As your business grows, moving from flat-rate pricing to a network cost plus pricing model can offer more flexibility and lower your costs. Network cost plus, sometimes called cost plus or interchange plus, gives you added transparency into the various fees associated with each transaction. With this level of detail, you may have the opportunity to identify and influence the biggest drivers of cost. However, this opportunity also comes with unpredictability and complexity: the factors that influence network costs fluctuate, can be hard to predict, and are subject to change by the card networks.

This guide helps you navigate the complexity associated with network costs for online transactions. You’ll learn about the different fees involved in online transactions, steps you can take to reduce those costs, and how Stripe can help.

While some of these tips may result in cost savings, others may not be right for your business. As you evaluate each of these opportunities, consider your industry, region, payment volume, card mix, and your customers to understand how it would impact your bottom line. For example, B2B companies that process corporate card transactions will have additional cost-saving opportunities compared to a B2C business. And depending on your business and payments integration setup, changes might require engineering investment or small changes to your customer experience, like gathering additional detail and passing it through with transactions.

Payments fundamentals

Before diving into the factors that influence network costs, it’s helpful to have a high-level understanding of how online payments work: how money moves from a customer to your business and how banks facilitate these payments. Learning about these fundamental building blocks will help you better understand the costs involved in this system and the opportunities to reduce those costs.

There are several major players involved in each online transaction:

- Cardholder: The person who uses a credit or debit card, either on behalf of themselves or a business.

- Business: The entity that accepts payments by card.

- Acquirer: A financial institution that processes card payments on behalf of the business and routes them through the card networks to the issuer. Sometimes acquirers may also partner with a third party to help process payments.

- Issuer: The financial institution that provides banking or transaction services and issues payment cards (such as credit or debit cards) to consumers or businesses on behalf of the card networks.

- Card networks: Card networks, like Visa and Mastercard, are the connection among all of these players. They communicate transaction information, move transaction funds, and determine the network fees for card transactions.

There are a variety of network fees that accompany each transaction processed through this five-party system. Visa, Mastercard, and other card networks set the network fees, which include interchange and scheme fees. American Express uses a slightly different model since they are the acquirer, the network, and the issuer, and their network costs are referred to as a discount rate.

Interchange typically represents the bulk of the network costs. This amount is paid to the issuer because it provides cards to consumers and businesses, adding customers to the system. Scheme fees are collected by the card networks themselves and can include additional authorization and cross-border transaction fees. Fees can also be assessed for refunds and other network services.

Factors that influence network costs

There is no one-size-fits-all approach to managing network costs. These fees vary from transaction to transaction, from card to card, and from business to business. For example, a payment made with a rewards credit card is likely to incur higher network fees than a transaction with a non-rewards card since issuers often use these fees to subsidize the cost of the rewards program.

There are a variety of factors that affect network costs, including:

- The size of the transaction

- The type of card used

- Your merchant category code (MCC)

- Where your business is located

- Where the issuer is located

- How the payment is processed (i.e., in-person, online, or via phone)

- If a network token was used in the transaction

How to manage network costs

While the majority of factors that affect network costs are out of your control, there are a handful of ways you can influence costs, especially to reduce the amount of interchange fees you may incur. This section covers four opportunities to manage network costs, including:

- Pass more transaction data to issuers

- ZIP code

- Level II (sales tax) and Level III (sale details) data

- ZIP code

- Enable network tokens

- Use local acquiring

- Implement other customer experience changes

1. Pass more transaction data to issuers

Additional cardholder data that you can pass to the issuers may be valuable and help them validate whether a transaction is legitimate, which in turn can lead to reduced fees for you. Two pieces of information in particular, ZIP code and Level II or Level III data, can have significant impacts on reducing costs.

ZIP code

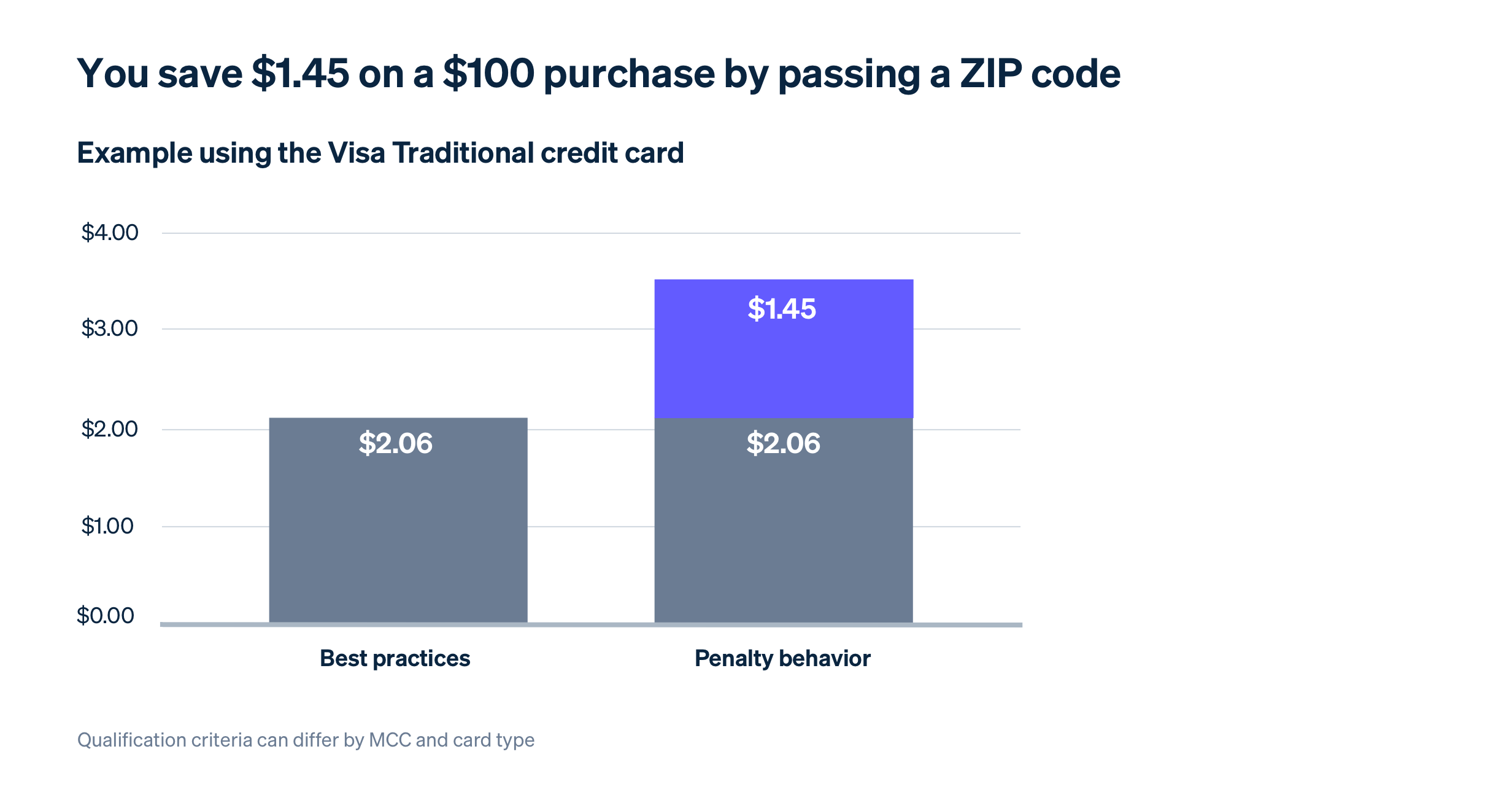

You could save up to $1.45 on a $100 transaction by passing ZIP codes.

Collecting a customer’s ZIP code during checkout and including it in the transaction data can be one of the biggest influences on the interchange fee by qualifying the payment for a lower rate. Depending on the card type, you can reduce network costs by up to 1.45% of the transaction amount by passing the ZIP code to the issuer. For Visa and Discover specifically, passing the ZIP code also helps you avoid higher charges—they both add an extra fee if ZIP code isn’t included.

While passing ZIP codes is a relatively simple way to reduce costs, it doesn’t apply to all businesses in all industries. Moreover, introducing additional requirements into the checkout process can increase friction and reduce conversion. Contact your account manager or our sales team if you have questions about whether your business is eligible for rate reductions when passing ZIP codes.

What you can do: Audit your own payment flow and make sure that all checkout forms (on desktop, mobile, or via digital wallets) are set up to prompt cardholders to enter their ZIP code.

Level II and Level III data

You could save up to $0.80 on a $100 corporate card transaction by passing Level II and Level III data.

For some businesses who sell B2B, passing additional types of data can also be beneficial. This type of data is called Level II and Level III.

Level II information is primarily made up of sales tax information and, if passed to the issuer in the transaction message, may result in a rate reduction of up to $0.50–$0.75 on a $100 transaction (depending on the card type). If you don’t charge sales tax as a line item, you’re not eligible to receive these rates.

Level III data is more detailed information about the sale, which helps issuers understand whether a transaction made with a business, corporate, or purchasing card actually qualifies as an eligible business expense, and allows you to qualify for even lower interchange rates compared to Level II. Level III information shares a description of the item purchased, quantity of units purchased, unit of measure, and more with issuers. For example, let’s say a business sends its employees to a conference and they use their business card to expense a transaction in a casino. How does the issuer know if this was a business dinner or if they were gambling? Should they approve the expense or not? Level III data tells the card issuer exactly what was purchased, whether it was two steak dinners or $50 worth of casino chips. With Level III data, that same $100 transaction could qualify for a reduction of up to $0.80.

What you can do: Look at your payment volume to see how many transactions are made with business, purchasing, and commercial cards and if you’re even eligible to receive these lower rates. For businesses with a high proportion of B2B card transactions, Stripe makes it easy to pass Level II and Level III data to the networks to lower your costs. Contact your account manager or our sales team to learn more.

2. Enable network tokens

Network tokens are payment credentials that can substitute PANs for online purchases. Network tokens ensure that the latest credential is used for your payments—if the underlying PAN associated with a network token changes or expires, the token will remain current and usable. In addition to authorization rate benefits, network tokens can also help reduce network costs for users on network cost plus pricing by realizing lower rates from card networks. Learn more about how network tokens work.

3. Use local acquiring

Network costs increase as you expand globally and process more transactions with international cardholders. Cards issued outside of your country follow a different interchange rate structure and are charged additional cross-border scheme fees. However, if you can process these charges as domestic transactions, you can potentially save up to $1.00 per $100 transaction. The savings could be even higher based on the settlement currency and card type.

Let’s say your business is located in the US and someone makes a purchase with a credit card issued in Germany. This is a true international transaction: it took place in the US with a card issued outside of the US. As a result, this transaction would incur a cross-border fee of over 1%. Eventually, you may open an office in Germany to support this growing market, but all your transactions would still be running through a US location and would still incur the additional fees.

It’s less expensive to acquire in the region where your customer is located because you’re able to receive domestic rates and avoid cross-border fees. In this case, opening a local German entity, location, and bank account means transaction fees on German cards processed by the German entity could decline by as much as 1%.

Every country has different interchange rates, so depending on where you’re expanding, you could also see additional cost savings in interchange (especially in most of Europe, where interchange is regulated).

What you can do: Stripe makes it easy to expand internationally with support in more than 45 countries. If you have a location that supports the sales of local goods or services and process a significant amount of transactions on cards issued in these countries, consider opening additional Stripe accounts to lower card payment costs.

Stripe also allows businesses to offer many international payment methods that are popular around the world without setting up international accounts. Read our guide to international payment methods to learn how they can increase conversion and offer other benefits.

4. Other customer experience changes

Consider changing how you process refunds and handle small transactions from the same customer. You can often make these changes indirectly (like by updating how you authorize and settle a transaction) to reduce costs and avoid directly impacting the customer experience.

Leave the authorization window open

Refunding a $100 transaction can be up to 24x more expensive compared to reversing an authorization.

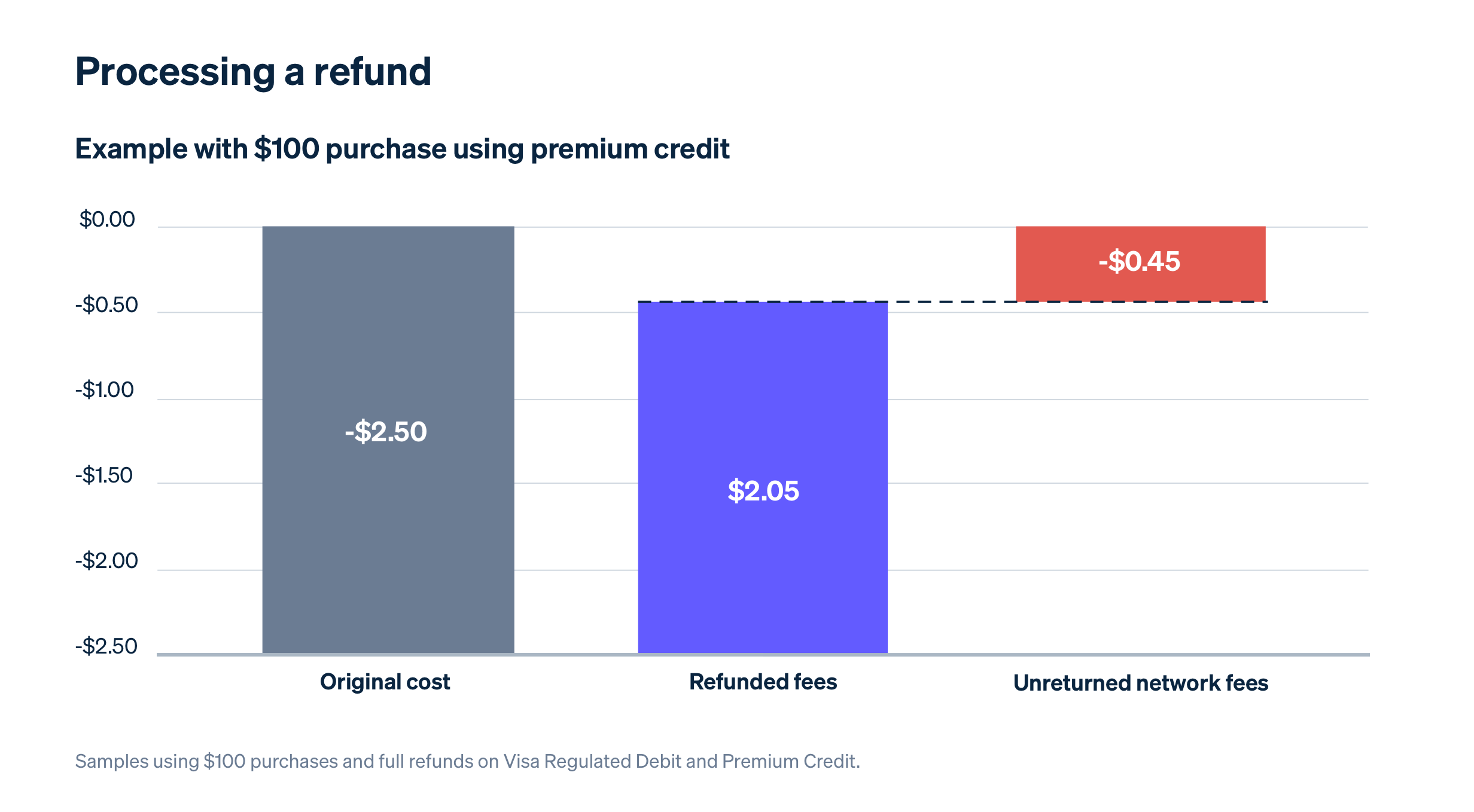

When you process a refund, you usually recoup less in interchange fees than you originally paid. For example, if a customer returns a $100 purchase made on a credit card, the networks might only refund $2.05 of the total $2.50 initial fees, causing you to lose $0.45.

Debit card purchases in the US are more extreme: there are no returns on interchange fees on any US debit card transaction.

If your business often processes refunds shortly after a payment, you can combat these potential lost fees by leaving the transaction authorization open rather than settling the sale right away. This is possible because you only pay interchange fees once a transaction is settled. If you leave the authorization open and a customer makes a return, you can simply reverse the authorization and avoid losing any extra interchange fees (since you never paid those fees to begin with).

For example, if you captured and settled a $100 debit card transaction and a customer requested a return, you could lose $0.42. However, if you had left the authorization open, you could only lose slightly less than $0.04.

You can generally leave an authorization open for up to two days before you pay additional fees, so this approach is most relevant for industries with the immediate delivery of goods (such as food delivery services).

What you can do: Configure the Stripe Payment Intents API to separate authorization and capture.

Optimize smaller transactions

Lower fixed fees with incremental authorizations.

Processing dozens of small transactions, like payments of $5 or less, can quickly increase your overall costs. While interchange fees can be lower on these payments, they still make up a sizable portion of the overall transaction.

If you expect minor changes in transaction value (like the addition of gratuity on top of a base charge), leave the authorization window open until you can settle the whole amount. This allows you to capture the payment once and incur a smaller set of fees for incrementally changing the authorization versus creating a new one each time. Incremental authorization is only available on certain networks. Contact your account manager or our sales team to learn more.

How Stripe can help

Cost optimization exists on a spectrum: some businesses may only want to make small, incremental changes while others may want to implement as many optimizations as possible. Stripe lets you choose how you want to optimize your costs in a way that best suits your existing and new business lines.

Stripe can help you manage costs with:

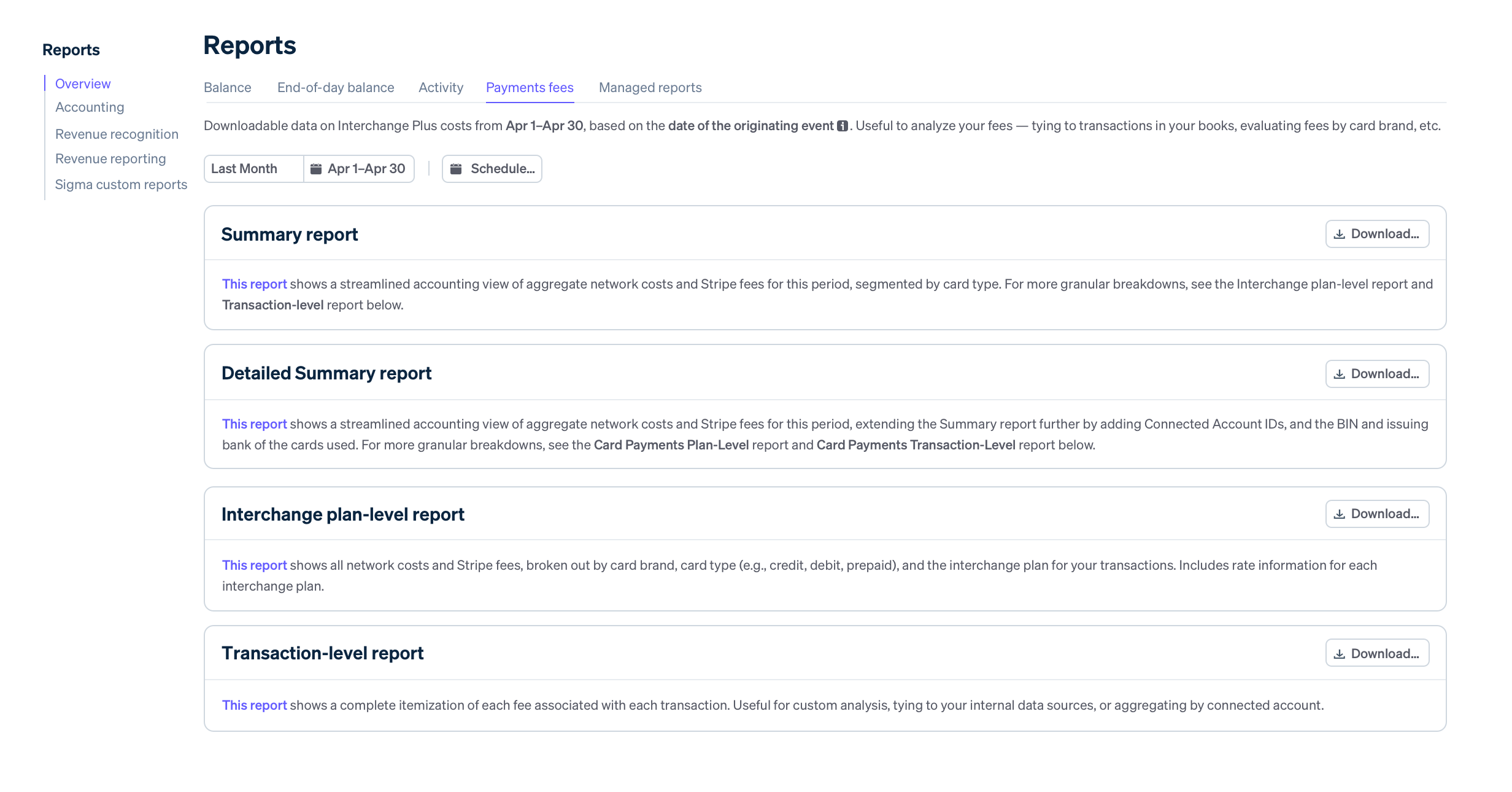

- Itemized fee reporting: Stripe provides transaction-level granularity into interchange, scheme, and Stripe fees. This helps you reconcile end-of-month reports back to a transaction basis and quickly identify any processing issues. In addition, the ability to see data at a transaction level can help you identify areas for cost optimization.

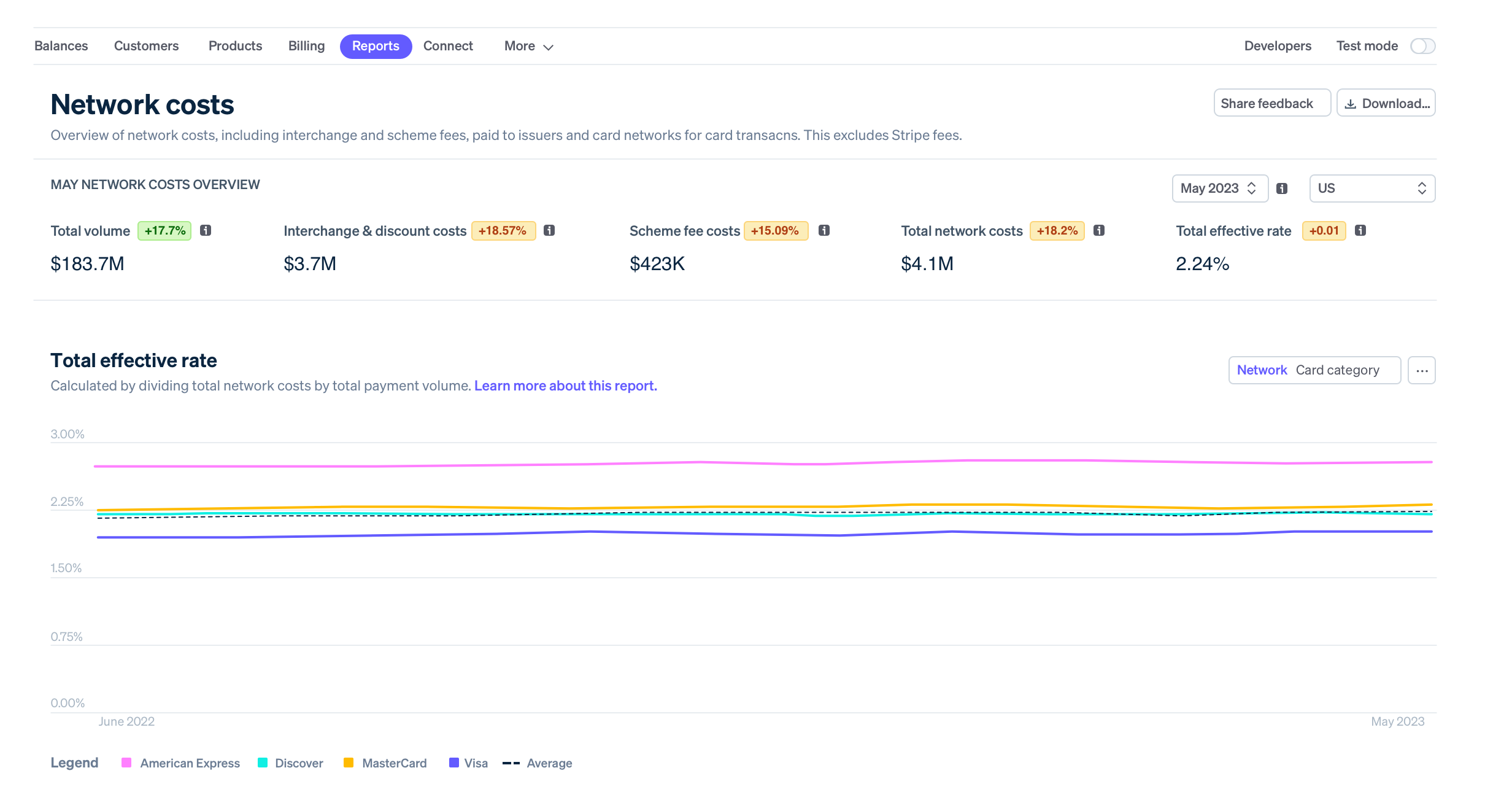

- Network cost insights: Users on network cost plus pricing can deep-dive into their network costs, identify opportunities for cost savings, and automate financial processes with the Network cost insights report in the Dashboard.

- Cost optimization workshops: During these workshops, we conduct a deep dive on your business to identify and quantify methods to reduce your costs. The analysis includes a review of effective rate and card mix over time, average order value, fee trends, and more.

To learn more about how Stripe can help you manage costs, contact your account manager or our sales team.