In today's globalised world, more businesses are operating in multiple states or countries. While this opens up opportunities to gain traction in more markets, it also creates complex tax implications.

Understanding two important tax terms – nexus and sales tax nexus – is necessary for expanding businesses that must comply with sales tax obligations. Failing to do so can result in significant financial penalties. What's more, businesses that do not manage their sales tax obligations properly may face reputational injury or even legal action. Additionally, understanding sales tax nexus can help businesses determine where they are required to collect and remit sales tax, allowing them to accurately calculate the costs of doing business in different jurisdictions and remain compliant with tax laws.

We'll cover what nexus and sales tax nexus are, including which activities can create sales tax nexus, different types of nexus and how businesses can determine whether they have sales tax nexus in a particular jurisdiction. You'll also learn best practices for helping your businesses to manage sales tax obligations, remain compliant and avoid potential penalties or legal action.

What's in this article?

- What is nexus tax?

- Types of sales tax nexus

- Sales tax nexus

- How Stripe can help

Stripe a Leader in the IDC MarketScape

The “IDC MarketScape: Worldwide SaaS and Cloud-Enabled SaaS Sales and Use Tax Automation Software for Small and Midmarket 2024 Vendor Assessment” has named Stripe a Leader in tax automation software, recognised for its ease of integration, reliability, and support for platforms and marketplaces. Learn more.

What is nexus tax?

Nexus tax, also known as "nexus fees" or "nexus surcharges", is a type of tax or fee imposed by states or jurisdictions on businesses that have a sales tax nexus within their borders. A sales tax nexus is created when a business has a sufficient connection to or presence in a state or jurisdiction, such as a physical presence or economic activity, which triggers a sales tax collection obligation.

Nexus tax is calculated based on the specific rules and rates of the state or jurisdiction in which the business has a sales tax nexus. Typically, nexus tax is a percentage of the total sales or revenue generated by the business within the state or jurisdiction. The exact percentage can vary widely depending on the state or jurisdiction, and some states may also levy additional fees or surcharges.

Examples of states where businesses with sales tax nexus are required to collect and remit state and local sales tax on taxable sales made within the state include:

California

California's state sales tax rate is currently 7.25%, but local sales tax rates can vary from 0.1% to 2.5%, depending on the specific location.New York

New York's state sales tax rate is currently 4%, but local sales tax rates can vary from 3% to 4.875%, depending on the specific location.Texas

Texas's state sales tax rate is currently 6.25%, but local sales tax rates can vary from 0.5% to 2%, depending on the specific location.

Types of sales tax nexus

Sales tax nexus is the connection or relationship between a business and a state or jurisdiction that creates a sales tax obligation. There are different types of sales tax nexus that can trigger a requirement to collect and remit sales tax, including:

Physical nexus

Physical nexus is created when a business has a physical presence in a state or jurisdiction, such as a shop, warehouse or office. This type of nexus is the traditional standard for sales tax collection and has been established through various court cases. Examples of physical nexus include a business that has a physical location, employees or inventory in a state.Economic nexus

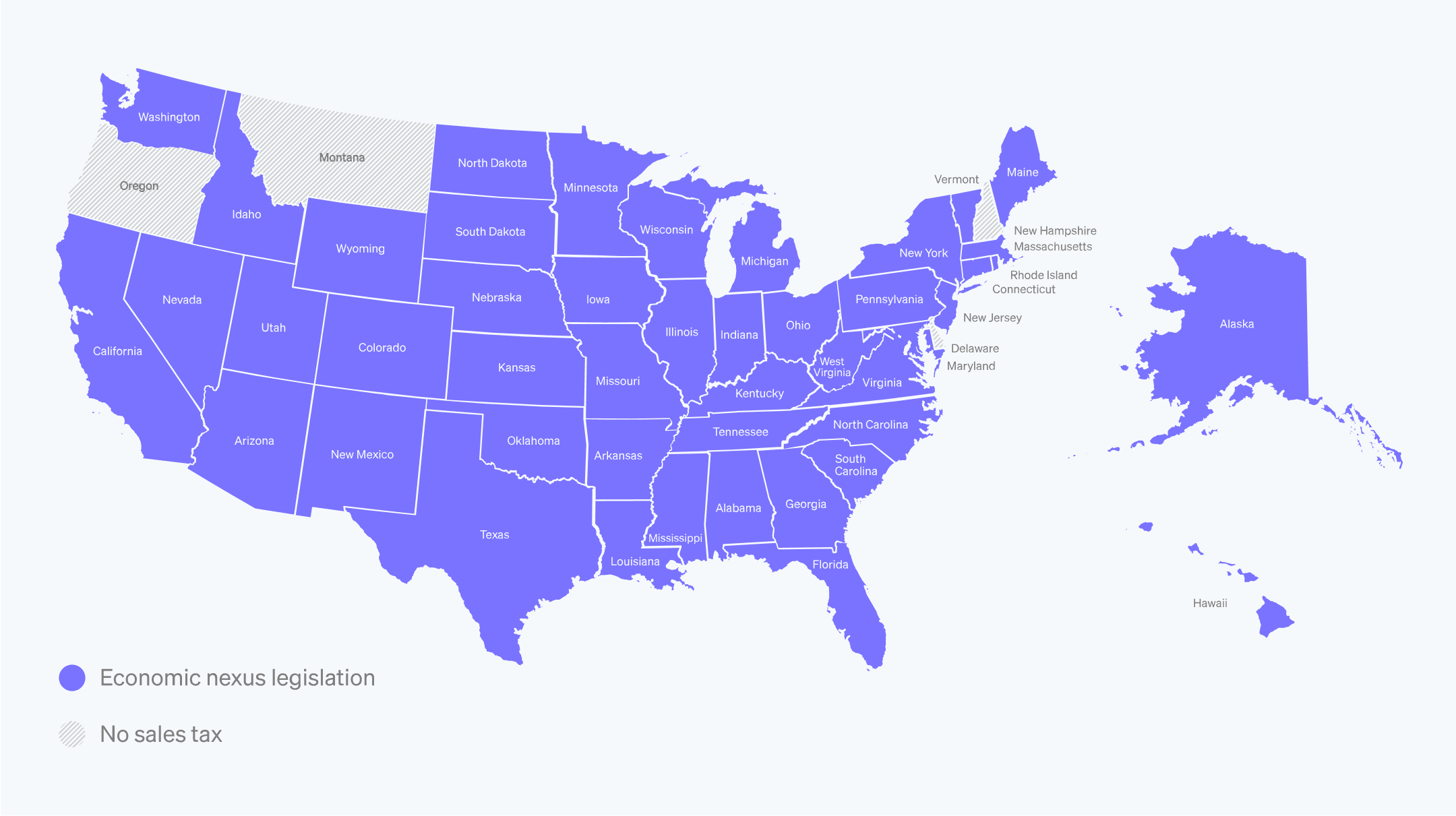

Economic nexus is created when a business has a certain level of economic activity in a state or jurisdiction, even if it does not have a physical presence there. Economic nexus laws typically set a threshold for sales, transactions or revenue generated in a state. If that threshold is met or exceeded, the business is required to collect and remit sales tax. Many states have adopted economic nexus laws in recent years in response to the US Supreme Court's decision in South Dakota vs Wayfair, which mandated that businesses must collect and remit sales taxes on transactions in any state where they conduct more than 200 transactions or US$100,000 worth of sales per year, even if they don't have a physical presence in that state.Affiliate nexus

Affiliate nexus is created when a business has a relationship with another business that has a physical presence in a state. This can happen when a business has an affiliate or subsidiary in a state that is related to the business, such as a common owner or branding. Affiliate nexus laws typically require the business to collect and remit sales tax if the affiliated business has a physical presence in the state.Click-through nexus

Click-through nexus is created when a business has a relationship with a third-party seller or referral agent in a state. This can occur when a business pays a commission or referral fee to a third party for sales made through their website or marketing efforts. Click-through nexus laws typically require the business to collect and remit sales tax if the third party has a physical presence in the state.

Sales tax nexus

Sales tax nexus is a term used to describe the connection between a business and US state or local government that triggers the requirement to collect and remit sales tax. It is the minimum threshold of activity that a business must have in a state before it is obligated to collect and remit sales tax in that state.

For instance, let’s say you run an online store that sells handmade candles. Your business is based in Arizona, but you also sell your candles in California, Texas, and New York. Each state has its own sales tax laws and rates, so you need to determine whether you qualify for sales tax nexus in those states.

In California, for example, you establish sales tax nexus if you have more than $500,000 in sales in the current or previous calendar year. As of 25 April 2019, California removed its previous threshold around the number of transactions. In Colorado, on the other hand, businesses that clear more than $100,000 in sales during any given year qualify for sales tax nexus.

Sales tax nexus can be created through various activities or factors, such as having a physical presence, economic activity, affiliate relationships, or click-through relationships in a state or jurisdiction. Once a sales tax nexus is established, the business is required to collect and remit sales tax on taxable sales made within the state or jurisdiction. The rules and requirements for sales tax nexus vary by state and jurisdiction, and it is important for businesses to understand their sales tax nexus obligations and comply with all applicable tax laws to avoid potential penalties or legal action.

Criteria for establishing sales tax nexus

There’s no universal set of criteria for establishing sales tax nexus, but generally several factors are considered when determining whether a business has a sales tax obligation in a particular state or jurisdiction. Some of the common criteria for establishing sales tax nexus include:

Physical presence

A physical presence can establish sales tax nexus in a state or jurisdiction. This can include having a physical office, store, warehouse, or other property in the state, or having employees or independent contractors working in the state.Economic activity

Many states have adopted economic nexus laws, which create a sales tax obligation for businesses that meet certain thresholds for sales, transactions, or revenue generated in the state. These thresholds can vary widely by state and are subject to change. Here’s a full list of economic nexus standards for every US state.Affiliate relationships

Some states have affiliate nexus laws, which create a sales tax obligation for businesses that have a relationship with an affiliate or subsidiary in the state. This can occur when a business has a common owner, branding, or other connection with an affiliate or subsidiary in the state.Click-through relationships

Some states have click-through nexus laws, which create a sales tax obligation for businesses that have a relationship with a third-party seller or referral agent in the state. This can occur when a business pays a commission or referral fee to a third party for sales made through their website or marketing efforts.

Impact of sales tax nexus on businesses

The impact of sales tax nexus on businesses can be significant, depending on the specific circumstances and requirements of each state or jurisdiction. It’s important for businesses to know the states and jurisdictions where they have sales tax nexus and its impact, including:

Compliance costs

One of the most significant impacts of sales tax nexus on businesses is the cost of complying with state and local tax laws. Businesses that have a sales tax nexus in multiple states or jurisdictions may need to register for sales tax permits, collect and remit sales tax on taxable sales, file regular sales tax returns, and keep detailed records of sales and taxes collected.Penalties and interest

Businesses that fail to comply with sales tax nexus requirements may face penalties and interest charges for late or incorrect filings or payments. These penalties can be substantial and can add up quickly, leading to additional costs and financial burdens for businesses.Competitive disadvantage

Businesses that don’t properly manage their sales tax obligations may face a competitive disadvantage compared to businesses that are compliant with tax laws. Compliant businesses can accurately calculate the costs of doing business in different jurisdictions, while non-compliant businesses may struggle to compete on price or other factors.Reputational damage

Failing to comply with sales tax nexus requirements can also lead to reputational damage for businesses. Customers may be less likely to do business with a company that has a history of tax compliance issues, and negative publicity or legal action can harm a business’s reputation and brand.

Steps businesses can take to comply with sales tax nexus laws

Complying with sales tax nexus laws can be a complex and challenging task for businesses, especially those that have a sales tax obligation in multiple states or jurisdictions. Here are some steps that businesses can take to comply with sales tax nexus laws:

Determine where you have sales tax nexus

The first step in complying with sales tax nexus laws is to determine where your business has a sales tax obligation. This can involve identifying where your business has a physical presence, economic activity, affiliate relationships, or click-through relationships, and understanding the sales tax nexus requirements of each state or jurisdiction where you have business activities.Register for sales tax permits

Once you have determined where you have a sales tax obligation, you will need to register for sales tax permits in each state or jurisdiction where you have nexus. This typically involves filling in an application and providing information about your business, such as your federal tax ID number, business type, and contact information. To streamline this process, let Stripe manage your tax registrations in the US and benefit from a simplified process that prefills application details – saving you time and ensuring compliance with local regulations.Collect and remit sales tax

After you have registered for sales tax permits, you will need to collect and remit sales tax on taxable sales made in each state or jurisdiction where you have nexus. This typically involves charging customers the appropriate sales tax rate, tracking sales and taxes collected, and filing regular sales tax returns and remitting sales tax payments to the state or jurisdiction.Keep detailed records

It’s vital to keep detailed records of all sales and taxes collected to comply with sales tax nexus laws. This can include maintaining records of sales invoices, receipts, and other documentation that support your sales tax collections and remittances.Stay up to date on sales tax nexus requirements

Sales tax nexus requirements can change frequently, and it’s important to stay up to date on sales tax laws and regulations in each state or jurisdiction where you have nexus. This can involve monitoring changes to sales tax rates, thresholds, and rules and working with a qualified tax professional to ensure compliance with all applicable tax laws.

How Stripe can help

For businesses that want to handle taxes, compliance, and ongoing monitoring of changes to laws and regulations with the most efficient approach possible, there are tech-powered solutions that strip away the manual work that traditionally goes into managing these concerns. Stripe Tax is a comprehensive tax solution that helps businesses automate the calculation, collection, and reporting of taxes on payments globally – all with a single integration. This includes helping businesses know where to register and automatically collecting the right amount of tax, plus generating all the reports a business needs to file their tax returns.

Here are some ways that Stripe Tax can benefit businesses specifically around the issue of sales tax nexus:

Automated sales tax calculations

Stripe Tax uses real-time sales tax rates and rules to automatically calculate sales tax on each transaction, taking into account the specific sales tax nexus requirements of each state or jurisdiction where the business has a sales tax obligation. This can help businesses ensure that they are accurately collecting the correct amount of sales tax and avoid potential compliance issues.Comprehensive sales tax coverage

Stripe Tax covers sales tax nexus requirements in all 50 US states and Washington D.C., as well as in many international jurisdictions, making it easy for businesses that use Stripe Tax to comply with sales tax requirements in multiple states and jurisdictions.Simplified filing and remittance

Stripe Tax can make filing and remittance easier. With our trusted global partners, users benefit from a seamless experience that connects to your Stripe transaction data – letting our partners manage your filings so you can focus on growing your business.Scalable sales tax solutions

Stripe Tax is designed to scale with businesses as they grow and expand operations. Businesses can easily add new sales tax obligations as they establish sales tax nexus in new states or jurisdictions, without needing to worry about managing sales tax compliance on their own.

Stripe Tax is a powerful solution for businesses looking to simplify and automate their sales tax compliance obligations, especially around the issue of sales tax nexus. By using Stripe Tax, businesses can ensure that they are accurately collecting and remitting sales tax in each state or jurisdiction where they have a sales tax obligation, without needing to navigate complex sales tax rules and requirements on their own. Learn more here.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.