With cross-border payments expected to increase to over USD$300 trillion by 2030, businesses that embrace cross-border commerce have unprecedented growth opportunities. However, cross-border transactions can be difficult to navigate. Businesses must address concerns such as currency conversions, preferred payment methods, regulatory compliance, and fraud prevention.

For many businesses, the work required to accept international payments is worth it, and can drive long-term success in the global marketplace. Below, we'll explain what international payments are, how to accept international payments, and which factors you need to consider to get started.

What's in this article?

- What is an international payment?

- How to start accepting international payments

- What types of payment methods are used for international payments?

- What types of businesses need to accept international payments?

- Benefits of accepting international payments

- How Stripe Payments can help

What is an international payment?

International payments, also known as cross-border payments or foreign transactions, refer to the transfer of funds between individuals, businesses, or financial institutions located in different countries. These transactions typically involve exchanging one currency for another. They may be subject to various regulations, fees, and processing times, depending on the countries involved, the payment methods used, and the financial institutions facilitating the transfer.

How to start accepting international payments

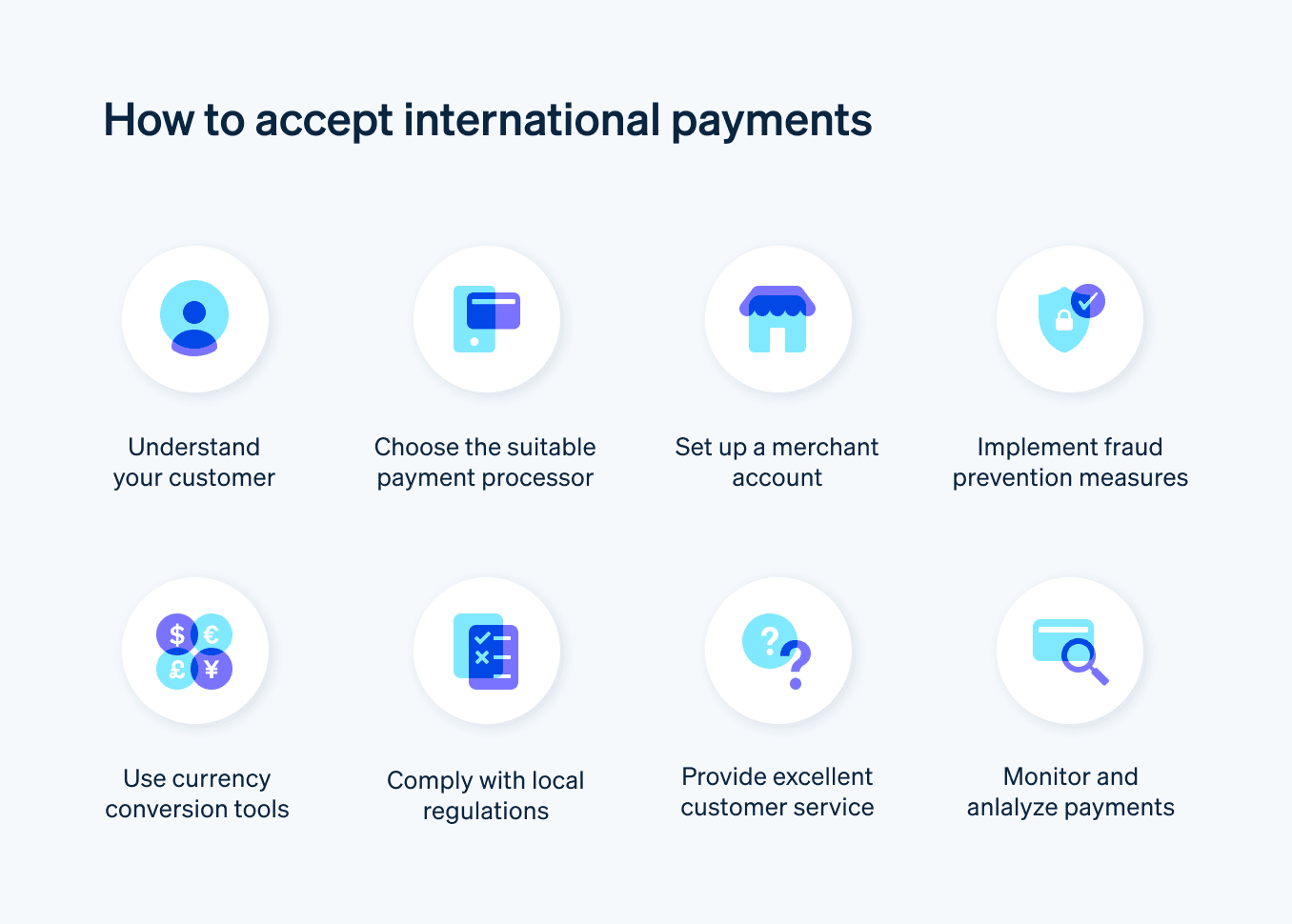

Businesses that want to expand their reach and serve an increasingly global customer base should consider factors such as currency conversions, popular payment methods in target markets, regulatory compliance, tax obligations, and fraud prevention.

Here are the key steps that businesses can take to establish a robust, user-friendly system for processing cross-border transactions:

Research your target markets

Your approach to international payments might vary considerably based on where you want to do business. Begin by researching the specific needs and preferences of your target audience in the countries you plan to serve. This includes identifying popular payment methods, currency preferences, and any unique regulations or requirements.

Choose a payment gateway or processor

Select a payment gateway or processor that supports currencies and payment methods that are popular in your target markets. For example, Stripe offers international payment processing services, including support for more than 135 currencies. Compare the fees, exchange rates, and features that these providers offer to find the best fit for your business.

Set up a multi-currency account

If you work with a payments provider that supports an optimised, dynamic approach to international payments, such as Stripe, this additional step won't be necessary. Otherwise, you'll need to open a multi-currency account or use a third-party service that can help you manage multiple currencies, minimise conversion fees, and simplify the process of accepting payments from customers in different countries.

Display prices in local currencies

If your e-commerce site is meant to serve audiences in multiple countries, make sure that you build out the web experience to display product and service prices in your customers' local currencies. You can display prices using currency conversion tools or plugins that are available for most e-commerce platforms.

Be aware of taxes and regulations

Companies that do business internationally need to understand and adhere to local tax and regulatory requirements everywhere they operate. These can include sales taxes, VAT, and any import or export regulations. Ensure that your business complies with these requirements to avoid legal or financial issues.

Implement fraud prevention measures

Because cross-border transactions can be more susceptible to fraud, employ robust security measures to protect your business and your customers.

Optimise the customer experience

Currency conversion is just one part of meeting the needs of customer segments that are internationally diverse. Think carefully about the customer journeys that you're building. What are the differences between your customer segments? How will you build an experience that's intuitive and accommodating for each of them?

Start by making your website and checkout process user-friendly and available in multiple languages, if necessary. Provide clear, concise information about shipping, returns, and customer support. This can build trust with an international audience.

Monitor performance and make adjustments

Review your international payment setup, analyse customer feedback, and keep an eye on industry trends on a regular basis. Be prepared to make adjustments as needed to improve the customer experience, remain compliant with regulations, and optimise the costs associated with accepting international payments.

What types of payment methods are used for international payments?

Offering multiple payment options improves the customer experience while increasing the chances of successful transactions. Businesses should carefully weigh the benefits and drawbacks of each payment method, considering factors such as cost, speed, convenience, and security.

Some common payment methods for international payments include:

Bank transfers

Electronic transfers are a popular method for transferring funds between bank accounts in different countries. While this option is typically secure and reliable, the fees charged by both the sending and receiving banks, as well as any intermediary banks involved, can make this option expensive. Processing times can vary from a few hours to several days.Credit and debit cards

International payments can be made using credit or debit cards, either for online purchases or at physical point-of-sale (POS) terminals. While this method can be convenient, it may involve higher fees and less favourable exchange rates than other options, as well as potential foreign transaction fees charged by the card issuer.International cheques and bank drafts

Cheques and bank drafts can be used for international payments, but they are becoming less popular due to slower processing times and higher fees. They also require the recipient to deposit the cheque or draft at a local bank, which may involve additional fees.Cryptocurrencies

Digital currencies are becoming more popular for international payments. Cryptocurrencies can offer faster processing times, lower fees, and increased privacy compared to traditional methods. However, their volatile exchange rates and regulatory uncertainty can be a concern for some users.Mobile payment apps

Some mobile payment apps, such as Alipay and WeChat Pay, have expanded their services to support international payments. These apps can offer a convenient and quick way to transfer funds, but they may have limitations on the countries and currencies supported, and fees may still apply.

What kind of businesses need to accept international payments?

Businesses that operate across borders can tap into diverse markets and reach customers around the world. This requires the ability to accept international payments, thereby catering to customers' preferred currencies and payment methods.

Some types of businesses that commonly need to accept international payments include:

- E-commerce businesses

- Travel and hospitality providers

- International service providers, consultants, and freelancers

- Exporters and importers

- Educational institutions

- Non-profit organisations

- Subscription-based businesses

- Online marketplaces

- Financial services firms

- Logistics and shipping companies

In recent years, advances in payment technology have created opportunities for more businesses and industries to operate internationally.

Benefits of accepting international payments

Accepting international payments can offer widespread benefits for businesses. It boosts potential revenue, strengthens brand recognition, improves customer experience, and encourages business innovation. By embracing cross-border commerce, businesses can position themselves for long-term growth and resilience.

Some of the key benefits include:

- Access to a larger customer base

- Increased revenue growth

- Competitive advantages

- Enhanced brand exposure and recognition

- Diversified income streams

- Deeper insight into customer preferences

- More innovation and adaptability

How Stripe Payments can help

Stripe Payments provides a unified, global payments solution that helps any business – from scaling startups to global enterprises – accept payments online, in person, and around the world.

Stripe Payments can help you:

- Optimise your checkout experience: Create a frictionless customer experience and save thousands of engineering hours with prebuilt payment UIs, access to 100+ payment methods, and Link, Stripe's digital wallet.

- Expand to new markets faster: Reach customers worldwide and reduce the complexity and cost of multi-currency management with cross-border payment options, available in 195 countries across 135+ currencies.

- Unify payments in person and online: Build a unified commerce experience across online and in-person channels to personalise interactions, reward loyalty, and grow revenue.

- Improve payments performance: Increase revenue with a range of customisable, easy-to-configure payment tools, including no-code fraud protection and advanced capabilities to improve authorisation rates.

- Move faster with a flexible, reliable platform for growth: Build on a platform designed to scale with you, with 99.999% uptime and industry-leading reliability.

Learn more about how Stripe Payments can power your online and in-person payments, or get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.