Revenue cycle management (RCM) is a financial process that is used by healthcare providers to bill, track and collect incoming payments. RCM encompasses patient registration, insurance verification, claims submissions, patient billing and collections. The RCM market is projected to exceed US$238 billion by 2030.

Below, we'll cover what the RCM process entails, how to simplify the process and address common challenges, and best practices for improving financial outcomes.

What's in this article?

- How revenue cycle management benefits healthcare operations

- Components and stages of the healthcare revenue cycle

- Best practices for revenue cycle management

- Submitting insurance claims: A step-by-step guide

- How the revenue cycle management process affects revenue

- How technology can help with revenue cycle management

- Challenges in healthcare revenue cycle management

Forrester has named Stripe a Leader in recurring billing. Stripe received the highest possible scores in 10 evaluation criteria and above average feedback from our customers. Read the report to discover why we believe Stripe Billing can help you unlock new revenue streams, adapt to market trends, and scale with ease.

How revenue cycle management benefits healthcare operations

Healthcare businesses rely on RCM to achieve financial stability, efficiency and better patient care.

Financial stability: RCM promotes a steady flow of income for healthcare providers by capturing and collecting payment promptly for the services rendered.

Efficiency and reduced costs: The RCM process saves time and resources spent on administrative tasks, such as billing and coding, allowing staff to focus on patient care.

Improved patient experience: A well-managed RCM system facilitates accurate billing and easier payment processes, minimising confusion and improving the overall patient experience.

Components and stages of the healthcare revenue cycle

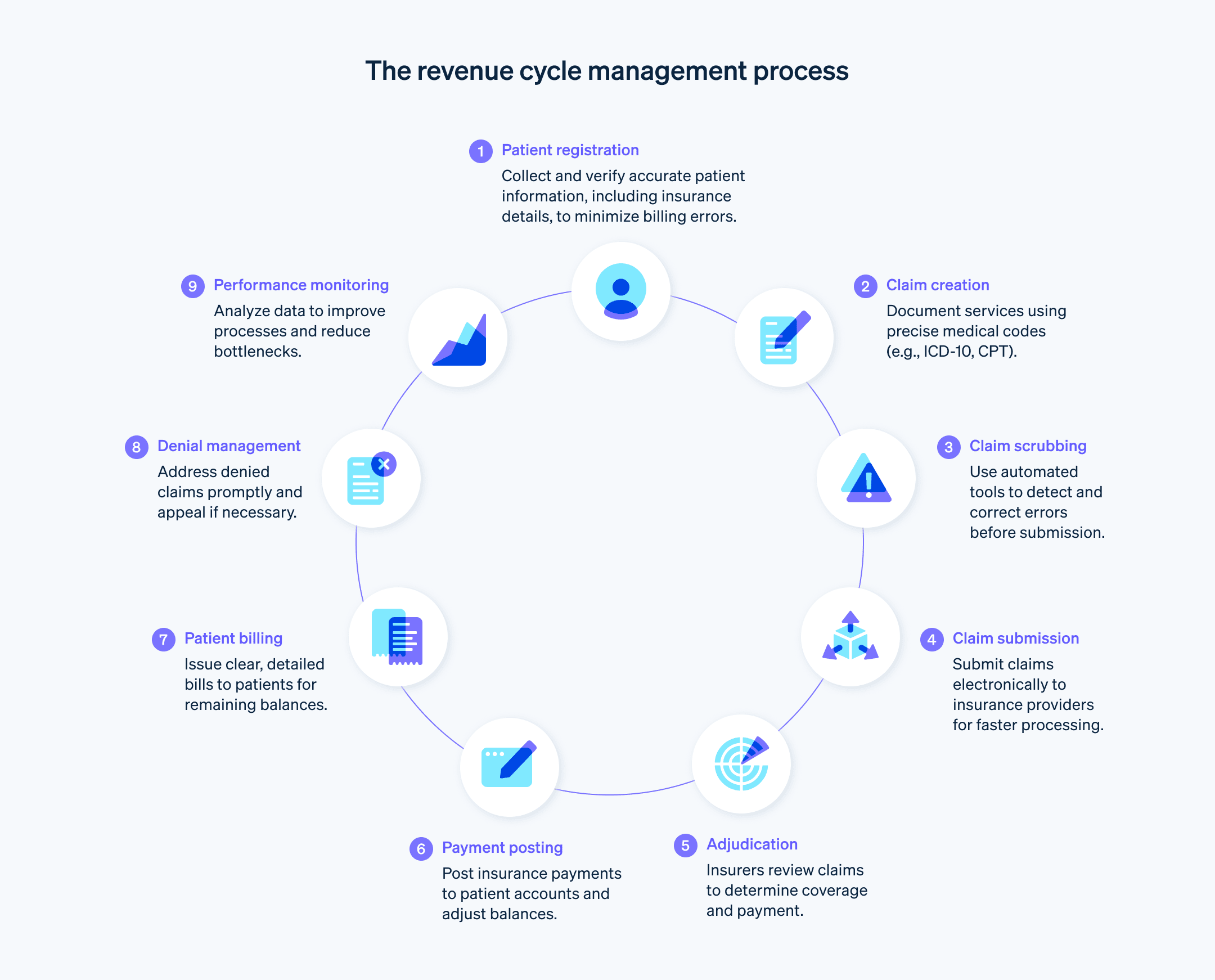

The healthcare revenue cycle has several stages which ensure that healthcare providers are compensated for the services that they deliver.

Pre-registration: Collecting a patient's demographic and insurance information before their visit.

Patient registration: Collecting further patient information, such as personal details and medical history.

Insurance verification and authorisation: Checking the insurance cover and obtaining the necessary authorisations for procedures.

Charge capture and coding: Documenting all services and procedures performed and translating them into billing codes (e.g. ICD-10 and CPT codes) for insurance claims. These codes are standardised across the industry and determine how much the healthcare provider will be reimbursed.

Claim submission: Submitting coded claims to insurance companies for payment. The payer will evaluate whether the claim complies with the payment policies and agreements and decide whether to pay in full, in part, or deny or reject the claim.

Denial management: Managing and appealing denied insurance claims.

Payment posting: Posting payment to the patient account once the insurance company has paid the healthcare provider.

Patient billing: Billing patients for any balance that hasn't been covered by the insurance. This can include co-payments, deductibles or charges for services that are not covered.

Collections: Following up on unpaid balances. This may include sending reminder bills, setting up payment plans or sending to collections.

Reporting: Analysing data and key performance indicators, in addition to reporting on the overall health of a healthcare provider's revenue cycle and flagging potential areas of improvement.

Best practices for revenue cycle management

Implementing an efficient RCM process involves comprehensive data collection, transparent patient communications and regular performance monitoring. Here's a rundown of best practices for revenue cycle management:

Data collection: At the initial point of contact, collect comprehensive patient information, including personal details, demographic details, contact information, health status and insurance details. Use digital tools to capture this data accurately and securely. Accurate data collection minimises billing errors and claim denials at a later stage.

Verification: Confirm the accuracy of the collected information, especially the insurance details. Use real-time verification systems to check the patient's cover, benefits and any pre-authorisation requirements. Confirming eligibility and obtaining pre-authorisations before providing services clarifies insurance payment responsibilities up front. This reduces claim rejections because of issues with cover and subsequent surprises when it comes to patient billing.

Data integrity: Update and validate patient information on a regular basis. Any changes in insurance, contact details or medical history should be reflected promptly in the patient's records. Inform patients about the registration process, what information they need to provide and why it's important. This ensures that claims are completed with accurate, up-to-date information.

Compliance: Reference all relevant regulations, such as patient privacy laws and data security standards, to develop a compliant registration process. This prevents legal or regulatory penalties from affecting revenue at a later stage.

Coding: Invest in ongoing education and training for staff in current coding standards and updates. Use precise and accurate coding for all services provided. This maximises reimbursement and reduces the likelihood of denied claims.

Claim scrubbing: Use automated claim-scrubbing tools to detect and correct errors that could lead to denials or delays. Scrubbing claims before submissions reduces the number of claims that are denied because of data-entry errors.

Claim submission: Develop a systematic process for submitting complete and accurate claims to insurance providers in a timely manner. A quick turnaround in claim submission accelerates reimbursements.

Claim tracking and denial management: Implement a tracking system for submitted claims. Address any denials or requests for additional information promptly to ensure that the revenue stream remains as uninterrupted as possible. Analyse denials and identify any patterns that could be addressed to reduce occurrences and expedite the appeal process.

Patient communication: Engage patients early and often about their financial responsibilities. Transparent communication about costs, billing procedures and payment expectations improves patient satisfaction and reduces collection issues.

Patient invoicing: Provide patients with easy-to-understand bills that include detailed explanations of the charges. Offer multiple payment options and payment plans to make it easier for patients to fulfil their financial obligations. This can speed up collections and reduce outstanding receivables.

Payment processing: Establish a system for how and when to process payments, post them to patient accounts and reconcile accounts to ensure that revenue is collected and recorded as quickly as possible.

Customer service: Maintain a knowledgeable and accessible customer service team to handle patient enquiries about registration, billing and insurance. Reducing patient confusion and addressing concerns helps to improve payment compliance and provides a better patient experience.

Using technology: Consider software and technology solutions that can simplify RCM processes, reduce manual errors and provide real-time insights into the revenue cycle. This can help with collecting payments more quickly and free up valuable resources to spend on other aspects of healthcare operations.

Performance monitoring: Review key performance indicators (KPIs) and metrics on a regular basis to monitor the health of the revenue cycle. Use these insights to make informed decisions and continuous improvements.

Submitting insurance claims: A step-by-step guide

After a patient has received healthcare services, the provider assembles and submits an insurance claim for reimbursement. Once claims have been accepted, providers update the balance owed on the patient account and bill the patient for the remaining balance. If claims are denied, the healthcare provider may need to resubmit an amended claim or file an appeal.

Claim creation: Healthcare providers document the patient visit and translate it into billable charges using appropriate medical codes that communicate the nature of the visit and the services provided. This includes diagnostic codes (e.g. ICD-10) and procedural codes (e.g. CPT and HCPCS).

Claim scrubbing: Claims undergo a thorough review process, known as scrubbing, to identify and correct any errors or inconsistencies. This step reduces the likelihood of claim rejections or denials because of issues such as incorrect patient information, coding errors or missing details.

Claim submission: The claim is submitted to the appropriate insurance company. This is typically done using electronic data interchange (EDI) systems, which allow for quicker submission and response times compared with manual processes.

Adjudication: The insurance company reviews the claim to determine its liability, verifying the cover and checking whether the services billed align with the patient's policy.

Payment determination: The insurer decides on the payment amount, which could be a full payment, partial payment or a denial. This decision is based on various factors, such as service cover, network agreements and patient eligibility at the time of service.

Payment and explanation of benefits (EOB): The insurer issues payment to the healthcare provider, accompanied by an EOB, which details which services were covered, the amounts paid and any patient responsibility, such as deductibles or co-payments.

Payment posting: The healthcare provider posts the payment to the patient's account, adjusting the account balance to reflect the payment and any remaining patient responsibility.

Patient billing: The provider issues a bill to the patient for any remaining unpaid balance.

Denial management: If a claim is denied, the provider reviews the reason for denial and corrects any issues. It may resubmit the claim or appeal the decision, depending on the circumstances.

Reporting and analysis: Providers review their claims process on a regular basis to identify any trends, such as common reasons for denials or delays in payment. This data informs process improvements to boost the success rate of future claims.

How the revenue cycle management process affects revenue

Each step of revenue cycle management works to ensure timely, accurate payment collection and generate revenue for the healthcare provider. Here's how each step of the process creates a smooth path to collecting revenue:

Patient registration: Accurate collection of patient information minimises billing errors that may delay payment.

Claim creation: Accurate medical coding and timely claim submission facilitates prompt payment from insurance providers.

Payment collection: Tracking payments from insurers and patients enables providers to handle discrepancies, denials and outstanding payments promptly, maintaining an uninterrupted stream of revenue.

Patient financial engagement: Communicating with patients about their financial responsibilities and payment options, and providing assistance with billing enquiries, creates greater patient satisfaction and makes them more likely to comply with payment obligations.

Reporting and analytics: The process of analysing financial data and identifying trends in payment collections informs key decisions that boost overall financial health and successful revenue generation.

Compliance: Compliance with evolving healthcare regulations and payer requirements safeguards revenue from potential legal or compliance-related disruptions. The RCM process takes a proactive approach to tending to these compliance concerns and prevents these issues from occurring.

How technology can help with revenue cycle management

Technology can make RCM more accurate and easier to keep up with, improving financial outcomes and reducing administrative burdens on healthcare providers. These technology tools can improve the RCM process:

Electronic health records (EHRs): EHRs integrate patient data across different healthcare settings, allowing for widespread access to patient information that helps providers to document and bill patient encounters correctly.

Automated eligibility verification: Automated systems can verify patient insurance cover and benefits in real time and before services are rendered, reducing the likelihood of billing errors and denials because of issues with cover.

Medical coding software: Advanced coding software helps coders to assign the correct codes for procedures and diagnoses. Some systems incorporate artificial intelligence (AI) and machine learning to suggest codes, reducing the risk of human error.

Claims management systems: These systems check claims for errors and automate the submission process. They can flag common issues that lead to denials, allowing for corrections before the claim is sent to the insurer.

Electronic billing and payment processing: Technology can send patient bills electronically and allow for online payments, thus speeding up these processes.

Data analytics and reporting: Advanced analytics tools can comb financial data for trends, bottlenecks and opportunities to improve the revenue cycle. This insight can inform key decisions and operational adjustments.

Patient engagement platforms: These platforms communicate with patients about their financial responsibilities, offer online billing and payment options, and provide educational resources, improving the patient experience and compliance with payments.

Denial management tools: Technology can track and analyse denied claims, identifying patterns and root causes so that providers can address systemic issues and refine their billing practices.

Automation of routine tasks: Automating routine administrative tasks, such as appointment scheduling, insurance verification and payment reminders, can reduce the workload for staff members and allow them to focus on more complex aspects of RCM.

Challenges in healthcare revenue cycle management

From maintaining compliance with evolving healthcare regulations to balancing the patient experience, here's an overview of the challenges that the RCM process can present:

Billing and coding complexity: The healthcare industry has complex billing and coding processes, with thousands of codes for diagnoses and procedures that are updated and changed frequently. Staying up to date on proper coding practices requires ongoing education and adaptation.

Evolving healthcare regulations: Healthcare regulations change frequently, which has an effect on various aspects of RCM, such as billing practices, patient privacy and data security. Providers must be vigilant in keeping up with these changes.

Payer variability: Billing and reimbursement requires working through the distinct rules, cover policies and reimbursement rates of numerous insurance payers, which complicates the claim creation, submission and dispute process.

Growing patient responsibility: With the rise in high-deductible health plans, patients are increasingly responsible for a larger portion of their healthcare costs. Collecting payments from patients can be more challenging than dealing with insurers because of their relatively limited resources.

Resource-intensive technology integration: Integrating various technology systems (such as EHRs, billing software and patient portals) can be complex and costly. A failure to integrate properly can lead to data silos and hinder the RCM process.

Denial management: Managing and reducing claim denials is a persistent challenge. Each denied claim requires additional resources to investigate, appeal or resubmit.

Staff training and turnover: The ongoing evolution of billing practices, coding and regulations requires continuous staff training. High turnover rates in RCM roles can disrupt the revenue cycle and lead to inconsistencies in processing.

Cybersecurity threats: As healthcare organisations rely increasingly on digital systems for RCM, they become more vulnerable to cybersecurity threats, such as data breaches, which can lead to major financial losses and reputational damage.

Data analysis burden: Collecting, integrating and interpreting large volumes of data can be challenging. Organisations may struggle to use this data effectively for decision-making purposes.

Balancing patient experience: Balancing the financial aspects of RCM with a positive patient experience can be challenging. Issues such as billing errors, lack of transparency and poor communication can lead to patient dissatisfaction and can affect an organisation's reputation.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.