Sellers issue a document called a receipt to buyers to certify the transaction of money or other items.

A receipt contains the name of the company issuing it (seller), the name of the party paying the money (buyer), the date of issue (transaction date), the details of the purchase, and the amount paid. It’s important to correctly include consumption tax on goods and services on a receipt.

This article explains how to record consumption tax and other information on your receipts.

What’s in this article?

- Receipt creation 101

- What you need to know about consumption tax before making receipts

- How to include consumption tax and other details on receipts

- Keeping up with the times

Receipt creation basics

A receipt typically contains the date, amount, item or service details, address, breakdown, etc. There is no need to use a specific template, and any format is acceptable as long as it presents the necessary data clearly and in a manner that the customer can understand. However, there are a few things to keep in mind when preparing receipts to prevent errors or tampering.

Receipts serve as proof of purchase and payment and are key documents required for tax reporting. Therefore, it is extremely important to record information on them accurately and manage and store them properly.

The total shown on the receipt affects deductions for tax reporting purposes. To file a tax return without mistakes or omissions, you must know whether to include the consumption tax associated with this amount on the receipt and how to display it.

Another important point involves the new Qualified Invoice System. Suppose you issue a receipt as a qualified invoice. In that case, it must meet the requirements of the simplified invoice (depending on the business type, the tax authority treats them as simplified invoices).

For more information on issuing receipts under the current Invoice System, please refer to the following article, “The role of receipts in the Invoice System and how to issue them”.

What you need to know about consumption tax before creating receipts

Japan currently has two consumption tax rates: 8% and 10%. These are based on the reduced tax rate system introduced when the government raised it to 10% following the October 2019 tax reform. The reduced rate is 8%.

Businesses must handle multiple rates that vary by item, and applying the deduction for purchases is one reason why businesses must be particularly careful regarding these rates.

To receive credit for purchase tax, companies must provide and maintain documents that comply with the Invoice System and clearly state the applicable rates (please refer to the National Tax Agency’s “Outline of the Qualified Invoice Preservation Method” [page 5] for the required information on qualified and simplified invoices).

In Japan, it is important to understand that there is a standard rate and a reduced rate of consumption tax and that multiple rates must be considered when preparing receipts.

The following sections will introduce some key points to keep in mind when including consumption tax on receipts.

How to include consumption tax and others details on receipts

1. Amounts include consumption tax

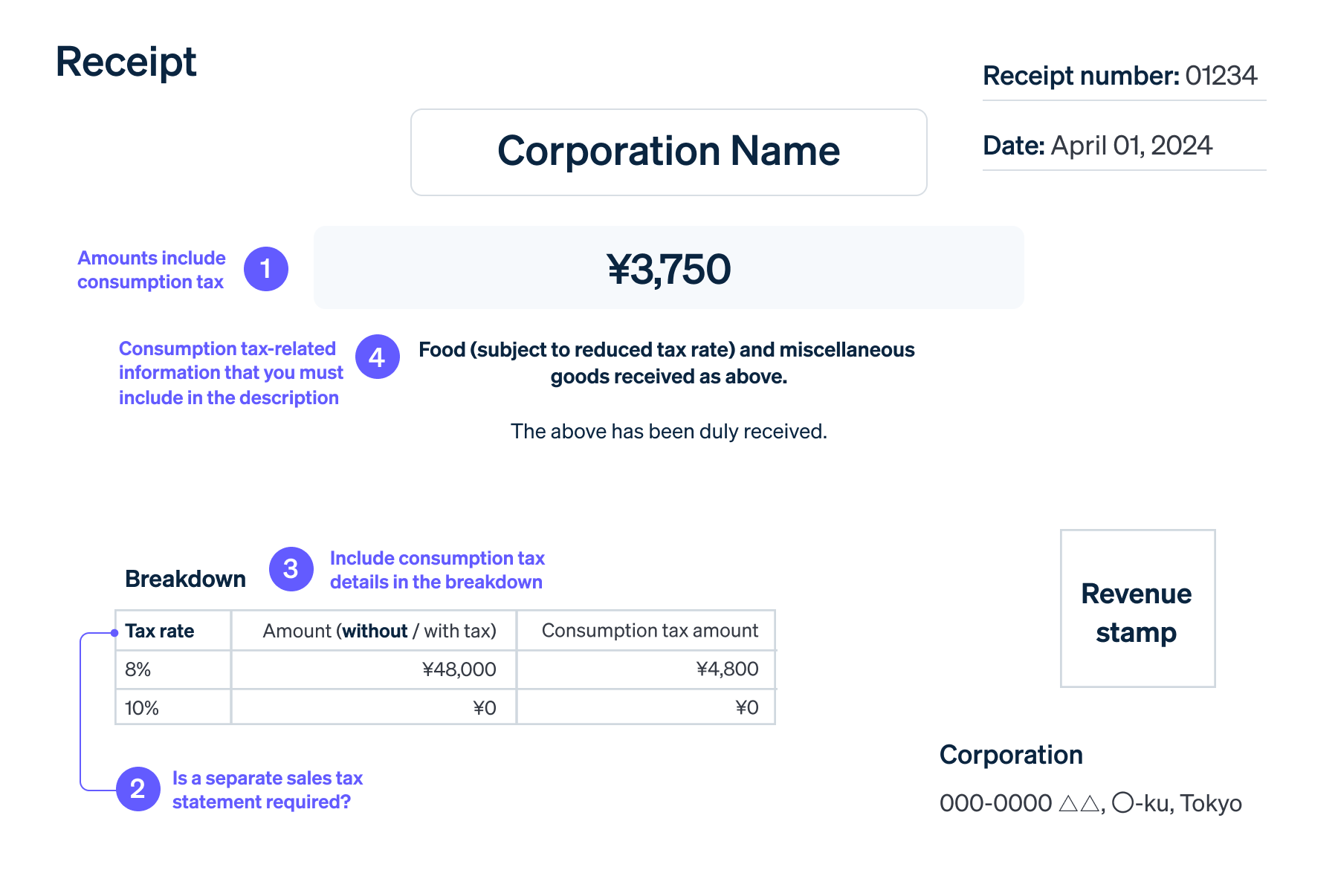

The amount shown on the receipt always includes tax and is the total the buyer paid. Therefore, you need to specify the price details, excluding tax and sales tax, in the “breakdown” in Note ③ below.

When entering monetary amounts, whether handwritten or digital, please begin each number with “¥” and end with “ー”, and type “,” for every three digits to separate thousands. This helps prevent tampering. Please be careful not to leave too much space between symbols or numbers.

Example of the amount column

- ¥30,000 ー

2. Is a separate sales tax statement required?

A seller will usually issue a receipt upon receiving payment based on the ”tax included” price.

However, since the receipt is not required to list consumption tax separately, there is no legal penalty for not including it.

But, to avoid problems and misunderstandings, it is best to state the price, excluding tax, the amount of consumption tax, and the total including tax paid for the goods.

For purchase tax credit purposes, if the receipt does not disclose the consumption tax as required by the Invoice System, the purchasing business might not be able to apply the credit, which could cancel the transaction.

To avoid this, it is important to remember to mention consumption tax on receipts in compliance with the Invoice System to facilitate purchases between business sellers and purchasers.

3. Include consumption tax details in the breakdown

The breakdown usually includes the total amount of each rate, split into 8% and 10%. The total can be either inclusive or exclusive of tax, but it will be easier to understand if the exclusive amount is separated from the consumption tax. You can list the breakdown of transaction amounts separately.

Since the launch of the Invoice System, when a seller issues a receipt as a qualified invoice, it must state the total paid (either excluding or including tax), the applicable tax rate (8% or 10%), and the total consumption tax amount for each rate separately, as shown below.

Examples of consumption tax breakdown (when the payment amount)

10% tax rate:

Excluding tax ¥50,000

Consumption tax ¥5,0008% tax rate:

Excluding tax ¥10,000

Consumption tax ¥800

4. Consumption tax-related information that you must include in the description

The description usually states the intended use. It needs to also declare any items subject to the reduced tax rate. Please note that if you leave the description blank, or if you simply write “cost of goods”, the tax authority will not recognise it as a voucher document because it cannot verify the details of the transaction, and as a result, you might not be able to record it as an expense.

When a business issues a receipt as a qualified or simplified invoice, it must always mention if it is subject to the reduced rate.

Examples of descriptions

- Food (subject to reduced tax rate) and miscellaneous goods as listed above

- * is subject to reduced tax rate

Since space on a typical receipt could be limited, the description might be brief, as shown in the first example above. For items subject to the reduced rate, specify in parentheses that they are subject to it.

When a customer purchases several items with different tax rates at the same time, if you use symbols such as “*” or “☆” as in the second example above, you need to include details such as item name, quantity purchased, and unit price excluding tax in a separate box to indicate which item the symbol refers to.

- Product A*: 1 item, ¥1,000

- Product B: 1 item, ¥2,000

Keeping up with the times

This article explains how to manage consumption tax when preparing receipts. Rates have steadily increased since it was introduced by the tax authority, and the system may be revised further.

Businesses must stay aware of the latest developments in systems and policies to keep up with changes in rates.

Online tools with customisable receipt templates and automatic generation are useful for creating them. You might also want to consider introducing automatic tax calculation functions and accounting software that can be customised to meet your needs.

Stripe offers Stripe Tax, which can automatically identify and reflect the 8% or 10% rate on different products, automating the tax processing of all electronic transactions and improving efficiency. This helps to improve and streamline various back-office operations related to consumption tax.

Stripe Payments can handle a multitude of billing methods, addressing all transaction needs from payment acceptance to information processing and revenue management in a single platform.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.