2023 年,568,000 德国人开设了自己的企业。其中,205,000 家是全职初创公司,363,000 家是副业。这些数字表明,您不必在就业和经营自己的业务之间做出选择。有了副业,您可以两者兼而有之。

在本文中,我们将解释什么是副业,以及它与贸易和小型企业有何不同。我们还将讨论拥有副业的好处、需要满足的要求、相关的税务详细信息以及注册流程。

本文内容

- 什么是副业?

- 贸易、小型企业和副业有什么区别?

- 副业有哪些优势?

- 经营副业必须满足哪些要求?

- 注册副业时适用哪些税务法规?

- 如何注册副业?

什么是副业?

在德国,副业是您在全职工作之外开展的商业活动。然而,与“二次就业”(“Nebentätigkeit”)不同,“副业”(“Nebenberuf”)一词不是一个法律术语。

副业可以采取多种形式,包括志愿者工作、对他人的无偿援助、商业或自由职业者自营职业,或作为雇员的第二份工作。副业的关键方面是它不是全职形式——对工作时间或收入没有具体的法律限制。然而,实践中的一般准则是,第二份工作应该占用您每周工作时长的一半以下,其带来的收入也应不超过您总收入的一半。

从事副业的权利源于职业自由的基本权利,如 Grundgesetz 第 12 条(德国基本法)中所述。您可以在缴纳社会保障缴款的同时从事固定工作,也可以在学习或培训期间从事副业。此外,养老金领取者和求职者等也可以从事副业。

另一方面,副业是作为您主业的补充活动运营的注册企业。这意味着每个副业都是二次就业,但并不是每一种二次就业形式都是副业。

贸易、小型企业和副业有什么区别?

在德国,任何想成为个体经营者的人都可以成为自由职业者,也可以注册贸易类业务。德国的自由职业活动限定在艺术、文学、教学或科学领域;而贸易类经营活动则集中在工业、零售业、商业等行业。

贸易类业务必须在贸易办公室注册,并且可以在不同的法律结构下运营,例如独资企业、民法合营 (GbR)、有限责任公司 (GmbH) 或公共有限公司 (AG)。有关自由职业者和商业活动之间的区别以及与经营贸易相关的义务的更多详细信息,请参阅我们有关德国的个体经营的文章。

小型企业是一种主要为小型公司设计的特定类型的贸易。它同样须在贸易办公室注册,但只能以两种法律形式设立:独资企业或民法合营。

与贸易类业务不同,小型企业的年营业额上限为 80 万欧元,年利润为 8 万欧元,如增长机会法案中所述。如果小型企业在上一个日历年的年营业额低于 22,000 欧元,并且预计当年的营业额低于 5 万欧元,则适用小规模创业者规则,享受增值税 (VAT) 豁免待遇。

由于副业通常是在全职工作之外运营的,因此通常被视为小型企业。这是因为副业的销售额和利润通常低于界定小型企业的门槛标准。

副业有哪些优势?

开设副业的主要好处是:

- 自我实现: 副业可以让您追求自己的兴趣和激情。这意味着您可以探索在您的主业中可能无法实现的项目和创意。

- 额外收入: 任何人都可以通过经营副业赚取额外收入,无论他们选择在主业之外从事什么活动。额外收入也是对全职员工的激励。如果他们的主业已是兼职工作,并将“空闲”时间投入副业,情况尤其如此。

- 较低的财务风险: 从财务角度讲,经营副业比全职业务风险要小。无论副业成功或失败,那些在拥有全职固定工作的基础上开展副业的人,依然能持续获得固定工作的收入。

- 灵活性: 因为副业可以根据您的日程安排和偏好进行管理,所以它往往很灵活。因此,您可以选择自己的工作时间和工作量。

- 获得新技能: 经营副业可以帮助您获得新技能和知识。您的日常工作和个人生活可以从中受益。您可以获得会计、营销和客户服务等领域的经验,以及创业技能。

- 人脉拓展: 副业能让您结识新的人脉,这不仅能为你带来更多商业与财务机遇,还能让您扩大职业人脉网络。

- 过度到个体经营: 人们仍然认为个体经营比全职工作风险更大,尤其是从财务角度讲。因此,人们可能不愿意将自己的商业理念付诸实践。您可以通过开展副业来实现稳定和自我实现,特别是在您也有一份全职工作时。全职工作提供了收入来源,同时让您迈出个体经营的第一步。若副业进展顺利,您最终可能会辞去全职工作,只专注于为自己工作。这种思路对没有稳定全职工作却想开展副业的人同样具有吸引力,比如学生群体,就可以从经营副业开启自己的职业生涯。

- 增加工作保障: 如果您的主业发生变化或不稳定,副业可以充当安全网。它提供了额外的收入来源,而这份收入在您遭遇失业时,会被证明具有重要作用。

经营副业必须满足哪些要求?

在注册副业之前,您需要澄清并解决一些问题。关键问题之一是:您是否有一个能够激励您、适合您的能力并且从长远来看会盈利的经营理念?

虽然人才和动力对于开展副业很重要,但您的企业最终必须赚钱。因此,建议根据您的理念建立一种商业模式。理想情况下,您应该制定一份全面的商业计划,概述您的经营范围并估算您的收入和成本。您还应该选择最适合您企业的法律形式。

您若有一份固定工作,将需要与您的雇主讨论您未来的方案。尽管您必须将方案告诉您的雇主,但这并不意味着您需要他们的许可才能开展副业。只有当副业损害公司的合法利益时,雇主才会拒绝您的方案。例如,若您的副业与您的公司存在竞争关系,或者这种双重工作负担严重影响您的工作表现,则可能出现这种情况。无论哪种方式,您的经营活动都必须符合您的雇佣合同。

您必须遵从 Arbeitszeitgesetz(德国工作时间法)中概述的规定。根据 Arbeitszeitgesetz 第 3 条,员工每天只能工作 8 小时。如果在 6 个日历月或 24 周内每个工作日平均不超过 8 小时,则在特殊情况下工作时间可增加至 10 小时。此外,工作日期间必须有 11 小时的休息时间(参见 Arbeitszeitgesetz 第 5 条)。尽管承担双重工作量,但所有在拥有固定工作的同时经营副业的人,都必须确保满足这些法律要求。

您不得在为主业分配的假期内开展副业。这可能被视为违反您的雇佣合同。假期的主要目的是帮助员工恢复精力并重新投入工作岗位。

开展副业的另一个要求是注册。下面,我们将解释注册副业的流程。

完成所有手续后,您需要规划业务的日常运营流程。这其中包括记账在内的各项工作。选择合适的会计软件是个不错的做法。若想简化开票流程,您可以使用 Stripe Invoicing。借助 Invoicing,您只需点击几下即可在线发送发票,还能自动处理开票流程,从而让会计处理更便捷。如果在定期开票和订阅管理方面需要支持,Stripe Billing 可以提供帮助。

注册副业时适用哪些税务法规?

在征税条款方面,副业与主业没有什么不同。因此,经营副业者也需缴纳增值税。所有销售的商品和提供的服务必须按 7% 或 19% 的税率缴纳增值税。然后将增值税支付给税务局。只有申请适用“小规模创业者”规则的副业,才可享受增值税豁免。

副业还必须缴纳贸易税。金额取决于年利润和副业注册所在市的贸易税率。对于以独资企业或民法合营 (GbR) 形式设立的副业,可享受 24,500 欧元的营业税免征额度。而股份公司则需从第一欧元的收入开始缴纳贸易税。此外,这类企业还需按 15% 的税率缴纳企业所得税,同时需在企业所得税税额的基础上额外缴纳 5.5% 的团结附加税。

独资企业和 GbR 不需支付企业所得税。对他们来说,只要会计年度内收入达到至少 410 欧元,副业的所有利润均计入年度所得税申报表中。

Stripe Tax 可以帮助您计算和报告税费。它会自动征税,因此您不必担心税务变化。您还能获取报税所需的所有相关文件,轻松快速地完成报税流程。

如何注册副业?

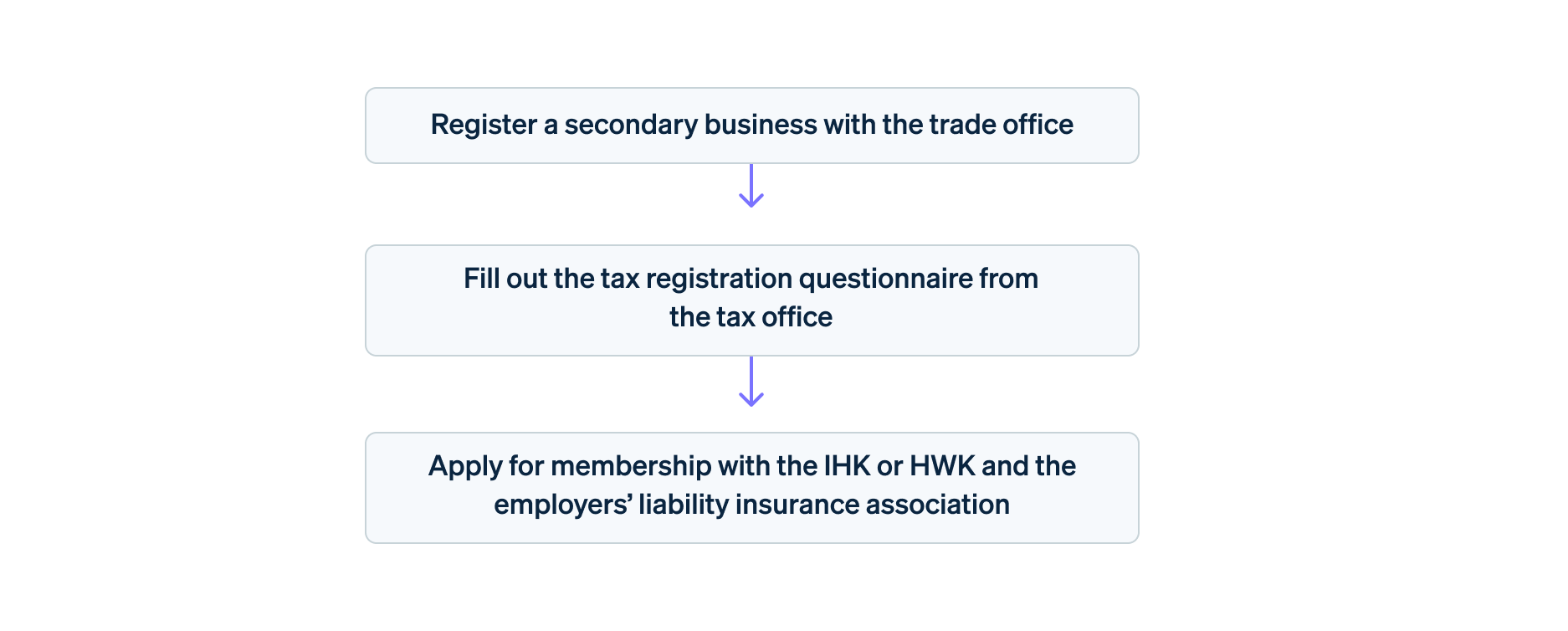

您只需几个步骤即可注册副业。与任何主业一样,副业必须在适当的贸易办事处注册。您需要填写适当的表格并支付两位数的小额费用,具体取决于市政当局。

贸易办事处会将您的副业注册信息发送给税务局。为确保信息快速正确地传递,可能需要向税务局查询。您将在一个月内收到税务局的税务注册问卷。您需要填写该问卷,内容包括您的预期营业额和利润。根据这些信息,税务局将确定要缴纳的税务金额。

贸易办事处还会将贸易注册事宜通知相关工商联合会 (IHK) 或工艺商会 (HWK) 以及适当的专业协会。您须成为 IHK 和 HWK 的付费会员。

注册副业:分步指南

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。