应税企业有义务缴纳消费税。销售额是成为应税企业的主要决定条件,但免税企业可以自愿选择成为应税企业。当应税企业申报并缴纳消费税时,它支付从购买税额中扣除的税款。

本文提供了应税企业的基本知识,解释了应税企业和应税交易的条件。此外,我们将解释免税企业在自愿成为应税企业时提交的《消费纳税人选举纳税报告》中的相关项目。

目录

- 什么是消费税应税企业?

- 应税企业的要求是什么?

- 什么是消费税应税交易?

- 消费税申报和支付

- 关于《消费纳税人选举纳税报告》的说明

什么是消费税应税企业?

消费税 应税企业应缴纳消费税,消费税是对客户购买商品和服务征收的税。

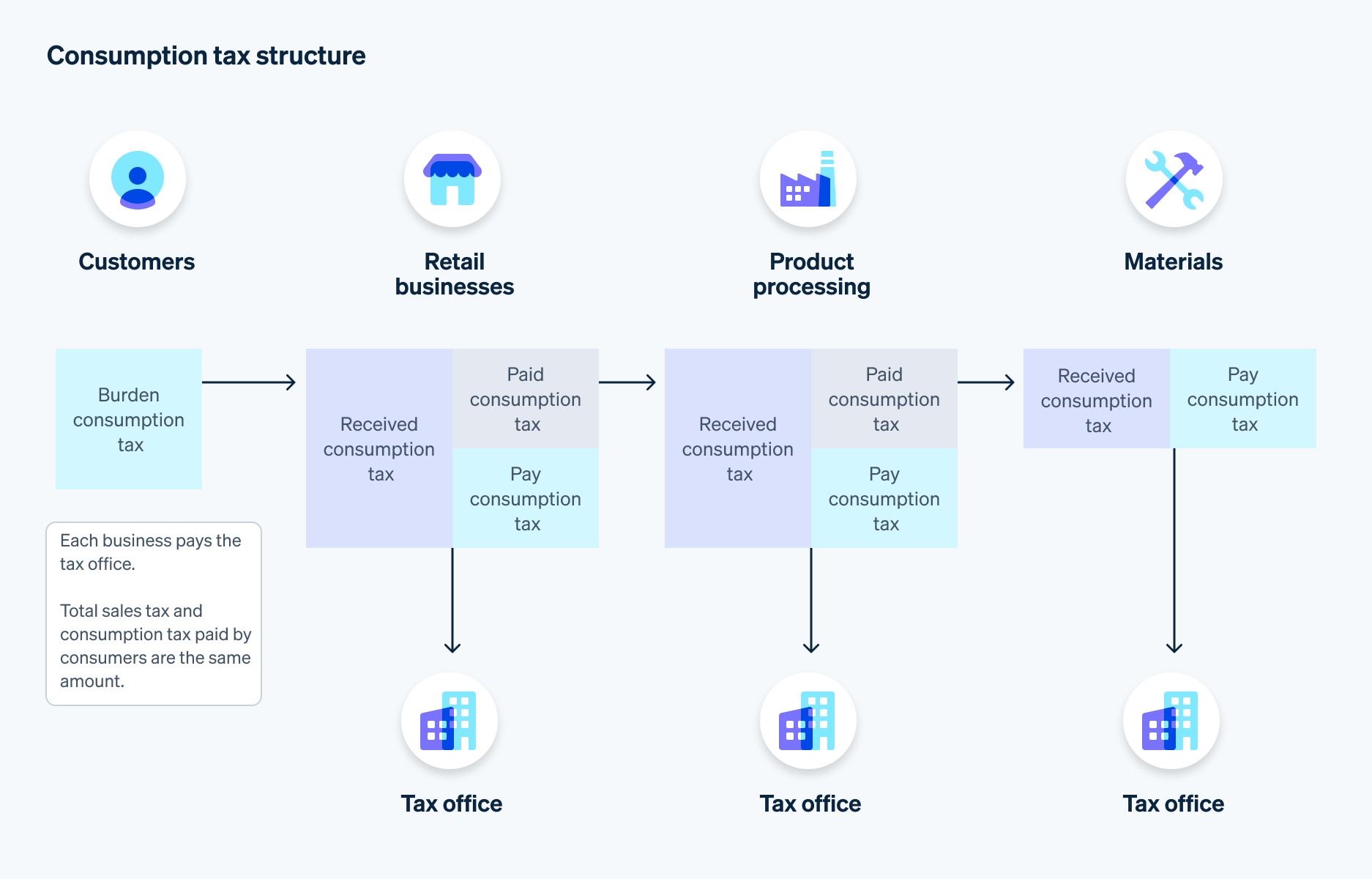

但是,客户不直接向政府缴纳消费税;相反,除了购买商品的价格外,他们还将其支付给企业。然后,收到消费税的企业在扣除其支付给购买来源的消费税负担金额后,向相关税务局支付差额(该扣除额为购买税抵免)。

因此,消费税是客户的责任,而不是企业的责任,企业代表客户间接支付。

另一方面,免税企业不缴纳消费税。

到目前为止,客户无法知道销售商品或服务的商店是应税还是免税。但是,为了满足发票申报 中定义的发票或简易发票 的要求,企业现在还必须在收据 上标注合格发票系统注册号,因此即使是普通客户也有更多机会看到此类文件,而且可以通过注册号确定企业是否应纳税。请注意,只有应税企业(在发票系统下注册的合格发票企业)才能开具合格发票。

应税企业有哪些要求?

企业必须满足几个条件才有资格纳税。如果企业满足以下任何条件,则应纳税,必须缴纳消费税:

前两年(或前两个会计年度)的应税销售额超过 1000 万日元。

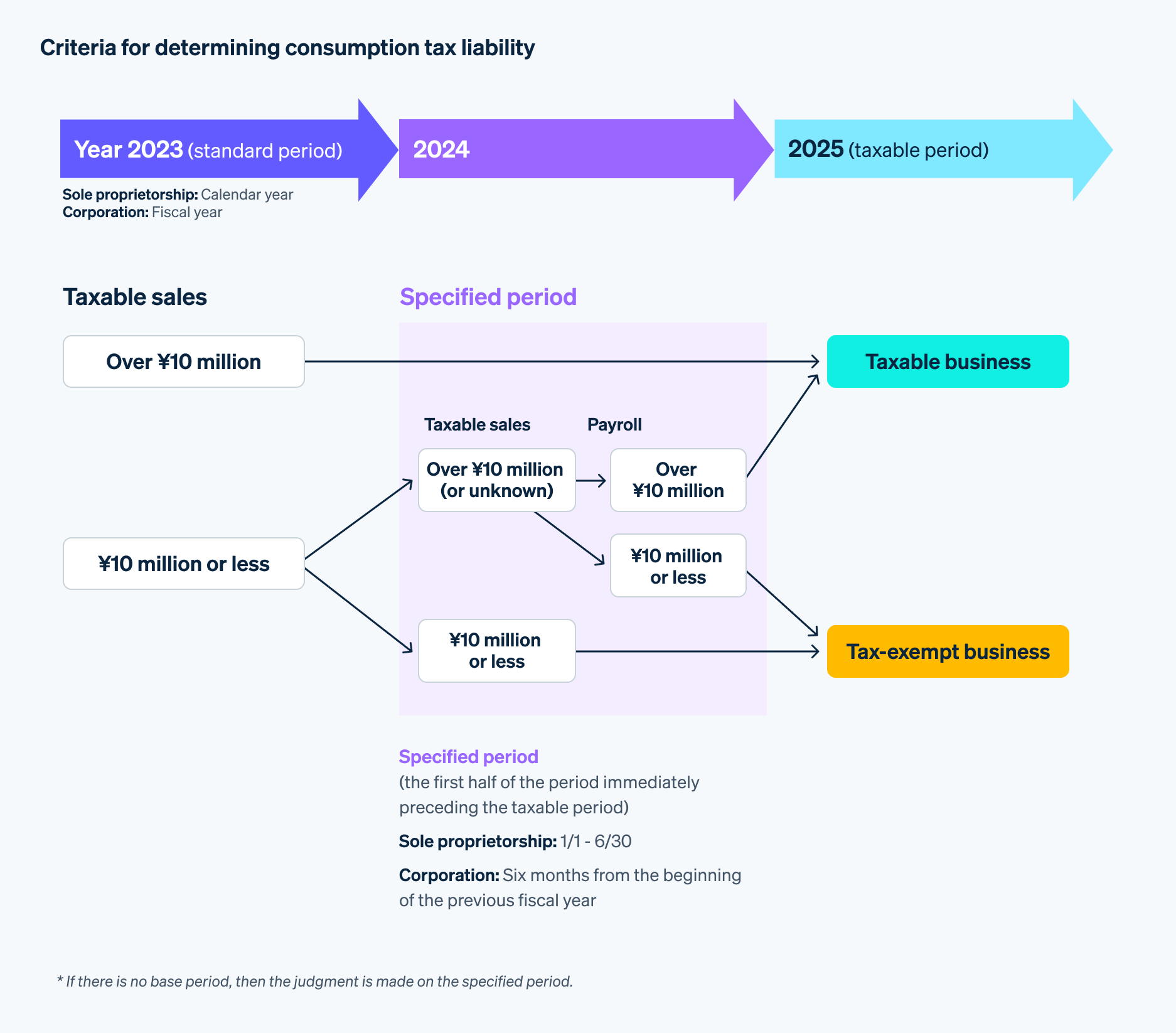

要确定企业是应税还是免税,关键是其前两年对独资经营者或公司的应税销售额是否超过前两个财政年度的 1000 万日元。这使得企业在下一年(或公司为下一财政年度)纳税。

例:2023 年 1 月 1 日至 12 月 31 日期间应税销售额为 800 万日元,2024 年 1 月 1 日至 12 月 31 日期间应税销售额为 1100 万日元的免税企业,包括独资企业,将在 2025 年免税,但将在 2026 年征税。

上半年应税销售额超过 1000 万日元(独资企业)

如果独资经营者在特定期间(1 月 1 日至 6 月 30 日)的上半年应税销售额或支付的工资超过 1000 万日元,则该经营者将在下一年度纳税。如上所述,符合这些条件的企业,无论其前两年的应税销售额如何,都应缴纳消费税。但是,即使指定期间的应税销售额超过 1000 万日元,如果工资和其他付款总额不超过 1000 万日元,则根据工资和其他付款的金额免税。

上一年度上半年的应税销售额超过 1000 万日元(法人)

如果企业在上一会计年度的前六个月支付的应税销售额或工资等超过 1000 万日元,则应纳税。请注意,在这种情况下,与独资企业条件一样,无论企业在前两个财政年度的应税销售额如何,该企业都将应纳税。

与独资企业一样,即使特定时期的应税销售额超过 1000 万日元,如果工资和其他付款总额不超过 1000 万日元,则根据工资和其他付款的金额免税。

除上述与一定时期内支付的销售额和工资等相关的条件外,以下情况也属于应税企业:

资本金在 1000 万日元以上的新设法人

原则上,资本金低于 1000 万日元的新成立法人在第一和第二会计年度免税,但如果资本超过 1000 万日元以上,则从成立的第一个会计年度开始纳税。另一方面,没有资本概念的独资企业在开业后的前两年是免税的,因为它在开业时没有销售收入来检查它是否需要纳税。

新成立的特定法人

新成立的特定法人是指母公司、关联公司或个人拥有公司 50% 以上的股份,且所有者的应税销售额超过 5 亿日元的公司。在这种情况下,即使新成立的公司的资本金低于 1000 万日元,从成立的第一年开始就是应税企业,不符合免税条件。

企业向税务局提交《消费纳税人选举纳税报告》

即使是属于免税业务类别的企业,也可以通过自愿提交《消费纳税人选举纳税报告》 转为应税企业。有关提交截止日期的更多信息,请参阅“关于《消费纳税人选举纳税报告》的说明”。

免税企业自愿成为应税经营者时,必须提交《消费纳税人选举纳税报告》。因此,免税企业没有义务缴纳消费税,可以保持免税状态。

在发票系统下注册为合格发票业务经营者

除了选择消费纳税人的纳税报告程序外,还存在小企业(如独资企业)因消费税而应纳税的情况。

如果您注册为合格的发票企业,即使您不符合应税企业的条件,即销售额在 1000 万日元以下的独资企业,您也将成为应税企业。因此,为避免在不知不觉中成为应税经营者,在决定是否成为合格的发票经营者之前,请加深对发票制度的了解,并考虑您的业务规模和损益。

如果您成为合格的发票企业,作为遵守发票系统的一项措施,则可能需要考虑实施一个系统,允许您在单个系统中开具、存储和管理满足合格发票要求的单据。Stripe Invoicing 可以处理与发票相关的需求,并按照发票系统创建发票,这将有助于微调后台操作。Stripe Tax 具有可根据需要自定义的自动消费税计算功能,可自动处理所有电子交易的税务,从而实现顺畅高效的操作。

什么是消费税应税交易?

应税交易是指需要缴纳消费税的交易。如果交易满足以下所有要求,则应纳税:

在日本进行的交易:消费税涵盖在日本进行的交易。因此,日本消费税不适用于在美国或欧洲进行的交易。例如,在“资产转让或出借”时,如果资产在日本,则为国内交易,同样,如果您在日本开展“提供服务”,则为国内交易。

企业作为企业进行的交易:“企业”是指独资企业和公司,“作为业务”是指重复、连续和独立地进行交易。例如,私家车、房屋等的销售,不是作为企业,而是仅作为个人,无需缴纳消费税。

对价交易:“对价交易”包括销售商品收取货款、租用办公室收取租金等。因此,对于捐赠、赠款或免费获得的服务,不征收销售税。

资产转让、资产贷款或提供服务(服务)的交易:正如国税厅 (NTA) 在“资产转让等” 中指出的,这些交易与上述“对价交易”相关,并且您作为企业进行这些交易是有偿的(例如,销售商品;向他人出借资产;提供基于专业知识或能力的服务,如注册会计师和律师)。

请注意,如果企业不符合上述任何要求,则不征收消费税。

消费税申报和支付

对于公司和独资经营者,向对纳税地点有管辖权的税务局提交纳税申报表。

至于付款,由于税务局在您提交纳税申报表后不会向您发送付款单,因此您自己进行适当的付款很重要。

如果是法人,您必须在会计年度结束后的第二天(会计月份的最后一天)起两个月内提交消费税申报表和付款。例如,如果会计年度从每年的 4 月 1 日开始,到 3 月 31 日结束,则付款的到期日为 5 月 31 日。

至于独资经营者的申报截止日期,则为次年 3 月 31 日(如果是周六或周日,则为下周一),但请注意,该日期与所得税申报截止日期(3 月 15 日)不同。

您可以在税务局提交纳税申报表,也可以通过邮寄或电子税务。您可以在税务局或通过其他方式付款,例如信用卡付款和在便利店付款。详情请参阅“国税缴纳程序”。

关于《消费纳税人选举纳税报告》的说明

如前所述,企业是否应税取决于应税销售额等条件。如果不符合应税条件的免税企业成为应税企业,则通过提交《消费纳税人选举纳税报告》进行更改。

以下是免税企业在提交报告之前应了解的一些事项:

何时提交《消费纳税人选举纳税报告》

根据 NTA 的 《消费纳税人选举纳税报告》程序页面,企业必须在其希望进行变更的应税期(财政年度的最后一天)的第一天前提交《消费纳税人选举纳税报告》。

例如,如果某公司的财政年度为 4 月 1 日至 3 月 31 日,并从下一个财政年度开始纳税,则提交《消费纳税人选举纳税报告》的截止日期为本会计年度的 3 月 31 日。对于独资经营者,通知必须在其纳税年份前一年的 12 月 31 日之前提交。

在选举程序成为应税企业后,我怎样才能再次成为免税企业?

在这种情况下,请遵循《消费纳税人选择不适合性纳税报告》程序。请注意,选择应税企业后,从应纳税期的第一天起两年内无法更改为免税企业。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。