An S corporation, often abbreviated to S corp, is a type of US corporation that's designed for small- to medium-sized businesses and which offers certain tax advantages. When a business is structured as an S corp, it can pass corporate income, losses, deductions and credits to shareholders without being subject to federal corporate income tax. This is known as pass-through taxation, meaning that the corporation does not pay taxes on its profits. Instead, the profits and losses are reported on the individual tax returns of the shareholders – and taxes are paid at the shareholders' individual income tax rates.

In the US, you can incorporate as an S corp in any state, but there are different implications for forming this type of entity in one state versus another. Below, we'll discuss which states are more and less favourable for S corp formation, as well as the steps involved in forming an S corp. Here's what you should know.

What's in this article?

- S corp requirements

- Differences between S corps and other corporate structures

- Best states in the US for business incorporation

- Less favourable states for S corps

- Steps to incorporate your business

S corp requirements

S corps are the most common form of business structure in the US, accounting for 73% of corporate tax returns in 2020. To become an S corp, a corporation must meet certain requirements.

Business type: Certain types of businesses, including certain financial institutions and insurance companies, cannot elect S corp status.

Location: The business must be based in the US.

Shareholders: The business must have no more than 100 shareholders, and they must be US citizens or residents. Shareholders can include individuals, certain trusts and estates, but cannot include partnerships, corporations or non-resident alien shareholders.

Stock: The business can have only one class of stock. Although there can be differences in voting rights, there cannot be any differences in distribution and liquidation rights.

Differences between S corps and other corporate structures

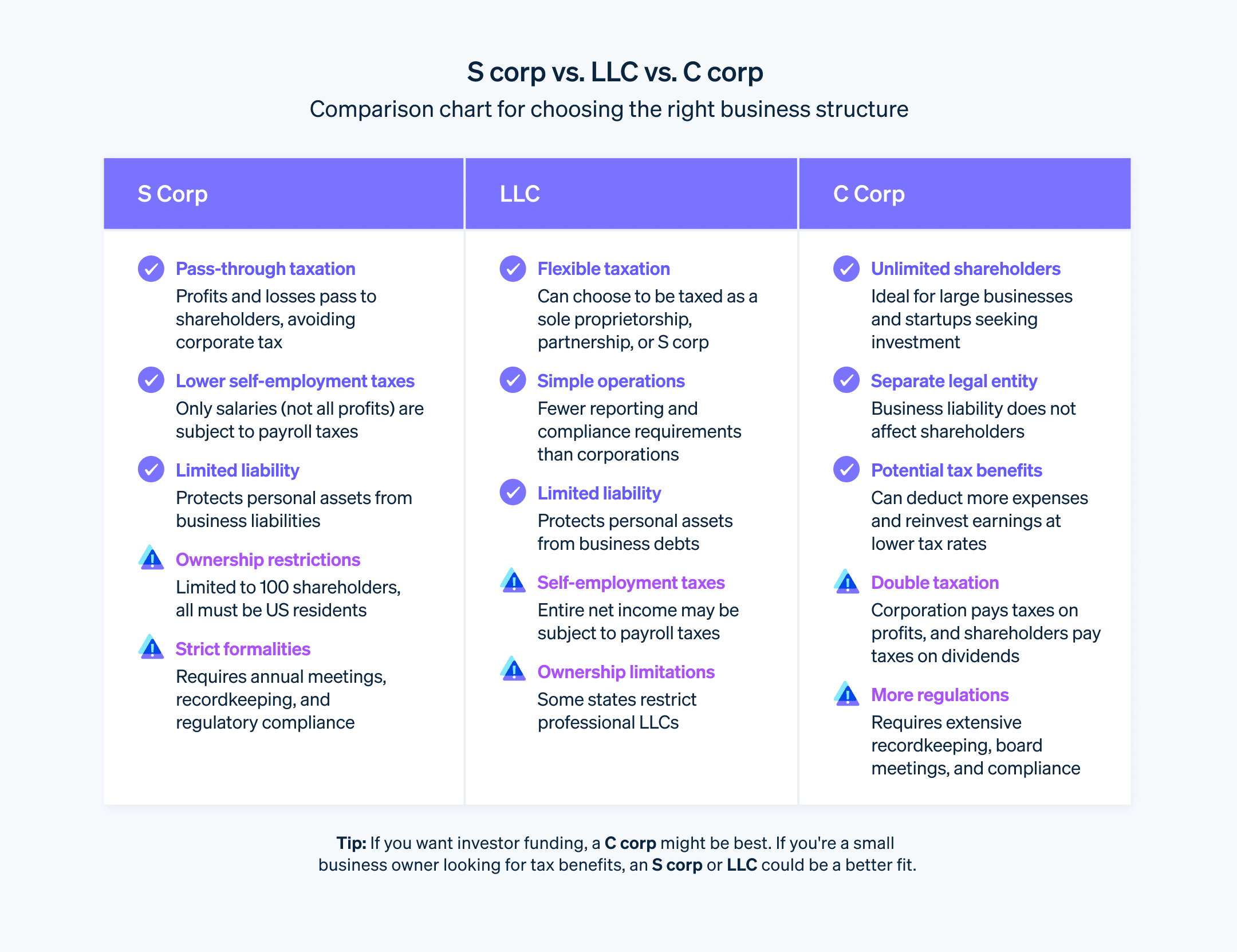

Although S corps share many similarities with other corporate structures, the taxation, ownership and compliance requirements for S corps set them apart. Here's a rundown:

S corporations vs C corporations

Taxation

S corps: S corps are pass-through entities for tax purposes. This means that income, losses, deductions and credits flow through to shareholders, who report them on their personal tax returns. The S corp does not pay federal income tax.

C corps: C corps are subject to double taxation. The corporation pays corporate income tax and then shareholders pay taxes on the dividends that they receive.

Ownership restrictions

S corps: S corps have restrictions on the number and type of shareholders. They can have up to 100 shareholders, and each must be a US citizen or resident. S corps cannot be owned by C corps, other S corps, limited liability companies (LLCs), partnerships or certain trusts.

C corps: C corps can have an unlimited number of shareholders, including foreign shareholders, and can have multiple classes of stock.

Formation and compliance

S corps and C corps are formed by filing articles of incorporation. Both have similar requirements for corporate formalities, such as holding annual meetings and keeping minutes.

- S corps: S corps must file an additional form (Form 2553) with the IRS to elect S corp status.

S corporations vs LLCs

Taxation

S corps: S corps have pass-through taxation at the shareholder level, but they must adhere to the requirements and eligibility criteria set by the IRS.

LLCs: LLCs also have pass-through taxation, but they have more flexibility than S corps. An LLC can choose to file taxes as a sole proprietorship, partnership, S corp or C corp.

Ownership and structure

S corps: S corps have restrictions on the number and type of shareholders, and must adhere to the standards of corporate structure, including directors, officers and shareholders.

LLCs: LLCs offer more flexibility in terms of ownership and management than S corps. They don't have any restrictions on the number or type of owners (referred to as "members" for LLCs), and can choose between member-managed and manager-managed structures.

Compliance and formalities

S corps: S corps are required to follow certain formalities, such as holding annual meetings and keeping minutes.

LLCs: LLCs have fewer compliance requirements and are typically easier to maintain than S corps, with less stringent recordkeeping and meeting obligations.

Best states in the US for business incorporation

Although the best state for a business to incorporate in depends on its needs and circumstances, certain US states are widely recognised for their favourable conditions for incorporation, attracting businesses from across the country and around the world.

Delaware: Known as the "corporate capital" of the US, Delaware is a popular choice for incorporation, particularly for larger businesses and startups that are seeking venture capital. The state is favoured for its tax benefits, business-friendly laws, flexible corporate management structure and Court of Chancery, which is a court that is dedicated to business disputes and known for its expertise in corporate law.

Nevada: Nevada is a popular choice because of its lack of state corporate income tax, franchise tax and personal income tax. It also offers strong privacy protections for corporate officers and directors, and has relatively simple compliance requirements.

Wyoming: Like Nevada, Wyoming has no state corporate tax, franchise tax or personal income tax, and is known for its business-friendly environment. It also provides strong asset protection benefits and privacy for business owners.

South Dakota: South Dakota is gaining popularity thanks to its favourable tax climate. It has no corporate income tax or personal income tax, and this is coupled with a relatively straightforward regulatory environment.

Texas: Texas is attractive to businesses because of its lack of individual income tax, a large and growing workforce, and a strong economy. Texas does, however, have a franchise tax based on business earnings.

Florida: Florida is a popular choice for incorporation because of its lack of personal income tax and growing economy. It offers a relatively business-friendly regulatory environment and access to a large and diverse market.

Less favourable states for S corps

Certain US states are considered to be less favourable for S corps because of their tax policies, regulatory environment and overall business climate. Although S corps benefit from pass-through taxation in the federal tax system, some US states have rules or tax structures that diminish these benefits or introduce complexities.

California: Although California is a hub for innovation and entrepreneurship, it has a minimum annual franchise tax and an additional 1.5% tax on S corporation net income. These taxes can represent a significant burden, especially for smaller S corps.

New York: New York state, and particularly New York City, can be challenging for S corps because of the complex tax system and higher tax rates. The state of New York taxes S corp income at the shareholder level, but New York City does not recognise the S corp election and taxes the corporation itself.

Illinois: Illinois taxes S corp income at the personal income tax rate for shareholders, but a replacement tax is also applied to the corporation's income.

New Jersey: New Jersey has a complex tax structure, and although S corps pass their income through to shareholders, the state has a variety of taxes and fees that can affect the overall tax burden of S corps.

Minnesota: Minnesota imposes a state tax on S corps which can add to their overall tax burden. This US state taxes S corp income at both the corporate level (albeit at a lower rate than C corps) and the individual level.

Tennessee: Tennessee does not recognise the federal S corp election and treats S corps as regular corporations for state tax purposes. Tennessee no longer requires businesses with annual gross sales of under US$100,000 to pay annual business taxes, but S corps with higher sales still have business tax obligations.

Steps to incorporate your business

Here's an overview of the steps required to incorporate your business:

Choosing the right business structure

LLC: Offers flexibility and simpler operations with pass-through taxation. Ideal for smaller businesses seeking less formality in their operations.

S corporation: Provides pass-through taxation without the self-employment taxes of an LLC. Comes with stricter regulations and limitations on ownership.

C corporation: Suitable for businesses that plan to go public or seek major investment. Has no limitations on ownership, but comes with double taxation.

Forming a corporation or LLC

Choosing a business name: The business name should comply with the state's rules (e.g. includes "Inc." or "LLC") and should be distinguishable from existing businesses in the state. Check with the state's business entity registry to ensure that the name is available.

Selecting a state for incorporation: A variety of factors should be considered, such as tax implications, the legal environment and business-friendly policies. Some businesses choose to incorporate in their home state, while others may choose a state such as Delaware or Nevada for their perceived benefits.

Choosing a business structure: Businesses need to decide whether an LLC, S corp or C corp best suits its needs for liability protection, taxation and ownership flexibility.

Filing articles of incorporation/organisation: The necessary documents need to be submitted to the state's business filing office. This typically includes information such as the business name, purpose, principal address, registered agent information and details about shares and stock (if applicable).

Obtaining an Employer Identification Number (EIN): The EIN is like a Social Security number, but for a business. It's required for tax purposes and to open a business bank account. Applications for EINs can be made through the IRS.

Creating corporate bylaws or an LLC operating agreement: These documents outline the governance of a business, including the roles of directors and officers, shareholder rights and meeting protocols. Although not all states require these documents to be filed, they are a helpful tool when defining a business's internal structure and operations.

Holding an organisational meeting: For corporations, this is when they'll adopt bylaws, elect officers and undertake other organisational tasks. LLCs can use this meeting to approve the operating agreement and make similar foundational decisions.

Registering for state and local taxes: Depending on the location and business type, businesses may need to register for various state and local taxes, such as sales tax or unemployment insurance tax.

Complying with licencing and permit requirements: Businesses should ensure that they have all the necessary licences and permits to operate legally.

Evaluating state statutes and tax implications

Understanding the corporate laws: Businesses should ensure that they are familiar with the corporate statutes in their chosen state of incorporation. These laws will govern the business's legal and operational framework.

Analysing tax requirements: Tax implications including income tax, franchise taxes, sales taxes and property taxes should be investigated. Remember that state tax laws can affect the benefits available to a chosen entity type, especially for S corps.

How Stripe Atlas can help

Stripe Atlas sets up your company's legal foundations so you can fundraise, open a bank account and accept payments within two business days from anywhere in the world.

Join 75K+ companies incorporated using Atlas, including startups backed by top investors like Y Combinator, a16z and General Catalyst.

Applying to Atlas

Applying to form a company with Atlas takes less than 10 minutes. You'll choose your company structure, instantly confirm whether your company name is available and add up to four co-founders. You'll also decide how to split equity, reserve a pool of equity for future investors and employees, appoint officers and then e-sign all your documents. Any co-founders will receive emails inviting them to e-sign their documents, too.

Accepting payments and banking before your EIN arrives

After forming your company, Atlas files for your EIN. Founders with a US Social Security number, address and mobile phone number are eligible for IRS expedited processing, while others will receive standard processing, which can take a little longer. Additionally, Atlas enables pre-EIN payments and banking, so you can start accepting payments and making transactions before your EIN arrives.

Cashless founder stock purchase

Founders can purchase initial shares using their intellectual property (e.g. copyrights or patents) instead of cash, with proof of purchase stored in your Atlas Dashboard. Your IP must be valued at US$100 or less to use this feature; if you own IP above that value, consult a lawyer before proceeding.

Automatic 83(b) tax election filing

Founders can file an 83(b) tax election to reduce personal Income taxes. Atlas will file it for you – whether you are a US or non-US founder – with USPS Certified Mail and tracking. You'll receive a signed 83(b) election and proof of filing directly in your Stripe Dashboard.

World-class company legal documents

Atlas provides all the legal documents you need to start running your company. Atlas C corp documents are built in collaboration with Cooley, one of the world's leading venture capital law firms. These documents are designed to help you fundraise immediately and ensure your company is legally protected, covering aspects like ownership structure, equity distribution and tax compliance.

A free year of Stripe Payments, plus $50K in partner credits and discounts

Atlas collaborates with top-tier partners to give founders exclusive discounts and credits. These include discounts on essential tools for engineering, tax, finance, compliance and operations from industry leaders like AWS, Carta and Perplexity. We also provide you with your required Delaware registered agent for free in your first year. Plus, as an Atlas user, you'll access additional Stripe benefits, including up to a year of free payment processing for up to $100K in payments volume.

Learn more about how Atlas can help you set up your new business quickly and easily and get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.