作为企业主,您可能很清楚,与客户的关系并不会在交易完成后结束。从客户决定购买的那一刻起,一系列的行动便开始进行,每一步都提供了激发客户对您业务的热情和亲近感的机会——或者破坏交易,导致您失去这位客户。尽管将客户转化为购买者通常被视为“终点”,但事实是,从网站安全性不足到模糊的运输细节,再到无法联系到客服,任何问题都有可能导致完成支付后的黑暗一面:撤单。

可以安全地假设,每位企业主都希望尽可能保留更多的收入,但即使是最精心设计的转化漏斗,有时也会导致客户在完成购买后想要退款。下面,我们将深入探讨有关撤单的所有内容:撤单是什么、如何运作、导致撤单的原因,以及企业主如何积极主动地预防撤单。

目录

- 什么是撤单?

- 撤单与退款的区别

- 撤单的常见原因

- 撤单是如何运作的?

- 撤单会给商家带来多少成本?

- 预防撤单的方法

- 如何对撤单提出异议

什么是撤单?

撤单是指在借记卡或信用卡购买后,资金被撤回的过程,这一过程是在客户向其银行或信用卡提供商提出争议后发起的。撤单几乎总是由客户发起,但商家也可以请求撤单(尽管这种情况并不常见)。

关于撤单的好消息是:全球撤单与交易的比例通常每年趋于下降,这意味着每年与总体交易数量相比,撤单数量逐渐变少了。这可以归因于商家正在投资的多个因素——我们在下面会详细介绍。

坏消息是:撤单仍然是一个普遍且昂贵的问题,与商业欺诈广泛纠缠在一起。根据 Juniper Research 发布的一项研究,预计电商企业在 2021 年因欺诈损失约 200 亿美元,比 2020 年的 175 亿美元增加了 18%。而根据 Lexis Nexis 的《欺诈的真实成本》 报告,商家每支付 1.00 美元的撤单,就需要支付 3.75 美元。

撤单与退款的区别

退款是指商家将资金退还给客户,而撤单则是客户的银行或信用卡提供商撤销费用并从企业账户中提取资金。在这两种情况下,资金都将退还给客户。撤单与退款之间的区别主要在于哪一方发起了资金的撤回,但还有其他几个关键区别:

- 谁参与其中?

在撤单中,发卡行推动行动,并在整个过程中与客户和商家保持联系。在退款中,客户通常直接与商家联系,企业随后从其一方发起资金的撤回。 - 谁控制资金?

在退款中,商家掌控争议的资金,而在撤单中,客户的银行掌控资金。退款涉及商家告知其支付处理商将资金返还给客户。在他们发起这一转账之前,资金不会移动。但是在撤单中,客户的银行通常会直接从商家的账户中提取相关资金,并在他们确定撤单请求的有效性之前保留这些资金。 - 需要多长时间?

不计算客户与商家沟通并达成退款决定所需的时间(这可能需要从一次简短对话到几周的电子邮件),退款流程通常需要 3 到 7 个工作日。然而,撤单可能需要几周到几个月,特别是当商家对争议的扣款提出异议时。

撤单的常见原因

为了制定可操作的计划以减轻商家所产生的撤单数量,了解其发生的各种原因非常重要。以下是一些最常见的场景:

合法欺诈:

本质上,这是撤单存在的根本原因。其背后的动机是给消费者提供一种工具,以逆转因欺诈活动而在其账户上出现的交易——而合法欺诈仍然占据了大部分的撤单。善意欺诈:

听起来比实际要好得多。“善意欺诈”是一个涵盖各种与合法欺诈无关的撤单原因的总称。从技术上讲,持卡人只能因有限的原因对扣款提出争议并触发撤单。实际上,许多人并未认真考虑是否应该对扣款提出争议,而是将其作为解决各种情况的快速方法。以下是一些常见示例:- 他们认不出涉及的这笔扣款。

如果有人查看其信用卡账单并看到一笔他们不记得的扣款,他们可能会选择对其提出争议并请求撤单。也许他们确实买了但却忘记了,也可能是他们忘记了的订阅的经常性费用,或者可能是商家的名称在账单上未能清晰显示。如果一笔交易对持卡人来说看起来不熟悉,他们就有可能提出争议。 - 存在交付问题。

如果商品未能按时送达,客户可能会认为其丢失并请求撤单。如果客户从未获得运输细节或追踪号码,或者无法轻松联系到商家以询问订单状态,这种情况尤其可能发生。 - 他们想避免退货流程。

通常,撤单被当作一种轻松的“免于处理退货”的方式。如果客户对他们购买的商品不满意,发现商家的退货政策不够透明或繁琐,或者想要退货但已经超出了规定的时间,他们可能会申请撤单。

- 他们认不出涉及的这笔扣款。

纠正文书错误:

错误发生时,撤单是一种纠正错误的机制。如果客户被多次扣款,或者仍然被收取已取消订阅的费用,他们可能会向其银行或信用卡公司提出争议以纠正错误。当扣款来自于缺乏便捷客户服务的商家时,这类撤单发生得更频繁。如果客户无法轻松向商家请求退款,他们可能会认为申请撤单是他们的最佳选择。

撤单是如何运作的?

撤单只在初始交易结束后发生:支付被处理,资金转入商家的账户,扣款出现在客户的信用卡账单上。

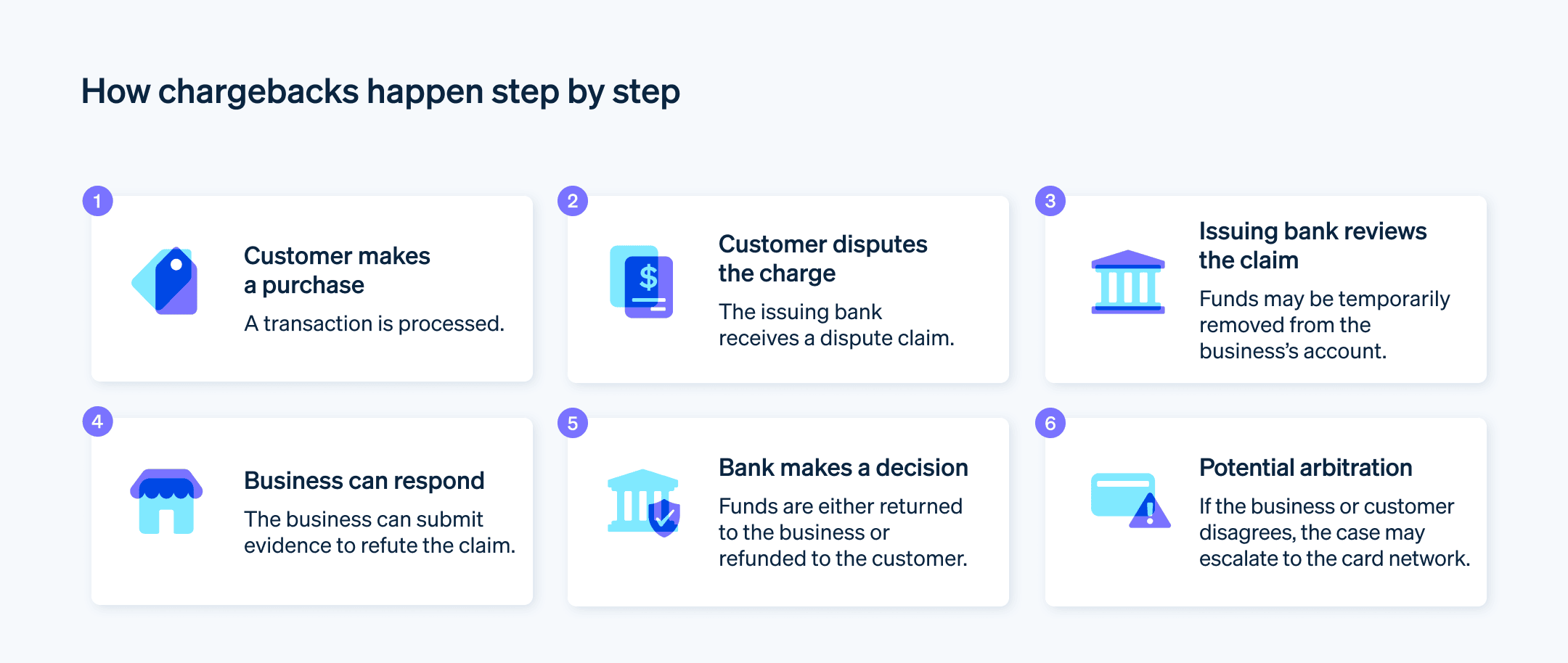

这时,撤单流程开始:

1. 客户提出争议。

一旦客户在账户账单上看到他们认为是欺诈的扣款,他们会向用于购买的信用卡的发卡行(即发卡银行)提出争议。

2. 发卡行启动撤单。

当客户对扣款提出争议时,发卡行将开始撤单流程。

3. 商家有机会反驳撤单。

客户申请撤单后,他们的银行将联系商家的银行,通知他们已请求撤单。此时,商家有机会提供证据,反驳客户认为扣款是非法的这一主张。

4. 银行作出决定。

发卡行将审核双方在撤单争议中的证据,并就是否继续处理作出决定。在这一点上,如果商家拒绝提供任何支持扣款有效性的证据,发卡行通常会批准客户的撤单请求。

5. 如果发卡行作出有利于商家的裁决……

如果持卡人的银行决定扣款是有效的并拒绝继续处理撤单,则资金不会退还给客户。如果在调查扣款之前,发卡行已将争议金额的款项记入持卡人账户,并且该扣款随后被发现是有效的,这些资金或信用将再次从持卡人账户中扣除。

6. 如果发卡行作出有利于客户的裁决……

如果银行确定客户有合理理由请求撤单,则资金将从商家账户中提取并返还给客户。

7. 作出决定后可以申请仲裁

如果银行支持商家,而客户仍想争取退款,客户可以选择进行仲裁。这会将问题移交给信用卡公司本身。这实际上是对发卡行决定的上诉过程。信用卡公司——Visa、AmericanExpress、Mastercard、Discover等——在撤单争议中拥有最终决定权。

撤单会给商家带来多少成本?

与撤单相关的费用因支付处理商而异。Stripe 每笔撤单收取 15 美元的费用。其他提供商的费用可能高达 50 美元甚至 100 美元。显然,目标是尽可能减少撤单,但偶尔仍会发生,因此了解您的支付处理商的收费很重要。

如何预防撤单

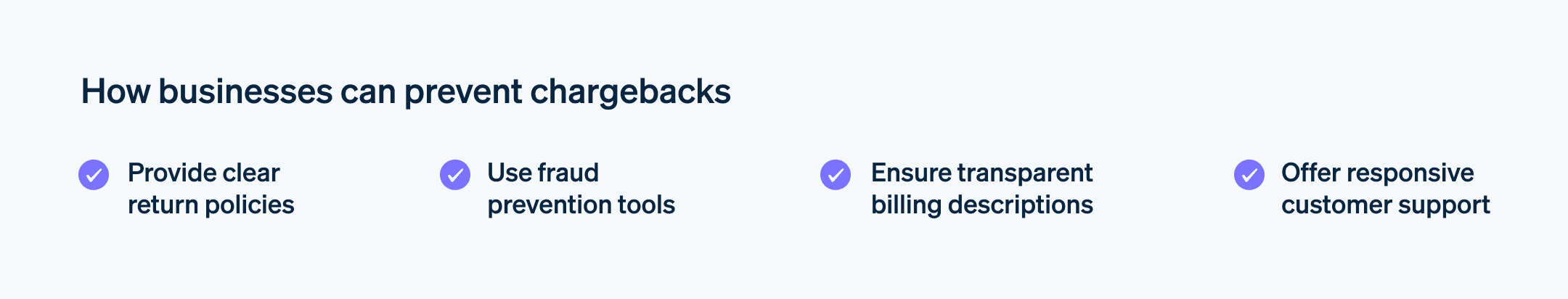

让我们积极应对这个问题。即使是最谨慎的商家也会遇到一些撤单,但可以采取一些措施来减少其发生频率。我们有一篇深入探讨为减少撤单可以采取的重要步骤的文章,但简要地说,以下是一些关键要点:

- 优先考虑信用卡支付的安全性。

- 尽可能简化退货流程。

- 管理交付预期。

- 及时与客户保持联系。

- 确保您的真实公司名称在信用卡账单上显示。

如何对撤单提出异议

即使您尽力防止撤单发生,它们仍然不可避免。当这种情况发生时,重要的是要有一个行动计划来审查欺诈索赔的真实性,并向前推进,无论结果如何。以下是反驳撤单索赔的概述:

确定争议的合法性。

如果您收到撤单通知,首先要确定它是由于真正的欺诈还是客服问题引发的。如果扣款确实是欺诈性的……

如果您对扣款的初步调查显示存在真实欺诈,您应该通知客户的发卡行您将不反驳撤单,并要求他们将资金退还给客户。您还应该告知您的支付处理商有关欺诈的情况,并查看这是否是个别事件或影响其他交易的更大问题。如果是“善意欺诈”……

如果您调查这个问题并确定没有实际欺诈发生,处理撤单问题最终取决于客户最初为何发起撤单。无论如何,您可能想要对撤单进行异议,这涉及以下几个步骤:- 联系客户。

许多撤单情况可以通过直接联系客户处理,表达希望解决促使他们申请撤单的任何问题,并倾听他们的意见。在大多数情况下,尝试与客户进行对话并自行达成解决方案是值得的。您可能最终还是会退款,但即使是这种结果,退款对您也比撤单更有利。 - 提供证据来反驳撤单。

如果与客户追求解决方案不奏效,而您确信没有真正的欺诈发生,您应提供相关证据。收据、确认号码、运输信息——所有这些都可以帮助确认交易的合法性。您的支付处理商很可能会与客户的发卡行沟通,因此他们可以提交任何证据。然后您将等待发卡行决定是否批准撤单。

- 联系客户。

虽然做生意者都不喜欢处理撤单问题,但采取积极和防御性的措施可以最大限度地减少收入损失,并减少对经营业务其他更愉快方面的干扰。要获取更全面的撤单预防指南,请点击此处了解更多。要了解 Stripe Radar 如何帮助商家应对撤单,请点击此处了解更多。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。