, segundo o incluso tercer año, pero ocurre».

Estudio de caso: el equipo financiero de Ramp

Hoy en día, el equipo financiero de Ramp desempeña un papel fundamental a la hora de ayudar a la empresa a crecer y evolucionar continuamente. Desde la obtención de 150 millones de dólares en deuda respaldada por activos hasta la transición a un nuevo ERP, nuestra función financiera ha sido fundamental para llevar a Ramp al siguiente nivel. Si hubiera seguido intentando gestionarlo yo mismo, dudo que Ramp hubiera llegado a donde está hoy.

Alex Song fue contratado como director financiero de Ramp 15 meses después de su creación. Yo mismo me encargaba de la contabilidad operativa y la planificación financiera antes de contratar al primer empleado dedicado exclusivamente a las finanzas. El aumento de la nómina y los gastos recurrentes de Ramp contribuyeron a la necesidad de crear un puesto específico. Ramp estaba a punto de quedarse muy atrasada en la contratación de personal financiero cuando Alex se incorporó.

Qué buscaba en mi primera contratación en el área de finanzas

Buscaba un candidato con una sólida formación en finanzas estratégicas y que pudiera actuar como socio para ayudar a Ramp a establecer una base financiera sólida. Buscábamos a alguien que pudiera aportar una sólida perspectiva financiera estratégica, que no solo fuera capaz de establecer los sistemas para crear estados financieros, sino que también pudiera evaluar nuestras asignaciones, por ejemplo, ¿estamos gastando demasiado o demasiado poco en un área determinada? Realmente queríamos un socio con ideas para la construcción de nuestro negocio. Por eso queríamos un candidato con experiencia en la asignación de cantidades significativas de capital e inversiones. Me encantó que Alex hubiera sido inversor en deuda durante años.

La experiencia de Alex en relaciones con inversores fue otra cualidad atractiva. Tenemos inversores en Goldman Sachs y Citi que están comprando efectivamente nuestro riesgo crediticio, y gracias a la experiencia previa de Alex, él era muy hábil para comunicar de manera creíble los entresijos de nuestros libros. Creo que las relaciones con los inversores son un elemento que no se discute en las contrataciones financieras. Al fin y al cabo, gran parte del negocio consiste en crear confianza y contar con un líder que no solo sea bueno sobre el papel, sino que también sea inteligente, elocuente y capaz de dirigir un gran equipo.

Cómo está creciendo hoy el equipo de Ramp

Ramp se encuentra ahora en un punto en el que está empezando a contratar especialistas que se dedican a una sola función. Se centra en dotar de personal a la organización según sus verticales más amplios, como por ejemplo contar con equipos financieros que apoyan específicamente a ventas y marketing, Gastos Generales y Administrativos (G&A) e I+D. Las capacidades de automatización de nuestra plataforma nos permiten contratar menos generalistas y mantener al mismo tiempo unas operaciones rigurosas.

Ramp también está pensando en contratar a un especialista en impuestos para ayudar a nuestro controlador, que actualmente es el responsable de todos los asuntos fiscales. A medida que el negocio se vuelve más complejo, esto empieza a ser una necesidad. Ampliar nuestro propio equipo nos permitirá apoyar mejor nuestro objetivo principal: ayudar a los líderes empresariales a ahorrar tiempo y dinero. Seguiremos escuchando atentamente a nuestros clientes y lanzando actualizaciones que les ayuden a hacer más con menos.

Crea un equipo financiero ágil y eficiente. Ramp puede ayudarte. crea tu cuenta. Para obtener más información sobre cómo los líderes financieros están creando su equipo y utilizando la tecnología, escucha el podcast de Ramp.