As digital commerce continues to grow, businesses are seeking innovative ways to meet customer needs and access new revenue streams. One opportunity that has recently grown in popularity is the online marketplace model. According to a report by Grand View Research, global online marketplace revenue is expected to reach $27.1 trillion by 2027. Online marketplaces such as Amazon, Airbnb, and Uber have disrupted their respective industries, proving the effectiveness and scalability of this business model.

Building an online marketplace involves careful planning, strategic decisions, and meticulous execution. The process includes defining the concept, conducting market research, developing the business model, designing the platform, attracting users, and refining based on feedback. Despite the challenges, the rewards of establishing a successful online marketplace are significant, offering businesses a chance to facilitate commerce on a larger scale, generate consistent revenue, and build a strong digital presence. Here’s a quick guide to important considerations as you begin scoping, planning, and launching a new online marketplace.

What’s in this article?

- What is a marketplace?

- How are marketplaces different from ecommerce websites?

- Types of online marketplaces and business models

- Marketplace payment processing: How to choose a provider

- How to create a marketplace

What is a marketplace?

A marketplace is a type of ecommerce site where multiple third-party providers offer products or services and the marketplace operator processes transactions. Online marketplaces are the digital equivalent of a physical market or shopping center, where multiple vendors convene to sell their products.

These platforms can be B2B (business-to-business), B2C (business-to-consumer), or C2C (consumer-to-consumer), depending on the nature of transactions that take place. Well-known examples of online marketplaces include Amazon, eBay, and Etsy.

How are marketplaces different from ecommerce websites?

While both marketplaces and regular ecommerce websites operate online and facilitate the buying and selling of goods or services, they differ in several key ways:

Variety of sellers

A marketplace aggregates products or services from multiple third-party sellers, providing a broad selection and variety for customers. A traditional ecommerce site, on the other hand, generally sells products or services from a single business.Inventory management

In a marketplace, individual sellers manage the inventory and the marketplace platform itself does not own any of the inventory. In contrast, a traditional ecommerce site often manages its own inventory and supply chain. One exception is the dropshipping model, which is a retail fulfillment method where a store sells products without keeping the items in stock, instead purchasing the product from a third party and having it shipped directly to the customer.Price competition

Because a marketplace hosts multiple sellers, there is often direct price competition for similar products. On a traditional ecommerce site, the prices are set by the business and there’s no direct competition on the same platform.Revenue model

Marketplaces typically make money by charging a commission or fee for each transaction made through the platform. Regular ecommerce sites earn revenue directly from the sale of their products or services.Responsibility for fulfillment

In a marketplace, the sellers are usually responsible for shipping their products to the customers, although some marketplaces may offer centralized fulfillment services. In a traditional ecommerce model, the business running the site is responsible for fulfillment.Customer relationship

In a marketplace, the customer relationship is often shared between the marketplace and the individual sellers. For a traditional ecommerce site, the relationship is solely between the customer and the company running the site.Reviews and ratings

Most marketplaces have a system for customers to rate and review individual sellers, helping to build trust and provide information for future customers. While ecommerce sites can also have review and rating systems, these are generally focused on the products, not the sellers.

Businesses need to understand these distinctions before deciding whether selling in a marketplace is the best fit for their near-term and long-term goals. If a marketplace is the right choice, then the next step is to understand the various types of marketplaces and the business models that support them.

Types of online marketplaces and business models

Different types of online marketplaces exist, each with unique characteristics and business models. These include:

Business-to-consumer (B2C) marketplaces

These are platforms where businesses sell to individual customers. An example of this model is Amazon, where many different businesses sell their products to customers and Amazon takes a percentage of each sale as a commission.Consumer-to-consumer (C2C) marketplaces

These platforms allow customers to sell goods to each other. eBay, for example, allows individuals to auction off items to the highest bidder. These marketplaces typically make money by charging a listing fee or taking a small percentage of each transaction.Business-to-business (B2B) marketplaces

These platforms facilitate transactions between businesses. An example is Alibaba, where manufacturers and wholesalers sell products in bulk to businesses around the world. They usually generate revenue by charging membership or transaction fees.Services marketplaces

These platforms connect service providers with customers who need those services. Examples include Uber, which connects drivers with passengers, and Upwork, which connects freelancers with clients. These platforms often take a commission from each transaction.Vertical marketplaces

These platforms specialize in one type of product or service. For example, Etsy focuses on handmade and vintage items, and Zillow focuses on real estate. Their revenue models can vary, but often involve transaction or listing fees.Horizontal marketplaces

These platforms sell many types of products and services across different industries. Amazon and eBay are good examples, as they offer a wide range of product categories. They typically generate revenue by charging sellers a commission on each sale.Peer-to-peer (P2P) rental marketplaces

These platforms facilitate the temporary rental of goods between peers. Airbnb is an example, enabling individuals to rent out their homes to travelers. They typically make money by charging a service fee on each booking.Decentralized marketplaces

This is a newer type of marketplace that uses blockchain technology to facilitate peer-to-peer transactions without a central authority. Examples include OpenBazaar and Origin Protocol. They usually don’t charge transaction fees but might make money through other means, such as selling proprietary tokens.Hybrid marketplaces

These are platforms that combine different types of marketplaces. For example, Amazon is primarily a B2C marketplace but also has B2B (Amazon Business) and C2C (Amazon Marketplace for used items) components.

These different types of marketplaces demonstrate how the marketplace model can adapt to various types of transactions and interactions, between different types of users. To gain the benefits of this flexibility, businesses should strategically choose the most advantageous marketplace model based on their unique strengths and target market.

Marketplace payment processing: How to choose a provider

Payment processing and payments infrastructure play an important role in online marketplace operations. They facilitate transactions between buyers and sellers, which is at the core of the marketplace business model. An efficient, secure, reliable payment processing system can build trust, improve the user experience, increase sales, and drive business growth.

Here are some factors to consider when vetting potential payment processing providers:

Cost

Fees charged by the payment provider can include setup fees, transaction fees, monthly fees, and chargeback fees. Some providers may also charge for additional services like fraud protection. For instance, Stripe charges a percentage plus a fixed fee per transaction, but doesn’t have setup or monthly fees.Global reach and currency support

If your marketplace serves international customers, you’ll need a payment processor that can handle multiple currencies and is available in many countries. Stripe, for example, supports over 135 currencies and is available in 46 countries around the world.Ease of integration

The payment system should be easy to integrate with your marketplace platform. Stripe, for instance, offers APIs that are known for their flexibility and ease of integration.Payout options and scheduling

Depending on the nature of your marketplace, you may need flexible payout options for your sellers. Stripe, for example, offers customizable payout schedules and multiple payout methods, making it a good fit for different types of marketplaces.Security

The provider should use robust security measures to protect sensitive financial data. Stripe uses machine learning for fraud detection and is a certified PCI Service Provider Level 1, the highest level of certification in the payments industry.Regulatory compliance

The payment processor needs to be compliant with regulations, such as data protection and privacy laws, in the regions they operate in. Stripe maintains strong compliance standards, including GDPR compliance for European customers.Customer support

Good customer support is important for resolving any issues that might arise. Stripe offers 24/7 support options including email, chat, and phone support.

With these factors in mind, here’s a general process for choosing a payment processing provider:

1. Define your requirements

Understand your business model, your target audience, the countries you’ll operate in, the currencies you need to support, your budget, and other specific needs.

2. Research

Research different providers to understand their offerings, costs, and reputation in the industry. Read reviews and talk to other businesses that use their services.

3. Compare

Evaluate different providers based on your requirements and their offerings. Consider the factors mentioned above: cost, global reach, ease of integration, payout options, security, compliance, and customer support.

4. Test

Many providers offer sandbox environments for testing. Use these sandboxes to understand the user experience and test the integration with your platform.

5. Choose and integrate

Once you’ve evaluated all the factors and tested the options, you can make an informed decision. Choose the provider that best fits your needs and integrate it into your marketplace.

The right payment processing solution can not only ensure smooth transactions but can also have a significant impact on the user experience, trust, and growth of your online marketplace.

How to create a marketplace

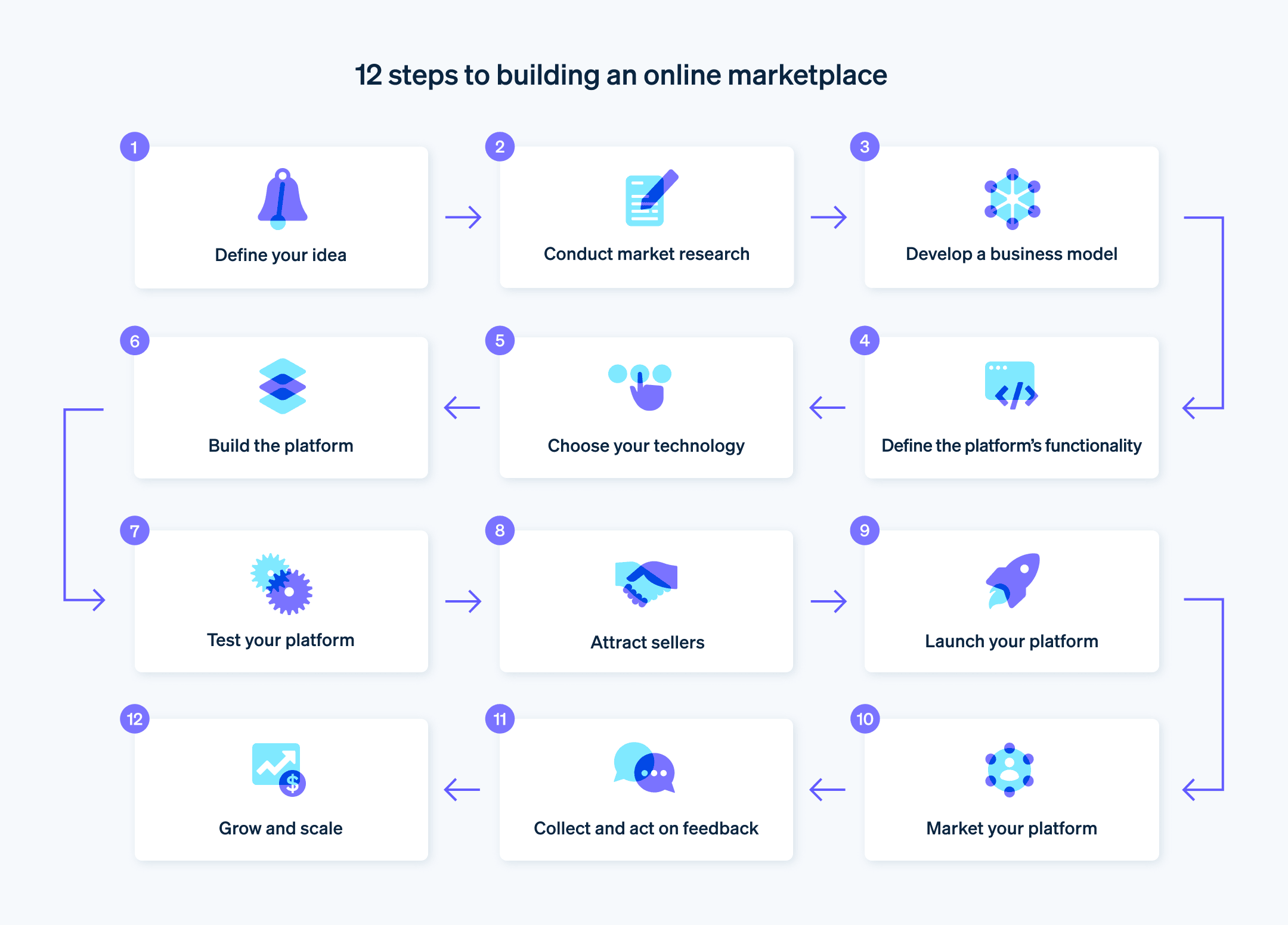

Creating an online marketplace involves several steps, from defining your idea to launching and promoting the platform. Here’s a quick look at the process:

Define your idea

Start by defining the core concept of your marketplace. What type of products or services will be sold? Who are your target buyers and sellers? What’s your unique selling proposition that sets you apart from existing platforms?Conduct market research

Understand the existing market, competitors, and customer needs. Look at successful marketplaces to understand what they’re doing well and where gaps exist that your marketplace can fill.Develop a business model

Decide on how you’ll generate revenue. This could be transaction fees, listing fees, subscriptions, or a combination of these. Also think about your pricing strategy and how it compares with competitors.Define the platform’s functionality

Outline the key features and functionality your platform needs. This often includes search and discovery tools, user profiles, product listings, a secure payment system, review and rating systems, and communication tools for buyers and sellers.Choose your technology

You can choose to build your marketplace from scratch, use a prebuilt platform, or use marketplace software. Consider your budget, timeline, and technical capabilities when making this decision. There are also various solutions for integrating payment processing, like Stripe.Build the platform

Whether you’re developing a marketplace from scratch or using a platform, you’ll need to implement the functionality you’ve defined. If you’re not a developer yourself, you’ll need to hire a development team.Test your platform

Before launch, conduct thorough testing to ensure everything works as expected. This includes testing the buying and selling process, the payment system, and all of the platform’s features.Attract sellers

Before you can attract buyers, you need sellers. Reach out to potential sellers who would be a good fit for your marketplace. Consider offering incentives to join.Launch your platform

Once you’ve tested everything and have some initial sellers, you can launch your marketplace. Start with a soft launch where you invite a small group of users to test the platform in the real world and provide feedback.Market your platform

Use various marketing strategies to attract buyers to your platform. This could include SEO, content marketing, social media marketing, paid ads, and partnerships.Collect and act on feedback

As users start to use your platform, gather feedback to understand what’s working and what’s not. Use this feedback to continually improve your platform.Grow and scale

As your marketplace becomes more established, consider strategies for growth. This could include expanding into new markets or categories, building community features, or using data for personalization and recommendations.

Remember that building a successful marketplace involves building trust and handling interactions between buyers and sellers. This process requires constant iteration and improvement based on user feedback. Carefully investing time in the beginning will create a solid foundation that will pay off exponentially as your marketplace launches and grows.

To learn more about how Stripe has powered payments for leading marketplaces, go here to read case studies.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.