对于任何接受信用卡支付的企业而言,防止信用卡欺诈始终是首要关切。在 2021 年,美国零售商每月经历了平均 1,740 次欺诈尝试,而且其中超过一半的尝试是成功的,这使得 2021 年成为有记录以来首次成功欺诈尝试超过失败尝试的一年。如果您的企业曾经花时间处理欺诈缓解措施,您可能已经遇到过缩写 AVS。无论您是否已经知道 AVS 的含义,深入了解 AVS 是什么、如何运作以及它如何融入企业的欺诈预防工作都是个好主意。

以下是企业需要了解的关于 AVS 的一切内容,这是减少信用卡欺诈最基本且有效的工具之一。

目录

- AVS 代表什么?

- 什么是 AVS?

- 地址验证服务是如何运作的?

- AVS 代码

- “AVS 被拒绝”是什么意思?

- 什么是 AVS 不匹配?

- 我是否应该为我的企业使用 AVS?

- 如何开始使用地址验证服务

AVS 代表什么?

AVS 代表“地址验证服务”(Address Verification Service)。有时也被称为“地址验证系统”。

什么是 AVS?

AVS 是一种身份验证工具,使企业能够通过将客户提供的账单地址与备案的银行卡账单地址进行比较,来检测和防止潜在的欺诈性信用卡或借记卡交易,从而确认它们是否匹配。美国、加拿大和英国的企业使用 AVS 来减少欺诈交易和不必要的撤单。

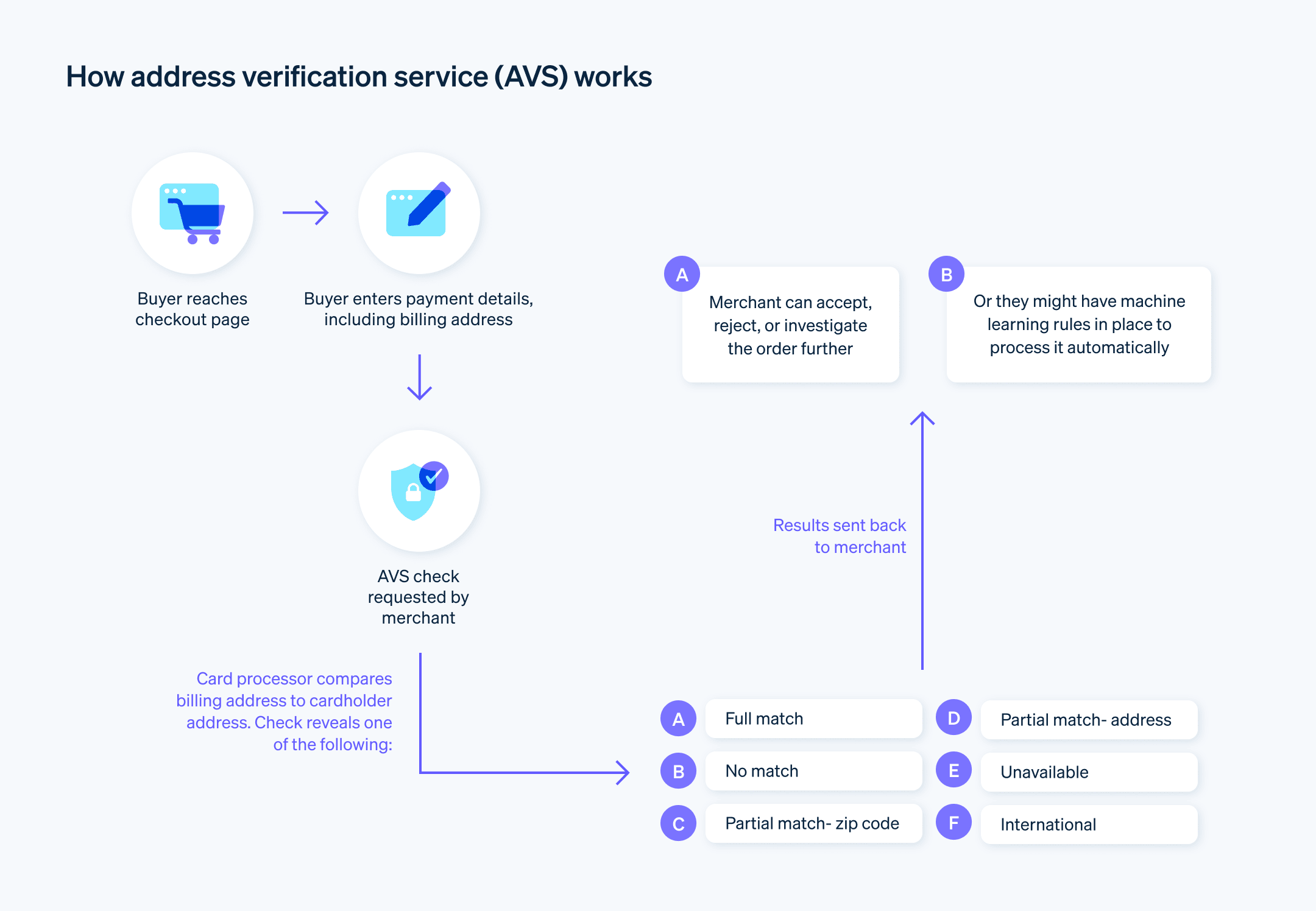

地址验证服务是如何运作的?

支付处理商和发卡行(也称为发行银行)将 AVS 作为工具提供给企业,以减少信用卡欺诈。AVS 发生在客户交易的银行卡授权阶段。当客户在结账时提交银行卡进行付款时,他们提供了一个账单地址。接受支付信息后,企业的支付处理商会向发卡银行发出请求以授权购买。在授权过程中,发卡行会检查几个方面:

- 账户中是否有足够的资金或信用额度以覆盖交易请求的金额。

- 银行卡当前是否有效。

- 银行卡验证值 (CVV) 代码是否与交易时输入的代码匹配。(这是通常位于卡片背面签名栏旁边的三位或四位数字代码。)

- 结账时提供的账单地址是否与备案的银行卡地址匹配。(这是 AVS 身份验证过程中的“地址验证”部分。)

AVS 通常用于对持卡人身份进行身份验证,尤其是在无卡 (CNP) 交易中,例如在线购买。

AVS 代码

在找到备案的银行卡地址后,发卡行会通过支付处理商向企业返回一个单字母代码,称为 AVS 响应代码。这些代码因卡组织而异,告知企业在交易中应采取的下一步措施。以下是四大美国信用卡公司可能的 AVS 响应代码。

|

代码

|

Visa

|

Mastercard

|

Discover

|

American Express

|

|---|---|---|---|---|

|

A

|

街道地址匹配,邮政编码不匹配 | 街道地址匹配,邮政编码不匹配 | 街道地址匹配,邮政编码不匹配 | 街道地址匹配,邮政编码不匹配 |

|

B

|

街道地址匹配,但邮政编码未经验证 | 不适用 | 不适用 | 不适用 |

|

C

|

街道地址和邮政编码未验证 | 不适用 | 不适用 | 不适用 |

|

D

|

街道地址和邮政编码匹配(仅限国际) | 不适用 | 不适用 | 不适用 |

|

E

|

AVS 数据无效或此卡类型不允许使用 AVS | 不适用 | 不适用 | 不适用 |

|

F

|

街道地址和邮政编码匹配(仅限英国) | 不适用 | 不适用 | 街道地址匹配,卡会员姓名不匹配 |

|

G

|

非美国发卡行不支持 AVS | 不适用 | 不适用 | 不适用 |

|

I

|

国际交易的地址信息未经验证 | 不适用 | 不适用 | 不适用 |

|

K

|

不适用 | 不适用 | 不适用 | 卡会员姓名匹配 |

|

L

|

不适用 | 不适用 | 不适用 | 会员卡名称和邮政编码匹配 |

|

M

|

街道地址和邮政编码匹配(仅限国际) | 不适用 | 不适用 | 持卡会员姓名、街道地址和邮政编码匹配 |

|

N

|

街道地址和邮政编码不匹配 | 街道地址和邮政编码不匹配 | 街道地址和邮政编码不匹配 | 街道地址和邮政编码不匹配 |

|

O

|

不适用 | 不适用 | 不适用 | 卡会员姓名和街道地址匹配 |

|

P

|

邮政编码匹配,街道地址因格式不兼容而无法验证(仅限国际) | 不适用 | 不适用 | 不适用 |

|

R

|

系统不可用,请重试 | 系统不可用,请重试 | 系统不可用,请重试 | 系统不可用,请重试 |

|

S

|

不支持 AVS | 不支持 AVS | 不支持 AVS | 不支持 AVS |

|

T

|

不适用 | 不适用 | 9 位邮政编码匹配,街道地址不匹配 | 不适用 |

|

U

|

地址信息不可用 如果美国银行不支持非美国 AVS,或者美国银行的 AVS 无法正常运行,则返回 | 地址信息不可用 | 地址信息不可用 | 地址信息不可用 |

|

W

|

9 位邮政编码匹配,街道地址不匹配 | 9 位邮政编码匹配,街道地址不匹配 | 9 位邮政编码匹配,街道地址不匹配 | 持卡会员姓名、邮政编码和街道地址不匹配 |

|

X

|

9 位邮政编码和街道地址匹配 | 9 位邮政编码和街道地址匹配 | 9 位邮政编码和街道地址匹配 | 不适用 |

|

Y

|

5 位邮政编码和街道地址匹配 | 5 位邮政编码和街道地址匹配 | 5 位邮政编码和街道地址匹配 | 5 位邮政编码和街道地址匹配 |

|

Z

|

5 位邮政编码匹配,街道地址不匹配 | 5 位邮政编码匹配,街道地址不匹配 | 5 位邮政编码匹配,街道地址不匹配 | 5 位邮政编码匹配,街道地址不匹配 |

整个 AVS 过程通常与银行卡身份验证过程的其他方面相结合,从客户提交银行卡和账单信息进行付款的那一刻起,到企业收到授权或拒绝消息的时刻,通常不超过几秒钟。

“AVS 被拒绝”是什么意思?

“AVS 被拒绝”是一个可能在企业尝试处理客户的银行卡支付时出现的消息,或者在持卡人尝试在线完成购买时出现。这个消息意味着发卡行拒绝授权银行卡交易,通常是因为提供的地址与发卡行档案中存储的持卡人地址不匹配。当发卡行检查企业的支付处理商提供的账单信息与他们档案中的持卡人信息时,如果发现两者之间存在差异,他们将返回上述代码之一,表明交易被拒绝。

什么是 AVS 不匹配?

在 AVS 中,不匹配发生在结账时提供的信用卡或借记卡购买的地址信息与发卡行档案中的地址不匹配。当这种不匹配发生时,通常交易将被拒绝。“AVS 不匹配”一词描述了在授权过程中发生的情况,这会促使发卡行拒绝交易。

我是否应该为我的企业使用 AVS?

AVS 是企业防止信用卡欺诈和欺诈对其业务及客户产生的多种负面影响的主要措施之一。大多数支付处理商和发卡行在银行卡交易中要求使用 AVS。原因很简单:AVS 是对抗信用卡欺诈的高效安全工具。

尽管 AVS 有重要的好处,但需要注意的是,AVS 并不是一个完美的系统。持卡人提供的账单信息可能与他们的发卡行档案中存储的信息不符,即使他们是合法的持卡人。这种情况可能发生在持卡人搬到另一个地址而没有更新其发卡行的账单地址时,或者如果发卡行在最初输入地址时出现错误。即使有这些缺陷,AVS 对企业和消费者的好处远远超过缺点。

如何开始使用地址验证服务

使用 Stripe 进行支付处理的企业无需采取任何额外步骤即可开始使用 AVS。Stripe 通过提交每笔银行卡交易的 CVC、邮政编码和账单街道地址给发卡行进行验证来使用 AVS。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。