For most businesses, accepting credit card payments is a must. Credit card acceptance opens up a vast customer base: 4.8 billion Visa cards were circulating worldwide in 2024. Businesses that accept credit cards can also tap into advanced data analytics that help inform business decisions, while benefiting from advanced fraud detection and prevention tools that credit card processors provide.

Below, we'll cover how to accept credit card payments as a small business, including the different types of card payments and best practices for setting up and maintaining payment processing systems.

What's in this article?

- How to accept credit cards as a small business

- Credit card payment best practices for small businesses

- Types of credit card payments

- How credit card processing works

- How Stripe Payments can help

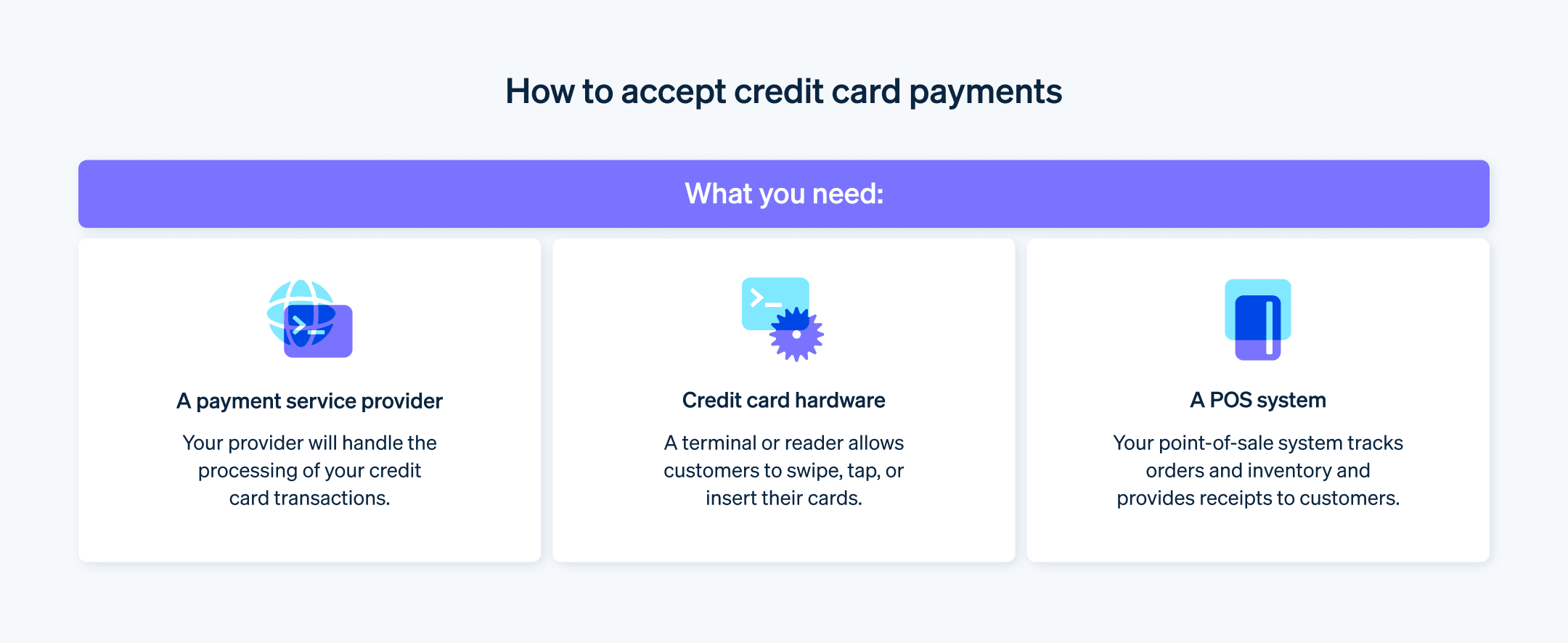

How to accept credit cards as a small business

1. Choose a payment services provider (PSP)

A PSP connects businesses, customers, financial institutions and card networks to process online payments. When selecting a PSP, businesses should consider these factors:

Market trends: Investigate trends in payment processing, including emerging technologies and customer payment preferences.

Technical support: Examine the PSP's level of technical support. Features such as 24/7 support, responsive customer service and access to technical expertise can swiftly resolve issues and maintain business continuity.

Customisation and scalability: Evaluate whether the PSP allows for customisation to fit your business needs, and whether it has the capabilities to scale with your business.

Customer and expert opinions: Engage in forums, get in touch with other businesses that use the PSPs and seek expert advice.

Available features: Examine the features of each PSP in detail. Do they offer multi-currency support or reporting tools? Is the interface user-friendly? Can it be integrated with your accounting software or customer relationship management (CRM) system?

2. Set up a merchant account

A merchant account is a specialised bank account that a business uses to accept credit and debit card payments. It acts as an intermediary, holding funds from card transactions before transferring them to the business's bank account.

Some PSPs, such as Stripe, bundle the merchant account with their services, eliminating the need for businesses to establish their own merchant account. This can simplify the process and reduce administrative burdens.

If you do need a merchant account, here are some points to consider:

Business model alignment: Look for a provider that understands your business model. Finding a good fit can lead to more favourable terms and streamlined operations.

Application preparation: When applying for a merchant account, prepare a comprehensive business case including your business plan, financial health, projected sales volumes and fraud mitigation strategies. This demonstrates to merchant account providers that you're a responsible partner and can help you obtain more favourable terms.

Approval factors: Understand what factors influence the approval of your application, such as credit history, industry type,and sales volume. Address potential red flags before they become issues.

Future needs: Consider how changes in your business size or model may affect your merchant account needs and confirm that there's flexibility to adapt to any changes.

3. Integrate a payment gateway

A payment gateway is a technology that businesses use to accept debit or credit card purchases from customers. It facilitates communication between the business' website and the acquiring bank and securely transmits sensitive payment information.

When choosing a payment gateway, businesses should consider the following factors:

Security features: Assess the payment gateway's security features, including encryption and tokenisation.

Ease of integration: Research what's involved in integrating the payment gateway with your systems. A simpler integration can reduce costs and minimise disruptions to your operations. Work closely with your web development team or an external expert to assess the technical integration. Focus on aspects such as application programming interface (API) connectivity, data encryption and error-handling mechanisms.

Unified commerce benefits: Look for PSPs with unified commerce solutions that can connect your in-store, mobile and online sales channels. This creates a holistic view of customer interactions, enabling better service and targeted marketing activities.

User experience: Look for an intuitive and straightforward payment process that minimises the number of steps required to complete a transaction and works across mobile and web platforms.

Performance: Conduct thorough testing that includes various scenarios, such as transaction failures, refunds and chargebacks, to confirm that the system can perform under a variety of conditions.

4. Acquire hardware and software for in-person transactions

When selecting hardware and software for in-person transactions, consider these factors:

In-person hardware considerations: When selecting hardware for in-person credit card transactions, consider durability, ease of use, compatibility with different card types (e.g. chip, magnetic stripe, NFC) and battery life for mobile devices.

Online system integration: In-person transaction systems should be capable of integrating fully with your online systems, offering real-time data synchronisation and a unified view of customer activity.

Ongoing support: Look for service providers that have ongoing support and training available for the hardware and software. This will ensure that any downtime is minimal and that any issues are resolved quickly.

Comprehensive solution evaluation: Consider the hardware and software environment. This includes how well the components can be integrated with each other, how easy it is to update the software and the availability of features, such as inventory management or customer loyalty programmes.

Data synchronisation: Look for a solution that provides real-time data synchronisation across all channels, including sales data, inventory levels and customer information.

Future-proofing: Choose hardware and software that can easily adapt to new payment methods, comply with upcoming regulations and integrate with evolving technology.

5. Consider compliance and security

Use the following security and compliance practices to stay up-to-date with regulatory requirements and industry standards.

Regular compliance updates: Create a schedule for reviewing and updating your compliance practices on a regular basis. This includes staying informed about changes in PCI DSS standards and implementing necessary changes in a timely manner.

Incident response plan: Develop a comprehensive incident response plan for potential security breaches. This plan should include steps for containment, investigation, notification and recovery, along with roles and responsibilities for your team.

Continuous employee education: Establish an ongoing education programme for employees, focusing on security best practices, new threats and compliance updates. Regular training can reduce the risk posed by human error and help to maintain a culture of security awareness.

Credit card payment best practices for small businesses

Understanding fees and pricing

Flat-rate pricing: Simple, predictable fees (for example, 2.6% and $0.10 per transaction). The flat-rate pricing model is ideal for low-volume businesses (such as small businesses), or any business that wants transparent and easily predictable rates.

Interchange-plus: Breaks down the interchange fee (set by card networks) and a processor markup. The interchange-plus model can mean lower costs for higher-volume or varied transactions, but may be harder to predict monthly costs due to changing interchange rates.

Subscription-based: Also called membership-based pricing, businesses pay a monthly fee plus fixed per-transaction costs. The subscription-based pricing model can be cheaper for higher-volume businesses, since processors do not take a percentage of sales.

All of Stripe's fees and pricing information are available on our website.

Advanced security measures

End-to-end encryption (E2EE) and tokenisation: Beyond basic PCI DSS compliance, E2EE and tokenisation keep cardholder data encrypted at every point in the transaction process, reducing the risk of data breaches.

Multi-factor authentication (MFA) for transactions: Implement MFA for online transactions, especially for high-value purchases or changes to account information. This adds a layer of security and reduces the risk of unauthorised access.

Regular security audits and penetration testing: Conduct thorough security audits and engage in regular penetration testing to identify vulnerabilities in your payment processing system and fix them before fraudulent actors have an opportunity to exploit them.

Payment processing

Dynamic currency conversion (DCC): Offer DCC to international customers so that they can see prices and make payments in their local currency. This can improve the customer experience and potentially increase sales from international markets.

Intelligent routing: Use intelligent routing to select the best payment gateway based on factors such as transaction success rates, processing fees and the card's issuing bank. This can boost approval rates and reduce costs.

Failover mechanisms: Implement failover mechanisms that re-route transactions automatically through a secondary processor if the primary one fails, ensuring continuity of service and minimising lost sales.

Customer experience

Checkout: Enhance the checkout process by minimising steps and reducing friction, especially on mobile devices. Consider options for one-click purchasing and storing customer payment information for future transactions.

Personalisation: Use the data gathered from payment processes to personalise the shopping experience. This can include customised offers or tailored recommendations based on purchase history.

Communication: Keep customers informed about the payment process, providing clear instructions and immediate feedback on the transaction status. Transparent communication can reduce chargebacks and strengthen customer trust.

Financial management

Interchange fees: Get to know the factors that influence interchange fees and implement best practices to qualify for the lowest possible rates.

Chargebacks: Develop a comprehensive strategy for managing and disputing chargebacks. This should include maintaining detailed transaction records, providing excellent customer service, and using tools such as address verification service (AVS) and card verification value (CVV) checks.

Cash flow: Use insights from your payment processing to better manage your cash flow. Analysing the timing of settlements and reconciling them promptly can help you forecast and manage your finances more effectively.

Continual improvement and adaptation

Industry trends: The payment industry is constantly evolving. Stay informed about the latest technologies, regulatory changes and customer payment preferences and adapt your strategies accordingly.

Feedback loops: Establish mechanisms to gather feedback from customers and internal stakeholders about the payment process. Use this feedback to refine and improve your payment strategies.

Staff training: Train your staff on the most up-to-date payment processing security protocols and best practices. An informed team can provide better service to customers and help to mitigate risks.

Types of credit card payments

Not all credit card payments use the same payment mechanism. As technology advances, customers have more options for using credit cards.

Swiped transactions (magnetic stripe)

This method involves swiping a card through a card reader that reads the magnetic stripe on the back of the card. This type of transaction, used in point-of-sale (POS) systems, has become less popular because of security concerns.

Data transmission: The magnetic stripe contains data that includes the cardholder's name, the account number, the card expiry date and a security code. When a customer swipes their card, the reader captures this data to initiate the transaction process.

Security aspects: Swiped transactions are considered to be less secure because of the static nature of the data on the magnetic stripe, which makes it susceptible to cloning and fraud.

Dipped transactions (EMV chip cards)

EMV (Europay, Mastercard, and Visa) chip cards are dipped into a reader, allowing the chip to communicate with the terminal and authenticate the transaction. This transaction type is standard in many regions, especially where there are stringent security measures for card-present transactions.

Data transmission: The chip generates a unique transaction code for each payment.

Security aspects: The dynamic encryption makes it difficult for fraudulent actors to replicate the card's data, which reduces counterfeit card fraud.

Tapped transactions (contactless)

Contactless transactions use near-field communication (NFC) or radio frequency identification (RFID) technology, which allows the card to be tapped on a reader without direct contact. This transaction type is popular in environments that prioritise speed and convenience, such as retail and public transportation.

Data transmission: Similar to EMV transactions, contactless payments transmit data via encrypted signals, providing a unique code for each transaction.

Security aspects: Contactless transactions provide a high level of security through encryption and by generating a unique code for each transaction.

Digital wallet transactions

Digital wallets (e.g. Apple Pay, Google Wallet) store credit card information on a mobile device, which customers can use to make payments via NFC technology. This type of transaction is increasingly popular in online and in-store transactions for its convenience.

Data transmission: When a payment is initiated, the digital wallet creates a tokenised transaction, substituting sensitive card details with a unique digital identifier.

Security aspects: Digital wallet transactions achieve a high level of security through tokenisation and biometric verification (e.g. fingerprint or facial recognition) on the user's device.

Online and card-not-present (CNP) transactions

Card-not-present transactions refer to online or phone purchases in which the card is not physically presented to the business. This type of transaction is used for all e-commerce, telephone orders and any remote payment scenarios in which the business cannot physically verify the card or cardholder.

Data transmission: The customer enters their card details manually and these are transmitted to the business for processing.

Security aspects: CNP transactions carry a higher risk of fraud because the card and cardholder are not physically present. For this reason, advanced security measures such as two-factor authentication and Secure Sockets Layer (SSL) encryption are recommended for CNP transactions.

How credit card processing works

Credit card processing is facilitated by a network of financial entities and technologies that work together to authorise and settle payments. Here's how the process works.

Initiation: When a customer makes a credit card purchase, the business' POS system or online payment gateway captures the transaction details, including the card information and purchase amount.

Authorisation: The transaction details are sent to the business' payment processor, and the issuing bank verifies the card's validity, available funds and any fraud risks.

Batching: At the end of the business day, the business sends all approved transactions in one batch to their payment processor.

Clearing and settlement: The payment processor forwards the batched transactions to the card networks, which route them to the respective issuing banks for settlement.

Fees and charges: Throughout this process, various fees are assessed by different entities involved in the transaction such as interchange fees (paid to the issuing bank), assessment fees (paid to the card network) and processing fees (paid to the payment processor).

Security and compliance: Compliance with the Payment Card Industry Data Security Standard (PCI DSS) is mandatory for all entities involved in credit card processing.

Disputes and chargebacks: In cases in which the cardholder disputes a transaction or there is a possibility of fraud, a chargeback process might be initiated. Businesses must respond to chargebacks with evidence to support the legitimacy of the transaction, or they risk losing the funds and incurring additional fees.

How Stripe Payments can help

Stripe Payments provides a unified, global payments solution that helps any business – from scaling start-ups to global enterprises – accept payments online, in person and around the world.

Stripe Payments can help you:

- Optimise your checkout experience: Create a frictionless customer experience and save thousands of engineering hours with prebuilt payment UIs, access to 125+ payment methods and Link, a wallet built by Stripe.

- Expand to new markets faster: Reach customers worldwide and reduce the complexity and cost of multi-currency management with cross-border payment options, available in 195 countries across 135+ currencies.

- Unify payments in person and online: Build a unified commerce experience across online and in-person channels to personalise interactions, reward loyalty and grow revenue.

- Improve payments performance: Increase revenue with a range of customisable, easy-to-configure payment tools, including no-code fraud protection and advanced capabilities to improve authorisation rates.

- Move faster with a flexible, reliable platform for growth: Build on a platform designed to scale with you, with 99.999% uptime and industry-leading reliability.

Learn more about how Stripe Payments can power your online and in-person payments or get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.