If you've ever made a purchase by inserting your credit or debit card, instead of swiping it, then you already know how to use EMV chip cards. If you're a business that accepts card payments from customers in person, your card reader probably already accepts these "dipped" chip payments. But even if you've been using this method for years, you might not know what EMV chip cards are, how they work, and why this payment technology has seen widespread global adoption as the new industry standard in the last 10 years.

EMV chip cards are a dominant presence in the world of card payment. EMVCo, the organisation that manages EMV technology, reported in 2024 that 96.2% of transactions used EMV chips.

Here's what businesses should know about EMV, the card technology that has raised the bar for secure payments – including how they work and why they're significantly more secure than traditional swiped card payments.

What's in this article?

- What is EMV and what does it stand for?

- What are EMV chip cards?

- How to accept EMV payments as a business

- How does EMV technology work?

- How do EMV card readers work?

- Contactless EMV card payments

- Are EMV chip card payments secure?

- How to use EMV chip cards

- How Stripe Payments can help

What is EMV and what does it stand for?

EMV stands for Europay, Visa and Mastercard, which are the credit card companies that spearheaded the development and widespread adoption of this chip technology.

EMV is a payment technology that uses a tiny, powerful chip embedded in credit and debit cards to make card transactions more secure. It was developed in the mid-1990s and has since become the standard for secure card payments. EMV technology is overseen by an organisation called EMVCo, which includes among its members major credit card companies such as Mastercard, Visa, American Express, Discover, JCB and UnionPay.

What are EMV chip cards?

EMV chip cards are credit and debit cards embedded with a small computer chip. This chip transmits data to the card reader during a transaction, as opposed to the traditional magnetic stripe on the back of the card. Although the EMV chip conducts transactions without the help of the card's magstripe, chip cards are typically still equipped with a magstripe.

There are two types of EMV chip cards:

Chip and PIN

These cards, considered the more secure option, require cardholders to create a PIN number and enter that number at the point of sale (POS) to authenticate the transaction. The payment can't proceed without the PIN number.Chip and signature

These cards require cardholders to provide a signature for each transaction, to verify their identity.

Originally, both types of EMV chip cards required the cardholder's signature on every transaction, but this has become less common over time. While some businesses still ask for customer signatures, credit card companies have enough additional fraud protection measures in place that this step is not as important as it once was. Here's a list of popular card issuers and whether their cards use chip and PIN or chip and signature.

Despite its widespread adoption, EMV technology is still relatively new. By the time EMV chip cards began gaining popularity in the US around 2011, they were already standard across Europe. US adoption gained momentum in 2015, when major card networks instituted policies that protected businesses offering EMV options from financial losses for certain types of fraudulent transactions.

As of 2024, 93.51% of US card-present transactions were EMV chip, up from 90.90% in 2023.

How to accept EMV payments as a business

Most modern card readers are equipped to accept EMV chip payments. Unless you're working with a much older POS system or card reader, you probably don't need to take any additional steps to accept EMV chip card payments from customers. Stripe Reader M2, the latest model of card reader for Stripe users, is EMV certified and comes ready to use for EMV chip, contactless and swipe payments.

If you want to accept EMV payments from customers, and you don't currently have a card reader – perhaps you process card payments manually or you previously operated exclusively online – you'll need to reach out to your payment processor and ask them what card reader hardware you should use. If you don't yet have a payment processor that supports in-person card payments, you can register for Stripe here.

How does EMV technology work?

EMV chips are significantly more secure than the magnetic stripes on cards, in large part because they don't transmit the card's real number during a transaction. Instead, they generate a unique code for every purchase and send that code to the business's card reader. This is a radical departure from the mechanism that powers magnetic stripe transactions, in which the card number itself is present on the stripe and is transmitted to the card reader during each transaction.

The codes generated by EMV cards can't be replicated, used more than once, or easily faked, which protects EMV cards from the security vulnerabilities that plague magstripe payments.

How do EMV card readers work?

EMV card readers are designed to read data contained within each card's embedded EMV chip. The chip sends encrypted data to the card reader in a similar way that a magstripe transmits the card number, but with a few key differences. Here's how EMV chip payments work:

When a customer submits a card for payment during in-person checkout, instead of swiping the card, they insert it into the card reader. The card must be inserted chip side up, chip end first. This process is called "dipping."

Once inserted, the EMV chip transmits to the card reader an encrypted, one-time code containing the card information. This is what makes EMV chip payments much more secure than swiped card payments: the real card number is never transmitted, and therefore remains protected in the event of a security breach.

To allow the purchase to proceed, the customer must provide either their PIN or their signature, depending whether the card is a chip and PIN or a chip and signature.

From this point, the transaction proceeds like any other card payment: the card reader transmits the payment data to the business's POS, which sends it to the payment processor that then contacts the card issuer for authorisation.

Finally, the card's issuer will return either an approval or a rejection, which will appear on the business's POS, concluding the transaction.

Contactless EMV card payments

Increasingly, many EMV chip cards are enabled with the ability to make contactless payments using near-field communication (NFC) technology. This gives cardholders the option to "tap to pay" instead of dipping their card, offering more flexibility in how and where they pay. In both types of EMV payments, the chip ensures the card data being transmitted is encrypted.

Are EMV chip card payments secure?

Yes, EMV chip cards are very safe, especially compared with magstripe transactions. The EMV chip was originally introduced in an effort to reduce credit card fraud, and it has been incredibly successful.

The impressive security of EMV card transactions is a result of encryption technology. Because EMV cards use unique codes for each transaction, instead of transmitting the real card number, it's much harder for a potential fraudulent actor to obtain customers' card numbers – even in the event of a security breach.

How to use EMV chip cards

For in-person transactions, using an EMV chip card is fast and intuitive. Here's how it works for an in-person purchase:

Insert or tap card

EMV chip cards must be inserted into a card reader chip side up or tapped against a card reader, if both the card and card reader are enabled for NFC contactless payments.Enter PIN if required

Some EMV chip cards require a PIN number to authenticate the transaction. While there's a trend toward more cards using PIN numbers to authenticate purchases, rather than signatures, many cards still don't require them.Provide signature if required

While this isn't as common as it used to be, some businesses still have policies that require customer signatures on card transactions for additional security against fraud.Remove card when prompted

Most card readers or POS terminals will indicate when a transaction is complete and the cardholder can safely remove their card.

EMV chips are not used for online purchases, since online transactions are card-not-present (CNP) by nature, and thus don't use this physical component of cards.

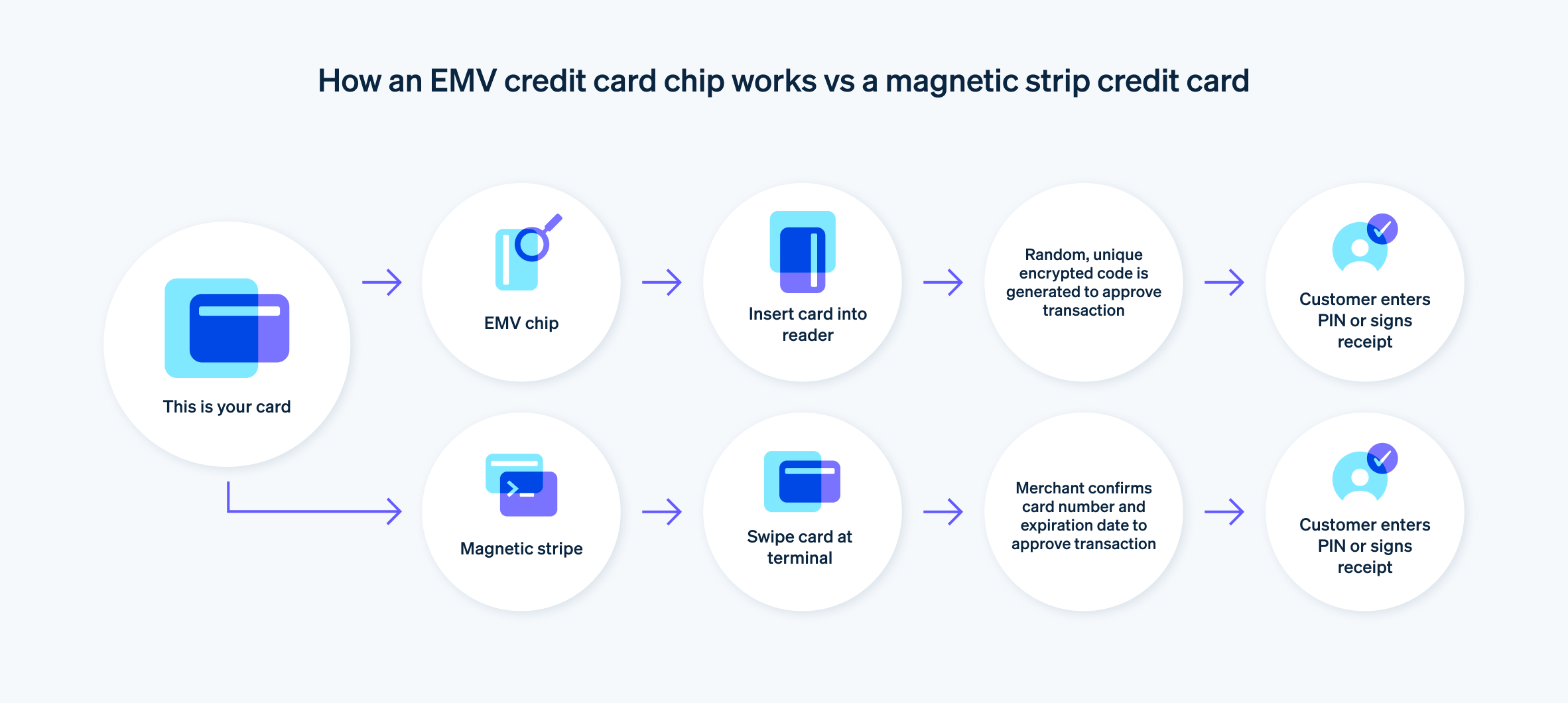

EMV credit card vs. magnetic strip credit card

Using an EMV credit card works slightly differently than using a magnetic strip credit card. Here's a look at the differences:

When using an EMV credit card, the customer inserts their card into the reader. A random, unique encrypted code is generated to approve the transaction. The customer enters their PIN or signs the receipt.

When using a magnetic strip credit card, the customer swipes their card at the terminal. The business then confirms the card number and expiry date to approve the transaction, and the customer enters their PIN or signs the receipt.

How Stripe Payments can help

Stripe Payments provides a unified, global payments solution that helps any business – from scaling startups to global enterprises – accept payments online, in person and around the world.

Stripe Payments can help you:

- Optimise your checkout experience: Create a frictionless customer experience and save thousands of engineering hours with prebuilt payment UIs, access to 125+ payment methods and Link, a wallet built by Stripe.

- Expand to new markets faster: Reach customers worldwide and reduce the complexity and cost of multicurrency management with cross-border payment options, available in 195 countries across 135+ currencies.

- Unify payments in person and online: Build a unified commerce experience across online and in-person channels to personalise interactions, reward loyalty and grow revenue.

- Improve payments performance: Increase revenue with a range of customisable, easy-to-configure payment tools, including no-code fraud protection and advanced capabilities to improve authorisation rates.

- Move faster with a flexible, reliable platform for growth: Build on a platform designed to scale with you, with 99.999% uptime and industry-leading reliability.

Learn more about how Stripe Payments can power your online and in-person payments or get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.