É essencial para criar uma empresa bem-sucedida ter um ecossistema que receba pagamentos de clientes e processe vendas a qualquer hora e em qualquer lugar. E as vendas que surgem quando você não tem acesso aos seus terminais de processamento de pagamento habituais?

Para isso, temos terminais virtuais. Para a maioria dos usuários, um terminal virtual está no sistema de pagamentos padrão, mas pode ser importante.

Explicamos o que é um terminal virtual, como funciona, por que pode ser necessário e o que os usuários da Stripe devem saber para configurá-lo.

Neste artigo:

- O que é um terminal virtual?

- Como funciona um terminal virtual?

- Quais tipos de empresas usam terminais virtuais?

- Vantagens dos terminais virtuais — e o único grande risco

- A Stripe oferece um terminal virtual?

O que é um terminal virtual?

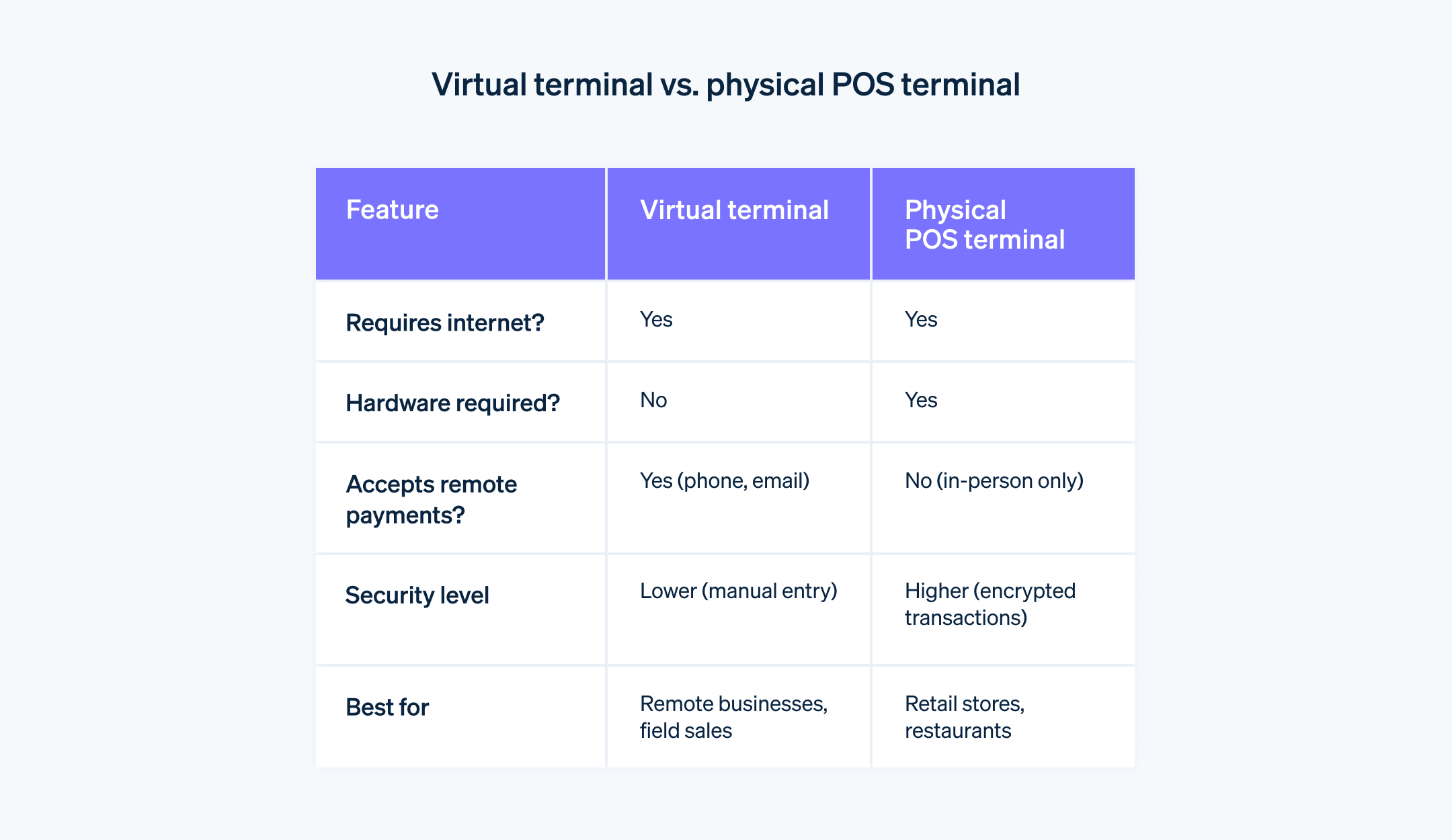

Os terminais virtuais operam com software baseado na web, permitindo que você processe pagamentos eletronicamente sem um terminal físico de ponto de venda (POS). Mesmo para usuários que costumam usar terminais de POS, os terminais virtuais oferecem outra maneira de processar transações de diversas origens, quando os terminais de pagamento tradicionais não estão disponíveis.

Como funciona um terminal virtual?

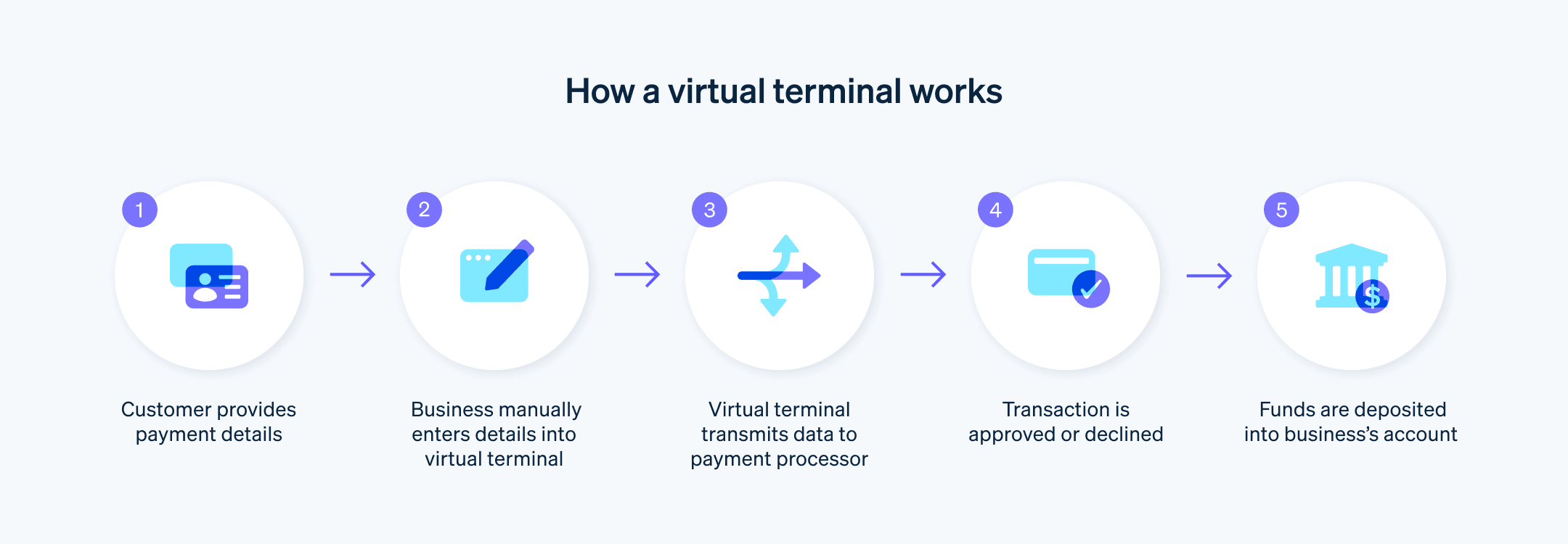

As empresas podem usar terminais virtuais para receber pagamentos de clientes por telefone, e-mail, fax ou pessoalmente em dispositivo conectado à internet, como um laptop, tablet ou smartphone. A maioria dos terminais virtuais aceita cartões de crédito e débito e também pagamentos por ACH. Ao contrário das transações presenciais feitas com máquina de cartão, os terminais virtuais exigem que o usuário insira manualmente os dados da transação e do pagamento.

Quais tipos de empresas usam terminais virtuais?

A maioria das empresas que recebem pagamentos de clientes pode se beneficiar do acesso a um terminal virtual. Mesmo que não use com frequência, incluir o terminal virtual na configuração geral de pagamentos evita atrasos inesperados no processamento de transações. Para algumas empresas, os terminais virtuais podem ser ideais para as operações do dia a dia. Alguns exemplos:

Restaurantes

Não é incomum que restaurantes e outros fornecedores de alimentação recebam pedidos online, por telefone e presenciais, num intervalo de poucos minutos. Os terminais virtuais podem ser fundamentais para o sistema de pagamentos de um restaurante, que é configurado para aceitar transações de diversas origens.Lojistas

Varejistas que vendem em diversas regiões também podem se beneficiar dos terminais virtuais. Por exemplo, se você vende cerâmica artesanal e tem um local físico permanente, mas também vende regularmente em feiras de artesanato ou informalmente para amigos, ter um terminal virtual significa que você pode processar pagamentos em qualquer lugar.Autônomos e consultores

Para quem é autônomo ou consultor e não costuma encontrar os clientes pessoalmente (pode ser um escritor, designer, contador, etc.) um terminal virtual permite aceitar pagamentos facilmente, sem investir em terminais físicos de POS e máquinas de cartão que talvez você acabe não usando.

Vantagens dos terminais virtuais — e o único grande risco

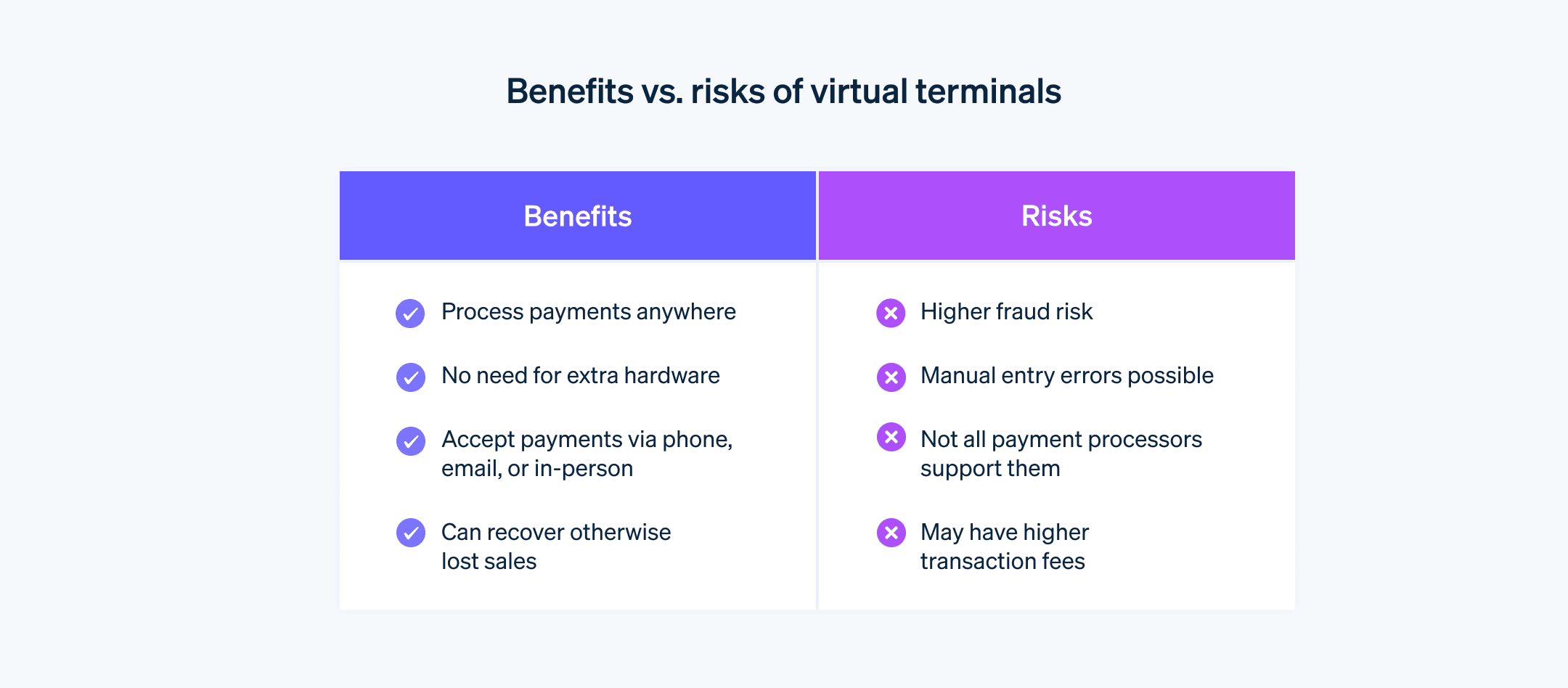

As vantagens de poder processar transações a qualquer hora, em qualquer lugar são óbvias, mas essa conveniência não vem sem risco. Veja um resumo dos prós e contras de usar um terminal virtual para processar pagamentos:

Vantagens

- Conveniência

Os terminais virtuais funcionam em qualquer dispositivo com um navegador de internet. Como a maioria das pessoas está sempre com um smartphone, os terminais virtuais são convenientes. - Flexibilidade

Os terminais virtuais podem ser usados em praticamente qualquer ambiente para aceitar pagamentos de diversas fontes: presencialmente, por telefone, e-mail ou até mesmo por correio. - Capturar vendas que poderiam ser perdidas

A maior vantagem dos terminais virtuais é dar aos empresários (ou funcionários designados) o poder de receber facilmente uma transação, mesmo que estejam longe do terminal de pagamento físico ou online da empresa. Isso significa que a empresa não perde vendas por não poder processar o pagamento, o que evita não só a perda de receita, mas também do valor vitalício do cliente (LTV).

- Conveniência

Riscos

- Segurança

O principal argumento contra os terminais virtuais é a sua segurança. Nos pagamentos presenciais feitos com máquina de cartão, ela transmite com segurança os dados do cartão para o POS do usuário e depois para o processador de pagamentos. Geralmente, esses dados são criptografados durante a transmissão para autorização. Em transações online sem cartão presente (CNP), o cliente insere seus dados de pagamento, como número do cartão, código CVV e endereço de cobrança. Com pagamentos feitos manualmente em terminal virtual, o usuário insere os dados de pagamento, uma forma inerentemente menos segura do que outras formas de pagamento.

- Segurança

A Stripe oferece um terminal virtual?

Empresas que usam Stripe podem adicionar um terminal virtual à sua plataforma Stripe. No entanto, eles não fazem parte das soluções prontas para uso da Stripe, principalmente porque dificultam a garantia de conformidade com nossos padrões severos de segurança e conformidade com PCI-DSS.

Para adicionar um terminal virtual à sua conta Stripe, é necessário uma API, que podemos ajudar você a configurar. Após criar seu terminal virtual, você poderá acessá-lo de qualquer navegador pelo Stripe Dashboard. Nosso objetivo é equilibrar a capacidade da empresa de aceitar pagamentos a qualquer hora e em qualquer lugar e garantir a maior segurança possível. Para manter altos padrões de segurança, os pagamentos em terminais virtuais devem ser considerados um método de backup útil, mas raro, para aceitar pagamentos por e-mail, fax ou telefone.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.