Subscription businesses lose, on average, 9% of revenue due to failed payments. These losses can stem from declined transactions, processing errors, or inefficiencies in payment routing, all of which can affect customer relationships, business operations, and revenue. To facilitate payments on every channel – and protect the customer experience – businesses must understand the roles of key players, such as payment processors and acquirers, that work together to make digital payments possible. Confusion over these entities can lead to inefficient payment setups, higher processing fees, and an increased risk of failed transactions.

In this article, we’ll examine payment processors and merchant acquirers: their differences, their unique functions, and how they work together in the payment process. We’ll also cover how Stripe’s all-in-one approach to payments services streamlines payment processing for businesses.

What’s in this article?

- What is a payment processor?

- What is a merchant acquirer?

- Differences between payment processors and acquirers

- How do payment processors and acquirers work together?

- Do Stripe customers need to have a separate acquirer?

- How Stripe handles payment processing and acquirers

What is a payment processor?

A payment processor is a company or service that facilitates electronic transactions between customers and businesses by processing and authorising credit card, debit card, and other digital payment methods such as digital wallets. The primary function of a payment processor is to verify the transaction details, ensure the availability of funds, and securely transfer the funds between the customer’s account and the business’s bank account.

Here’s how it works:

- When a customer makes a purchase, the payment processor captures the payment details and forwards them to the necessary financial institutions for approval.

- The processor communicates with the customer’s issuing bank or card network (such as Visa or Mastercard) to confirm fund availability and detect potential fraud.

- Once the transaction is approved, the payment processor facilitates the secure transfer of funds from the customer’s account to the business’s merchant account.

Payment processors also help businesses adhere to compliance standards, such as PCI DSS, to protect sensitive payment data and reduce the risk of fraud.

What is a merchant acquirer?

An acquirer, also referred to as an acquiring bank or merchant acquirer, is a financial institution that partners with businesses to process credit and debit card transactions. It acts as an intermediary between businesses, payment processors, and issuing banks and makes sure the electronic transactions are authorised, processed, and settled securely. In the context of electronic payments, the acquirer plays an important role by:

- Establishing and maintaining merchant accounts, which allow businesses to accept card payments

- Facilitating the authorisation and settlement of transactions between the business and the issuing bank, or issuer (the bank that issued the credit or debit card to the customer)

- Assuming the risk of chargebacks, fraud, and disputes in card transactions

When a customer makes a card payment, the acquirer sends the transaction request to the issuing bank (the bank that issued the customer’s credit or debit card). If the issuing bank approves the transaction, the acquirer finalises the payment and ensures that funds are deposited into the business’s merchant account within a few business days.

Without an acquirer, businesses wouldn’t be able to process card payments or manage settlements efficiently.

Differences between payment processors and acquirers

Payment processors and acquirers play different roles in the overall payment processing system, with each serving a unique purpose in facilitating transactions between customers and businesses. Although their roles may appear similar at first glance, it’s important to understand their individual functions and relationships within the system.

Here’s a summary of the key differences between payment processors and acquirers:

Role in the transaction process:

Payment processor: The payment processor facilitates and authorises electronic transactions between customers and businesses by verifying the transaction details, checking the availability of funds, and securely transferring funds between customer and merchant accounts.

Acquirer: The acquirer partners with businesses to process credit and debit card transactions and is responsible for establishing and maintaining merchant accounts; facilitating the authorisation and settlement of transactions with issuing banks; and assuming the risk of chargebacks, fraud, and disputes.

Relationship with the business:

Payment processor: The payment processor works as a service provider for the business, processing and authorising transactions on their behalf. The business does not have a direct relationship with the processor but does have a direct relationship with a payment service provider who acts as an intermediary between the business and the payment processor. In some cases, the payment processor and payment service provider are the same entity – as with Stripe, for example. In those cases, businesses do have a direct relationship with the processor.

Acquirer: By providing and managing the merchant account, the acquirer has a direct relationship with the business. The acquirer is responsible for underwriting the merchant account and assuming some level of risk in case of disputes or chargebacks. Again, if the business is working with a comprehensive payment service provider like Stripe, there is no need to work with a separate acquirer. Below, we’ll discuss more about how Stripe provides this combined functionality.

Relationship with card networks and issuing banks:

Payment processor: The payment processor communicates with card networks and issuing banks to verify and authorise transactions. The processor typically has agreements with multiple acquirers and works as an intermediary between acquirers and businesses.

Acquirer: The acquirer communicates with card networks and issuing banks to authorise and settle transactions. Acquirers are members of card networks and have agreements in place to process transactions on their behalf.

Both payment processor and acquirer entities are key to a smooth and secure electronic payment process. Payment processors handle the technical aspects of processing and authorising transactions, while acquirers manage the financial piece, including establishing merchant accounts and facilitating communication with issuing banks.

How do payment processors and acquirers work together?

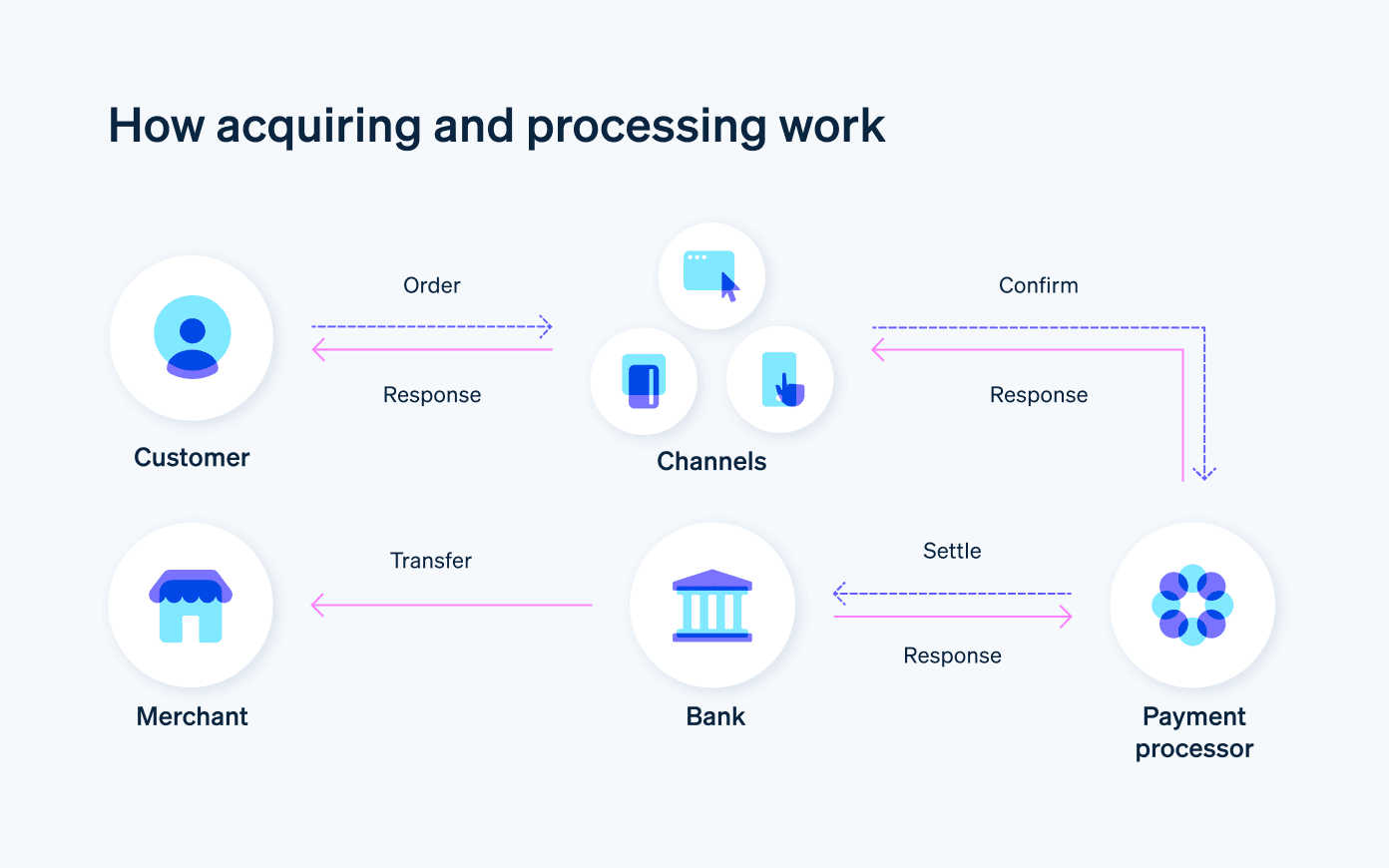

Payment processors and acquirers are important components of the electronic payment ecosystem, working together to ensure efficient and secure transactions between customers and businesses. The close collaboration between these two entities can be broken down into the following steps:

Transaction initiation

When a customer initiates a payment using a credit or debit card, the business’s payment gateway securely captures the transaction details and transmits them to the payment processor.Transaction authorisation

The payment processor forwards the transaction information to the acquirer, who sends it to the card network. The card network directs the transaction to the issuing bank for authorisation.Approval or decline

The issuing bank verifies the card details and checks the availability of funds in the customer’s account. Based on these factors, the issuing bank either approves or declines the transaction. This response is sent back through the card network, the acquirer, and the payment processor to the business.Settlement

If the transaction is approved, the issuing bank transfers the funds to the acquirer. The acquirer deposits the funds into the merchant account, typically within a few business days. The payment processor ensures that the transaction data is accurately recorded and transmitted to all parties.

Throughout this process, the payment processor and acquirer work in tandem to manage the transaction’s technical and financial aspects respectively. The payment processor manages the authorisation and secure transfer of transaction data, while the acquirer manages the merchant account, authorises the transaction with the issuing bank, and facilitates the settlement of funds.

Do Stripe customers need to have a separate acquirer?

Stripe is a payment-processing platform that serves as both a payment processor and an acquirer. When a business signs up with Stripe, it does not need to have a separate acquirer or establish a separate merchant account. Stripe handles all aspects of electronic payment processing, from transaction authorisation to settlement of funds.

As a full-stack payment service provider, Stripe simplifies the payment process for businesses by combining the roles of payment processor and acquirer into a single service. This means that businesses using Stripe can accept different forms of digital payments, including credit and debit cards, without establishing relationships with multiple entities.

How Stripe handles payment processing and acquirers

By integrating the functions of payment processing and acquiring into a single platform, Stripe simplifies the electronic payment process for businesses. Here's how Stripe handles payment processing and acquiring:

Onboarding

When a business signs up with Stripe, it creates a Stripe account that serves, effectively, as its merchant account. This account allows the business to accept various forms of digital payments, including credit and debit cards, without needing a separate acquirer or merchant account.Transaction processing

When a customer initiates a payment on the business's website or app, Stripe's integrated payment gateway securely captures the transaction details and forwards them to Stripe's processing infrastructure.Transaction authorisation

Acting as both the payment processor and acquirer, Stripe communicates with the card networks and the issuing banks to verify the transaction details and check the availability of funds.Approval or decline

The issuing bank approves or declines the transaction based on the card details and available funds. This response is sent back through the card network to Stripe, which relays the decision to the business.Settlement

If the transaction is approved, Stripe facilitates the transfer of funds from the issuing bank to the business's Stripe account. Stripe then transfers the funds – referred to as a payout – to the business's designated business bank account, typically within a few working days.

By combining the roles of payment processor and acquirer, Stripe provides a comprehensive, integrated solution for businesses to accept, process and manage electronic payments. This all-in-one approach simplifies the payment process, reduces the need for multiple relationships within the payment environment and streamlines the overall experience for businesses and their customers. To learn more and get started, take a look here.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.