A record-breaking 5.5 million new business applications were filed in the US in 2023—and this entrepreneurial growth can benefit nonresidents as well as Americans. People who are not residents or citizens of the United States may establish a formal business entity such as a corporation or limited liability company (LLC) within the US by following the process outlined in this guide. The specifics of this process vary based on the state where the business is registered, and the business is required to comply with all federal and state regulations, including tax obligations and proper business documentation. Registering a business as a nonresident involves additional complexity, but it’s an achievable goal.

Below, we’ll cover the steps of registering a US business as a nonresident, including deciding on the right corporate structure and dealing with immigration and visa requirements.

What’s in this article?

- Choosing the right business structure

- Selecting a state for business registration

- Registration and compliance process

- Setting up financial infrastructure

- Maintaining legal and regulatory compliance

- Immigration and visa considerations

Choosing the right business structure

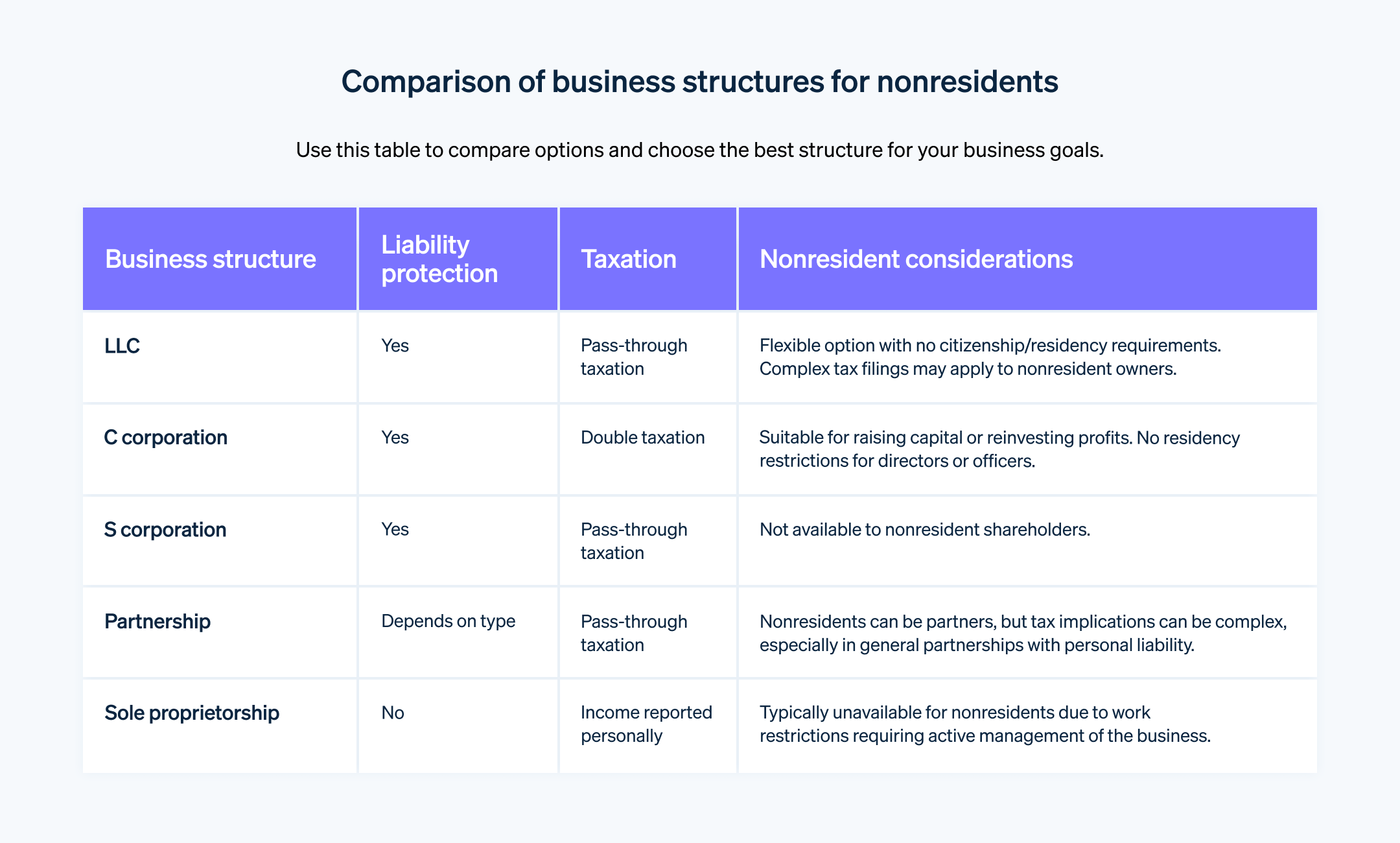

Selecting the appropriate business structure is the first step in creating any business, regardless of your residency status. Your choice will influence your taxes, paperwork requirements, personal liability, and ability to raise funds. When looking at different business structures, nonresidents should consider the importance of personal asset protection, tax obligations, recordkeeping requirements, and compliance standards. Other factors that could help determine the right structure include whether you’ll need to raise capital and your long-term objectives for the business.

Here’s an overview of the primary corporate structures in the US, along with key considerations for nonresidents.

LLC

An LLC offers personal liability protection, meaning personal assets are typically protected in case of business debts or lawsuits. LLCs have fewer reporting requirements compared with corporations.

Taxation: Typically, an LLC is a “pass-through” entity for tax purposes, which means the business doesn’t pay taxes but profits and losses pass through to the owners’ personal tax returns. Nonresidents face a complex tax landscape, however, and might need to file specific forms or elect to have the LLC treated differently for tax purposes.

Nonresident consideration: An LLC’s flexibility and protection makes it a popular choice for nonresidents. There’s no requirement for members to be US citizens or residents.

C corporation

A C corporation is a separate legal entity from its owners and provides the highest level of personal liability protection. It can raise capital by issuing stock and is required to have a board of directors and hold regular meetings.

Taxation: C corporations are subject to corporate income tax. Profits distributed as dividends are taxed again at the shareholder’s level, leading to double taxation. For nonresidents, however, this might be less of an issue if they don’t take dividends and reinvest profits in the business.

Nonresident consideration: Nonresidents can own a C corporation, and there are no residency requirements for directors or officers. This is a good option if you’re planning to reinvest profits or seek venture capital.

S corporation

An S corporation is a pass-through entity like an LLC and has similar structure requirements as a C corporation.

Taxation: Income is passed through to shareholders’ personal tax returns. It is not subject to double taxation.

Nonresident consideration: Nonresidents cannot be shareholders of an S corporation, so this option is typically not available for nonresident business owners.

Partnership

In a partnership, two or more people share ownership. There are several types of partnerships, including general partnerships (GP) and limited partnerships (LP).

Taxation: It’s a pass-through entity, and profits and losses flow through to partners’ personal tax returns.

Nonresident consideration: Though nonresidents can be partners, the tax implications can be complex, especially in a general partnership in which partners are personally liable for business debts.

Sole proprietorship

This is the simplest form of business, owned and operated by one person without distinction between the owner and the business.

Taxation: Income is reported on the owner’s personal tax return.

Nonresident consideration: Typically, nonresidents can’t establish a sole proprietorship in the US because it requires the owner to work in the business, which conflicts with visa and work permit regulations.

Selecting a state for business registration

Choosing where to register your business is another key step. Laws, taxes, and business requirements vary considerably from one state to another. Here are factors nonresidents should consider when choosing a state for their business registration:

Taxation: Some states, such as Wyoming, Nevada, and South Dakota, are known for their favorable tax policies, which can include lower business taxes or no state income tax.

Legal system: Consider how business-friendly the state’s legal system is. Delaware, for example, is known for being business friendly and for its established body of corporate law.

Filing fees: Initial filing fees and annual report fees vary by state.

Franchise taxes: Some states impose a franchise tax on businesses, which can be an important consideration depending on the size and earnings of your business.

Physical presence or nexus: Regardless of what state your business is registered in, having a physical presence in any state can create nexus tax obligations. If your business requires a physical location or you plan to have employees in the US, consider the logistics and costs of those operations in different states.

Privacy: Some states have more privacy protections for business owners than others. For instance, Wyoming and Nevada do not require the disclosure of shareholders or directors.

Market access: If your business is targeting a specific geographic market, consider registering in or near that location for better access and networking opportunities.

Professional support: Availability of professional services such as legal and accounting, especially those that are familiar with international business owners, can be an important factor.

Popular states for registration

Delaware: Known for its business-friendly laws, Delaware is a popular choice with domestic and foreign businesses. Delaware’s Court of Chancery specializes in business law, providing clarity and predictability for corporate litigation.

Nevada and Wyoming: These states are attractive because of their favorable tax policies and privacy considerations.

California and New York: Though these states are not the most advantageous for taxes, they might be a good choice because of their substantial markets and easy access to business networks, especially if your business activities are centered there.

Registration and compliance process

For nonresidents, registering a business in the US involves several steps for legal and regulatory compliance. Here’s an outline of the process.

Choose a registered agent

Businesses in the US are required to have a registered agent. This agent receives legal documents and government correspondence on behalf of your business and must have a physical address in the state where your business is registered.

Register your business entity

Depending on the business structure, you’ll need to file different documents to register your business with the state’s business filing office. These documents include articles of incorporation for a corporation or articles of organization for an LLC.

Obtain an EIN

An employer identification number (EIN) is necessary for tax purposes, for hiring employees, and to open a business bank account. Nonresidents can obtain an EIN by completing an IRS Form SS-4 and might need to call the IRS to complete the process.

Business licenses and permits

Depending on the type of business and its location, you might need to obtain specific licenses and permits to operate legally in the US.

Annual reports and franchise taxes

Most states require businesses to file annual reports and pay franchise taxes. The requirements vary by state and business structure.

Federal tax obligations

Nonresident business owners must comply with US federal tax laws. Your tax obligations are determined by the nature of your business activities in the US and might also be affected by the tax treaty between your home country and the US.

State tax obligations

Depending on the state where your business is registered and the nature of your business, you might be subject to state income tax, sales tax, and other state-specific taxes. If your business has a substantial presence in a state, you might need to pay state taxes even if you aren’t registered there. The definition of a substantial presence can vary by state.

Banking and financial transactions

Opening a US business bank account can be challenging for nonresidents because many require a local physical presence. Some banks might let you open an account remotely, but this often requires additional documentation and verification. Consider the banking and financial regulations that apply to your business, including the Foreign Account Tax Compliance Act (FATCA) and Anti-Money Laundering (AML) laws.

Setting up financial infrastructure

Setting up the financial infrastructure for a US-based business involves several key components for smooth financial operations and compliance with US regulations.

Opening a US business bank account

To open a business account, you’ll typically need your passport, proof of business registration (such as articles of incorporation or organization), an EIN, and sometimes a US address. Some banks might require additional documentation. When choosing a bank, look for one that has experience dealing with international clients and can provide support with setting up your account remotely if you can’t travel to the US.

Accounting and bookkeeping

Good recordkeeping is important for tax compliance and financial management. Use accounting software to manage your finances, track income and expenses, and prepare for tax season. Options such as QuickBooks, Xero, or FreshBooks are popular among small businesses. Keep careful records of all financial transactions including invoices, receipts, and bank statements.

Tax obligations

You’ll need to pay federal taxes on income earned by your US business. The specific obligations depend on your business structure and operations. Make sure you’re aware of state and local tax requirements, which can include income tax, sales tax, and other applicable taxes based on your business’s location and activities. The tax treaty between the US and your home country might also affect your tax obligations. Consider consulting with a tax professional who has expertise in international business.

Payment processing services

When choosing a payment processor, consider the processor’s fees, ease of integration with your website or sales platform, and their ability to handle international transactions. With Stripe, for example, businesses can process online and in-person transactions. Stripe is a smart choice for nonresidents because it lets businesses accept payments from customers worldwide and doesn’t require businesses to obtain their own merchant account.

Financial planning and management

Develop a budget that outlines expected income and expenses to keep your business financially healthy. Review financial statements regularly to assess your business’s financial performance and make informed decisions. Consider setting aside funds to cover unexpected expenses or fluctuations in cash flow.

Compliance and reporting

Your financial practices are subject to US laws and regulations, including AML laws and FATCA. You might need to report certain financial activities to US authorities, especially if you’re moving large sums of money across borders.

Maintaining legal and regulatory compliance

All businesses operating in the US must do so in compliance with laws and regulations at the federal, state, and local levels. This includes tax obligations, labor laws, and standards governing corporate responsibility, environmental protection, and intellectual property. It’s a good idea to periodically review your business operations for compliance with all relevant requirements: this can involve self-audits or hiring consultants. The legal and regulatory obligations for US businesses are outlined below.

Federal compliance

Tax compliance: Stay up to date with federal tax obligations, including income tax and employment taxes. File annual tax returns, and make estimated tax payments if necessary.

Securities and Exchange Commission (SEC) compliance: If your business involves trading or issuing securities, you will be subject to SEC regulations.

Industry-specific regulations: Depending on your business sector, you might need to adhere to industry-specific federal regulations (e.g., regulations governing healthcare, finance, or the food and beverage industry). If your business involves manufacturing or dealing with hazardous materials, you will need to comply with Environmental Protection Agency (EPA) standards.

State and local compliance

Annual reports: Most states require businesses to file annual reports and pay a filing fee. These reports keep your business information up to date with the state.

State taxes: Comply with state income, sales, and payroll tax requirements. This might include quarterly or annual filings and payments.

Licenses and permits: Renew any state or local licenses and permits to keep your business authorized to operate legally.

State-specific regulations: Be aware of any state-specific laws that might affect your business such as consumer protection laws, employment laws, and environmental regulations.

Corporate compliance

Corporate governance: Maintain proper corporate governance practices, which might include holding annual meetings, keeping minutes, and adhering to your business’s bylaws or operating agreement.

Recordkeeping: Keep detailed records of all business activities, financial transactions, compliance efforts, and decisions made by the business’s leadership.

US labor law compliance

Employment laws: If you have employees in the US, comply with federal and state labor laws regarding wages, working conditions, nondiscrimination, and benefits.

Immigration compliance for employees: Ensure any foreign workers have the appropriate visas and work permits.

Intellectual property compliance

- IP registration: Register your trademarks, copyrights, and patents in the US to protect your intellectual property. Regularly monitor and enforce your intellectual property rights to prevent infringement.

Data privacy and security compliance

Data protection: Comply with US data protection laws such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA), depending on your business type and location.

Cybersecurity: Implement strong cybersecurity measures to protect business and customer data.

Immigration and visa considerations

Nonresidents who want to actively manage or work at their US-based business must work through the US immigration system. Here are some important considerations related to immigration and visas:

Visa application process: The application process can be complex and varies by visa type. It typically involves filing a petition, attending an interview at a US embassy or consulate, and providing extensive documentation about your business and investment.

Tax implications: Visa holders are subject to US tax laws and might be considered tax residents depending on their time spent in the US. Understand your tax obligations as a visa holder to avoid legal issues.

Maintaining visa status: Different visa classifications permit different activities. Violating the terms of your visa could lead to loss of status or removal.

Path to permanent residency: Some visas, such as the EB-5, provide a direct path to permanent residency. Others, including the E-2 visa, do not automatically lead to a green card but might offer potential pathways through other means, such as a change of status or employer sponsorship.

Dependents: Consider the visa options for your dependents (i.e., spouse and children). Some visas let dependents accompany you to the US, and in some cases, your spouse may obtain work authorization.

Types of visas and green cards

B-1 temporary business visitor visa: The B-1 visa is primarily for business visitors attending meetings or conferences or negotiating contracts. It does not permit actively running a business or being employed in the US but is suitable for short visits related to your business.

E-2 treaty investor visa: The E-2 visa lets individuals work in the US for a business in which they have invested a substantial amount of capital. There’s no minimum investment specified, but the amount should be substantial relative to the total cost of purchasing or establishing the business. This kind of visa is available to individuals from countries with which the US maintains a treaty of commerce and navigation.

L-1 intracompany transferee visa: The L-1 visa allows the transfer of managers, executives, or specialized knowledge employees to the US branch of a business that operates in the US and abroad. The L-1A visa is specifically for executives and managers, while the L-1B visa is for employees with specialized knowledge.

EB-5 investor visa: The EB-5 visa lets investors become permanent residents if they invest $1.8 million (or $900,000 in a targeted employment area) in a new commercial enterprise that creates at least 10 full-time jobs for US workers.

How Stripe Atlas can help

Stripe Atlas sets up your company’s legal foundations so you can fundraise, open a bank account, and accept payments within two business days from anywhere in the world.

Join 75K+ companies incorporated using Atlas, including startups backed by top investors like Y Combinator, a16z, and General Catalyst.

Applying to Atlas

Applying to form a company with Atlas takes less than 10 minutes. You’ll choose your company structure, instantly confirm whether your company name is available, and add up to four cofounders. You’ll also decide how to split equity, reserve a pool of equity for future investors and employees, appoint officers, and then e-sign all your documents. Any cofounders will receive emails inviting them to e-sign their documents, too.

Accepting payments and banking before your EIN arrives

After forming your company, Atlas files for your EIN. Founders with a US Social Security number, address, and cell phone number are eligible for IRS expedited processing, while others will receive standard processing, which can take a little longer. Additionally, Atlas enables pre-EIN payments and banking, so you can start accepting payments and making transactions before your EIN arrives.

Cashless founder stock purchase

Founders can purchase initial shares using their intellectual property (e.g., copyrights or patents) instead of cash, with proof of purchase stored in your Atlas Dashboard. Your IP must be valued at $100 or less to use this feature; if you own IP above that value, consult a lawyer before proceeding.

Automatic 83(b) tax election filing

Founders can file an 83(b) tax election to reduce personal income taxes. Atlas will file it for you—whether you are a US or non-US founder—with USPS Certified Mail and tracking. You’ll receive a signed 83(b) election and proof of filing directly in your Stripe Dashboard.

World-class company legal documents

Atlas provides all the legal documents you need to start running your company. Atlas C corp documents are built in collaboration with Cooley, one of the world’s leading venture capital law firms. These documents are designed to help you fundraise immediately and ensure your company is legally protected, covering aspects like ownership structure, equity distribution, and tax compliance.

A free year of Stripe Payments, plus $50K in partner credits and discounts

Atlas collaborates with top-tier partners to give founders exclusive discounts and credits. These include discounts on essential tools for engineering, tax, finance, compliance, and operations from industry leaders like AWS, Carta, and Perplexity. We also provide you with your required Delaware registered agent for free in your first year. Plus, as an Atlas user, you’ll access additional Stripe benefits, including up to a year of free payment processing for up to $100K in payments volume.

Learn more about how Atlas can help you set up your new business quickly and easily, and get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.