Starting in 2025, all businesses in Germany will be required to receive e-invoices. This means that they will have to adapt their processes accordingly. In this article, you will learn what regulations will apply to the receipt of e-invoices as of 2025. We also explain how companies can obtain these digital documents and which technology solutions fit best for this scenario.

What’s in this article?

- What provisions apply to the receipt of e-invoices starting 2025?

- How can companies receive an e-invoice?

- Which software is suitable for receiving and processing e-invoices?

- What are the advantages of e-invoice processing?

What provisions apply to the receipt of e-invoices starting 2025?

As of January 1, 2025, B2B companies in Germany will be obliged to use paperless methods for invoicing. This means those that do business with each other must be able to issue and accept e-invoices. Only small-scale entrepreneurs are partially exempt from the e-invoicing obligation: they can continue to issue these documents as paper or PDF files, but they must be able to acquire and handle digital versions. Detailed information on the exemption for small-scale entrepreneurs and the underlying Annual Tax Act 2024 can be found in our article on the small-scale entrepreneur rule from 2025.

The starting point for companies’ requirement to e-invoice is the EU Directive 2014/55/EU from 2014. The directive aimed to make public administration more efficient while improving cooperation across national borders in the European Union. To this end, a stated objective of the directive was the use of e-invoicing for public procurement. As a result of the transposition into national law, B2G (business-to-government) entities in Germany will be required to issue electronic invoices to public purchasers by 2020.

As of 2025, this obligation will be extended from B2G to B2B organizations. The basis is the EU initiative ViDA (VAT in the Digital Age). The measures adopted in November 2024 are intended to modernize the existing European value-added tax (VAT) system and adapt the existing Council Directive 2006/112/EC. The implementation of ViDA is planned for the period from 2025 to 2035.

One of ViDA’s goals is to enable cross-border businesses to report their transactions to tax authorities individually, in a standardized structure, and in real time. The basis for this is electronic invoicing according to European standard EN 16931 requirements. As a result, ViDA requires EU member states to mandate digital invoicing for domestic transactions for their companies starting in 2025.

In Germany, the switch to e-invoicing, as planned by the EU, will take place in three steps. In the first step, companies must be able to accept and handle e-invoices. Second, they must issue and send these themselves. All billing documents must be reported via a web portal in the third step.

The Growth Opportunities Act, passed by the German parliament in March 2024, forms the basis for these steps. It requires B2B companies to issue bills digitally starting in 2025. Conversely, the change in the law means they must also be able to receive and process paperless statements beginning January 1, 2025.

What is an e-invoice?

Electronic invoices are digital documents that contain all transaction data in a structured, machine-readable layout. Unlike traditional paper records or unstructured PDF files, e-invoices can be directly worked with by accounting and ERP platforms. It is based on the XML (Extensible Markup Language) file structure, which consists of a data set in the form of lines of code. Information is organized hierarchically in this format, and all billing information is stored in a fixed location. As a result, digital versions in XML can be automatically read and handled with the right infrastructure.

The most common XML–based layouts in Germany are XRechnung and the ZUGFeRD option. While the XRechnung contains only an XML file, the ZUGFeRD hybrid solution consists of an XML and a PDF file.

How can companies receive an e-invoice?

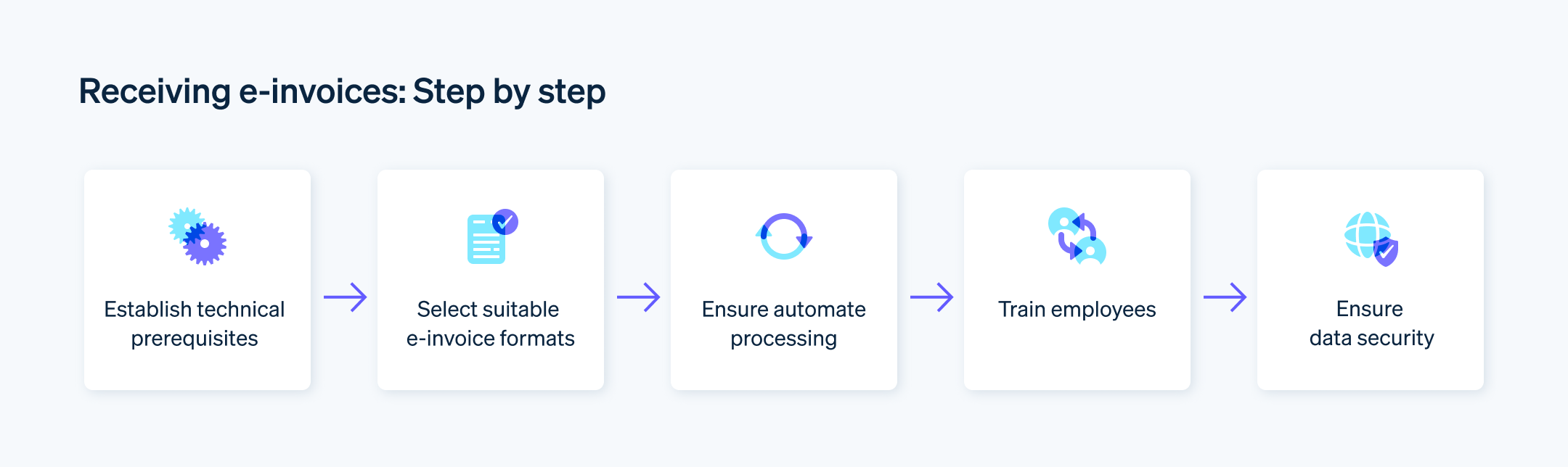

Companies that have exclusively taken in PDF or paper invoices need to make some technical and structural adjustments to their accounting workflow.

Establish the technical requirements

The main technical requirement is an accounting system that supports retrieval, conversion, and handling of e-invoices. In principle, an email account is sufficient since they can be quickly sent as an attachment, regardless of structure. Still, simply obtaining an e-invoice this way is not enough. Accepting it and being able to process it are two different things—especially since partners might prefer other transmission channels. In addition to uploading files, paperless interfaces in accounting software or the services of external providers can also be used. It is key to structure the desired receiving channels accordingly.

Select appropriate e-invoice types

Since there are different e-invoice formats, such as XRechnung and ZUGFeRD, companies must clarify with their trading partners which option is preferred. It is important to make sure that the company can process all incoming digital documents. Accounting systems need to be able to handle all standard structures.

Ensure automated processing

A major advantage of e-invoicing is that it can be processed automatically. However, this requires interfaces to existing accounting frameworks. These must be able to import and handle e-invoices. Additionally, incoming files need to be checked for completeness and accuracy. If existing IT solutions cannot do this, validation can be done using specialized tools.

Train employees

Implementing e-invoicing requires technical adaptations and employee training. Accounting and bookkeeping staff need to be familiar with the new formats and systems, which will establish smooth workflows and reduce errors.

Ensure data security

Handling electronic invoices requires protecting sensitive information. Organizations need to apply security measures such as encryption and restricted access to maintain data integrity. Furthermore, it is key to note that the GoBD (principles for the proper keeping and retention of books, records, and documents in electronic form) applies to e-invoices and traditional ones. This includes storage in an archiving system that guarantees that the bill is kept in an audit-proof manner for the statutory retention period of 10 years.

Which software is suitable for receiving and processing e-invoices?

Companies that want to receive and process e-invoices have several software solutions. Many vendors of traditional accounting systems have integrated paperless methods into their programs. The first step is to determine whether your existing frameworks can handle such tasks. If not, you can use the move to e-invoicing as an opportunity to integrate a new accounting tool.

It is also possible to maintain your existing infrastructure and use the services of specialized providers. Businesses need to ask themselves the following:

- Format compatibility: Does the software support the relevant standards such as XRechnung or ZUGFeRD?

- Integration capacity: Can the software easily integrate into your existing frameworks?

- Scalability: Is the solution suitable for your current company size and future requirements?

- User-friendliness: Is the software uncomplicated and requires little effort to train employees?

- Costs: Do the licensing and maintenance costs fit your company’s budget?

Stripe Invoicing is a convenient solution. You can easily receive, read, and process e-invoices through the Billit partner app. Invoicing can also be used to create and send e-invoices—a one-time setup is sufficient. The status of sent e-invoices can also be monitored in real time for transparent tracking and control. You are automatically notified of any errors or missed payments, so problems can be identified and solved quickly.

What are the advantages of e-invoice processing?

Digital methods offer companies numerous advantages. Below is an overview of the most important ones.

Compliance with legal regulations

From 2025, e-invoicing will be mandatory for German B2B entities. Exceptions apply exclusively to small businesses, which only need to be able to acquire them. Companies that change their accounting practices will comply with the German Growth Act and EU requirements.

Increased efficiency

E-invoicing encourages automated workflows. By eliminating manual steps such as data entry or verification, records can be handled faster, and errors are less likely. Quicker turnaround also allows bills to be paid on time, enhancing supplier relationships.

Increased transparency and control

With e-invoicing, businesses have access to up-to-the-minute information about the status of their billing documents, from receipt to payment. For example, with Stripe Invoicing, e-invoices can be tracked live, making receivables management more transparent and giving businesses effective control. Digital invoicing solutions also allow for detailed analysis and reporting.

Improved cooperation

Structured e-invoices facilitate data exchange between trading partners. Recognized standards simplify and improve collaboration across national borders.

Cost reduction

No paper, printing, or postage expenses arise when no physical bills are created or sent. Nevertheless, e-invoicing can save money for more than just the sender. Recipients can also reduce costs by saving time through automated processing. In this way, paperless approaches can lower personnel expenses in the accounting department.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.