企业能够概览即将到来的付款情况始终有用。同样地,当客户转账紧急期望的款项或特别大额款项时,也应该通知客户。汇款通知可以帮助实现这一点。在本文中,您将了解什么是汇款通知、汇款通知应包括哪些信息,以及是否有义务发送汇款通知。我们还将解释汇款通知、付款凭单和账单通知之间的区别。

目录

- 什么是汇款通知?

- 企业是否有义务发送汇款通知?

- 汇款通知应包括哪些信息?

- 汇款通知与付款凭单和账单通知有何区别?

解码 AI 支付创新:驱动营收增长的策略指南

了解如何使用人工智能优化从结账到争议处理的整个支付生命周期,从而帮助您增加收入、降低成本并提升客户体验。下载报告。

什么是汇款通知?

在开具账单后,企业需要等待收款。汇款通知是一种来自付款方的通知,表示账单的付款已被处理并即将到账。这是一种帮助企业概览未结账单和预计收款的有用方式。汇款通知可以由任意一方发送,具体取决于双方的约定。通常在转账大额款项、紧急期望的付款和/或国际转账时,或者在合并多笔付款时会使用汇款通知。它简化了收款方的流动性规划,并有助于在合并付款中将金额分配到具体的项目。在这种情况下,“通知” (advice) 的意思是“告知”。

然而,由于如今大多数付款都是通过数字方式完成且能即时到账,电商企业现在很少使用汇款通知进行开账单。最初,汇款通知通常与邮寄支票一同发送,并包含有关支票用途的信息。处理支票的人可以使用这些信息将支票分配到相应的账单上。如今,会计程序通过人工智能 (AI) 及其创建的自动化行为自动完成这些操作。

企业是否有义务发送汇款通知?

企业没有义务发送汇款通知。相反,它被视为一种礼节性的行为。同样地,作为企业,当您收到汇款通知时,无需采取任何行动。

这不同于 SEPA 直接借记流程,在该流程中,收款人有义务迅速通知付款人即将发生的借记。

汇款通知应包括哪些信息?

付款人通常应列出付款涵盖的所有项目。以下是通常包括的详细信息:账单日期、账单号码、适用的折扣(如有)以及账单金额。

汇款通知与付款凭单和账单通知有何区别?

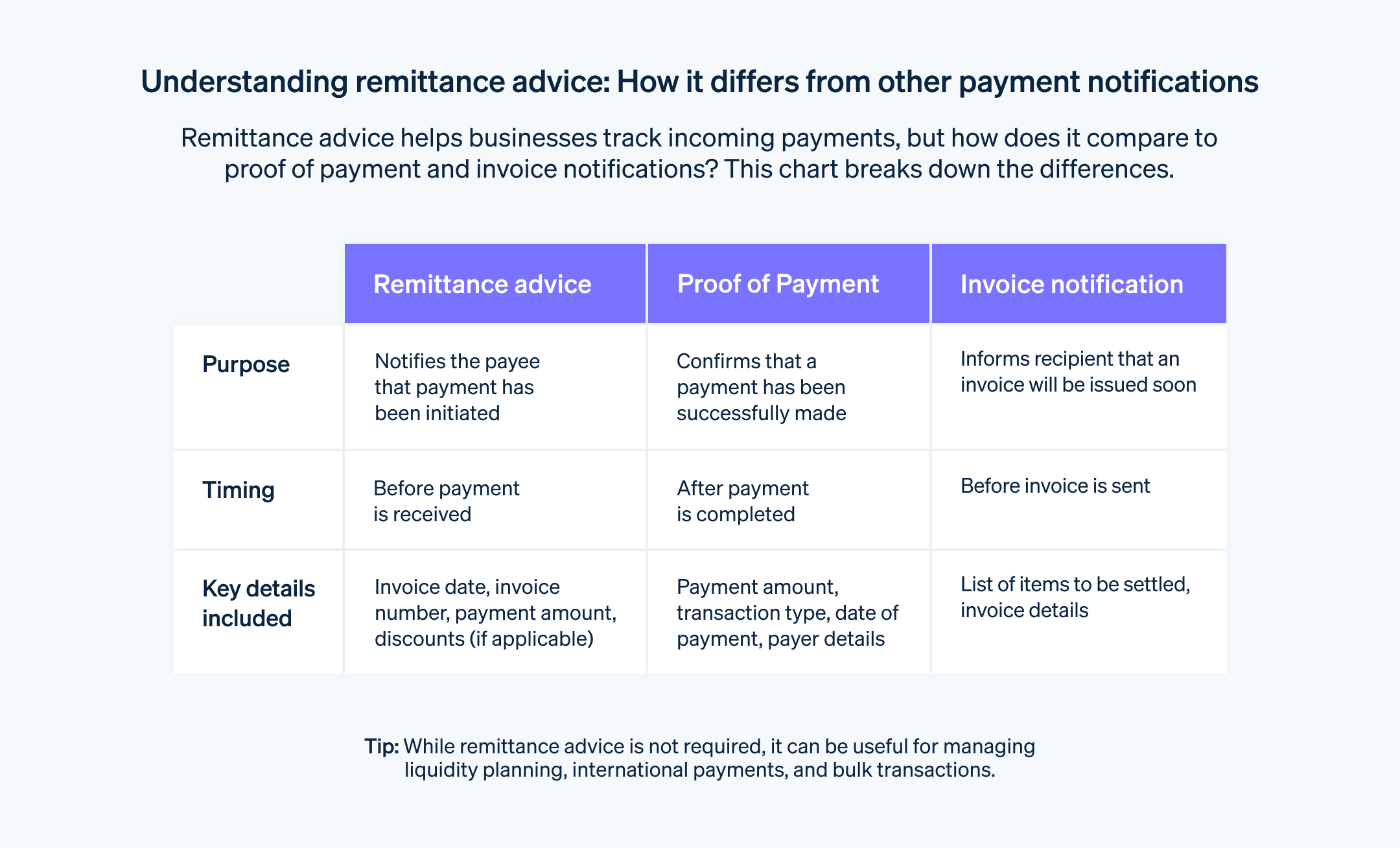

汇款通知是表示即将付款并支持付款流程的通知。如今,汇款通知通常以自动生成的电子邮件形式出现,并可能包含付款指令的参考信息。它们可能包括对付款订单的引用。

另一方面,账单通知是表示即将收到账单的通知。它通常包括待结算的所有项目清单。

相比之下,付款凭单是表示已完成付款并帮助企业跟踪所有收支的通知。它显示了已支付的金额以及资金来源。付款凭单包含金额、交易类型和付款日期等详细信息。它可能以现金收据或已完成的转账形式呈现。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。