É sempre útil para as empresas ter uma visão geral dos pagamentos recebidos. Do mesmo modo, também devem informar os seus clientes sempre que tenham transferido pagamentos urgentemente esperados ou particularmente elevados. O aviso sobre remessas pode ajudar com isso. Neste artigo, você aprenderá sobre o que é aviso sobre remessas, quais informações o aviso sobre remessas deve incluir e se há uma obrigação de enviar aviso sobre remessas. Também explicaremos as diferenças entre aviso sobre remessas, comprovante de pagamento e notificação de fatura.

O que há neste artigo?

- O que é aviso sobre remessas?

- As empresas são obrigadas a enviar avisos sobre remessas?

- Quais informações os avisos de remessa devem incluir?

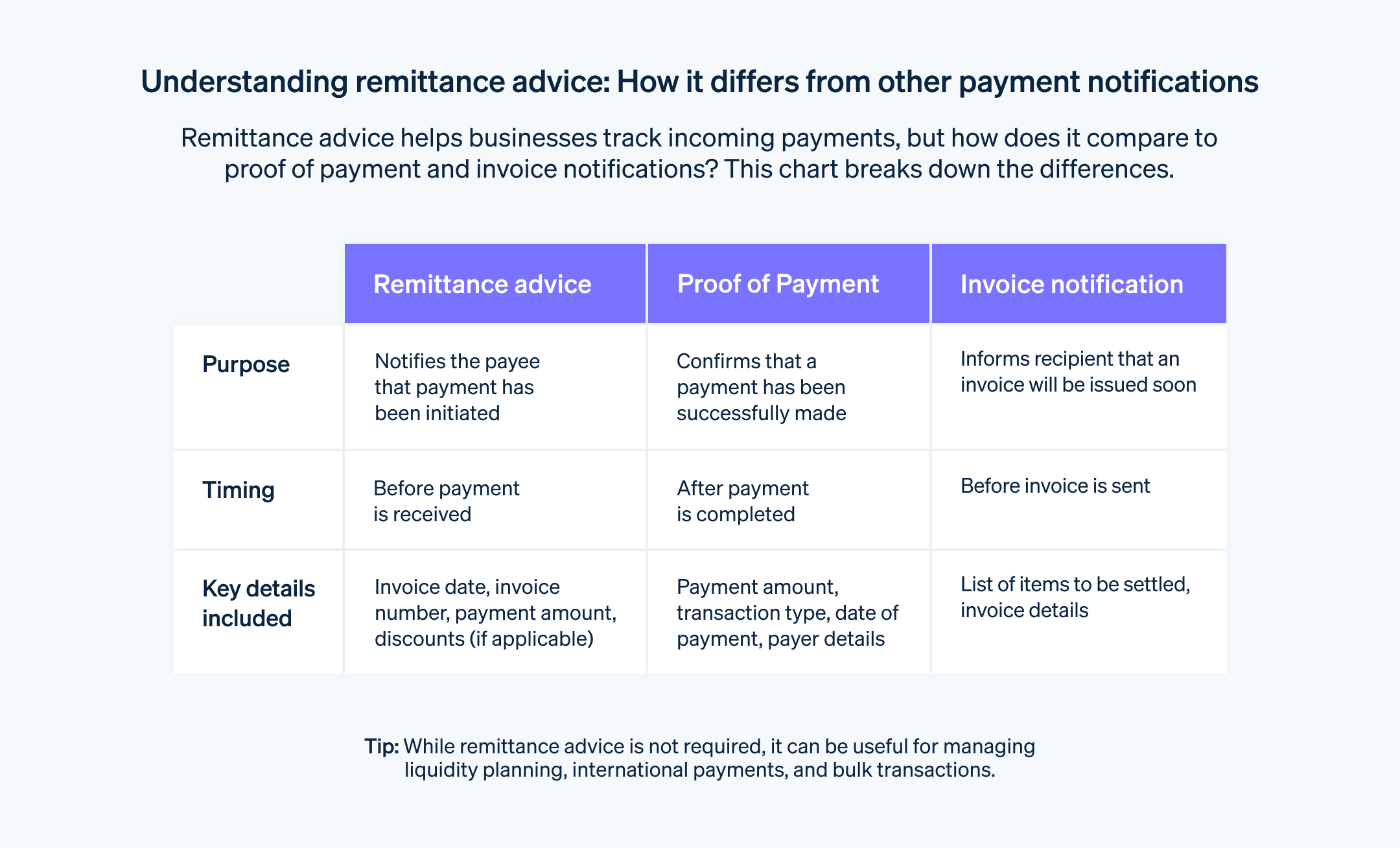

- Qual a diferença entre o aviso de remessa e o comprovante de pagamento e a notificação de fatura?

Como a IA está transformando os pagamentos: estratégias para impulsionar o crescimento da receita

Saiba como a IA pode otimizar todo o ciclo de vida dos pagamentos — desde o checkout até o gerenciamento de disputas — para ajudar você a aumentar a receita, reduzir custos e proporcionar uma melhor experiência ao cliente. Baixe o relatório.

O que é aviso sobre remessas?

Após a emissão da fatura, as empresas precisam aguardar para receber o pagamento. Um aviso sobre remessas (uma notificação do pagador de que o pagamento de uma fatura foi transmitido e será recebido muito em breve) é uma maneira útil de obter uma visão geral de faturas pendentes e pagamentos futuros a receber. O aviso sobre remessas pode ser emitido por qualquer uma das partes, dependendo do que foi acordado. É frequentemente usado para transferir grandes quantias, pagamentos urgentes e/ou transferências internacionais ou ao combinar pagamentos. Ele simplifica o planejamento de liquidez para o beneficiário e ajuda a alocar valores a itens individuais para pagamentos combinados. Nesse sentido, a palavra "aviso" significa "alerta".

No entanto, como a maioria dos pagamentos agora é feita digitalmente e recebida imediatamente, os avisos sobre remessas agora raramente são usados por empresas de e-commerce para faturamento. Originalmente, o aviso sobre remessas seria enviado com um cheque no correio e conteria informações sobre a finalidade do cheque. Essas informações poderiam então ser usadas pela pessoa que processa o cheque para ajudá-la a alocar o cheque para a fatura correta. Hoje, os programas contábeis fazem isso automaticamente usando inteligência artificial (IA) e comportamentos automatizados que ela cria.

As empresas são obrigadas a enviar avisos de remessa?

As empresas não são obrigadas a enviar avisos de remessa. Ao contrário, são vistos como uma cortesia. Da mesma forma, como empresa, você não precisa fazer nada quando recebe avisos de remessa.

É diferente do processo de débito automático SEPA, onde é obrigatório que o beneficiário informe imediatamente o pagador de um débito recebido.

Quais informações os avisos de remessa devem incluir?

Em geral, os pagadores devem listar todos os itens cobertos pelo pagamento. Os seguintes detalhes normalmente estão incluídos: data da fatura, número da fatura, qualquer desconto quando aplicável e o valor da fatura.

Qual é a diferença entre o aviso de remessa e o comprovante de pagamento e a notificação de fatura?

O aviso de remessa notifica que um pagamento está prestes a ser feito e apoia o processo de pagamento. Hoje em dia, o aviso de remessa assume a forma de e-mails gerados automaticamente. Podem incluir uma referência a uma ordem de pagamento.

Por outro lado, uma notificação de fatura é uma notificação de que uma fatura está prestes a ser recebida. Normalmente inclui uma lista de todos os itens a serem liquidados.

Por outro lado, o comprovante de pagamento serve como notificação de que um pagamento foi feito e ajuda as empresas a rastrear todos os pagamentos de entrada e saída. Mostra o que foi pago e de onde veio o dinheiro. O comprovante de pagamento inclui detalhes como valor, tipo de transação e data de pagamento. Pode assumir a forma de um recibo em dinheiro ou de uma transferência completa.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.