为不同地点之间和跨境的资金转账提供便。在这一领域工作的企业或个人必须了解汇款公司的复杂性和监管环境,以确保合规性并扩展到新市场。

以下是汇款公司世界指南:介绍汇款公司的定义、运作方式、客户群体、必须遵守的监管框架以及对企业的重要影响。

目录

- 什么是汇款公司?

- 汇款公司的职能?

- 汇款公司与支付处理商

- 货币服务业务与汇款公司

- 汇款公司许可证要求

- 谁需要汇款公司许可证?

- 如何获得汇款公司许可证

什么是汇款公司?

汇款公司通常也称为“货币服务企业”(MSB),是一家公司或个人,为一个人或实体向另一个人或实体转移资金提供便利,通常是在不同的地理位置之间或跨越国际边界。

这些服务通常是接收客户的资金,然后将其转给指定的收款人。汇款公司提供多种转账方式,包括通过电汇和其他电子资金转账 (EFT)、移动转账或第三方支付处理商转账。

为防止洗钱、恐怖主义融资和其他非法活动,汇款公司必须接受监管和监督。在包括美国在内的许多国家/地区,汇款公司必须向适当的监管机构,例如金融犯罪执法网络 (FinCEN)或州级机构注册,并遵守特定的报告和合规要求。

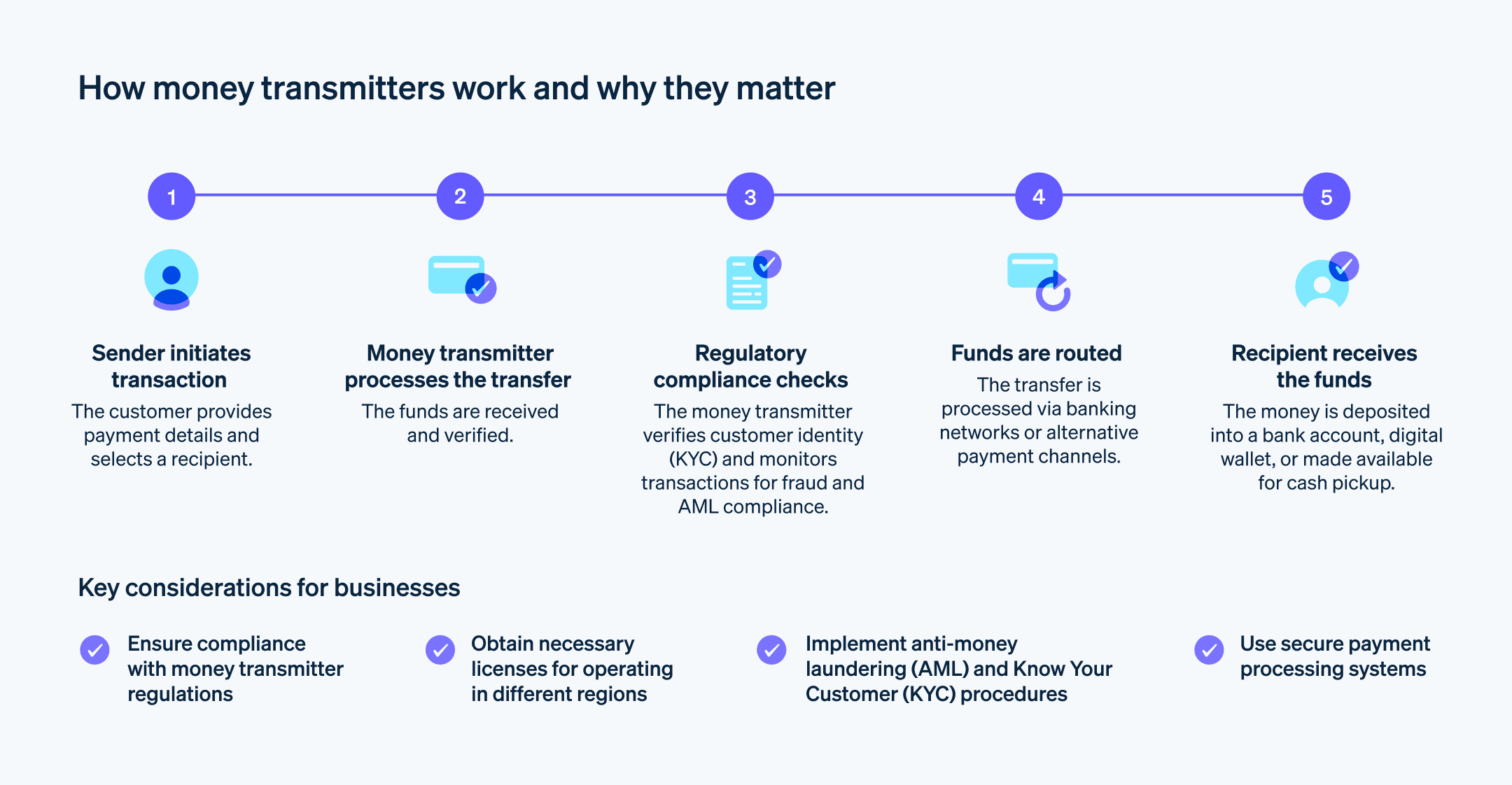

汇款公司是做什么的?

汇款公司主要提供个人和企业发送和接收资金的服务。他们充当中介,促进国内和国际个人和企业之间的资金流动。

以下是汇款公司执行的一些主要功能和活动:

资金转账

汇款公司为资金从一个地点转移到另一个地点提供便利。它们接受汇款人(又称发起人)的资金,并通过各种方法将资金转给收款人(受益人)。具体可用方法通常因资金汇出地和汇入地而异。国际汇款

汇款公司使个人能够跨境汇款。他们提供的服务允许在国外工作的移民和个人向他们本国的家人或企业汇款。支付服务

汇款公司通常提供支付服务,允许客户支付商品和服务。这可能包括在线支付处理、账单支付,以及通过移动应用或其他数字平台促进交易。货币兑换

一些汇款公司提供货币兑换服务,允许客户将一种货币兑换成另一种货币。这对旅行者或参与国际商业交易的个人尤其有用。为无银行账户或银行账户不足的人提供金融服务

汇款公司通常为无法获得传统银行服务的个人提供服务。它们为这些人提供了一种存储和转账、支付账单或接收资金的手段,提供了金融包容性和可获得性。合规与监管

为防止洗钱、恐怖主义融资和其他违法行为,汇款公司必须接受监管和监督。他们必须遵守监管要求,例如向有关当局注册、维持反洗钱 (AML) 和客户身份验证程序 (KYC),以及报告可疑交易。

汇款公司与支付处理商

虽然汇款公司和支付处理机构都处理货币交易,但它们的特定角色、服务和客户群将它们区分开来。以下是它们之间差异的概述:

交易类型

汇款公司在汇款人和收款人之间转移资金,但这些交易中的资金交换有各种各样的原因。它们可能包括个人对个人的转账、汇款和商业支付。支付处理商专门处理买卖双方之间的交易支付,即一方向另一方提供资金以换取商品和服务。这包括在线购买、销售点 (POS) 交易、经常性付款、电子商务交易,以及使用信用卡、借记卡的支付和数字钱包。法规监督

汇款公司和支付处理商都在监管框架内运作。汇款公司受到特定的法规和监督,通常需要在 FinCEN 等监管机构或州级机构注册。他们必须遵守 AML 和 KYC 法规,以防止非法活动。支付处理商也在法规监督下运营,但审查和合规要求的程度可能因管辖区域和处理的交易类型而异。他们必须遵守数据安全标准、支付网络规则和其他行业法规。增值服务

汇款公司可能会提供资金转账以外的其他服务。这些服务可以包括货币兑换、账单支付服务或针对无银行账户或银行账户不足人群的定制金融服务。支付处理商还经常提供不同的增值服务:欺诈检测和预防、拒付 管理、经常性计费解决方案,以及详细的交易报告。客户群

汇款公司主要面向需要跨境汇款的个人和企业,或无法使用传统银行服务的个人。支付处理商服务于各类客户,包括在线企业、零售商、服务提供商和电子商务平台。

要创建安全、高效的资金转账体验,就必须了解汇款公司和支付处理商之间的区别,并就哪种服务最适合业务需求做出明智的决定。

货币服务企业与汇款公司

汇款公司通常被称为“货币服务企业”,尤其是在美国。虽然有些人将这两个词互换使用,但这两个实体之间还是有区别的。了解 MSB 和汇款公司之间的区别对于监管合规以及寻求特定金融服务的个人或企业非常重要。以下是您应该了解的内容:

服务范围

MSB 除提供汇款服务外,还提供一系列金融服务。他们还可以提供货币兑换服务,允许客户将一种货币兑换成另一种货币。此外,MSB 通常提供支票兑现服务。一些 MSB 可能会提供预付卡或签发汇票,这是一种类似于支票的支付工具。汇款公司是 MSB 的一个分支,主要从事资金转账业务。它们可能提供也可能不提供属于更广泛的 MSB 范围的额外服务。

监管要求

MSB 和汇款公司都受到监管部门的监督和合规要求,以防止非法活动并保护消费者。在美国,MSB 需要在美国财政部下属的 FinCEN 注册。MSB(包括汇款公司)必须遵守反洗钱法规,实施稳健的 KYC 协议,并报告可疑交易。

汇款公司还必须遵守有关其在促进资金转移方面的作用的附加规定。他们通常需要在州级监管机构注册,保持足够的资本储备,并遵循特定的报告和合规程序。这些要求旨在确保汇款活动的透明度、合法性和安全性。

汇款许可证要求

汇款许可证要求因司法管辖区和现行具体法规而异。但是,汇款公司的许可流程中通常包含一些常见要求:

注册和申请

汇款公司通常需要在适当的监管机构注册。这可能是在联邦一级,如美国的 FinCEN,也可能是在州一级,大多数汇款公司的许可证都是在州一级颁发的。申请过程通常包括提交有关企业、企业所有者、管理人员和董事的详细信息,以及监管机构要求的任何证明文件。财务要求

汇款公司通常需要满足某些财务要求才能获得许可证。这可能包括提供经审计的财务报表,证明有足够的资本储备,以及维持保证金或其他形式的财务担保以保护客户。背景调查

汇款机构及其关键人员,如所有者、管理人员和董事,通常都要接受背景调查。这可能涉及指纹采集、犯罪记录检查以及检查过去的违规行为或制裁。此外,监管机构可能会评估“适当人选”标准,评估与业务相关的个人的能力、诚信和财务责任。合规计划

汇款公司必须证明他们已经实施了强有力的合规计划。这包括制定政策和程序来防止洗钱、恐怖主义融资和其他非法活动。合规计划通常涉及实施 KYC 协议和政策、交易监控系统、员工培训以及勤勉地报告可疑活动。报告和记录保存

汇款公司通常被要求保留其交易、客户信息和其他相关文件的详细记录。他们必须遵守报告要求,其中可能包括向监管机构提交定期报告,例如交易报告、财务报告或可疑活动报告。持续的合规和审计

一旦获得许可,汇款公司就必须履行持续的合规义务。这可能涉及定期审计、监管审查或检查,以确保持续遵守许可要求和适用法规。

根据司法管辖区的不同,获得汇款许可证的具体要求可能会有很大差异。有意成为汇款公司的个人或企业应咨询其司法管辖区的相关监管机构或寻求法律意见,以了解其服务范围、目标客户和主要辖区所涉及的具体要求和流程。

谁需要汇款许可证?

在许多国家,任何从事汇款业务的个人或公司都需要获得汇款许可证。以下是一些需要许可证的活动:

销售或发行支付工具:这包括出售或发行支票、汇票、旅行支票或储值卡等活动。

接收汇款:这包括任何接受客户钱款以将其传送到另一个人或地点(无论是国内还是国际)的企业。

转账:这是指使用电汇和电子资金转账等方法代表客户汇款的过程。

货币兑换或交易:这是指为客户买卖外币。

运营支付平台:这包括为用户之间转账提供便利的任何在线平台或移动应用程序。

某些实体通常不需要汇款许可证,例如:

银行和信用合作社:银行当局已经对这些机构进行了监管,因此这些机构通常不需要单独的汇款公司许可证。

政府机构:联邦、州和地方政府机构在执行公务时,通常可以免除许可要求。

被许可人的某些代理人:代表被许可的汇款公司行事的代理人可能免于获得自己的许可证,但他们必须在被许可的实体的监督和合规计划下运作。

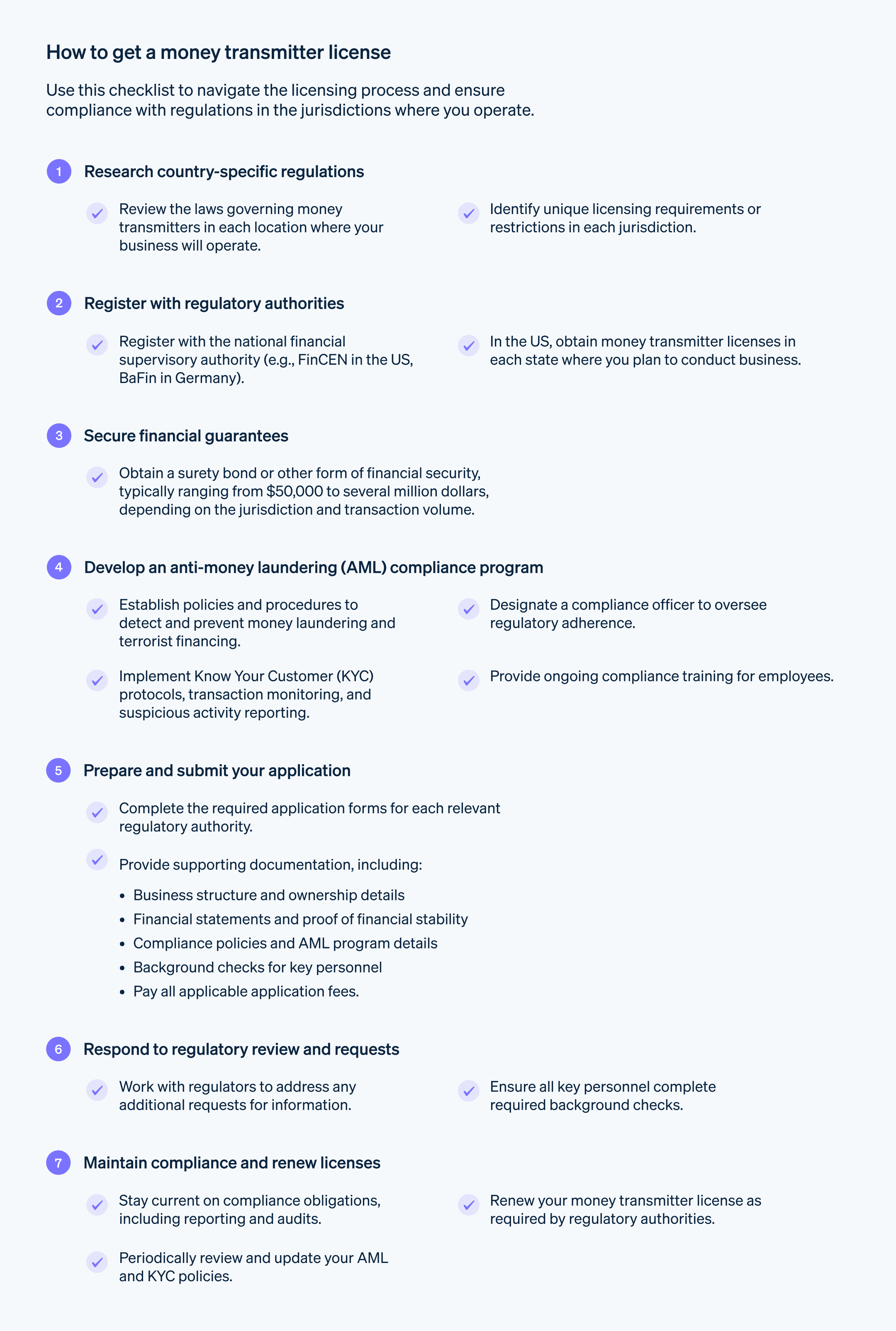

如何获得汇款公司许可证

获得汇款许可证是一个多步骤的过程,可能需要几个月或更长时间才能完成。申请这种许可证的企业通常需要在联邦当局注册,并在计划开展业务的每个国家获得许可证。考虑与法律和合规专业人士合作,以确保您满足所有必要的要求。

以下是注册和申请此许可证的分步指南:

研究特定国家/地区的法规:查看您业务运营的每个地点的汇款公司法律、法规和规章。请密切注意任何独特的要求或限制。

向当局注册:在您提供服务的每个国家/地区的国家/地区金融监管机构注册。例如,美国有金融犯罪执法网络 (FinCEN),德国有联邦金融监管局 (BaFin)。在美国,汇款公司还必须在他们计划开展业务的每个州获得许可证。

获得保证金或其他财务担保:获得担保债券或其他可接受的财务担保形式,金额通常从 50,000 美元到数百万美元不等。金额取决于司法管辖区和您的预期业务量。

制定反洗钱合规计划:制定全面的政策、程序和控制措施,以防止洗钱、恐怖主义融资和其他非法活动。指定一名合规官,进行持续的员工培训,并实施交易监控和报告系统。

提交申请:将完整的申请包连同所有必需的证明文件和费用提交给负责监督汇款公司的监管机构。监管机构将审查您的申请,进行背景调查,并可能要求提供更多信息或澄清。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。