In 2023, 568,000 people in Germany started their own businesses. Of these, 205,000 were full-time startups, while 363,000 were secondary businesses. These numbers show that you don’t have to pick between being employed and running your own business. With a secondary business, you can do both.

In this article, we’ll explain what a secondary business is and how it differs from a trade and a small business. We’ll also go over the benefits of having a secondary business, the requirements it needs to meet, the relevant tax details, and the registration process.

What’s in this article?

- What is a secondary business?

- What’s the difference between a trade, a small business, and a secondary business?

- What are the advantages of a secondary business?

- What requirements must be met to run a secondary business?

- What tax regulations apply when registering a secondary business?

- How do you register a secondary business?

What is a secondary business?

In Germany, a secondary business is a commercial activity you carry out in addition to your full-time job. However, the phrase “secondary business” (“Nebenberuf”) is not a legal term, unlike “secondary employment” (“Nebentätigkeit”).

Secondary employment can take various forms, including volunteer work, unpaid assistance to others, commercial or freelance self-employment, or a second job as an employee. The key aspect of secondary employment is that it is not carried out on a full-time basis – there are no specific legal limits on working hours or income for it. However, the general guideline in practice is that a second job should take up less than half of your weekly working hours and generate less than half of your income.

The right to engage in secondary employment stems from the fundamental right to freedom of occupation, as outlined in Article 12 of the Grundgesetz (German Basic Law). You can take up secondary employment alongside a permanent job subject to social security contributions, as well as during your studies or training. Additionally, pensioners and job seekers, among others, can also engage in secondary employment.

A secondary business, on the other hand, is a registered business that operates as a supplementary activity to your primary occupation. This means that every secondary business is secondary employment, but not every form of secondary employment is a secondary business.

What’s the difference between a trade, a small business, and a secondary business?

In Germany, anyone looking to become self-employed can work as a freelancer or register a trade. Freelance activities in Germany must be in artistic, literary, teaching, or scientific fields. Trade activities are primarily found in sectors such as industry, retail, and commerce.

A trade must be registered with the trade office and can operate under different legal structures, such as a sole proprietorship, civil law partnership (GbR), limited liability company (GmbH), or public limited company (AG). For more detailed information on the differences between freelance and commercial activities and the obligations associated with running a trade, please see our article on self-employment in Germany.

A small business is a specific type of trade designed mainly for smaller companies. It must also be registered with the trade office, but it can only be established in two legal forms: as a sole proprietorship or a civil law partnership.

Unlike a trade, a small business is limited to a maximum annual turnover of €800,000 and an annual profit of €80,000, as specified in the Growth Opportunities Act. If a small business had an annual turnover of less than €22,000 in the previous calendar year and is expected to have less than €50,000 in the current year, it can benefit from the small-scale entrepreneur rule, which exempts it from value-added tax (VAT) liability.

Because a secondary business is typically run in addition to a full-time job, it’s often treated as a small business. This is because a secondary business is usually below the sales and profit thresholds that define a small business.

What are the advantages of a secondary business?

The key benefits of setting up a secondary business are:

- Self-fulfilment: A secondary business allows you to pursue your interests and passions. This means you can explore projects and creative ideas that may not be possible in your primary job.

- Additional income: Anyone can earn extra money by starting a secondary business, no matter what activities they choose to do in addition to their primary job. The extra income can also be an incentive for full-time employees. This is especially true if they already work part-time in their primary job and devote their “free” time to the secondary business.

- Lower financial risk: Financially speaking, it’s less risky to start a secondary business than a full-time business. Regardless of the success or failure of their secondary business, people who launch them from a full-time permanent job continue to get paid.

- Flexibility: Because a secondary business can be managed around your schedule and preferences, it tends to be flexible. As a result, you can choose your hours and workload.

- Acquisition of new skills: Running a secondary business can help you acquire new skills and knowledge. These can benefit your day job as well as your personal life. You can gain experience in areas such as accounting, marketing, and customer service, as well as entrepreneurial skills.

- Expanded network: A secondary business allows you to make new contacts, which can lead to a wider range of business and financial opportunities and an expanded professional network.

- Move into self-employment: There is still a perception that self-employment is riskier than a full-time job, especially financially. As a result, people may be reluctant to pursue their business ideas. You can achieve both stability and self-fulfilment by starting a secondary business, especially if you also have a full-time job. This provides a source of income while allowing you to take the first steps toward self-employment. If it works, you could eventually quit your full-time job and focus solely on working for yourself. The idea might also appeal to someone starting a secondary business without a steady full-time job. Students, for example, can start their careers with a secondary business.

- Increased job security: A side business can act as a safety net if your primary job changes or becomes unstable. It provides an additional source of income that can prove useful in the event of a job loss.

What requirements must be met to run a secondary business?

Before registering a secondary business, you need to clarify and address a few things. One of the key questions is: do you have a business idea that motivates you, fits your abilities, and will be profitable in the long run?

While talent and drive are important to start a secondary business, your venture must ultimately make money. Therefore, building a business model around your idea is advisable. Ideally, you should create a thorough business plan that outlines the scope of your venture and estimates your revenues and costs. You should also choose the legal form that best suits your business.

If you have a permanent job, you will need to talk to your employer about your future plans. Although you must tell your employer about your plans, that doesn’t mean you need their permission to start a second business. Employers can only refuse your plans if the secondary business harms the company’s legitimate interests. This could be the case, for example, if your side business competes with your company or the double burden seriously affects your performance. Either way, your activity must be consistent with your employment contract.

You must comply with the regulations outlined in the Arbeitszeitgesetz (German Working Hours Act). According to Section 3 of the Arbeitszeitgesetz, employees can only work eight hours per day. If an average of 8 hours per working day is not exceeded for 6 calendar months or within 24 weeks, working hours may be increased to 10 hours in exceptional circumstances. Additionally, there must be 11 hours of rest between working days (see Section 5 of the Arbeitszeitgesetz). Despite the double workload, everybody who manages a secondary business in addition to a permanent job must make sure that these legal requirements are met.

You must not conduct your secondary business on holiday days allotted for the primary job. This might be considered a breach of your employment contract. The main purpose of a holiday is to help the employee recover and return to their job with renewed energy.

Another requirement for starting a secondary business is registering it. Below, we’ll explain the process of registering your secondary business.

After completing all the formalities, you should structure the daily operations of the business. This includes setting up the bookkeeping, among other tasks. It’s a good idea to get the right accounting software. To simplify invoicing, you can use Stripe Invoicing. With Invoicing, you can send invoices online in just a few clicks and automate the process, which makes accounting easier. If you need support with recurring billing and subscription management, Stripe Billing can help.

What tax regulations apply when registering a secondary business?

In terms of taxation, a secondary business is no different from a main trade. Therefore, secondary business owners are also subject to VAT. VAT must be charged on all goods sold and services provided at a rate of 7% or 19%. The VAT is then paid to the tax office. Only secondary businesses that have applied for the small-scale entrepreneur rule are exempt from VAT.

Secondary businesses must also pay trade tax. The amount depends on the annual profit and the municipality’s trade tax rate where the secondary business is registered. For secondary businesses established as sole proprietorships or GbRs, there is a €24,500 trade tax allowance. Corporations, on the other hand, pay trade tax from the first euro. For these, the profit is also taxed at 15% corporate income tax, with an additional 5.5% solidarity surcharge on the corporate income tax amount.

Sole proprietorships and GbRs do not pay corporate income tax. For them, all profits from the secondary business are included in the annual income tax return as long as at least €410 was earned in the fiscal year.

Stripe Tax can help you calculate and report your taxes. It collects taxes automatically, so you don’t have to worry about tax changes. You also get access to all relevant documents needed to file tax returns quickly and easily.

How do you register a secondary business?

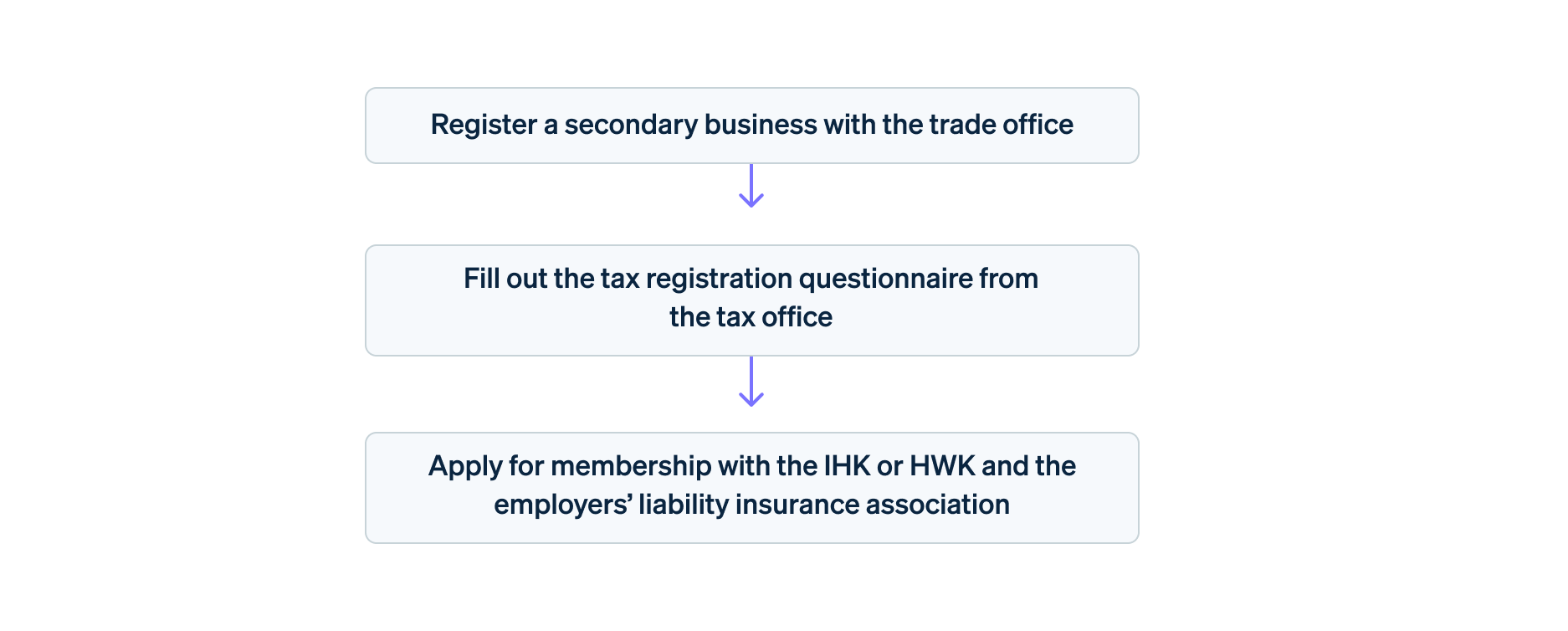

You can register a secondary business in just a few steps. A secondary business, like any primary business, must be registered with the appropriate trade office. You will need to fill out the appropriate form and pay a small two-figure fee, depending on the municipality.

The trade office will send your secondary business registration information to the tax office. To ensure that the information is passed on quickly and correctly, it may be worth checking with the tax office. You will receive a tax registration questionnaire from the office within a month. You will need to fill it in, including your expected turnover and profits. Based on this information, the tax office will determine the amount of tax to pay.

The trade office will also notify the relevant Chamber of Commerce and Industry (IHK) or Chamber of Crafts (HWK), as well as the appropriate professional association, about the business registration. You must take out a paid membership for IHK and HWK.

Registering a secondary business: Step by step

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.