Italy introduced mandatory electronic invoicing in 2019 for B2B and B2C transactions. Until 2023, some taxpayers were exempt, but starting January 1, 2024, the electronic invoicing requirement applies to nearly all value-added tax (VAT) holders, regardless of their tax regime or revenue level. This article explores B2C e-invoicing in detail and highlights the key differences between B2C and B2B e-invoicing.

What’s in this article?

- B2C electronic invoicing explained

- How to fill out a B2C electronic invoice

- Differences between B2C and B2B electronic invoicing

B2C electronic invoicing explained

Italy was the first country in Europe to introduce mandatory electronic invoicing. The legislation covers both mandatory B2C and B2B electronic invoicing. Electronic invoicing involves:

Creating the invoice in a specific extensible markup language (XML) format

Submitting it to the Italian Revenue Agency’s (Agenzia delle Entrate’s) Exchange System (SdI), where leaving an invoice unsubmitted means it hasn’t been issued

Digitally storing it in compliance with regulations

B2C electronic invoicing involves issuing invoices from businesses or professionals to private customers identified by their tax codes. These invoices differ from public administration (PA) electronic invoices (issued to public entities) and B2B invoices (sent between businesses or professionals).

Is a PEC address required for B2C electronic invoicing?

At first, when Italy introduced electronic invoicing, a certified email (PEC) address was necessary for individuals to receive electronic invoices. If the customer lacks a PEC address or a recipient code, the company can issue the electronic invoice using the customer’s tax code. The government later simplified the process by requiring companies to send the invoice to the customer via email or in paper format, while also making it accessible in the individual’s tax account.

How to fill out a B2C electronic invoice

Here’s how to complete an e-invoice for a private individual in three scenarios:

Without a recipient code or PEC

Without a recipient code but with a PEC

From a foreign country

B2C e-invoice to a private individual without a recipient code or PEC

As stated earlier, customers are not required to have a PEC address or a recipient code to receive electronic invoices. Here is how to issue a B2C electronic invoice in this case:

Enter the default code “0000000” in the recipient code field.

Leave the VAT number field blank.

Fill out the tax code field.

Leave the recipient’s PEC address field blank.

To deliver the invoice to a private individual, you must send it in electronic format via email or as a paper copy. The private individual can also access the invoice from their secure area on the Italian Revenue Agency website.

B2C e-invoicing to a private individual without a recipient code but with a PEC

If the customer has a PEC address, you must do the following when completing the B2C e-invoice:

Enter the default code “0000000” in the recipient code field.

Leave the VAT number field blank.

Fill out the tax code field.

Fill out the recipient’s PEC address field with the address you have been provided.

You will need to send the invoice to the customer in portable document format (PDF) via email or in paper format.

B2C e-invoice to a foreign private individual

To issue an electronic invoice to a foreign customer (either EU or non-EU), you need to provide the following information:

Enter the code “XXXXXXX” (seven Xs) in the recipient code field.

In the VAT number section of the country ID field, enter the foreign country code using the International Organization for Standardization (ISO) 3166-1 alpha-2 standard.

In the code ID field, enter an alphanumeric value to identify the recipient (up to 28 characters, not validated by the SdI), and leave the tax code field blank.

In B2C e-invoicing, after specifying the country of residence, you can skip the province field and enter the generic value “00000” in the postal routing code (CAP) field.

Taxpayers can manage the e-invoicing process using free tools provided by the Italian Revenue Agency or opt for e-invoicing software from private providers, such as Stripe Invoicing, a versatile platform that allows users to create and send both one-time and recurring invoices without any coding required. With Invoicing, you can save time and receive payments more quickly, as users collect on more than 87% of Stripe invoices within 24 hours. Additionally, through collaboration with third-party partners, you can use Invoicing for electronic invoicing as well.

Differences between B2C and B2B electronic invoicing

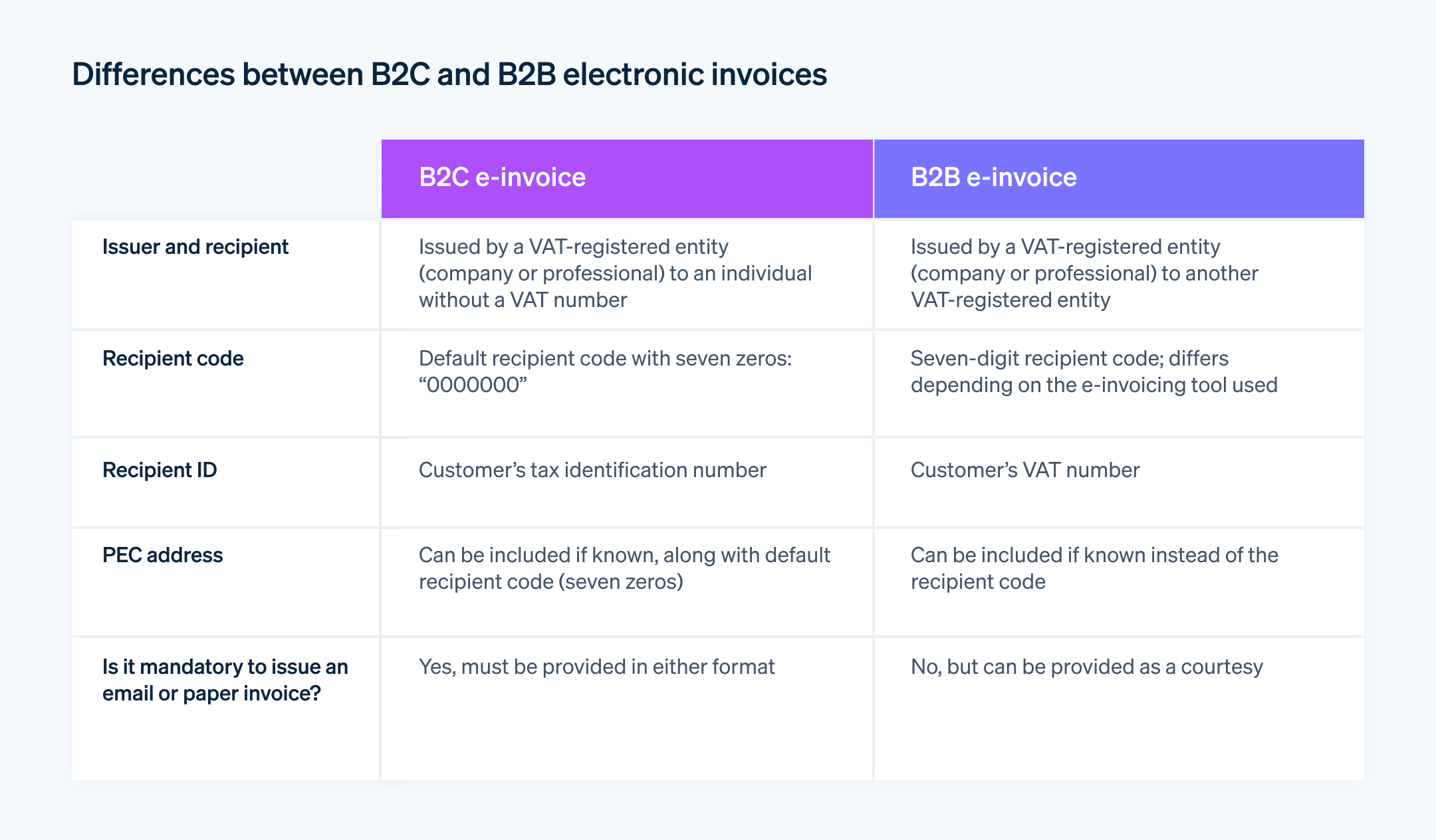

Similar to B2B e-invoicing, B2C e-invoicing requires creating the e-invoice using dedicated software and submitting it to the SdI. However, there are specific differences to consider when sending a B2C e-invoice to individuals.

For B2C e-invoicing, unlike B2B e-invoicing, after completing the customer’s master data, you must enter the default code “0000000” in the recipient code field. If the private individual has a PEC address and has provided it, after entering the seven zeros as the recipient code, you must also include their tax code and PEC address.

You must always send the B2C e-invoice to the SdI, but you also have to provide the customer with a copy of the e-invoice in PDF (if sent by email) or paper format. This copy is fully valid, and the customer is not obligated to retrieve the e-invoice.

You must also inform the customer that the invoice will be available online in their secure area on the Invoices and Billing portal. The SdI makes invoices available to individuals in a dedicated section of their tax account, accessible using Fisconline, the National Service Card (CNS), or the Public Digital Identity System (SPID).

Here are the main differences between B2C e-invoices and B2B e-invoices:

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.