Säljare utfärdar ett dokument som kallas kvitto till köpare för att intyga transaktionen av pengar eller andra medel.

Kvittot innehåller namnet på det företag som utfärdat kvittot (säljaren), namnet på den som betalar pengarna (köparen), utfärdandedatum (transaktionsdatum), uppgifter om köpet och det belopp som betalats. Det är viktigt att korrekt inkludera konsumtionsskatt på varor och tjänster på ett kvitto.

I den här artikeln beskriver vi hur man redovisar konsumtionsskatt och annan information på kvitton.

Vad innehåller den här artikeln?

- Grundläggande information vid skapande av kvitto

- Detta behöver du veta om konsumtionsskatt innan du gör kvitton

- Så inkluderar man konsumtionsskatt och andra uppgifter på kvitton

- Hänga med i tiden

Grundläggande information vid skapande av kvitto

Ett kvitto innehåller vanligtvis datum, belopp, information om artikel eller tjänst, adress, uppdelning osv. Man behöver inte använda en specifik mall, och alla format är godtagbara så länge de presenterar nödvändiga uppgifter tydligt och på ett sätt som kunden kan förstå. Det finns dock några saker att tänka på när man upprättar kvitton för att förhindra fel eller fusk.

Kvitton fungerar som bevis på köp och betalning och är viktiga dokument som krävs för skatterapportering. Därför är det oerhört viktigt att redovisa korrekt information på dem och hantera och lagra dem på rätt sätt.

Summan som visas på kvittot påverkar avdragen man får göra i skattedeklarationen. För att lämna in en skattedeklaration utan fel eller utelämnanden måste du veta om du ska inkludera konsumtionsskatten som är kopplad till detta belopp på kvittot och hur du ska visa den.

En annan viktig punkt gäller det nya systemet för kvalificerade fakturor. Anta att du utfärdar ett kvitto som en kvalificerad faktura. I så fall måste den uppfylla kraven för förenklad faktura (beroende på företagsform behandlar skattemyndigheten dem som förenklade fakturor).

För mer information om att utfärda kvitton enligt det nuvarande fakturasystemet, se följande artikel: "Kvittonas roll i fakturasystemet och hur man utfärdar dem."

Detta behöver du veta om konsumtionsskatt innan du skapar kvitton

Japan har för närvarande två konsumtionsskattesatser: 8 % och 10 %. Dessa grundar sig på systemet med reducerade skattesatser som infördes när regeringen höjde skattesatsen till 10 % efter skattereformen i oktober 2019. Den reducerade skattesatsen är 8 %.

Företag måste hantera flera skattesatser som varierar beroende på artikel, och att tillämpa avdraget för inköp är en anledning till att företag måste vara särskilt försiktiga med dessa skattesatser.

För att få avdrag för skatt på inköp måste företag tillhandahålla och spara dokument som följer reglerna i fakturasystemet och tydligt ange tillämpliga skattesatser (se den nationella skattemyndighetens ”Sammanfattning av metoden för bevarande av kvalificerade fakturor" [sidan 5] som beskriver vilken information som behöver anges på kvalificerade och förenklade fakturor).

I Japan är det viktigt att förstå att det finns en standardkonsumtionsskattesats och en reducerad konsumtionsskattesats och att flera skattesatser måste beaktas när man skapar kvitton.

Följande avsnitt presenterar några viktiga punkter att tänka på när man inkluderar konsumtionsskatt på kvitton.

Så inkluderar man konsumtionsskatt och andra uppgifter på kvitton

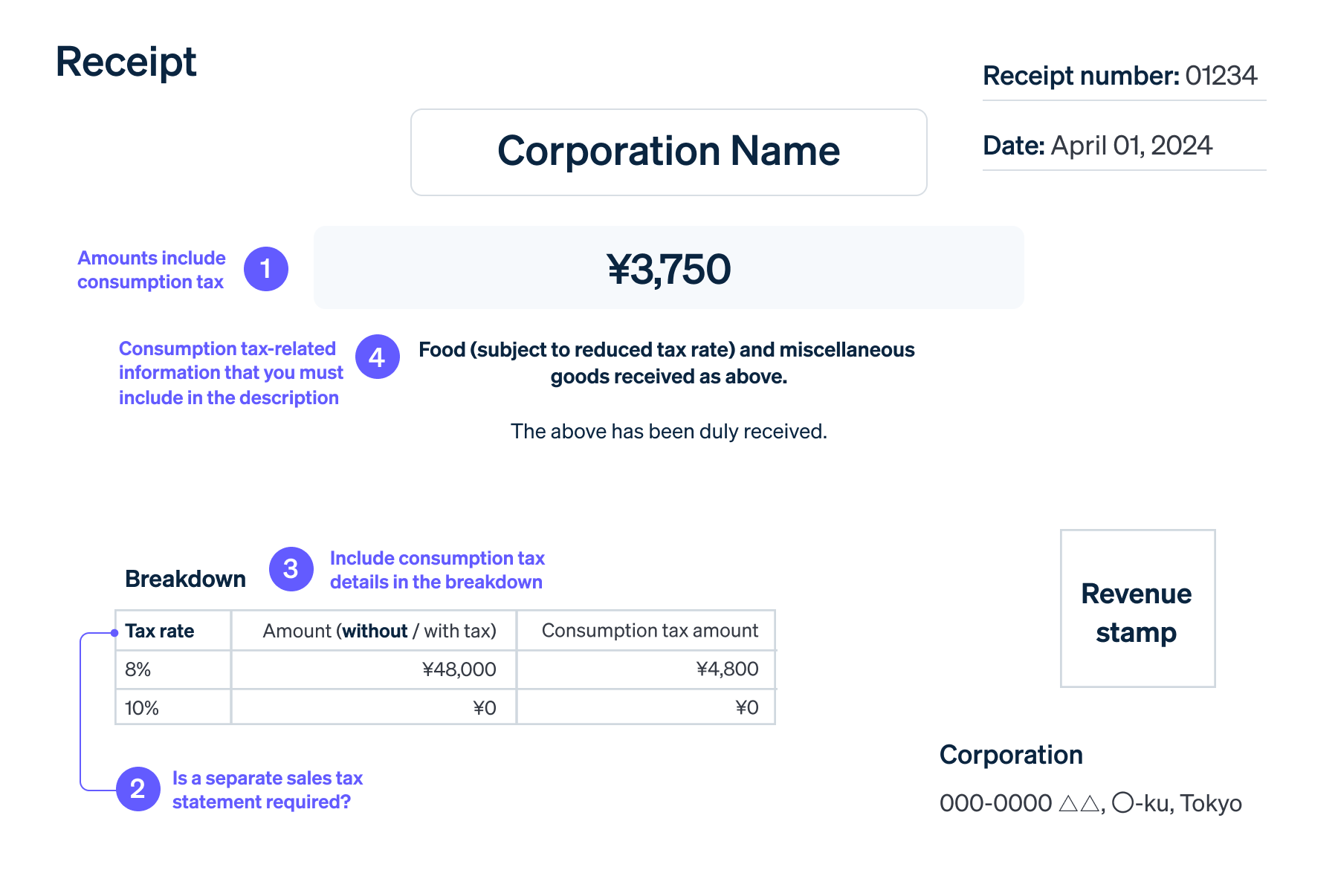

1. Belopp är inklusive konsumtionsskatt

Beloppet som visas på kvittot inkluderar alltid skatt och är det belopp som köparen betalt. Därför måste man ange prisuppgifterna, exklusive skatt och omsättningsskatt, i "uppdelningen" i not ③ nedan.

När man anger monetära belopp, oavsett om de är handskrivna eller digitala ska varje siffra börja med "¥" och sluta med "ー" och man ska skriva "," vid var tredje siffra för att skilja tusental åt. Detta bidrar till att förhindra manipulering. Var försiktig så att du inte lämnar för mycket utrymme mellan symboler eller siffror.

Exempel på beloppskolumnen

- ¥30,000 ー

2. Krävs en separat skattedeklaration för omsättningsskatt?

En säljare utfärdar vanligtvis ett kvitto när han eller hon tar emot betalning baserat på priset "inklusive skatt".

Men eftersom det inte finns någon skyldighet att ange konsumtionsskatt separat på kvittot, blir det ingen rättslig påföljd om man inte inkluderar den.

Men för att undvika problem och missförstånd är det bäst att ange priset, exklusive skatt, beloppet för konsumtionsskatt och det totala beloppet inklusive skatt som betalats för varorna.

Beträffande avdragsrätt för skatt på inköp, är det så att om konsumtionsskatten inte specificeras på kvittot enligt fakturasystemets krav, kanske det köpande företaget inte kan utnyttja avdraget, vilket kan annullera transaktionen.

För att undvika detta är det viktigt att komma ihåg att nämna konsumtionsskatt på kvitton i enlighet med fakturasystemet för att underlätta köp mellan säljare och köpare.

3. Inkludera uppgifter om konsumtionsskatt i uppdelningen

Uppdelningen omfattar vanligtvis det totala beloppet för varje skattesats, uppdelat i 8 % och 10 %. Summan kan vara antingen inklusive eller exklusive skatt, men det blir lättare att förstå om beloppet exklusive konsumtionsskatt redovisas separerat från konsumtionsskatten. Du kan visa uppdelningen av transaktionsbeloppen separat.

Sedan lanseringen av fakturasystemet måste en säljare som utfärdar ett kvitto som en kvalificerad faktura ange det totalt betalda beloppet (antingen exklusive eller inklusive skatt), tillämplig skattesats (8 % eller 10 %) och det totala konsumtionsskattebeloppet för varje skattesats separat, enligt nedan.

Exempel på uppdelning av konsumtionsskatt (när betalningsbeloppet)

Skattesats 10 %:

Exklusive skatt 50 000 JPY

Konsumtionsskatt 5 000 JPYSkattesats: 8 %:

Exklusive skatt 10 000 JPY

Konsumtionsskatt 800 JPY

4. Information om konsumtionsskatt som måste anges i beskrivningen

Beskrivningen anger vanligtvis den avsedda användningen. Den måste också specificera alla artiklar som omfattas av den reducerade skattesatsen. Observera att om man lämnar beskrivningen tom, eller om man bara skriver "kostnad för varor", kommer skattemyndigheten inte att godkänna det som en verifikation eftersom de inte kan verifiera uppgifterna om transaktionen, vilket innebär att man kanske inte kan bokföra det som en utgift.

När ett företag utfärdar ett kvitto som en kvalificerad eller förenklad faktura måste det alltid framgå av kvittot om det omfattas av den reducerade skattesatsen.

Exempel på beskrivningar

- Livsmedel (med reducerad skattesats) och diverse varor enligt ovan

- * omfattas av reducerad skattesats

Eftersom utrymmet på ett typiskt kvitto kan vara begränsat kan beskrivningen vara kortfattad, som du ser i det första exemplet ovan. För varor som omfattas av den reducerade skattesatsen anger man inom parentes att de omfattas av den.

När en kund köper flera artiklar med olika skattesatser samtidigt och man använder symboler som "*" eller "☆" som i det andra exemplet ovan, måste man inkludera information som artikelnamn, köpt kvantitet och enhetspris exklusive skatt i en separat ruta för att ange vilken artikel symbolen hänvisar till.

- Produkt A*: 1 artikel, ¥1,000

- Produkt B: 1 artikel, ¥2,000

Häng med i tiden

I den här artikeln beskriver vi hur man hanterar konsumtionsskatt när man upprättar kvitton. Skattesatserna har ökat stadigt sedan skatten infördes av skattemyndigheten, och systemet kan komma att revideras ytterligare.

Företag måste hålla sig uppdaterade om den senaste utvecklingen inom system och policyer för att hålla jämna steg med förändringar i skattesatser.

Onlineverktyg med anpassningsbara kvittomallar och automatisk generering är användbara för att skapa dem. Du kanske också vill överväga att införa funktioner för automatisk beräkning av skatt och introducera bokföringsprogram som kan anpassas för att möta dina behov.

Stripe erbjuder Stripe Tax, som automatiskt kan identifiera och återspegla skattesatsen på 8 % eller 10 % på olika produkter, automatisera behandlingen av skatt på alla elektroniska transaktioner och förbättra effektiviteten. Detta bidrar till att förbättra och effektivisera olika backoffice-moment relaterade till konsumtionsskatt.

Stripe Payments kan hantera många olika faktureringsmetoder och tillgodose alla transaktionsbehov från godkännande av betalningar till informationsbehandling och intäktshantering på en enda plattform.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.