Gift cards are a pre-loaded form of digital or physical currency. They have become a mainstay in the retail industry as an alternative to traditional cash or credit card transactions. According to a 2023 report from Allied Market Research, the global gift cards market was valued at US$835 billion in 2022, and it is expected to exceed US$4 trillion by 2032. Gift cards drive immediate revenue and engage customers in a way that often leads to repeat business.

Below is a quick guide to accepting gift cards for businesses, including different types of gift cards and the benefits of accepting gift card payments. We'll also examine the best practices that businesses should employ when building a gift-card programme.

What's in this article?

- Types of gift cards

- Business benefits of accepting gift cards

- Gift-card management best practices

- How to choose gift-card management software

Types of gift cards

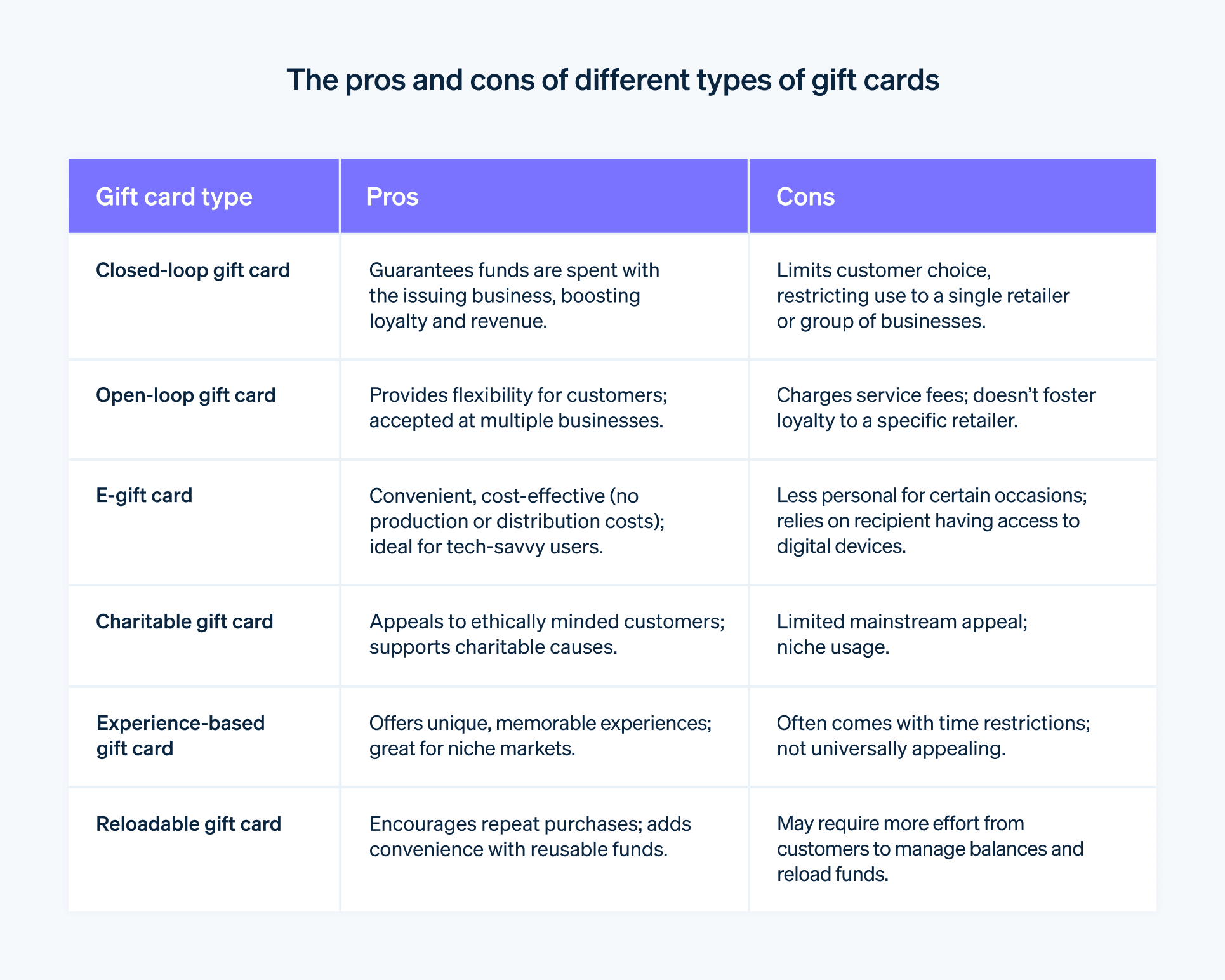

There are several types of gift cards, and each has a specific purpose and usage pattern, among other considerations. Here's a list of the different types of gift cards:

Closed-loop gift cards

Closed-loop gift cards can be used with a single retailer or a specific group of related businesses. They cannot be redeemed elsewhere. While this limits the customer's choice, it guarantees that the funds will be spent with the issuing business, thus retaining revenue and encouraging customer loyalty.Open-loop gift cards

Unlike closed-loop cards, customers can use open-loop gift cards at a variety of businesses. They are often co-branded with payment networks, such as Visa or Mastercard, and function almost like a debit card. While they provide customers with flexibility, they charge service fees and don't usually build customer loyalty for a particular retailer.E-gift cards

E-gift cards are digital cards that are sent via email or short message service (SMS). They have gained traction thanks to their convenience and are highly popular with tech-savvy customers. E-gift cards are economically favourable for businesses, given that they don't have the same production and distribution costs as physical gift cards do.Charitable gift cards

Charitable gift cards allow the cardholder to make a donation to a charity of their choice. Although they are not common in mainstream retail, customer demographics with certain ethical inclinations may prefer them.Experience-based gift cards

Customers can redeem gift cards for experiences, such as spa days or adventure activities, rather than goods. They serve specialised markets and usually have time restrictions.Reloadable gift cards

Customers can add funds to reloadable gift cards, similar to prepaid debit cards. This feature tends to boost customer loyalty and facilitate repeat purchases.

Business benefits of accepting gift cards

In a 2023 survey from the National Retail Federation in the United States, 55% of Christmas shoppers said that they wanted to receive a gift card, making it the most popular choice of gift. Adopting a gift-card programme can increase immediate revenue, deepen customer relationships and help with meeting other business objectives. Here's a closer look at some of the advantages that come with accepting gift cards:

Immediate increase in revenue

Gift-card sales generate up-front revenue for a business. Unlike other revenue streams that depend on future actions or outcomes, such as instalment payments or conditional contracts, gift cards supply an immediate influx of cash. This is particularly advantageous for businesses with uneven or cyclical revenue patterns, as it provides more predictability and financial stability.Additional customer spending

The psychological aspect of spending "free money" can encourage gift-card holders to exceed the original value of the card. If the base amount of a purchase is already covered, customers are more willing to spend more on higher-priced items or add-ons. This increase in individual transaction value can have a substantial impact on overall revenue figures.Increased customer acquisition and loyalty

Gift cards often introduce new customers to a business. When an existing customer gives a gift card to someone else, they are extending an invitation to experience the brand. As the recipient of the gift card probably trusts the person who gave it to them, it is more likely that they will return and become loyal customers themselves.Effective inventory management

Businesses can use gift cards to guide customer spending. For example, they might tie a gift card promotion to specific products that are overstocked or seasonally appropriate. Businesses can use carefully designed campaigns to motivate customers to buy certain items, which can then help to balance inventory levels and reduce holding costs.Lower operational costs

The cost-to-benefit ratio of gift cards, especially digital cards, is generally good. Digital cards eliminate the costs of printing, storing and delivery, which helps businesses to maintain a healthy bottom line. A percentage of gift cards issued will also go unused, further improving the overall economics of a gift-card programme without adding operational complexity.Customer insights

The transaction data collected from gift card redemptions can be a rich source of information about customer behaviour. It can show which products customers favour, when the most redemptions occur and how first-time customers use the cards compared with repeat customers. Businesses can then analyse this data to fine-tune inventory and pricing strategies, marketing campaigns and customer-engagement initiatives.Sustained brand awareness

Each time a customer interacts with a gift card, they are engaging with the brand. And this doesn't just apply to gift card transactions. Each time a customer encounters the gift card in their wallet or email inbox, it reinforces the brand and provides opportunities for further engagement and loyalty-building.Minimised payment risk

Gift cards are prepayments for future goods or services, eliminating certain financial uncertainties. Unlike cheques or credit payments that could default or incur chargebacks, gift cards represent funds that have already been transferred.Compliance with established regulations

Many businesses view regulatory compliance as a hurdle, but the regulations affecting gift cards are generally well-defined and manageable. This simplifies the legal aspects of running a gift-card programme.

Gift-card management best practices

Managing a gift-card programme demands meticulous planning, ongoing monitoring and strategy adjustments based on real-world performance and changing market conditions. The following best practices will position your gift-card programme for optimal performance:

Transparent communication

Businesses should fully disclose the terms and conditions of using a gift card, such as expiry dates and service fees. Transparent communication adheres to regulatory guidelines and builds trust with customers. For example, an FAQ section dedicated to gift-card policies on the business website is a resource that is easily accessible to customers.Strong tracking systems

Implement a well-designed tracking system to oversee gift card sales and redemptions. It should capture granular data, such as which items are bought frequently with gift cards and patterns in seasonal spending. This real-time information provides invaluable business insights and can identify and prevent fraud.Multi-channel availability

Businesses can create multiple revenue streams by offering gift cards both in shops and online. The convenience of online purchasing and digital delivery appeals to a segment of customers who prefer to shop remotely, while physical cards sold in shops target more traditional buyers. Providing options for both channels can maximise reach and profitability.Periodic audits

Auditing the gift-card programme on a regular basis can reveal any strengths and weaknesses. These audits should focus on accounting practices, data-security measures and other topics to ensure that the programme remains protected and financially sound. Audit findings should inform timely adjustments to programme operations.Customer-engagement initiatives

Engaging with customers after they've redeemed a gift card can generate additional sales. Post-redemption engagement could include targeted email campaigns, special discounts on future purchases or invitations to exclusive events. Such efforts can prolong the customer life cycle and boost revenue.Strategic partnerships

Collaborating with complementary businesses can extend the utility and attractiveness of a gift-card programme. For example, a bookshop could partner with a local coffee shop and allow gift cards to be used at both venues. Such partnerships create mutual benefits by driving cross-traffic and improving the customer experience.Security measures

As gift cards are equivalent to cash, securing them is key. Implementing multi-factor authentication for digital gift cards and using tamper-evident packaging for physical cards can reduce the risk of fraud. Monitoring continuously for suspicious activities can also minimise unauthorised transactions.Performance metric analysis

Being flexible is key to maintaining a successful gift-card programme. Regular analysis of performance metrics will provide actionable insights. Are the gift cards primarily being used by new customers or are they helping to retain existing ones? Are redemption rates satisfactory? Answers to these questions will help businesses to adapt their strategies effectively.Clear and consistent branding

A gift card is a brand ambassador and its design should reflect the brand's identity. This includes the look and feel of physical cards, and the user interface for digital cards. Cohesive branding offers a unified customer experience and helps customers to remember the brand.Regulatory compliance

Although compliance with legal requirements for gift cards is less cumbersome than it is for other business operations, it still requires vigilant management. Businesses need to stay up to date with changing laws and update their terms and conditions accordingly to maintain the legality of the gift-card programme.

How to choose gift card management software

Selecting the right gift card management software involves considering multiple factors:

Functionality and features

First, consider what you want the software to do. Some businesses might require multi-channel support for online and physical stores, while others may need advanced tracking and analytics capabilities. Whether you need to issue digital and physical cards, conduct transactional audits, or run promotional campaigns, the software should cater to your business needs.Customer experience

An easy-to-use software solution will shorten the learning curve and improve operational accuracy. Test the software in advance to get feedback on the user interface, navigation structure, and overall usability. Superior customer experience will increase the success of your gift card programme.Data analysis and reporting

High-quality software should include extensive reporting capabilities. This should include basic transaction history as well as advanced analytics, such as usage patterns and popular buying times. This data can inform business decisions, from inventory management to targeted marketing campaigns.Security

Gift card management software must have strong security measures in place. These should include encryption for data at rest and in transit, as well as strong authentication mechanisms. Regular software updates addressing security vulnerabilities are also important to keep the system protected against evolving threats.Scalability

Choose a software solution that can grow along with your business. The system should be able to handle increased transaction volumes, conduct more extensive data analysis, and add more features as required. Changing systems in the future can be costly and disruptive to your business.Cost and budget

Assess the long-term value instead of focusing solely on initial costs. Consider purchase price and subscription fees, but also look at costs related to training, maintenance, and any additional features that might be needed in the future.Compliance and legalities

Software should comply with relevant laws and industry standards concerning gift cards. This includes regulations for data protection, consumer rights, and financial reporting. Non-compliance can result in legal complications and reputational damage.Provider reputation and support

A reputable provider often indicates a reliable product. Reviews, customer testimonials, and years in business can help businesses assess a vendor’s credibility. Excellent customer support, including troubleshooting and regular updates, is important for ongoing programme operations.Software integration

Examine how well the software integrates with your existing systems, such as point-of-sale systems, e-commerce platforms, and CRM software. Smooth integration can save a considerable amount of time and effort. Learn more about how to create gift cards and vouchers that are compatible with your Stripe payment solutions.Customisation capabilities

Look for software that allows you to customise it for your specific needs – from branding elements such as logos and colour schemes on digital gift cards to customised reporting features. This customisation will add value to your programme and improve the customer experience.

Carefully select gift card management software by accounting for your specific business requirements and future growth. Prioritising functionality, security, and scalability can help you create an effective, sustainable gift card programme.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.