Use cases

Global payments are evolving. Stripe can help.

Stripe powers adaptive enterprises around the world, including dozens of industry leaders processing billions in annual payment volume. We help companies simplify global expansion, optimise their payments infrastructure, and easily add new business models and revenue streams.

Expand internationally

Global coverage, local expertise

Accept payments from customers around the world with cardholder support in more than 195 countries. Offer dozens of local payment methods to improve conversion rates and create better experiences for your customers. Let Stripe handle complex regulatory nuances for each new country so you can focus on your core business.

Available for businesses in 46 countries

Supported payment methods

Learn more about which payment methods are supported in specific countries.

Convert more customers

Intelligent revenue optimisation

Stripe lets you accept, store, manage, and pay out money globally with a single integration. Stripe maximises revenue for businesses by improving authorisation rates on every payment and reducing declines with powerful machine learning.

Stripe is constantly improving, scaling issuer-specific authorisation optimisation with Adaptive Acceptance.

Stripe will also help you increase revenue with built-in features such as machine learning retries and take advantage of local Stripe acquiring to increase acceptance rates and reduce costs.

Optimised business setup

-

MID assignment

-

MCC assignment

-

Local acquiring

Smart network messaging

-

BIN-level formatting

-

Stored credentials optimization

-

Issuer data sharing

-

Incrementals

-

Overcaptures

-

Partials

Automated card management

-

Network tokens

-

Batch card account updater

-

Real-time card updater

Authentication, validation and fraud protection

-

Dynamic 3D Secure

-

Dynamic $0/1 validations

-

Industry-leading ML fraud protection

Machine-learning powered retries

-

ISO message adjustment

-

Data healing

-

Smart dunning for subscriptions

Real-time API status

The leader in payments infrastructure

Global companies rely on Stripe for industry-leading uptime and performance. We continually deploy improvements to our platform, which handles more than 200 million business-critical API requests every day.

A unified product suite

The Stripe enterprise payments stack

Our platform processes payments around the world and is built to help you adapt as rules change – from PCI certification to SCA-ready payments. Our unified product suite also helps you tackle fraud, issue cards, set up recurring billing, or even integrate in-store payments with your online stack.

Credit cards

Wallets

Local bank debits

Local bank transfers

Secure tokenisation

Card present with Terminal

Subscription management

Invoicing

Revenue and finance automation

Mobile SDKs

Vouchers

Buy now, pay later

Industry recognition

A leader in retail payments and billing

2025 Gartner® Magic Quadrant™ for Recurring Billing Applications: A Leader

Read moreCase studies

Ford transforms its ecommerce experience with Stripe

Ford Motor Company and Stripe have partnered to scale the manufacturer’s e-commerce capabilities faster and to deliver an always-on experience for Ford and Lincoln customers.

Challenge

Ford CEO Jim Farley made it clear when he took over the top spot at the vehicle manufacturer in October 2020 that one of his biggest focuses would be on connected vehicle services.

Solution

Ford will use Connect to facilitate a customer’s payments to a correct local Ford or Lincoln dealer. As Ford develops e-commerce offerings across the product and service spectrum, Stripe’s platform and services are expected to drive new efficiency into processing of e-commerce payments, such as vehicle ordering, reservations and digital and charging services.

Products

Stripe has developed strong expertise in user experiences that will help provide easy, intuitive and secure payment processes for our customers.

WooCommerce partners with Stripe to launch in 17 new countries in 3 months

As one of the most popular e-commerce platforms in the world, WooCommerce enables WordPress businesses to sell and manage orders directly from their websites.

Challenge

WooCommerce wanted to help its merchants adapt quickly to changing consumer habits through its own integrated payments solutions.

Solution

WooCommerce decided to launch a brand new platform, WooCommerce Payments, by integrating several different Stripe products to enable merchants to do everything from taking contactless payments and accessing funds in real time to tapping into business funding to keep operations afloat. In just three months and with a team of fewer than 20 people, the company partnered with Stripe to launch WooCommerce Payments in 17 countries – from Canada to New Zealand and across Europe.

Products

Building on Stripe, we started with payments, billing and subscriptions. But we’re quickly adding Stripe Terminal for in-person payments, and planning to offer a full suite of fintech services to help our merchants grow their business, including access to capital and more – not only in the US, but also Europe and other regions where WooCommerce thrives. We chose Stripe because its extensive options across payments and financial services are what enable us to do this, and do it rapidly without compromise.

GitHub works with Stripe to add a donations programme

Microsoft-owned GitHub is a code management platform that was looking for a partner to help it launch Github Sponsors to support open-source developers.

Challenge

GitHub wanted to create a compliant and seamless onboarding experience that is accessible to the developer community in various languages around the world. Once onboarded, anyone on the Sponsors platform can sponsor a developer contributing to an open source project – and GitHub can match it up to $5000 per developer.

Solution

GitHub used Stripe to onboard developers in 34 countries to accept donations. In two months, Stripe helped GitHub reduce a manual 9-step, week-long process to a fully localised, 2-minute onboarding experience. It also expanded support to more countries and currencies without additional work.

Products

We are extremely happy customers, and Stripe makes it possible for us to build new products like GitHub Sponsors that would be nearly unthinkable without them.

Nasdaq chooses Stripe for robust security and scalability

Nasdaq is a global technology company democratising access to the capital markets. It owns and operates several stock exchanges across the US and Europe. Nasdaq chose Stripe for robust security and scalability.

Challenge

After making several acquisitions, Nasdaq knew it needed a payments provider that would allow it to work securely across its subsidiaries and assist in improving its recurring billing and financial reporting.

Solution

Stripe Payments allowed Nasdaq to provide simple and secure card payment options, while Stripe Billing gave the Nasdaq team a flexible way to bill their customers on a recurring basis, including accepting alternative payment methods. Nasdaq will continue to grow its software solutions with the trust of Stripe’s leading security infrastructure.

Products

Scalability and security are two key areas of focus in operating all of our solutions. That is why we chose Stripe. We saw Stripe as the most secure provider.

Custom packages

Speak to an expert

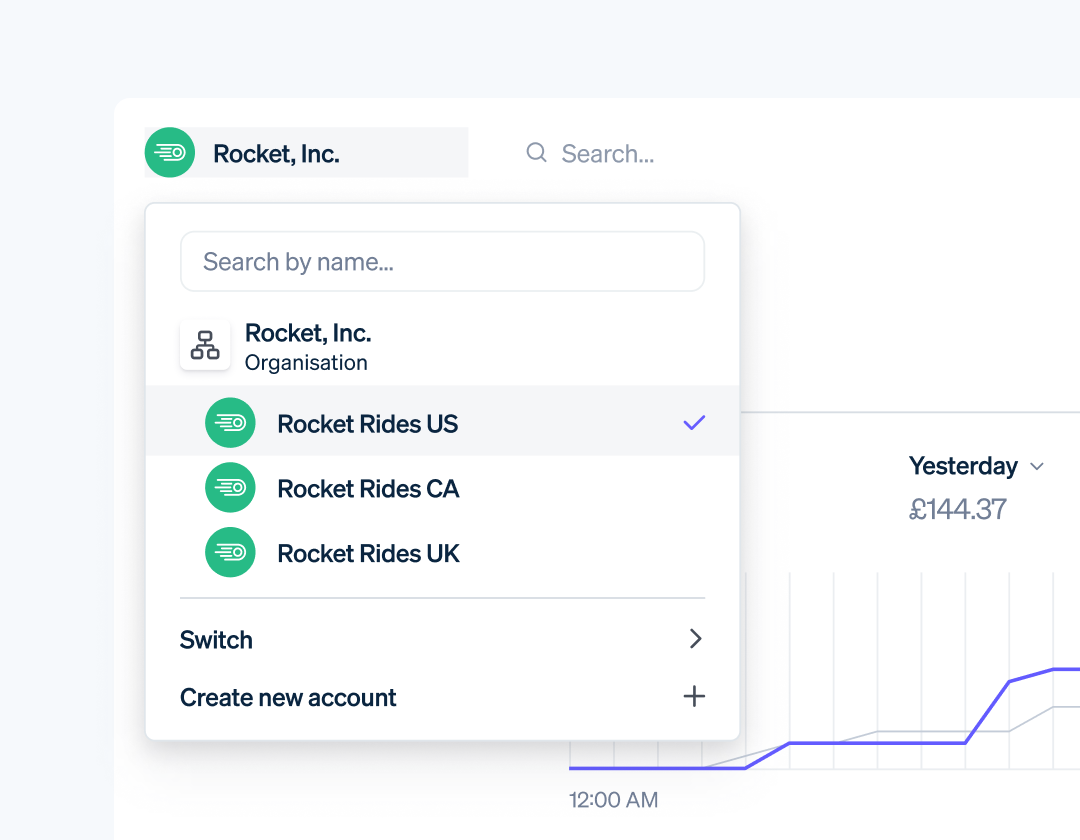

Streamlined account management for your enterprise

Simplify operations and centralise reporting across business lines and geographies with Stripe Organisations.

How can we help you?

We partner closely with you from onboarding to deployment, offering 24x7 phone, email and chat support, dedicated technical account management, support in your Dashboard, and personalised recommendations for your business goals. Let’s get started.

Adaptive Enterprises

Learn how 600 global chief executives are unlocking new revenue streams and growth opportunities.

The Forrester Wave

Stripe is the highest scoring payments provider – recognized for its scale, technology and speed of innovation.