Bank transfers in Mexico are an important aspect of the country’s financial sector, especially for businesses. They are often preferred for their reliability and the level of trust they command from both businesses and customers.

Bank transfers have gained popularity in Mexico, growing 60% from 2020 to 2022. This is partly due to the increasing digitalization of financial services, as more customers and businesses are choosing online platforms for their banking needs. This shift is also driven by the growing ecommerce sector in Mexico, where bank transfers are a convenient payment option for online purchases.

The regulatory environment in Mexico plays a significant role in shaping the use of bank transfers. The government and financial regulatory bodies have implemented rules and guidelines to govern these transactions. These regulations are designed to protect customers and businesses, guaranteeing the safety and legality of transactions. The regulatory framework also addresses issues such as fraud prevention and data protection.

Below, we’ll discuss what businesses need to know about bank transfers in Mexico: how they work, what they cost, and what businesses need to consider when incorporating them into their payment strategy.

What’s in this article?

- Who uses bank transfers in Mexico?

- How bank transfers work in Mexico

- What is Sistema de Pagos Electrónicos Interbancarios (SPEI)?

- Which banks and institutions facilitate bank transfers in Mexico?

- Benefits for businesses that accept bank transfers to and from Mexico

- Security measures for Mexican bank transfers

- Requirements for businesses to start accepting bank transfers in Mexico

- Do businesses outside the country need a Mexican bank account to receive bank transfers from Mexico?

- Alternatives to bank transfers in Mexico

Who uses bank transfers in Mexico?

The types of businesses that use bank transfers in Mexico are similar to those that use them in the US, since they’re seeking the same benefits. Here’s an overview of which businesses are frequently using bank transfers for a wide range of transactions:

Ecommerce businesses

Ecommerce platforms in Mexico frequently use bank transfers for customer payments. It’s a safe and traceable method, which is especially useful for larger transactions. Customers who shop online often choose bank transfers as an easy way to track their spending and feel confident about the security of their financial data.Small and medium-sized enterprises (SMEs)

Many SMEs in Mexico rely on bank transfers for business-to-business (B2B) transactions. These businesses leverage the transparency and recordkeeping advantages transfers provide. This method also helps them manage their finances better with a clear record of incoming and outgoing payments.Freelancers and independent contractors

Individuals who work for themselves, such as freelancers, often use bank transfers to receive payments from clients—both domestically and internationally. This method provides them with a simple, direct way to get paid for their services.Real estate transactions

For buying and renting property, bank transfers are commonly used because of the large sums involved. Both individuals and real estate companies prefer this method for its security and the ability to transfer significant amounts of money effectively.Utility and service payments

Many people in Mexico use bank transfers to pay for utilities and services. This method is convenient for recurring payments, allowing customers to automate transactions and avoid missed payments.International transactions

Businesses with a global reach often use bank transfers for international trade. They offer wide acceptance and the ability to handle different currencies, making it a reliable way to manage cross-border payments.Paying salaries

Companies commonly use bank transfers to pay employees’ salaries. Funds are directly and securely transferred into employees’ bank accounts, which is both convenient for the employer and the employee.High-value retail purchases

Many customers like using bank transfers for big-ticket purchases such as electronics or furniture. They can be more reliable for large transactions than other payment methods, which might impose limits on purchases.

How bank transfers work in Mexico

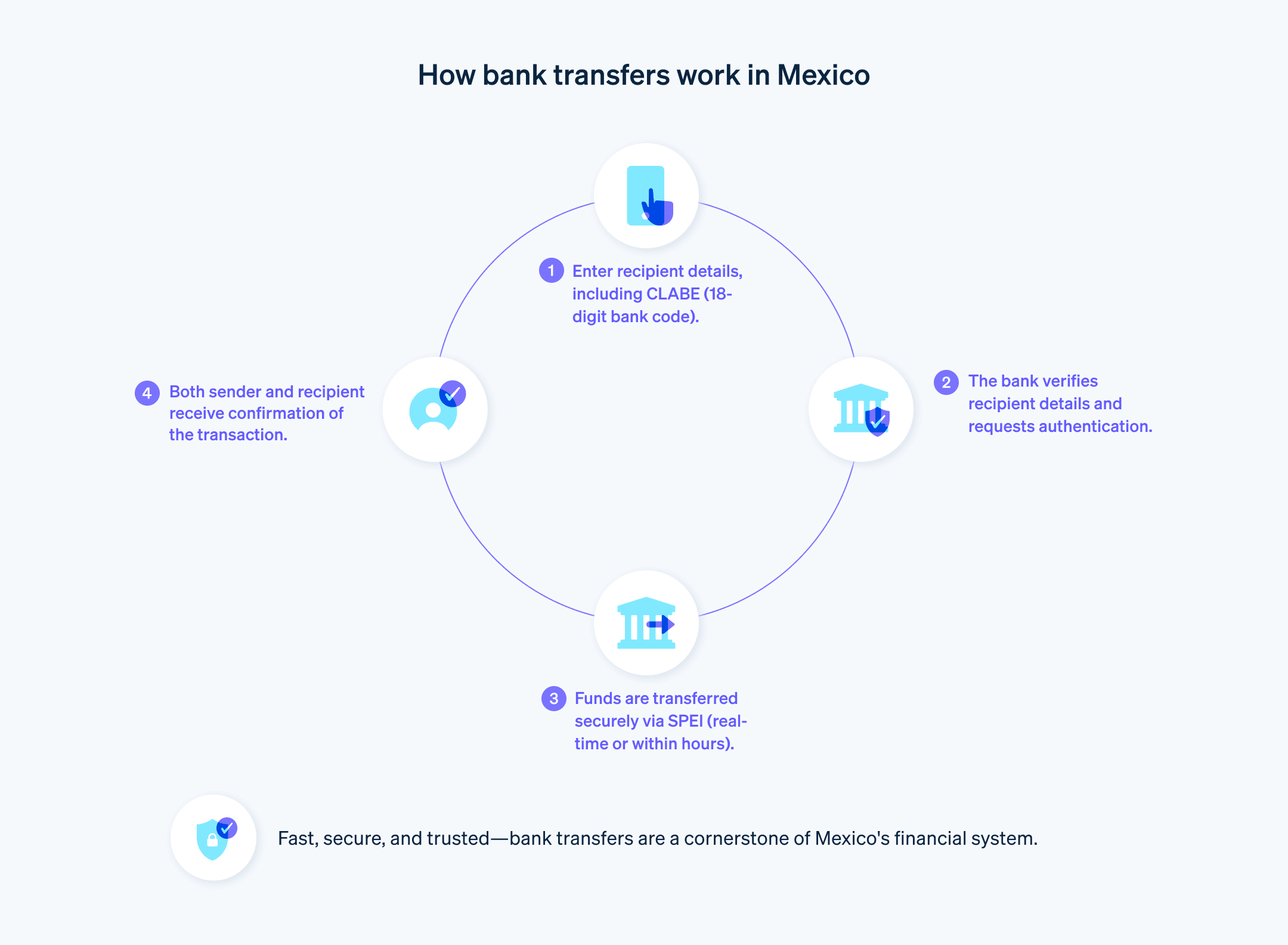

Bank transfers operate through well-established processes that cater to both individuals and businesses. Here’s a closer look at how they work:

Transfer initiation

A user, either an individual or a business representative, starts by logging into their bank’s online platform or visiting a branch. They need to provide the recipient’s bank details, which typically include the account number and the bank’s Clave Bancaria Estandarizada (or CLABE, a standard 18-digit banking code in Mexico). For international transfers, additional information such as SWIFT/BIC codes are usually required.Verification process

The bank then verifies these details. This step is important for transaction security. For online transfers, users might need to authenticate the transaction, often through a one-time password (OTP) or a similar security measure.Transfer processing

Once the details are verified and authenticated, the bank processes the transfer. For domestic transfers within Mexico, this can take a few minutes to a few hours. International transfers might take a few business days, depending on the banks and countries involved.Fees and charges

Banks may charge a fee for bank transfers, particularly for international transactions. These fees vary based on the banks and the nature of the transfer. Some banks offer free domestic transfers, particularly for online transactions.Transaction limits

Banks often limit the amount of money that can be transferred daily or per transaction. These limits are in place for security reasons and can vary from one bank to another.Receipt and confirmation

After the transfer is complete, both the sender and the recipient usually receive a confirmation—either by email, a text message, or a notification in their banking app. This confirmation includes details such as the transaction amount and the date.Dispute resolution

If there’s an issue with the transfer, such as an incorrect amount or recipient details, the sender can contact their bank for resolution. The bank then investigates and, if necessary, initiates a reversal or correction process.

This process reflects the efficiency and security of bank transfers in Mexico. While the system is simplified for ease of use, it also incorporates various measures to reduce errors and minimize fraudulent activities.

What is Sistema de Pagos Electrónicos Interbancarios (SPEI)?

The Sistema de Pagos Electrónicos Interbancarios (SPEI) is an electronic payment system developed and operated by the Banco de México, which is Mexico’s central bank. SPEI facilitates real-time, secure electronic transfers between bank accounts within the country. Here are its key features:

Real-time transfers: One of the main characteristics of SPEI is its ability to process immediate transfers. Payments are typically completed within seconds or minutes, which is significantly faster than traditional bank transfer systems.

Wide participation: Almost all banks in Mexico participate in SPEI, making it a standard method for electronic transfers in the country. This widespread participation allows customers of different banks to transfer funds to each other with ease.

Security: The system incorporates several layers of security to ensure the safety and integrity of transactions. This includes encryption, authentication protocols, and continuous monitoring for suspicious activities.

Accessibility: SPEI is accessible through various channels, including online banking, mobile banking apps, and some ATMs. This makes it convenient for individuals and businesses to execute transactions on the go.

Low cost: Transfers via SPEI generally cost less than traditional wire transfers or international payment methods. This cost-effectiveness makes it popular for both personal and business use.

Higher transaction limits: SPEI is capable of handling high-value transactions, so it is suitable for both everyday payments and larger business transactions.

24/7 availability: SPEI operates 24 hours a day, 7 days a week, which is particularly useful for urgent payments.

Support for bulk payments: For businesses, SPEI supports bulk payments, making it suitable for payroll or supplier payments.

Which banks and institutions facilitate bank transfers in Mexico?

In Mexico, several major banks and financial institutions play a key role in facilitating bank transfers. These institutions are integral to the Mexican financial sector and provide several services, including personal and business banking. Here are some of the most prominent institutions:

Banco Bilbao Vizcaya Argentaria (BBVA México): One of the largest financial institutions in Mexico, BBVA México offers comprehensive banking services. It has a robust online banking platform and widespread network of branches and ATMs.

Banco Nacional de México (Banamex): A subsidiary of Citigroup, Banamex is one of the oldest and most well-established banks in Mexico. It provides extensive financial services, including personal, corporate, and investment banking.

Santander México: Part of the global Santander Group, the bank has a significant presence in Mexico. It serves both individuals and businesses with a variety of banking products.

HSBC México: As part of the global HSBC Group, HSBC México offers several banking services for personal, business, and commercial banking. It’s known for its international banking expertise.

Banco Mercantil del Norte (Banorte): Banorte is one of the largest and most prominent Mexican-owned banks. It offers a wide array of services, including retail and commercial banking.

Scotiabank México: Part of the Canadian multinational Scotiabank, the bank provides a range of services in Mexico and is known for its personal and commercial banking products.

Banco Azteca: Part of Grupo Elektra, a major retail group, Banco Azteca serves a large customer base—particularly in the consumer banking sector.

Inbursa: Owned by the business magnate Carlos Slim, Inbursa has a range of financial offerings, including banking, insurance, and investments.

These banks, along with other financial institutions, facilitate both domestic and international bank transfers in Mexico. They offer transfer services to meet a variety of modern customer needs, including online and mobile banking options.

Benefits for businesses that accept bank transfers to and from Mexico

For businesses operating in Mexico, it’s important to understand the context of Mexico’s unique payment system. Here’s how bank transfers align with specific aspects of the Mexican market:

High bank penetration among businesses: In Mexico, most businesses have access to and regularly use banking services. This makes bank transfers a simple, convenient, and familiar payment method for B2B transactions.

Customer preference for direct bank payments: A significant portion of Mexican customers prefer direct bank payments over other methods for their security and convenience. This is particularly true for larger transactions, where customers value the security and traceability of bank transfers.

Growing digital banking infrastructure: Digital banking and fintech solutions have grown substantially in Mexico. This evolution makes bank transfers more accessible and easier to manage for both businesses and customers. The integration of digital banking solutions makes bank transfer processes quicker and more efficient.

Lower costs for local transactions: Compared to international payment gateways and credit card processors, local bank transfers often incur lower transaction fees. This cost-effectiveness is beneficial for SMEs that operate on tighter margins.

Immediate payment confirmation: In the Mexican banking system, bank transfers typically confirm payment almost immediately. This rapid processing helps businesses fulfill orders faster and manage inventory more effectively.

Enhanced security and fraud prevention: The Mexican banking system has strong security measures for bank transfers. This includes two-factor authentication (2FA) and other fraud prevention mechanisms, making transactions safe for both parties.

Favorable for high-value transactions: In Mexico, bank transfers are often preferred for high-value transactions, particularly in B2B settings. This preference is due to the ability to send a transaction directly, without intermediaries.

Alignment with regulatory practices: Mexico’s financial regulations encourage transparent transaction methods. Bank transfers provide a clear transaction record, making it easy for businesses to adhere to these regulatory standards, including compliance with tax and anti-money laundering laws.

By accepting bank transfers, businesses in Mexico can align with local banking habits and regulatory environments. This can build customer trust, reduce operational costs, and improve financial management.

Security measures for Mexican bank transfers

Mexico’s bank transfer system includes security measures to protect both the sender and recipient of funds. These safeguards minimize the risk of fraud and enable secure, reliable, and transparent transfers.

Two-factor authentication (2FA)

Many Mexican banks use 2FA for online banking and transfers, meaning you’ll often need to provide two forms of identification before accessing your account or confirming a transaction. This is typically your password along with a code sent to your phone.Secure Sockets Layer (SSL) encryption

When you use online banking for transfers, your data is protected by SSL encryption. This technology scrambles data into an unreadable format, making it hard for unauthorized parties to intercept or tamper with your information.Automatic logouts

For additional security, most banking platforms automatically log you out after a period of inactivity. This prevents unauthorized access if you forget to log out from a public or shared computer.Monitoring and alerts

Banks in Mexico also monitor accounts for unusual activity. If their systems pick up on something unusual, such as an unexpected large transfer, they’ll typically send you a security alert. This could be via email, SMS, or a phone call.SPEI

The system used for electronic transfers in Mexico includes built-in security features to ensure that transactions are safe and traceable.Personal identification numbers (PINs)

For both online banking and ATM transactions, you need to use a PIN. This personal code adds another layer of security.Security questions

Some banks ask security questions for certain transactions or account changes. These questions are an added layer of protection so that only you can access or modify your account details.Regular software updates

Banks continuously update their software to address new security threats. These updates include enhancements to protect your financial data.Customer education

Banks also educate their customers about safe banking practices. This might include advice on creating strong passwords, recognizing phishing attempts, and keeping your personal information safe online.

Requirements for businesses to start accepting bank transfers in Mexico

To start accepting bank transfers in Mexico, businesses need to meet several requirements. Fulfilling these requirements will enable a smooth setup and secure transactions:

Business bank account: You’ll need a business bank account with a Mexican bank. This account is where you’ll receive transfers. To open this account, you’ll typically need your business registration documents, tax identification number, and personal identification for the business owners.

SPEI enrollment: For electronic transfers, enrollment in SPEI is often necessary. This system facilitates fast and secure electronic transfers between accounts in different banks in Mexico.

Compliance with anti-money laundering (AML) regulations: Businesses must comply with AML regulations. This involves setting up processes to detect and report suspicious activities and may require additional documentation to verify the nature of your business and the source of funds.

Know your customer (KYC) procedures: Banks will have KYC procedures. You’ll need to provide detailed information about your business and its owners. This could include the nature of your business, the source of your funding, and identification documents.

Online banking setup: If you want to manage transfers online, you’ll need to set up online banking with your business account. This might involve additional security measures such as token devices or mobile authentication apps.

Understand the fees and terms: You should be aware of the fees and terms associated with receiving bank transfers. Each bank has its own fee structure, so it’s important to understand these details to help manage your finances effectively.

Technical integration for online businesses: If you operate online, you might need to integrate bank transfer options into your payment system. This could involve working with a payment gateway that supports bank transfers in Mexico.

Training staff: Make sure your staff is trained on how to handle bank transfers, especially if they involve manual processing. They should know how to verify transfers, reconcile accounts, and handle customer inquiries.

Do businesses outside the country need a Mexican bank account to receive bank transfers from Mexico?

Yes, businesses outside Mexico typically need a Mexican bank account to receive bank transfers directly from Mexico. This is mainly due to how banking systems and international financial regulations work. Here are a few points to consider:

Banking regulations: International banking regulations often require businesses to have a local bank account in the country where they are receiving payments. This is to comply with local financial laws and regulations, including anti-money laundering rules.

Currency exchange and fees: Receiving international transfers often involves currency exchange, which can carry higher fees. Having a local Mexican bank account can simplify transactions and potentially reduce these costs.

SPEI: Mexico’s SPEI facilitates fast and secure electronic transfers within Mexico. To use SPEI, a Mexican bank account is usually required.

Ease of transactions: Having a local account can make transactions smoother for both the sender and the recipient. It reduces the complexities associated with international transfers, such as longer processing times and additional verification steps.

Alternatives: Businesses that cannot or choose not to open a Mexican bank account can use alternatives such as international wire transfers, third-party payment processors, or financial services that specialize in cross-border payments. These services can receive payments in Mexico and then transfer them to the business’s primary account, though there may be additional steps and higher fees.

Alternatives to bank transfers in Mexico

Companies that conduct business in Mexico have several alternatives to using bank transfers for their financial transactions. These options address multiple scenarios, offering flexibility in how companies manage payments and receivables. Here are some of the main alternatives worth investigating:

Cash payments: Cash is still preferred in many parts of Mexico, especially in less urban areas. Many customers and small businesses prefer cash for its immediacy and because not all customers have access to banking services. However, physical cash can be less secure and less practical, especially for larger transactions.

Credit and debit cards: While the use of cards is increasing, especially in urban areas and among younger customers, Mexico still lags behind some countries in card penetration. Businesses that target a more technologically inclined or international clientele would benefit from accepting card payments.

Digital wallets: Digital wallets such as Mercado Pago and OXXO Pay are also growing in popularity. These appeal to tech-savvy customers and are a staple for online shopping. Digital wallets offer a middle ground between traditional banking and the ease of mobile transactions.

Direct debit: Used mainly for recurring payments (such as utilities or subscriptions), direct debit is convenient for customers who have a bank account and want to automate their regular payments. Businesses that offer subscription-based services often employ this payment method.

OXXO payments: OXXO, a widespread convenience store chain, offers a unique payment solution where customers can pay for online purchases in cash at any OXXO store. This system bridges the gap for customers who shop online but don’t use credit cards or bank transfers.

Money transfer services: For international transactions, services such as Western Union and MoneyGram are popular, especially for people outside the country sending remittances to family in Mexico. However, they can incur higher fees.

Mobile point-of-sale (POS) systems: These systems are increasingly popular in Mexico, especially among small and medium-sized businesses. They allow businesses to accept card payments using a mobile device, catering to customers who prefer card payments but shop at smaller stores.

Cryptocurrency: While still a niche market in Mexico, cryptocurrency is slowly gaining traction—particularly for cross-border transactions and among tech-forward customers and businesses.

The choice of payment method in Mexico largely depends on the target customer and the nature of the business. For instance, a business focusing on rural or older customers might rely more on cash and direct debit—while a business targeting urban, younger, or international clients might benefit from offering card payments, digital wallets, and mobile POS systems. Understanding these nuances is key to selecting the right mix of payment options.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.