The presence of POS terminals in Spain continues to increase. As indicated by statistics from the Bank of Spain, the number of terminals reached 4.2 million at the end of the first half of 2023 – 9.7% more than in July 2022.

If the commercial activity of your business requires you to accept in-person payments and you want to make the best decision when choosing a POS, the information in this article will help you decide what criteria you should take into account.

What’s in this article?

- What is a POS?

- What is a POS for?

- How does a POS work?

- What types of POS terminals exist in Spain?

- What to take into account when choosing a POS in Spain

- Frequently asked questions about POS in Spain

What is a POS?

POS stands for “point of sale” and is a collection solution businesses use to carry out their commercial activity. In Spain, it is common for the term “TPV” (the Spanish equivalent of the “POS” acronym) to be used as a synonym for “terminal” or “card reader.” However, it is important to understand that a POS system encompasses other elements. These are the fundamental components of a POS system:

- Card reader: These are devices that process card payments or payments with digital wallets. At the end of 2025, Bizum – the Spanish payment service provider resulting from the collaboration of 34 Spanish banks – is expected to launch its own wallet, Bizum Pay.

- Software: Computer programs manage sales and other aspects related to the business, such as taxes, inventory, or financial reports.

- Code readers: These devices read the content of barcodes or quick response (QR) codes.

- Printers: Although more and more companies send invoices or receipts to their customers by mail or short message service (SMS), it is very common for a POS system to have, at a minimum, a thermal printer for receipts.

- Cash register: Some businesses still opt for traditional cash registers that include several of the basic functions of a POS. In many cases, the most digitalised companies that use their POS system from a computer or tablet will have a small cash drawer to manage cash payments.

What is a POS for?

A POS system encompasses several tools that serve three main purposes:

- Charge the correct amount to customers with their preferred payment methods: A modern POS system must be able to automatically calculate the amount and the value-added tax (VAT) applicable to your sales, as well as support different payment methods in addition to cash and cards (e.g., digital wallets).

- Manage business sales: Your POS system should be able to integrate with your other systems (e.g., your customer relationship management [CRM] system) to automatically update your inventory, create loyalty programs, or send sales invoices to your customers.

- Generate accounting reports: Even the simplest POS system can generate listings of your sales for a specific period of time to simplify your accounting tasks. However, a solution adapted to today’s businesses should allow you to use that data to generate personalised reports to analyse, for example, your profit margins or the best opportunities to launch new offers.

How does a POS work?

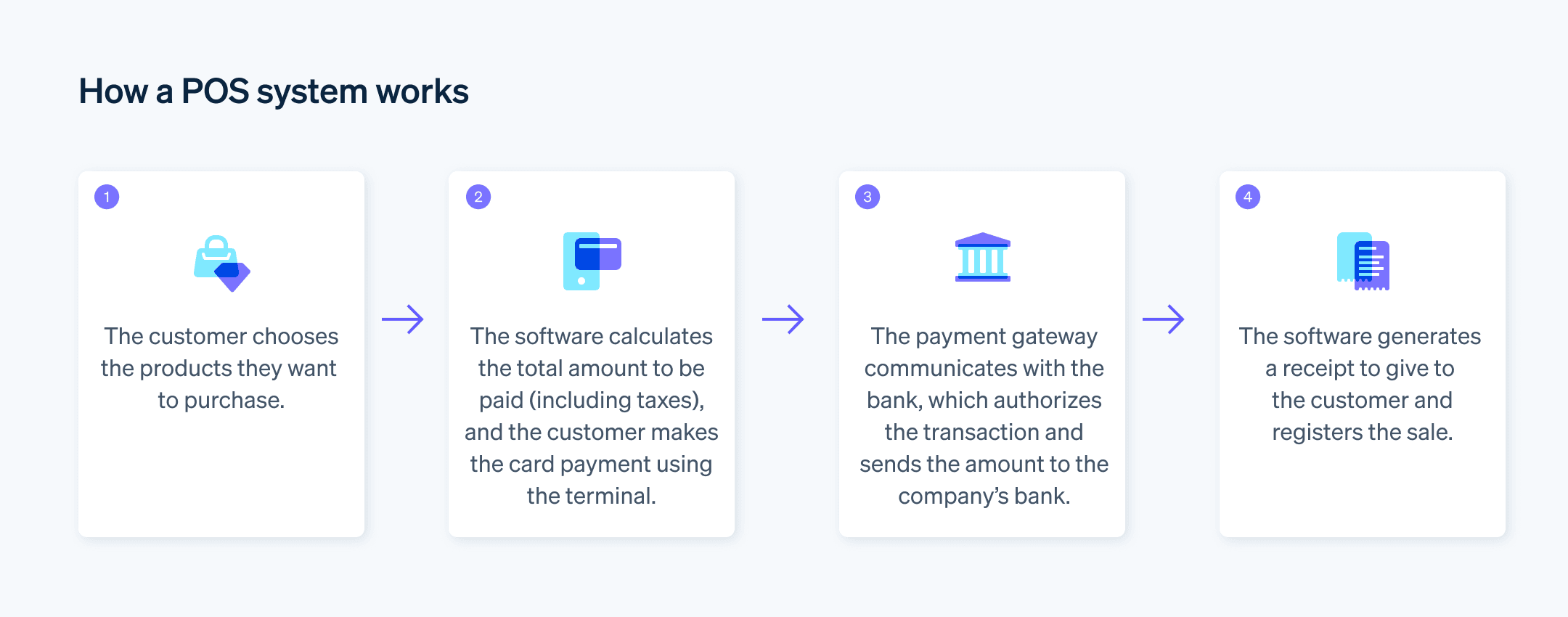

Although each type of POS system introduces certain nuances in its operation, they generally follow a similar process:

- Product registration: When the customer chooses the products they want to purchase, the POS system registers them (e.g., using the code reader). If necessary, the system also automatically updates the stock in the inventory.

- Calculation and collection of the amount: The POS software calculates the final amount with the corresponding VAT and shows the amount the customer must pay. The customer can use the card machine to pay by card or use any other payment method supported by the device.

- Transaction authorisation: The payment gateway communicates with the bank that issued the customer card to verify that it has sufficient funds. If it is confirmed that the card has funds and there are no suspicions of card fraud, the bank will authorise the transaction and send the funds to the business’s account.

- Receipt issuance: The POS system generates a receipt for the sale, which can be printed instantly or sent digitally to the customer. Then, it records the sale as completed.

What types of POS terminals exist in Spain?

The POS terminals businesses in Spain usually choose can be divided into five categories:

Traditional POS

A traditional POS system includes a cash register – with software that must meet the requirements of the anti-fraud law – to enter sales data and manage cash payments. It also includes a terminal provided by the bank that the company uses to accept card and digital wallet payments. In some cases, a traditional POS system includes other devices, such as a receipt and invoice printer.

Bankless POS

A bankless POS system can have an identical configuration to a traditional POS system. However, the business uses a terminal that is not linked to its bank. By avoiding contractual agreements with their banking entity, companies have greater control over their POS system and the types of devices their company uses.

For example, with Stripe Terminal, you can get state-of-the-art card readers that support payments with digital wallets and cards. Plus, Terminal integrates seamlessly with Stripe’s entire payments stack, allowing you to consolidate online and in-person payments and create more accurate sales reports.

Virtual POS

Virtual POS is software that does not require any type of hardware, such as a terminal. In this case, the virtual POS works with a payment gateway to send the transaction information to the bank and for the bank to approve or refuse payment. Customising a virtual POS to offer other payment methods to customers is usually much easier than working with third-party hardware. In Spain, it can also offer you the option of accepting payments with Bizum.

Mobile POS

The mobile POS system works on devices such as smartphones or tablets and allows businesses to accept payments without any additional hardware. For example, with Tap to Pay, companies can accept contactless payments from an Apple or Android device.

Self-service POS

The self-service POS system allows people who physically go to a business to scan and pay for products without the intervention of a company employee. For example, in 2019, Decathlon implemented them in 165 stores and, four years later, celebrated a 10% increase in turnover in Spanish stores.

What to take into account when choosing a POS in Spain

Beyond the type, there are other aspects to evaluate when choosing a POS system. In Spain, the following characteristics require consideration:

- Payment methods: It is important that your POS system supports the payment methods preferred by Spanish customers. Although cash payment is still very common in Spain, more than half of Spaniards under 35 no longer consider it their preferred method, with nearly 10% citing mobile apps as their first choice.

- Unified commerce: Consider how to unify online and in-person payments. According to the Cetelem Observatory, the study unit of BNP Paribas, 75% of Spaniards continue to prioritise in-person purchases and mostly cite difficulties in managing returns as the source of their preference. To ensure sales from all your channels are synchronised, it is important that your POS system offers unified commerce options.

- Payment regulations: The POS system must comply with the law on measures to prevent and combat tax fraud. This means it should be complete and traceable and not allow accounting or management manipulations with the aim of defrauding the Spanish Tax Agency (AEAT).

- Security: It is important that your POS has systems of payment data tokenization and other security measures. This is especially important in Spain where 83,517 incidents related to cybersecurity took place in 2023, according to data from the National Security Institute.

- Rates: Check that your POS service provider clearly details rates and commissions. Although banking entities are transparent, they often require the contracting of related services. Remember that, in these cases, you have the option of using a free POS system that does not depend on a bank.

Frequently asked questions about POS in Spain

Is a terminal the same as a POS?

Not exactly. Although, in Spain there is a lot of confusion about it. The terminal is just one of the components of the POS system that is specifically intended for payments and collections with cards or digital wallets. The POS system includes this device and other elements, including those that are not physical, such as software.

What tax regulations does the POS have to comply with?

The anti-fraud law and the Create and Grow Law. With the first, the AEAT ensures the POS system does not allow “B accounting” or alter the financial data of the business. The Create and Grow Law requires the POS system be integrated with a legally valid electronic billing system.

Do POS terminals in Spain allow instalment payments?

In most cases, no. Although, there are banks that offer the possibility of contracting instalment payments as an additional POS service. In fact, there are solutions such as Plazox, from Banco Santander, which do not carry commissions. These types of services can mean extra income for your business, since 33% of people who buy goods in Spain use “buy now, pay later” payments, as explained by Forbes.

Do POS terminals in Spain allow tips?

In many cases, yes. According to the general secretary of the Spanish Hospitality Business Confederation, the number of tip payments by card has increased significantly in recent years.

Can POS terminals in Spain be paid for with the Digital Kit subsidy?

Yes, as long as the collection solution is offered by a company that adheres to the Digital Kit initiative (i.e., a digitising agent). You can check the maximum amounts for each of the segments on the Acelera pyme website.

How long does it take for a POS payment to arrive?

As a general rule, a traditional POS that uses a terminal provided by the business’s bank should guarantee the proceeds are settled in the business’s account, at most, between three and four business days after the payment has been approved. Some banks, such as BBVA, offer settlement of funds the next day, but additional conditions usually apply. If you prefer to work with a free POS, Stripe Terminal can guarantee the settlement of funds in three business days for companies in the EU.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.