For businesses and customers in Europe, SEPA transfers are an important part of payment processing that allows seamless cross-border transactions in euro-denominated payments.

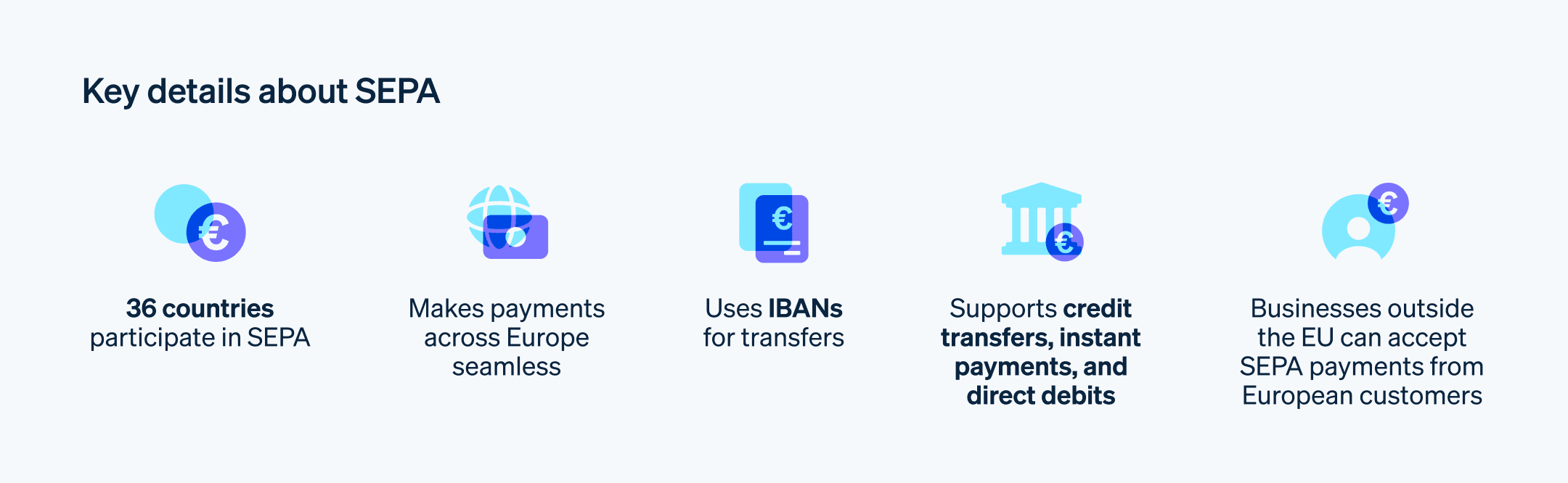

The Single Euro Payments Area (SEPA) is a payment framework that enables businesses and individuals to send and receive electronic euro payments across 36 participating countries with the same comfort as a domestic transaction.

If you are handling recurring payments, supplier payments, or utility bills, you need to understand how SEPA payment schemes work to improve your financial operations and reduce costs. In this article, we’ll cover what SEPA is, how SEPA transfers work, and how businesses can use them for easy cross-border payments.

What’s in this article?

- What is SEPA?

- List of SEPA countries

- How does SEPA work?

- How to make a SEPA payment

- How long do SEPA payments take?

- Do I need a SEPA account for my business?

- Should non-SEPA businesses open a European bank account?

- How Stripe Payments can help

What is SEPA?

SEPA stands for Single Euro Payments Area (SEPA), which is an initiative to simplify cashless payments and create consistency for transactions within and among EU member countries. Established by the European Payment Council (EPC) and regulated by the European Central Bank, SEPA allows individuals and businesses to make domestic and cross-border payments under the same conditions, regardless of national borders.

SEPA currently processes around 50 billion transactions every year and includes SEPA Credit Transfers, SEPA Direct Debit transactions, and debit card payments. SEPA first began operations in January 2008 with the launch of SEPA Credit Transfers, followed by Direct Debits and debit cards in November 2009.

In principle, SEPA’s goal is similar to that of the ACH and Fedwire networks in the US: to facilitate standardized transactions between financial institutions in a way that provides a consistent framework for all users. Before SEPA’s formation, its member countries were fragmented into discrete national markets, which created friction when processing transactions across borders. Cross-border transactions were slower, costly, and required complex banking details.

The establishment of SEPA involved the development of shared standards, procedures, and infrastructure for transferring funds that was adopted by every member state. Beyond minimizing barriers to funds transfers between accounts, SEPA brought with it the added bonus of reducing the costs associated with moving capital throughout the EU and surrounding countries. SEPA has boosted the economies where it operates and provides convenience for consumers and businesses all over the world.

List of SEPA countries

As of May 2025, there are 41 countries in the SEPA zone, including many non-EU countries.

How does SEPA work?

SEPA’s standardized payment scheme allows for the direct debiting of any EUR-denominated bank account within the SEPA region. It also means that making domestic payments and cross-border transactions within any given member country is easy and inexpensive. SEPA enables account holders and payment service providers (PSPs) to receive direct deposit payments and to issue payments electronically from their bank account, even while traveling in another country.

For consumer transactions, SEPA allows businesses to directly debit customer accounts within a member country using the SEPA Direct Debit scheme.

SEPA is made up of four payment processing schemes:

- SEPA Credit Transfer: Standard one-time payments across SEPA member states

- SEPA Instant Credit Transfer: Real-time instant payments up to €100,000

- SEPA Direct Credit Core: Used primarily for recurring payments such as utility bills, supplier payments, and loan repayments

- SEPA Direct Debit Business-to-Business: Similar to SEPA Direct Debit Core but exclusively for B2B transactions with stricter authorization requirements

How to make a SEPA payment

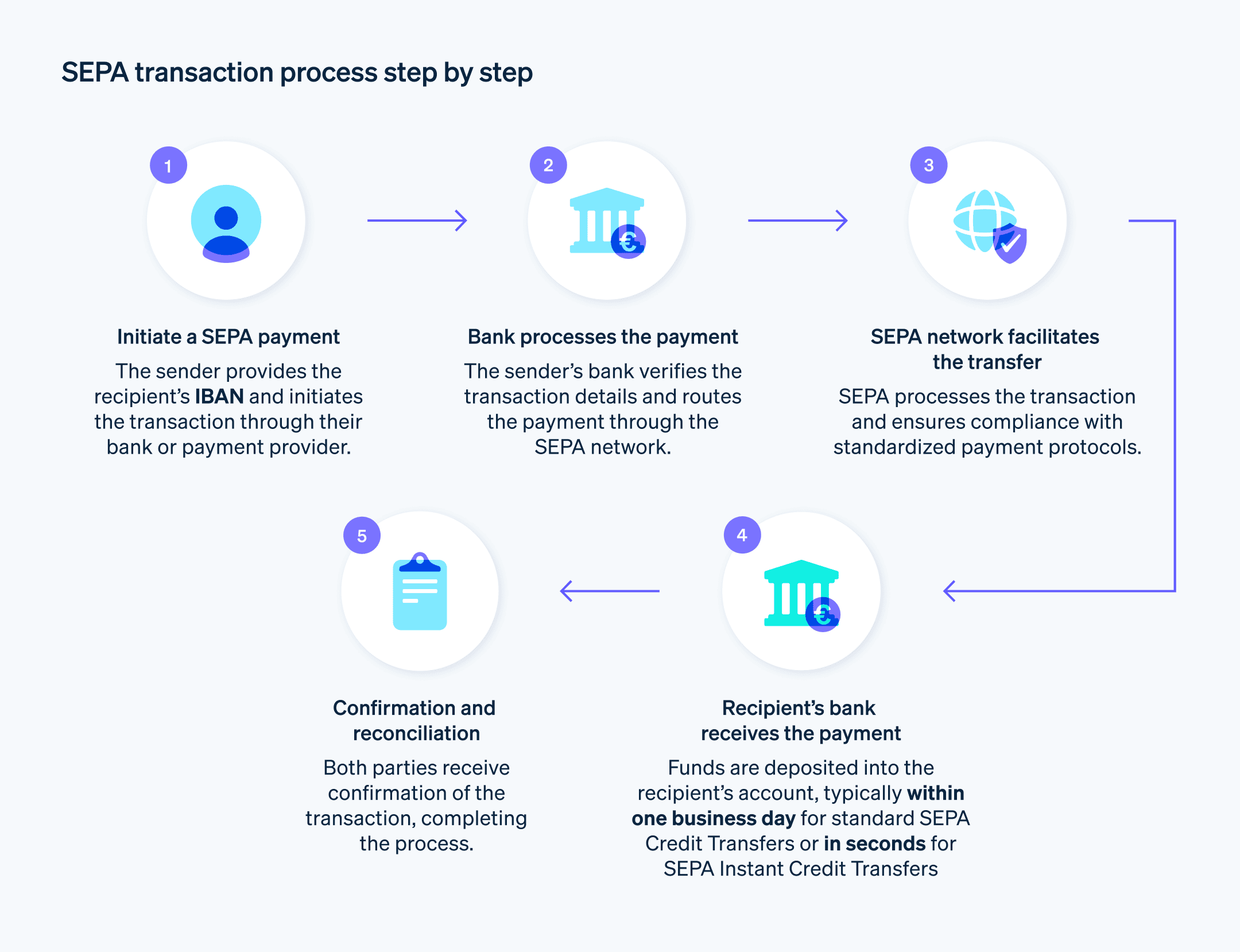

Every bank account in the SEPA area is assigned an International Bank Account Number (IBAN) and Bank Identifier Code (BIC), the European equivalent of a US bank account number. Similar to how domestic transfers using the ACH and Fedwire networks require both parties’ bank account and routing numbers in order to complete a funds transfer, SEPA transfers require the IBAN identification codes of all European accounts involved in the transaction.

Here’s an overview of how different types of SEPA transfers work:

SEPA Credit Transfer: SEPA Credit Transfers are one-time funds transfers between banks that both have IBAN codes. These transfers are conducted in euros and are commonly used for consumer purchases in SEPA countries. If you’re a business that is not based within the SEPA area, you wouldn’t use this type of transfer, since both the issuing and receiving financial institutions must be located in SEPA countries.

SEPA Instant Credit Transfer: Whereas most transfers between accounts require submitting a transfer request and waiting anywhere from hours to days for it to be settled, SEPA Instant facilitates real-time transfers in amounts up to €100,000. Using this method, euro-based transactions can be completed by any two account holders in the SEPA area at any time, on any day, and will be processed immediately. Ninety-nine percent of SEPA Instant Credit Transfers are completed within five seconds and can be made using smartphones.

SEPA Direct Debit: Direct Debit is the most common way for foreign (non-EU) businesses to interact with accounts within SEPA. For Stripe customers, SEPA Direct Debit is a reusable notification payment method. This means it’s a payment method that can be internally associated with the customer and reused by the business, in authorized capacities. It’s also a delayed notification payment method, meaning the success or failure of the transaction is only known after the transaction has finished processing, which can take several days.

How long do SEPA payments take?

Most SEPA payments are settled within one business day of being initiated. However, processing times depend on the payment scheme used:

- SEPA Credit Transfers: Settled within 24 hours on business days.

- SEPA Instant Payments: Completed in under 10 seconds, with 24/7 availability.

- SEPA Direct Debit transactions: Typically take three to six business days for settlement, especially when processing cross-border payments from non-SEPA regions.

Do I need a SEPA account for my business?

Businesses do not need a separate SEPA bank account in order to process payments using the SEPA network. SEPA itself is not a financial institution (i.e., it doesn’t issue or maintain its own accounts), but rather a system that is used by banks located within member countries. If your business bank account has an IBAN number and your business is based in a SEPA member country, then you already have access to the SEPA network and the products that operate within it.

Businesses that are not based in SEPA member countries, including those in the US, may still be able to use some aspects of SEPA as they relate to consumer transactions for payments from customers who do reside in SEPA member countries.

Should non-SEPA businesses open a European bank account?

If your business operates in eurozone countries or has subsidiaries in the SEPA region, opening a local SEPA account could be beneficial.

With a SEPA-based bank account, businesses gain access to fast, low-cost SEPA transfers, cheaper cash withdrawals, and reduced fees for cross-border transactions.

As a Stripe user, you can add SEPA Direct Debit and other payment methods from the Stripe Dashboard without changing your code.

How Stripe Payments can help

Stripe Payments provides a unified, global payments solution that helps any business—from scaling startups to global enterprises—accept payments online, in person, and around the world.

Stripe Payments can help you:

- Optimize your checkout experience: Create a frictionless customer experience and save thousands of engineering hours with prebuilt payment UIs, access to 125100+ payment methods, and Link, a wallet built by Stripe.

- Expand to new markets faster: Reach customers worldwide and reduce the complexity and cost of multicurrency management with cross-border payment options, available in 195 countries across 135+ currencies.

- Unify payments in person and online: Build a unified commerce experience across online and in-person channels to personalize interactions, reward loyalty, and grow revenue.

- Improve payments performance: Increase revenue with a range of customizable, easy-to-configure payment tools, including no-code fraud protection and advanced capabilities to improve authorization rates.

- Move faster with a flexible, reliable platform for growth: Build on a platform designed to scale with you, with 99.999% uptime and industry-leading reliability.

Learn more about how Stripe Payments can power your online and in-person payments, or get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.