In the fast-paced world of ecommerce, offering various payment options is an important factor for business success. The Netherlands’ leading online payment system, iDEAL, is now gaining traction among German merchants. iDEAL enhances your online store’s appeal to Dutch customers, boosting sales.

In this article, we’ll explain what the iDEAL payment method is, how it works, and its benefits. We’ll also discuss whether Stripe merchants can offer iDEAL as a method of payment.

What’s in this article?

- What is iDEAL?

- How does iDEAL work?

- What are the advantages of iDEAL?

- Can merchants who use Stripe offer iDEAL as a payment option?

What is iDEAL?

The iDEAL online payment system was created in 2005 by a consortium of major Dutch banks. In 2023, approximately three-quarters of all ecommerce payments in the Netherlands were made using iDEALs making it by far the most popular online payment method in the Netherlands.

iDEAL is similar to the widely used German payment method, Giropay. Both systems allow payments to be made directly through the user’s online banking system, enabling secure, real-time transfers without needing a credit card. When shoppers select iDEAL as their payment method in an online store, they are redirected to their usual online banking environment to complete the payment.

How does iDEAL work?

Merchants who wish to integrate iDEAL as a payment method must meet certain requirements. Without an intermediary payment service provider, merchants first need a merchant account with a bank that supports iDEAL. To open the account, merchants must submit registration documents and proof of compliance with local business regulations. After that, iDEAL can be integrated into the existing infrastructure using the given API or software development kit (SDK).

Alternatively, retailers can integrate and use iDEAL with Stripe. In this case, Stripe handles the technical integration and ensures compliance with all regulatory standards. Compliance with the Payment Card Industry Data Security Standards (PCI DSS) and the European Union’s General Data Protection Regulation (GDPR) is another key prerequisite for using iDEAL. These guidelines provide secure payment processing and legal compliance in handling and storing customer information.

Once the technical integration is complete, merchants need to thoroughly test the iDEAL payment process. It’s important to ensure that transactions go through correctly and that payment information is transferred securely. Error handling needs to be tested as well. Finally, customers need to be educated about iDEAL before introducing it as a payment method. This payment method needs to be clearly listed as an additional option in the site’s terms and conditions, privacy policy, and payment information.

iDEAL can be used by ecommerce businesses and online merchants. The payment method is suitable for service providers in telecommunications, utilities, and digital offerings, among others. Further it is an excellent choice for the travel and hospitality industry, as hotels and airlines benefit from fast and secure processing for urgent reservations and bookings. iDEAL is also usable for subscription billing, and is commonly used in SaaS models or streaming services.

iDEAL 2.0

In 2022, iDEAL 2.0 was launched as an upgrade to the original iDEAL payment system. The update provides merchants with new features, as well as improvements to existing processes. iDEAL 2.0 uses modern APIs and open banking technologies, making technical integration easier. Transactions can be processed faster with iDEAL 2.0 thanks to improved authentication and authorization measures, and refunds and recurring payments are also more straightforward. Moreover the update enables smoother integration with mobile banking apps and makes it easier for customers to use with better guidance.

Payment process for users

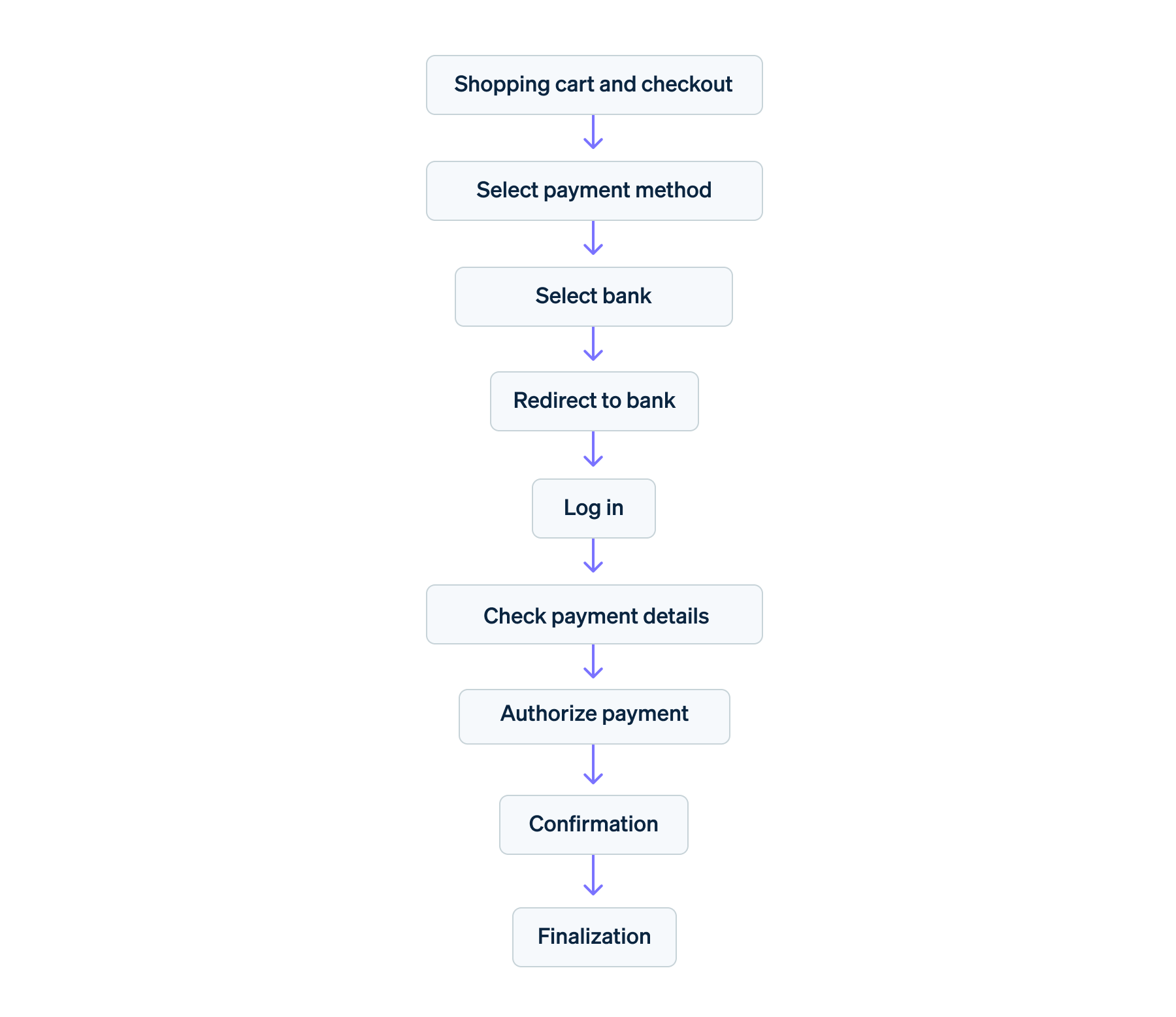

iDEAL enables users to pay for goods and services online in just a few steps:

- Shopping cart and checkout: Shoppers select products or services on an online retailer’s website and proceed to checkout.

- Select payment method: During the checkout process, shoppers select iDEAL as their payment method.

- Select bank: A list of participating banks is displayed. Shoppers select their bank from this list.

- Redirect to bank: Shoppers are redirected to their bank’s online portal.

- Log in: Shoppers then log in to their online banking account using their username, password, and two-factor authentication.

- Check payment details: Shoppers can view the payment details, such as the amount, recipient, and reason, which are automatically completed. These can now be checked.

- Authorize payment: If the details are correct, the payment can be authorized by entering a transaction number (TAN) provided by SMS or a TAN generator app.

- Confirmation: Shoppers are redirected to the merchant’s website after authorization. This is where the successful payment is confirmed. Typically, shoppers will also receive a confirmation email.

- Finalization: Merchants are notified of the successful payment and can proceed with the order.

iDEAL payment process: Step by step

What are the advantages of iDEAL?

iDEAL provides several advantages for both merchants and buyers. Here is an overview of the key benefits:

Advantages for merchants

- Easy integration: iDEAL can be seamlessly added to existing ecommerce platforms and payment systems, making it simple for merchants to implement. In addition to technical infrastructure integration, iDEAL can also be easily added to existing accounting systems. This simplifies accounting and financial reporting.

- Security and reliability: Since payments are made directly from the buyer’s bank account, there’s no risk of chargebacks or payment defaults. Furthermore, buyers cannot revoke their payments.

- Real-time payment confirmation: Merchants receive instant payment confirmation, which speeds up order processing. Real-time confirmation is especially beneficial for merchants selling digital goods and services: Customers can use them immediately after payment.

- Access to transaction data: iDEAL provides merchants extensive access to transaction data. This can be used to gain information about customers’ buying and payment behavior, along with improving marketing strategies or adjusting inventory levels.

- Broad acceptance in the Netherlands: iDEAL is the most popular online payment method in the Netherlands. This makes the payment process easier for Dutch shoppers when merchants offer it as a payment option. iDEAL is also a great way for merchants outside the Netherlands to attract new Dutch customers.

Advantages for buyers

- Security: iDEAL uses the banks’ existing online banking systems, which are highly secure. Transactions are protected by two-factor authentication and encryption.

- Familiarity: Buyers use their usual online banking systems, which boosts their confidence in payment processing.

- Speed: Payments are processed and confirmed instantly, making purchasing faster.

- No additional registration: Buyers can pay with iDEAL using their current bank account without setting up a new account or profile.

- Free for buyers: Buyers typically don’t have to pay any extra fees when using iDEAL.

A quick look at the benefits of iDEAL for merchants and buyers.

|

Advantages for merchants

|

Advantages for buyers

|

|---|---|

| Easy integration | Security |

| Security and reliability | Familiarity |

| Real-time payment confirmation | Speed |

| Access to transaction data | No additional registration |

| Wide acceptance in the Netherlands | Free of charge for buyers |

Can merchants who use Stripe offer iDEAL as a payment option?

Merchants using Stripe can offer their customers more than 100 different payment options, including iDEAL. There’s no need to integrate each payment option individually—all relevant payment methods are preconfigured. You can also activate additional options, such as iDEAL, in the Stripe Dashboard. This allows customers in Germany to pay with iDEAL as long as they have an account with a participating bank.

With Stripe Payments, you can accept payments globally, whether online or in-store, using a single solution. Standardized payment processing provides shoppers with the broadest options and a smooth customer experience. Stripe Checkout also allows you to either embed a pre-built payment form into your website or direct your customers to a Stripe-hosted payment page. This helps you accelerate and streamline the payment process for your customers. In addition, you will receive continuous support and detailed documentation of all transactions. Learn how to boost your sales by reading on designing an ecommerce checkout page that converts more sales.

Offering iDEAL through Stripe as a payment option will allow you to increase your customer base in the Dutch market significantly. For more information, learn more about iDEAL payments with Stripe.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.