A critical part of building a successful business is creating a payments ecosystem ready to accept customer payments and process sales at any time and anywhere. What about sales that come your way when you don’t have access to your usual payment processing terminals?

Enter virtual terminals. For most users, a virtual terminal is not a standard part of their payments arsenal, but it can be an important one.

We’ll cover what a virtual terminal is, how it works, why you might need to use one and what Stripe users should know about setting one up.

What's in this article?

- What is a virtual terminal?

- How does a virtual terminal work?

- What types of businesses use virtual terminals?

- Benefits of using virtual terminals – and the one big risk

- Does Stripe offer a virtual terminal?

What is a virtual terminal?

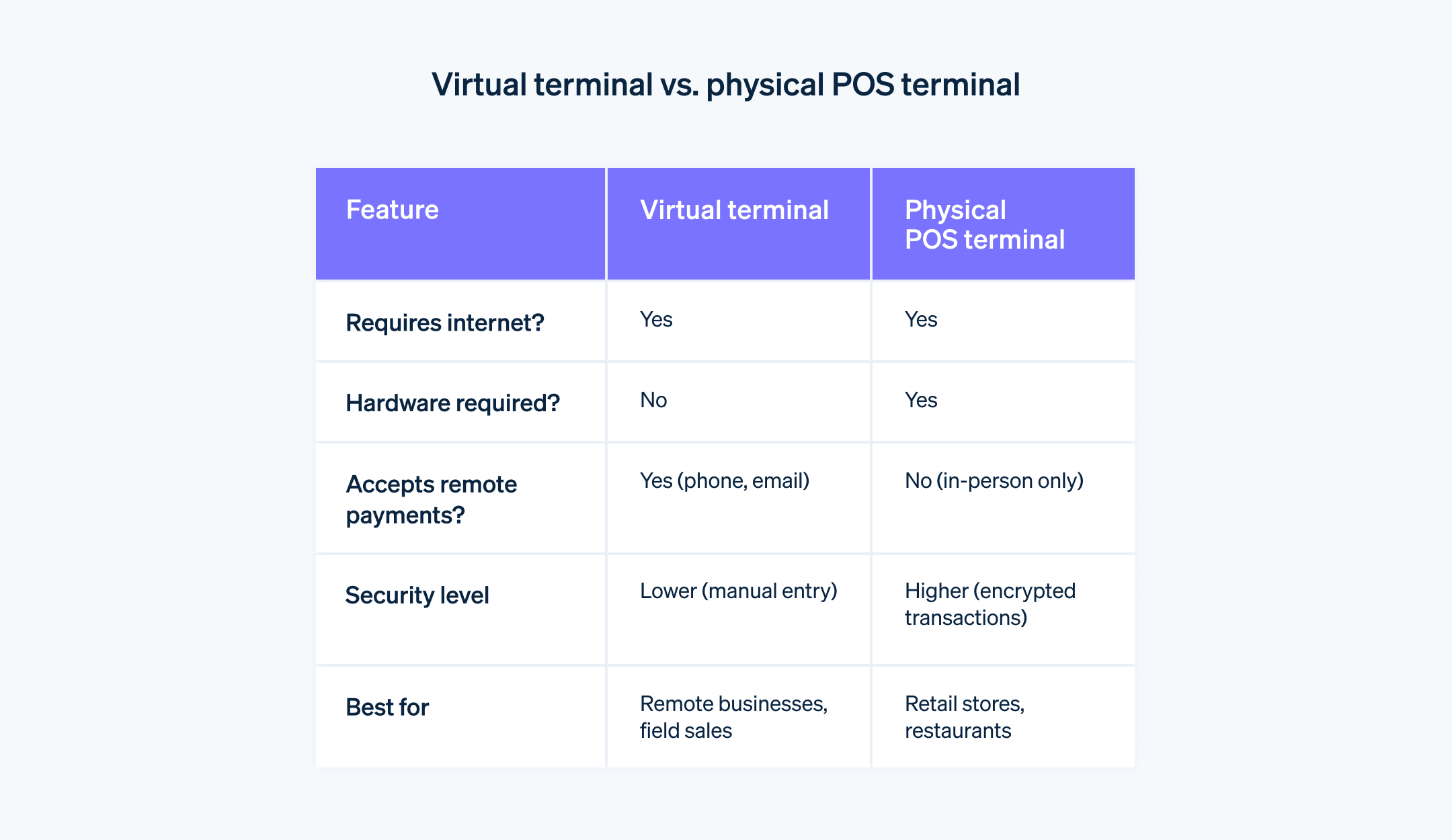

Virtual terminals operate using web-based software, giving you the ability to process payments electronically – without using a physical point of sale (POS) terminal. Even for users who normally use POS terminals, virtual terminals offer another way of processing customer transactions from a range of sources when traditional payment terminals aren’t available.

How does a virtual terminal work?

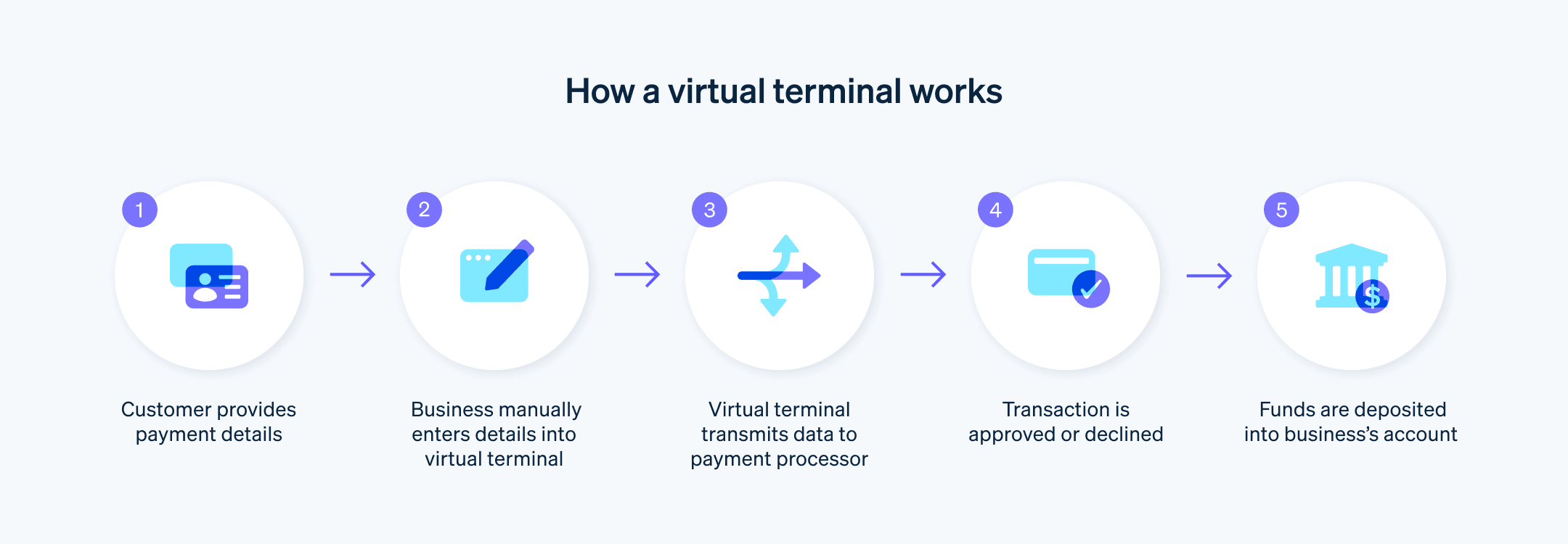

Businesses can use virtual terminals to accept payments from customers via telephone, email, fax or in person through an Internet-equipped device like a laptop, tablet or smartphone. Most virtual terminals accept credit and debit cards, as well as CHAPS payments. Unlike in-person transactions made with a card reader, virtual terminals require the user to manually input the transaction and payment information.

Which types of businesses use virtual terminals?

Most businesses that accept payments from customers could benefit from access to a virtual terminal. Even if you don’t use it frequently, having a virtual terminal as part of your overall payments setup means that you’ll never have to delay processing a transaction that comes up unexpectedly. And for many businesses, virtual terminals can be an ideal fit for day-to-day operations. Here are a few examples:

Restaurants

It’s not unusual for restaurants and other food-based users to accept customer orders online, over the phone and in person – all within the same minutes-long span. Virtual terminals can serve as a key piece in a restaurant’s overall payment system, one that is set up to field transactions from a variety of input sources.Retailers

Retailers who sell in a variety of settings can also benefit from virtual terminals. For instance, if you sell handmade ceramics and have a permanent brick-and-mortar location but also regularly sell at craft fairs or informally to friends, having a virtual terminal means that you can process payments anywhere.Freelancers and consultants

If you’re a freelancer or consultant who rarely sees clients in person – think writer, designer, accountant and countless others – a virtual terminal allows you to accept payments easily, without investing in physical POS terminals and card readers that you might not end up using.

Benefits of using virtual terminals – and the one big risk

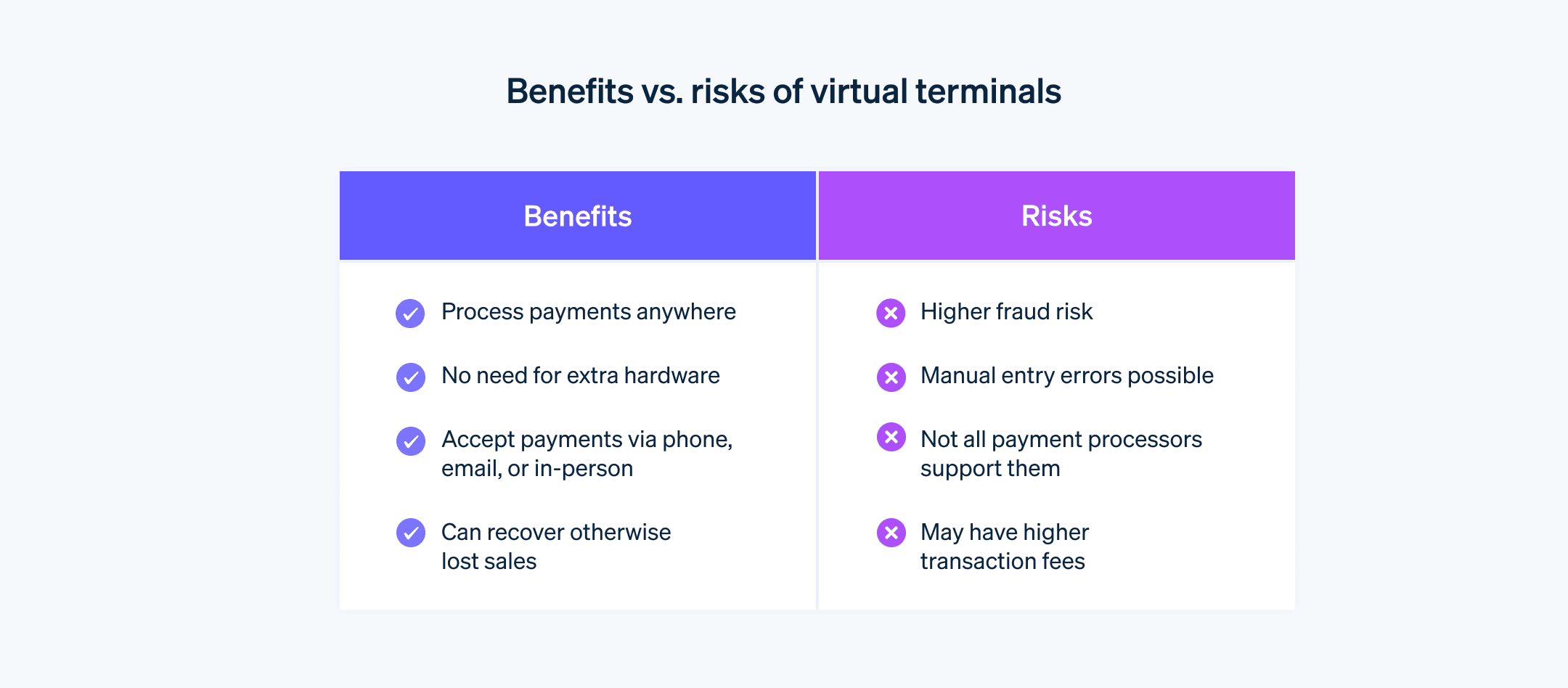

The benefits of being able to process customer transactions at any time, anywhere are obvious, but this convenience doesn’t come without risk. Here’s a rundown of the pros and cons of using a virtual terminal to process payments:

Benefits

- Convenience

Virtual terminals work on any device with an Internet browser. As most people have their smartphone on them at all times, virtual terminals are convenient to access. - Flexibility

Virtual terminals can be used in almost any setting to accept payments from a range of sources – in person, over the phone, by email or even by post. - Capture sales that might otherwise be lost

The biggest upside to virtual terminals is that they give business owners (or designated employees) the power to easily accommodate a customer transaction even if they are away from the business’s physical or online payment terminal. This means that your business won’t lose sales due to the inability to process a payment – a potential loss not just in revenue, but in customer lifetime value (LTV).

- Convenience

Risks

- Security concerns

The main argument against virtual terminals is their security. With in-person card payments made using a card reader, the card reader securely transmits the card information to the user’s POS and then on to their payment processor. Frequently, this information is encrypted as it’s transmitted for authorisation. In online card-not-present (CNP) transactions, the customer inputs their payment information, such as card number, CVV code and billing address. With payments made manually with a virtual terminal, the user inputs the payment details, which is inherently less secure than other payment methods.

- Security concerns

Does Stripe offer a virtual terminal?

Businesses that use Stripe can add a virtual terminal to their Stripe platform. However, they are not part of Stripe’s out-of-the-box solutions primarily because they make it harder to ensure adherence to our uncompromising standards for security and PCI-DSS compliance.

Adding a virtual terminal on your Stripe account requires an API, which we can help set up for you. After creating your virtual terminal, you’ll be able to access it from any browser via your Stripe Dashboard. Our goal is to balance a business’s ability to accept payments at any time and anywhere while ensuring that payments are as secure as possible. To maintain high security standards, virtual-terminal payments should be considered a useful but rare backup method for accepting payments via email, fax or telephone.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.