销售税合规流程可能十分复杂,而且耗时,在美国尤其如此。每个州都有自己的销售税管理机构,负责制定企业何时需要收取税款的税务法规。这些法规在过去几年中经历了多次变更,并且还在不断变化,因此很难确定您需要在何时何地对交易收取销售税。

本指南将帮助您确定何时需要在美国注册以收取税款,从而避免因不合规而产生的罚款和利息。本指南还将向您展示如何在各州注册销售税,并详细解释如果您目前有义务收取销售税但尚未注册,您该怎么办。我们还将分享 Stripe 如何帮助您管理持续的税务合规。

何时注册以收取销售税

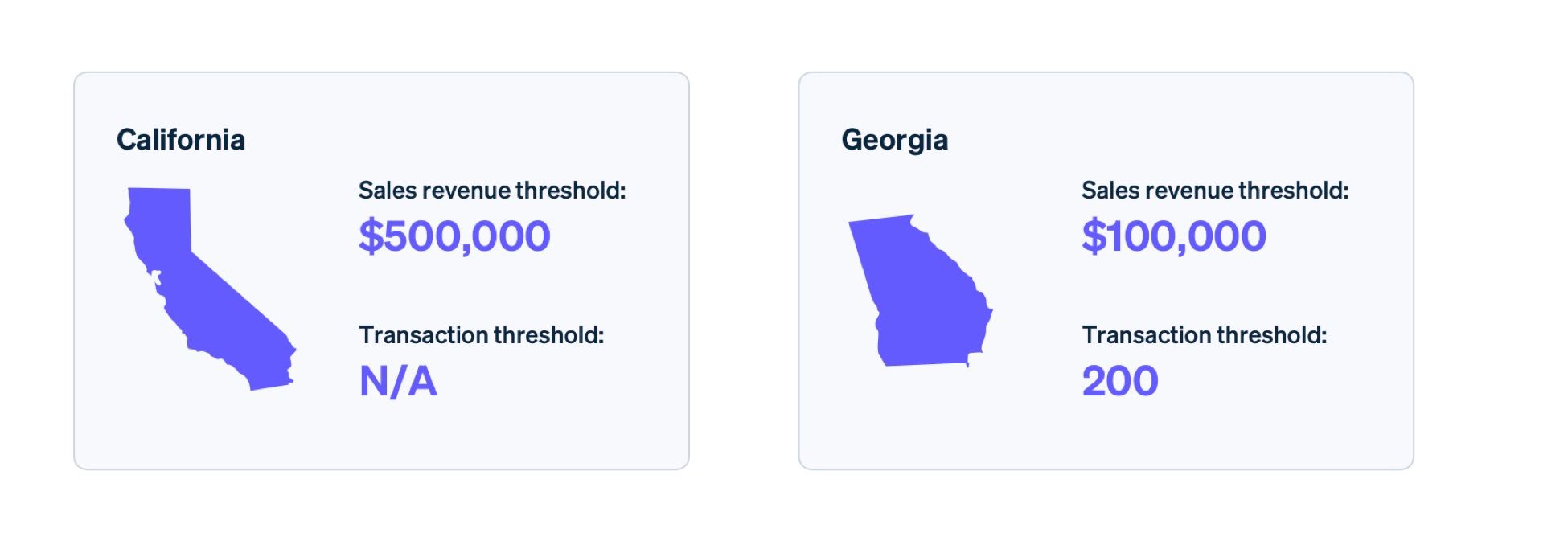

在美国,如果符合实际关联或经济关联标准 或该州的任何其他要求,则需要在每个州注册销售税。对于外州卖方,经济关联通常是确定何时注册以收取销售税的适用标准。经济关联阈值基于销售收入或交易量,有时两者兼有。例如,在加利福尼亚州,如果来自加利福尼亚州客户的销售收入超过 50 万美元,您必须注册并收取销售税。但是,在佐治亚州,如果来自佐治亚州客户的销售收入超过 10 万美元或完成 200 笔交易,则您必须开始收取销售税。

加利福尼亚州和佐治亚州的经济阈值金额不同

加利福尼亚州和佐治亚州的经济阈值金额不同

销售税经济关联定义(如实际关联)因州而异,但通常,任何类型的实际联系都可能构成“充分存在”(或关联),并要求您在该州注册并收取销售税。这可能包括在该州设有办公室或总部、设备或员工,甚至包括临时的情况,例如参加行业贸易展览。您的库存存储地点也可能在该州产生关联。(包括存储在亚马逊 FBA 仓库或其他第三方物流中心的库存。)

需要注意的是,有五个州没有全州范围的销售税:阿拉斯加州、特拉华州、蒙大拿州、新罕布什尔州和俄勒冈州。这意味着您无需在这些州收取一般销售税。但是,阿拉斯加州授权在市级征收销售税。在大多数情况下,商家只需在州一级注册销售税,但也有一些例外情况,我们将在下文中说明。

确定需要在哪里收取税款后,下一步是向州或地方税务机关注册。这一点至关重要,因为您必须先注册才能收取税款,然后才能开始计算和收取销售税。请记住,这些指南适用于直接卖方。如果您仅在交易平台销售商品,则您应咨询销售税专家,以确定您是否需要注册销售税许可证,因为交易平台的税务指南各不相同。

在美国,商家只有在确定了其关联所在地后,才应进行注册,无论该关联是通过实际关联还是经济关联标准,亦或是该州的任何其他要求所规定的。无论您销售何种类型的产品(例如,数字商品、服务或实物产品),您的注册流程都保持不变。

- 自治州允许各自治城市自行管理销售税并定义自己的税基。这些城市可以自行制定税收规则,卖方可能需要在这些地区完成额外的注册。以下是自治州:阿拉巴马、阿拉斯加、亚利桑那、科罗拉多和路易斯安那。

- 阿拉斯加是一个自治州。有关更多信息,请参见脚注一。阿拉斯加远程卖方销售税法案于 2020 年 1 月 6 日通过。但是,此后由当地管辖区决定是否采纳该法案。一旦当地管辖区采纳该法案,企业有 30 天时间开始向该管辖区内的阿拉斯加买方征收销售税。

- 亚利桑那州是一个自治州。有关更多信息,请参见脚注一。

- 科罗拉多州是一个自治州。有关更多信息,请参见脚注一。

- 路易斯安那州是一个自治州,尽管它们在路易斯安那州被称为“教区”。有关更多信息,请参见脚注一。

- 卖方必须在纽约州和康涅狄格州满足销售和交易数量的门槛。

如何在美国注册销售税许可证

由于每个州都有自己的销售税机构,您必须分别注册以在已满足税务注册要求的州收取销售税。要注册销售税许可证,请先前往州税务机关网站。您可以在此处找到每个州的链接,或者让 Stripe Tax 为您管理整个美国税务注册过程。

参与“简化销售税和使用税协议” (SSUTA)的州可豁免。该协议的创建是为了尝试简化销售税的注册流程。目前,有 24 个州通过了符合 SSUTA 的立法:阿肯色州、佐治亚州、印第安纳州、爱荷华州、堪萨斯州、肯塔基州、密歇根州、明尼苏达州、内布拉斯加州、内华达州、新泽西州、北卡罗来纳州、北达科他州、俄亥俄州、俄克拉荷马州、罗德岛州、南达科他州、田纳西州、犹他州、佛蒙特州、华盛顿州、西弗吉尼亚州、威斯康星州和怀俄明州。卖家可以在此处注册简化销售税注册系统 (SSTRS)。注册后,用户将在每个州分别设置账户,如果他们在任何与 SSUTA 不符的州有销售税义务,则需要单独注册。

如果您之前满足某个州的税务注册要求但未注册,则有几种选择。如果您超过税务注册要求已经过去了几个月,请咨询销售税专家,以确定适合您业务的最佳方式。大多数州都有一个自愿披露计划,帮助卖家解决之前的销售税负债,您也可能有资格参与该州的宽恕计划,以便使您合规。在州或地方税务机关正确注册之前,不要开始收税。

Stripe Tax 如何提供帮助

Stripe 助力交易市场以更低成本构建并扩展全球支付与金融服务业务,开拓更广阔的增长机遇。Stripe Tax 显著简化全球税务合规复杂度,让您专注业务发展。该系统全自动计算并征收全美各州及 100 个国家/地区的实体与数字商品服务相关的销售税、增值税及商品及服务税。该功能原生内置于 Stripe 平台,无需第三方集成或插件即可快速启用。

Stripe Tax 可帮助您:

- 了解在哪里注册和收税:基于 Stripe 交易数据,研判需代征税费的地区。您可以在几秒钟内在新的州或国家/地区开启税费代收功能。您可以通过在现有的 Stripe 集成中添加一行代码来开始收税;也可以向 Stripe 的无代码产品(例如 Invoicing)添加税费代收功能。

- 注册缴纳税款:如果您的企业位于美国,可以让 Stripe 代为管理税务注册事宜,享受预填申请详情的简化流程——为您节省时间,简化当地法规合规流程。如果您位于美国境外,Stripe 将与 Taxually 合作,帮助您在当地税务机关完成登记。

- 自动收取销售税:Stripe Tax 能自动完成应纳税额的计算与收取,支持数百种产品与服务,并实时同步全球税规与税率更新。

- 简化申报和上缴流程:通过与我们可信赖的全球合作伙伴的合作,用户可以体验到与您的 Stripe 交易数据无缝链接,我们的合作伙伴会帮助您管理申报事宜,让您能够专注于发展业务。

了解有关 Stripe Tax 的更多信息。