Buy now, pay later has emerged as one of the most popular payment methods: More than half of US customers have used a buy now, pay later service, and almost 10% of e-commerce transactions in Australia are paid using a buy now, pay later provider. It was the fastest growing payment method in 2020 in India and the UK, and analysts estimate that these services will account for 12% of total global e-commerce spend on physical goods by 2025.

What is buy now, pay later (BNPL)?

Buy now, pay later (BNPL) is an alternative payment method that allows customers to purchase products and services without having to commit to the full payment amount up front. In doing so, customers have the ability to immediately finance purchases and pay them back in fixed instalments over time. For example, a customer making a £100 purchase could pay for the item in four interest-free instalments of £25.

Buy now, pay later services – such as Affirm, Afterpay, Klarna, and Zip – are used by a wide variety of businesses, especially e-commerce retailers, to increase conversion, increase average order value, and reach new customers. On buy now, pay later eligible sessions, businesses on Stripe have seen up to 14% increase in revenue. These payment methods offer customers the ability to immediately finance purchases and pay them back in fixed instalments over time.

You, as the merchant, receive the full payment of the item up front, minus any fees (just like a credit card payment), and don’t have to manage the financing. The buy now, pay later providers take on the task of underwriting customers, managing the instalments, and collecting payments, so you can focus on growing your businesses.

This guide covers the basics of buy now, pay later payment methods. You’ll learn how they work, how to choose a provider, and how Stripe can help.

How do buy now, pay later services work?

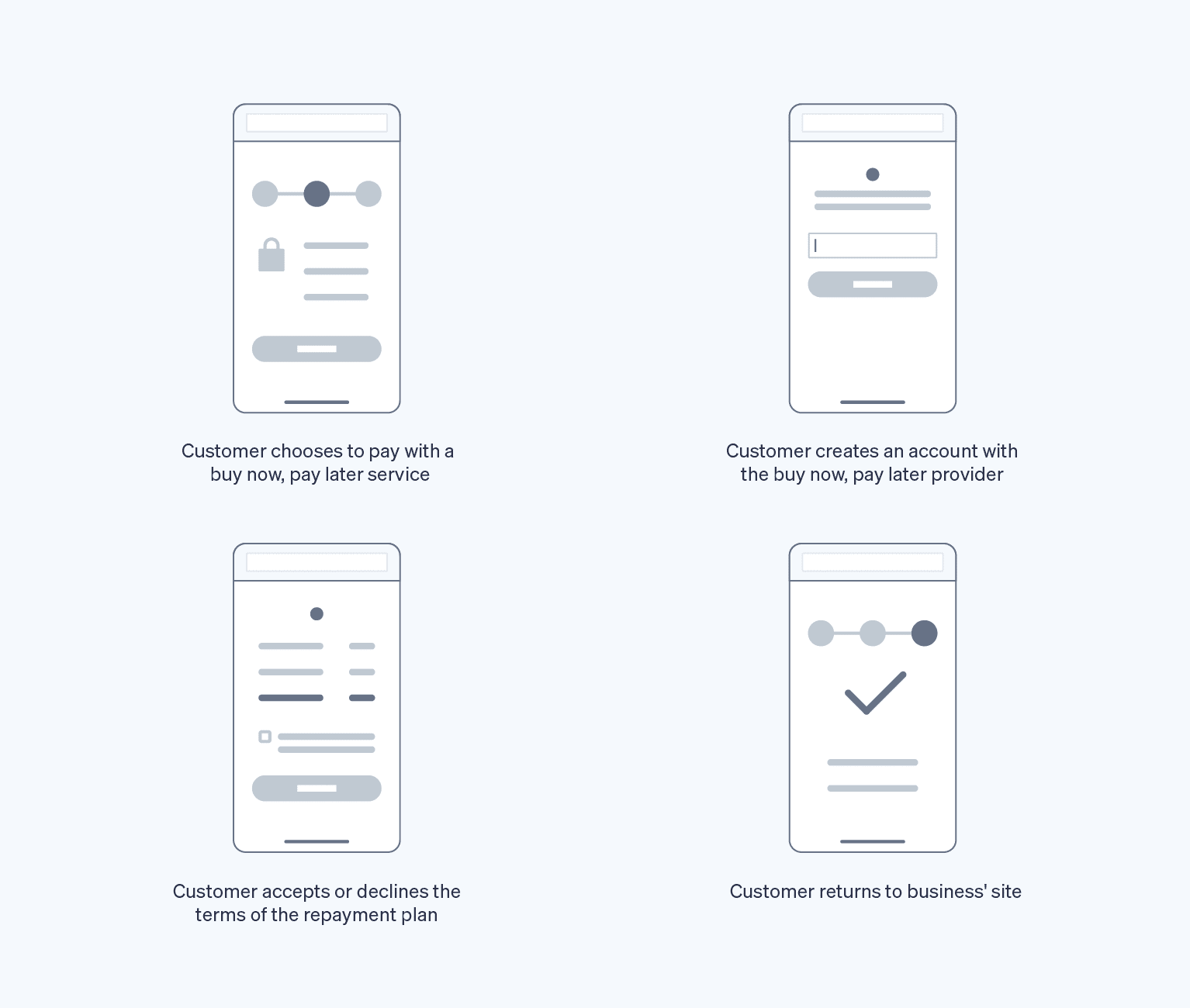

Buy now, pay later services are typically presented as an option in the payment flow, alongside credit cards and other payment methods. When customers make a one-time purchase, they simply select a buy now, pay later provider in the payment form, and are redirected to the provider’s site or app to create an account or log in. Customers choose whether to accept the terms of the repayment plan – typically selecting bi-weekly or monthly instalments – and complete the purchase.

Once the purchase is complete, businesses receive the full payment up front (minus any fees). Customers pay their instalments directly to the buy now, pay later provider, often with no interest and no additional fees when they pay on time.

Do buy now, pay later payment methods affect a customer's credit score?

As long as customers are careful not to overspend and continue to make payments on time, most buy now, pay later payment methods shouldn't significantly impact a customer's credit score.

However, credit scores may be impacted if providers run a hard credit check or if a customer fails to make payments on time.

How do buy now, pay later services make money?

Buy now, pay later services generate revenue by charging fees to both customers and businesses. Business fees will depend on the provider, but will normally include a fee for the initial setup process and a fixed fee for each transaction. Customer fees are generally related to interest charges or late fees for missing payments.

What are the benefits of buy now, pay later services?

Frictionless checkout experiences are vital for any business, especially if you are focused on e-commerce growth. Customers expect streamlined, customisable payment experiences – ones that give them the flexibility to choose how to make a purchase. Not only do buy now, pay later payment methods offer this flexibility and convenience to your customers, they also reduce fraud and increase conversion and average order value.

By offering buy now, pay later options, you can:

- Get paid up front and receive protection from repayment risk and fraud: You receive the total transaction amount up front, immediately – whether or not the customer successfully pays their instalments. This means that buy now, pay later providers take on all the customer risk, shielding your business from fraud. If a customer does file a fraud-related dispute, the buy now, pay later provider takes on the risk and any associated costs.

- Reach more customers: Offering a variety of payment methods allows you to create a relevant and familiar payment experience, helping attract more customers. Buy now, pay later options are particularly popular among younger customers who often don't have a credit card: more than 26% of millennials and almost 11% of Generation Z shoppers used buy now, pay later services to pay for their most recent online purchases. Buy now, pay later services also have established marketing channels, such as their shop directory and email marketing, which may provide additional opportunities for you to reach new customers.

- Offer a better customer experience: Buy now, pay later payment services offer customers a faster, more convenient way to access financing. Customers are only subject to a soft credit check (versus a hard check for other financing methods). There are no separate applications, application fees or additional processing time and most providers have simple-to-understand repayment plans and terms. Returning customers can also check out with ease, completing the payment flow in just a few clicks.

- Increase conversion: Customers are more likely to make a purchase, especially a large one, if they can pay for the item over time. Buy now, pay later services help reduce the sticker shock – it's less intimidating to make four, interest-free payments of £50 than one £200 transaction with a credit card with interest continually accruing.

- Boost your average order value: Buy now, pay later services remove the barrier to larger purchases, allowing customers to break up the payment over time to fit within their budget. For businesses that sell lower priced goods, customers may be more likely to purchase additional items once they learn they can pay the total amount over time.

For consumers, buy now, pay later services can offer a convenient, affordable way to make purchases. Buy now, pay later providers also take steps to ensure they offer responsible lending and services to consumers. For example, they provide information to consumers about the money they owe and how they set their fees and require businesses to adhere to guidelines for how they communicate these services to their customers. Given the growing popularity of these services, some governments are considering introducing new rules in order to promote responsible practices and ensure consumers understand the product. Stripe is following these developments closely to understand how consumers and businesses might be affected.

Do customers or businesses pay more when using buy now, pay later?

Generally, customers do not end up paying more money when using buy now, pay later payment methods.

Additionally, the cost of a product or service does not change when using a buy now, pay later service. If a product is priced at £100, the customer would still end up paying £100 to the business making the sale.

However, there may be associated processing fees for businesses that choose to provide a buy now, pay later service. The cost of using a buy now, pay later service will depend on the provider.

Are buy now, pay later payment methods right for my business?

Buy now, pay later payment methods are beneficial for most business, especially:

- Retailers selling high-value goods and services, such as luxury items or travel fares that want to boost conversion

- Retailers selling low-value goods and services that want to increase average basket size and reach new customers who might not have credit cards or the means to pay the full cost up front

How do you choose a buy now, pay later provider?

Selecting the right buy now, pay later provider depends on the types of items you sell, the price of those items and your customer base. When evaluating providers, consider the following:

- Repayment terms: Buy now, pay later providers offer different instalment plans and term lengths, ranging from a few weeks to multiple years. If your business typically has a high average order value, look for buy now, pay later providers that offer repayment over a longer period of time (like having customers pay monthly instalments over six months). On the other hand, businesses with a lower average order value may be able to offer fewer instalments over a shorter amount of time, like four instalments over six weeks.

- Credit limits: Every customer will have a different spending limit based on their usage, credit and/or repayment history, but some buy now, pay later providers have minimum and maximum credit limits. Again, evaluate your average order value and select a provider that offers enough credit for customers to successfully make a purchase.

- Customer location: Decide in which markets you'd like to offer a buy now, pay later service based on where your customers are located. This may mean offering more than one buy now, pay later provider to maximise your geographic coverage. You may also want to select the buy now, pay later provider that is most popular in the region; for example, Afterpay and Zip are the most popular buy now, pay later services in Australia, while Klarna is most popular in Germany and the Nordics.

Buy now, pay later provider comparison

Find relevant buy now, pay later services by reviewing the profiles of Stripe-supported options below. You can also see which payment methods are available for your account by visiting the Dashboard.

|

Affirm

|

Afterpay/Clearpay

|

Klarna

|

Zip

|

|

|---|---|---|---|---|

|

Relevant payer geography

|

Canada, US | Australia, Canada, New Zealand, UK, US | Australia, Austria, Belgium, Canada, Czechia, Denmark, Finland, France, Germany, Greece, Ireland, Italy, New Zealand, Norway, Poland, Portugal, Spain, Sweden, Switzerland, the Netherlands, UK, US | Australia, US |

|

Repayment options

|

|

|

|

|

|

Transaction limit

|

$50 minimum; $30,000 maximum | $1 minimum; $1k - $4k maximum or local equivalent (varies by geo) | $10 minimum or local equivalent. $5,000+ for financing possible; maximum varies by customer | For AU: AU $1,000 to AU $5,000; AU $50,000 for select businesses For US: $35 - $1500 |

|

Active customer base

|

31 million global customers | 20 million global customers | 150 million global customers | 6.3 million customers globally |

Learn about Stripe’s pricing for buy now, pay later payment methods.

*Late fees may apply. Eligibility criteria apply. See www.afterpay.com for more details. Loans to California residents made or arranged pursuant to a California Finance Lenders Law licence. © 2021 Afterpay US

Affirm

Affirm is modernising consumer credit and changing the way people shop. Their predictive technology delivers personalised payment options that are tailored to each purchase, including flexible payment plans from 4 interest-free payments every 2 weeks to longer instalments up to 36 months.

Affirm partners with 235K retailers and has a network of over 31 million addressable customers in the US. Customers have the flexibility to buy what they want today and make simple payments over time. Affirm's transparent terms (no fees, no compounding interest) boost customer satisfaction and can result in higher conversion rates and repeat purchases for merchants.

Afterpay

Afterpay, also known as Clearpay in the UK, allows customers to break up their payment into interest-free instalments with Pay in 4 and finance higher value orders with monthly interest-bearing instalments (available in the US only). Afterpay is available in Australia, Canada, New Zealand, the UK and the US and has 20 million active consumers.

As a leader in the buy now, pay later space, Afterpay sets sensible and transparent initial spending limits for new customers that may increase over time, rewards customers for responsible spending and has developed a one-stop solution for in-store and online shopping.

Klarna

Klarna offers the most variety in payment options, which gives customers more freedom to choose when and how to pay for a purchase. Klarna provides payment solutions for more than 150 million shoppers and 450K+ businesses and is active in 45 markets.

There are four different ways for customers to pay for a transaction with Klarna: Pay in Instalments, Pay Later, Pay in full and Financing:

- Klarna Pay in Instalments allows customers to make an online purchase and spread the cost over three or four interest-free payments.*

- Klarna Pay Later in 30 days lets customers immediately complete a transaction and pay the full amount later, at no additional cost.

- Pay in full is offered in many European countries and lets a customer pay for a transaction immediately using stored payment credentials. Supported payment methods include bank transfers or direct debit.

- Klarna Financing offers customers up to 36 months of credit. To receive financing, they complete a one-time application. If approved, customers make their monthly payments to Klarna online or in the mobile app.

Zip

Zip, a leading global buy now, pay later company, provides options to simplify how customers pay with a variety of flexible payment options. It's a familiar payment method used by 6.3 million customers globally. Customers in Australia can choose to pay later with interest-free repayments with Zip Pay or in interest-free instalments for up to 36 months with Zip Money. Customers in the US can choose to Pay in 4.

There are three ways for customers to pay for a transaction with Zip:

- Zip Pay (AU) offers customers a line of credit up to $1,000 AUD. Customers can select their repayment frequency – either weekly, biweekly or monthly.

- Zip Money (AU) offers customers a line of credit between $1,000 AUD and $5,000 AUD or up to $50,000 AUD with select Zip merchants. Customers have flexibility on the amount, date and frequency of repayment.

- Zip Pay in 4 (US) lets customers pay for purchases between $35 USD and $1,500 USD over 4 instalments.

How do I set up buy now, pay later for my business?

Setting up buy now, pay later payment methods for your business is simple. Once you've selected a buy now, pay later provider that aligns with your business goals, you'll likely undergo an application process that includes providing information about your company. Another option is to integrate directly with a software provider to expedite implementation and ease of use. For example, with Stripe, once approved, our team will help you integrate the BNPL service into your website and you'll be able to provide buy now, pay later services as an additional payment method for your customers.

How Stripe can help

E-commerce companies around the world use Stripe to accept multiple payment methods – including buy now, pay later – and simplify global operations. Stripe is making it possible to accept buy now, pay later options in minutes with a single integration. Stripe offers:

Fast and seamless integration options

Stripe's product suite comes with built-in global payment support so you can offer the most relevant payment experiences for your customers.

- Stripe's payment surfaces let you add new payment methods, including buy now, pay later, directly from the Stripe Dashboard – no coding required. Stripe's machine learning algorithm then dynamically shows customers the most relevant payment methods.

- Drive up-funnel conversion by adding Stripe's Payment Method Messaging Element, which helps your customers know which buy now, pay later payment options they have at checkout directly from your product, cart or payment pages.

- Platforms and marketplaces can use Stripe Connect to accept money and pay out to third parties. Your sellers or service providers benefit from the same streamlined Stripe onboarding and get instant access to select payment methods.

- Stripe's Payments API makes it easy to support multiple payment methods through a single integration. This leaves you with a unified and elegant integration that involves minimal development time and remains easy to maintain, regardless of which payment methods you choose to implement.

No paperwork

Eligible businesses can accept any of these buy now, pay later options with Stripe in minutes – there is no additional application, onboarding or underwriting process to get started. Find out which buy now, pay later options you are eligible for by visiting the Dashboard.

Unified monitoring and reporting

Payments made with any payment method, including buy now, pay later services, appear in the Stripe Dashboard, reducing operational complexity and allowing for lightweight financial reconciliation. This enables you to develop standardised processes for typical operations such as fulfilment, customer support and refunds.

For more information on supporting buy now, pay later payment methods with Stripe, read our docs or contact our sales team. To start accepting payments right away, sign up for an account.