The payment processing market is projected to reach a value of approximately US$198billion by 2032, a huge increase from its valuation of US$65.6 billion in 2022. This underscores the importance of simple, effective and secure payment processing solutions for businesses that accept online payments.

With increasing customer expectations for diverse payment methods and a smooth payment experience, businesses are assessing a growing number of payment processing options. Some are considering whether they should create their own payment gateway. By developing this custom solution, businesses can gain greater control over their transactions, improve the customer experience and reduce transaction costs. However, the process of creating a payment gateway is complex, requiring careful planning and execution.

Below is a guide to creating your own payment gateway, helping you to better understand the requirements, benefits and potential challenges.

What's in this article?

- What is a payment processor?

- What is a payment gateway?

- How do payment gateways work?

- How do payment processors work?

- Benefits of developing your own payment gateway

- Barriers to building your own payment gateway

- How to create your own payment gateway

What is a payment processor?

A payment processor is a financial entity that is appointed by a business to handle credit and debit card transactions. This role is important for the operations of e-commerce businesses that accept card payments, both online and offline.

Payment processors facilitate the transfer of transaction information. However, their role extends beyond just transferring information. Payment processors also provide other services that help to secure, authenticate and streamline card transactions for businesses.

What is a payment gateway?

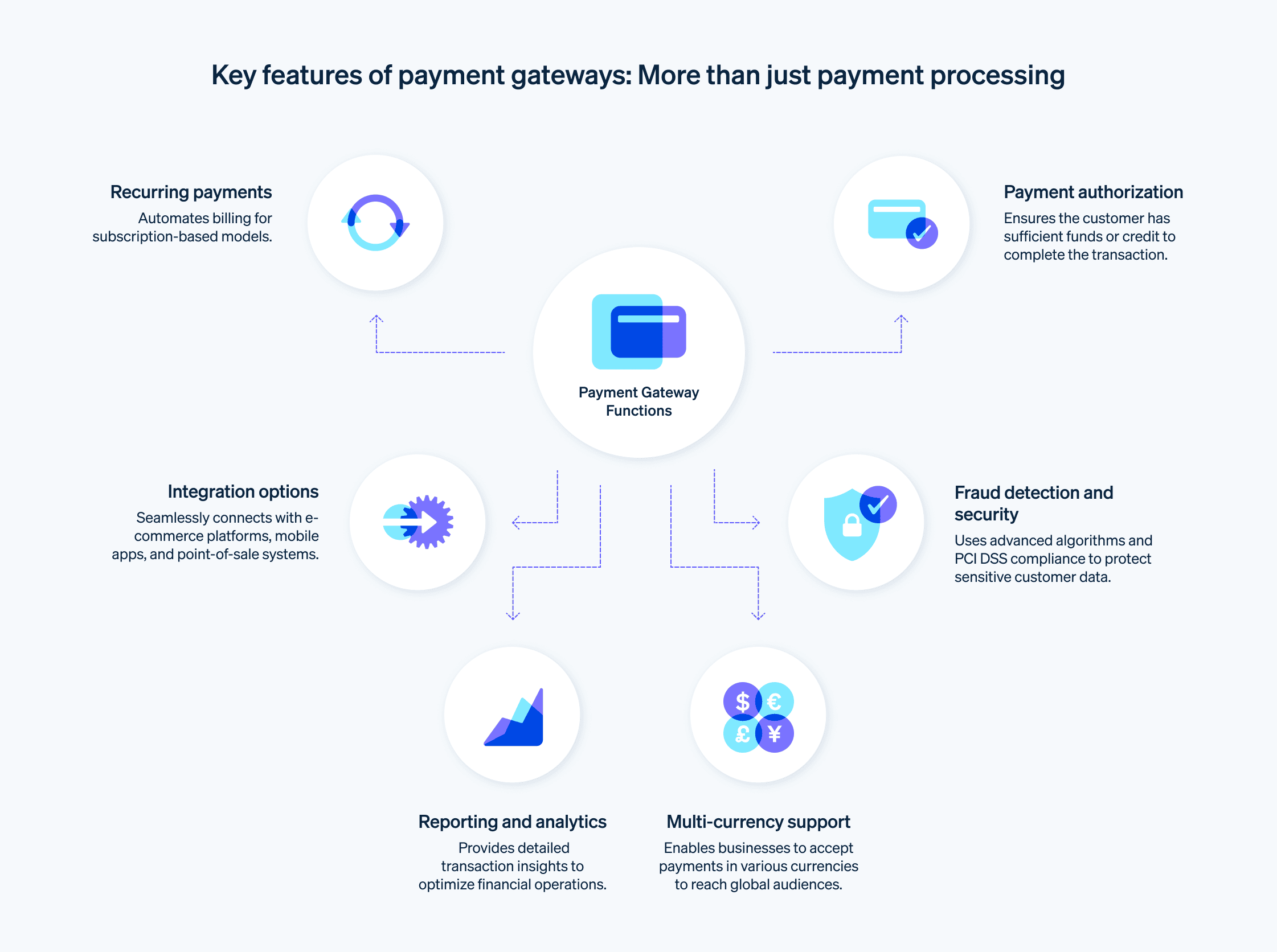

A payment gateway is a technology used by businesses to accept card and digital wallet payments from customers. The term includes not only the physical card readers found in brick-and-mortar retail outlets, but also the online counterparts that take care of the payment process for e-commerce, mobile commerce and other card-not-present (CNP) transactions.

Payment gateways facilitate communication between the various components involved in the transaction process. They send credit card information from the business's website to the credit card payment networks for processing, and they return transaction details and responses from the payment networks back to the website.

How do payment gateways work?

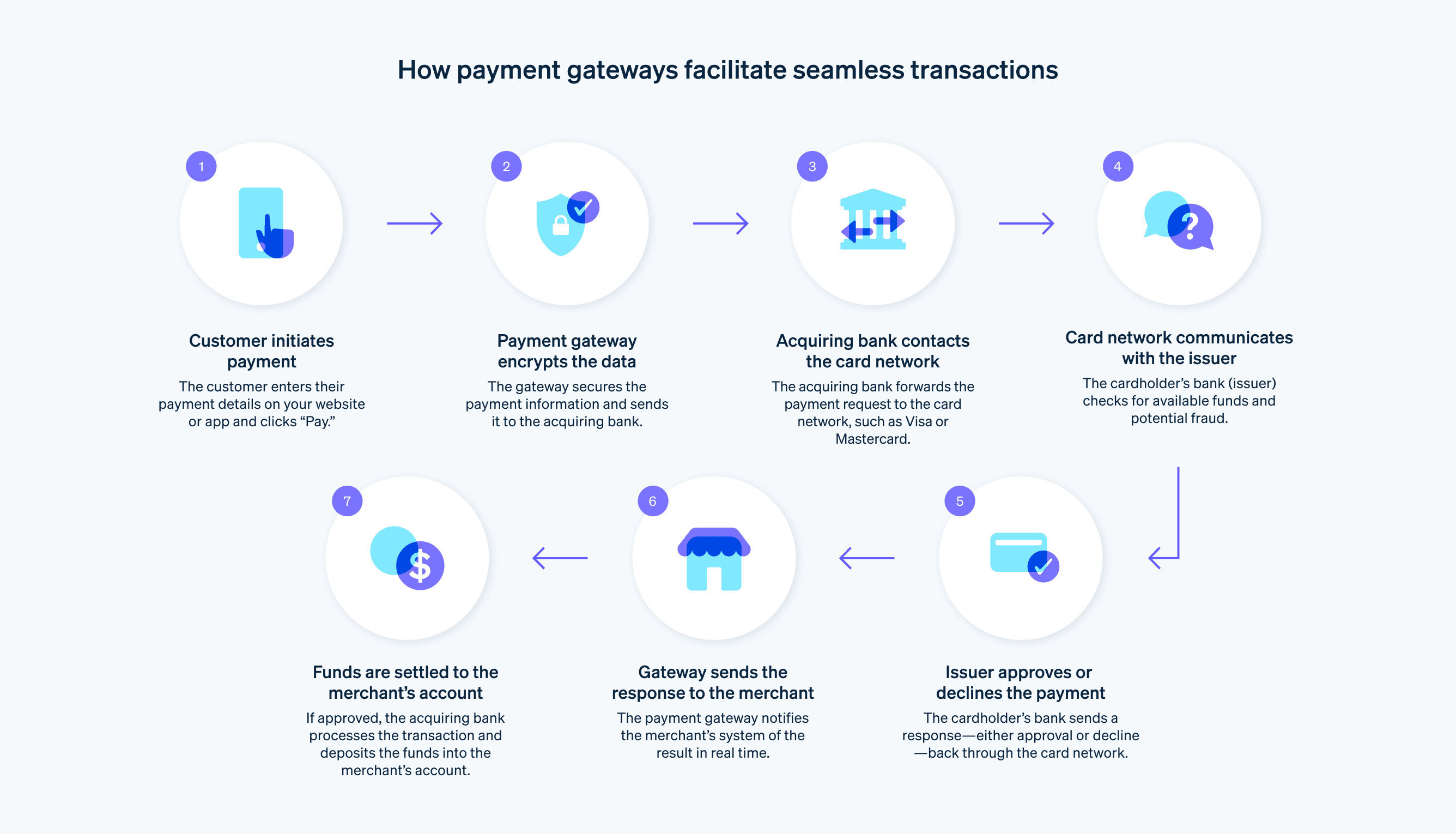

Payment gateways and processors function as intermediaries between businesses and customers, ensuring that each transaction is carried out securely and promptly. The process typically includes several steps, starting from the customer making a payment for goods or services and ending with the business receiving the payment.

Payment gateways have several important responsibilities during the transaction process, including:

Encryption

When a customer places an order, the gateway encrypts the payment information before sending it to the business's web server. From there, the gateway sends the transaction data to the payment processor used by the business's acquiring bank.Authorisation requests

The payment processor sends the transaction data to a card network, which routes it to the bank that issued the customer's card to authorise or decline the transaction.Filling the order

The processor then forwards an authorisation related to the business and customer to the payment gateway. Once the gateway has obtained this response, it transmits it to the business's website (or whatever interface processed the payment) to complete the payment process. If the transaction is approved, the business can then fulfil the order.Settlement

At the end of the day, the business sends a batch of all approved authorisations to its acquiring bank for settlement. The bank deposits the total of the approved funds into the business's nominated account. This could be a daily, weekly or other agreed-upon schedule.

By providing a secure pathway between the customer, the business and the payment processor, payment gateways ensure smooth, secure and quick online transactions. Payment gateways also employ various security measures, such as SSL encryption and fraud-prevention tools, to protect sensitive data, including credit card numbers and other personal information.

How do payment processors work?

The terms "payment processor" and "payment gateway" are sometimes used interchangeably, but they represent two distinct stages in the payment cycle. Here's a more detailed explanation of how each one works:

Payment processor

A payment processor is a company that works with a business to handle the processing of transactions for acquiring banks. When a customer pays for a product or service with a credit or debit card, the payment processor immediately performs several tasks:

Authorisation

It verifies the details of the credit card (such as whether the card has expired or not) and checks if the customer has enough credit to cover the purchase.Transaction processing

After authorisation, the payment processor will then process the transaction. This involves transferring the customer's information and the transaction information to the bank that issued the credit card.Payment

Once the transaction has been processed, the payment processor will then transfer the funds from the customer's account to the business's account.

Payment gateway

A payment gateway is a service that authorises credit card payments for online and offline businesses. It's the equivalent of a physical point-of-sale terminal in a shop or restaurant. It transfers information between the payment portal – such as a website or mobile app – and the payment processor or acquiring bank.

Here's a simplified overview of how a payment gateway works:

Encryption

When a customer orders a product from an online business, the payment gateway encrypts the credit card details securely and sends this information to the business's server.Authorisation request

The business then forwards this information to its payment processor, which in turn sends it to the customer's credit card issuer for authorisation.Filling the order

The credit card issuer sends a response back to the payment processor. The response includes information about whether the transaction was approved or declined. If the transaction was approved, the business can fulfil the customer's order.Settlement

At the end of the day, the business sends the day's approved authorisations in a batch to its acquiring bank for settlement. The bank deposits the total of the approved funds into the business's normal business bank account.

For both payment processors and payment gateways, the main objectives are to handle sensitive credit card information securely, ensure that the customer has enough credit to cover the purchase and move funds from the customer's account to the business's account. They each play important roles in e-commerce transactions, enabling businesses to sell products online and customers to make purchases confidently and with ease.

Benefits of developing your own payment gateway

Developing your own payment gateway can be a challenging task. There are numerous complexities involved, ranging from security measures to compliance with financial regulations. However, there are also several significant benefits to developing your own payment gateway, especially for large businesses or those with specific requirements. Here are some of the main benefits:

More control over the payment process

When you own your payment gateway, you have full control over the entire payment process. You can customise the gateway to fit the specific needs of your business and your customers. For example, you can incorporate additional security features or create a unique user interface that matches your brand identity.Cost savings

Using third-party payment gateways comes with transaction fees. Over time, these costs can add up, particularly for businesses that process a high volume of transactions. By developing your own payment gateway, you can eliminate these transaction fees, leading to significant cost savings.Revenue generation

A company that owns a payment gateway can also offer it as a service to other businesses, potentially creating a new revenue stream. This is particularly applicable if the gateway is feature-rich, secure and reliable.Integration

A self-developed payment gateway can be integrated easily with other internal systems, such as CRM or ERP. This ensures a seamless exchange of data, which is necessary for real-time reporting, data analysis and customer support.Global expansion

Third-party payment gateways may not support all currencies or payment methods, which could be a hurdle for businesses aiming to expand internationally. With your own payment gateway, you can support multiple currencies and payment methods, making it easier to do business globally.Customer experience

By developing your own payment gateway, you can tailor the checkout process to match your desired customer experience. For instance, a simplified checkout process with minimal redirects can help to reduce basket abandonment rates.

Even given these benefits, there are two important things to note about creating your own payment gateway:

- Many of these benefits can be captured by working with the right third-party payment provider. For example, Stripe – which offers a payment gateway functionality – supports more than 135 currencies globally, which most businesses will likely find to be sufficient for their needs.

- Developing your own payment gateway also comes with its own challenges, so businesses should conduct an in-depth cost-benefit analysis before proceeding. You'll find more details about these challenges below.

Barriers to building your own payment gateway

Creating your own payment gateway is a significant task that can come with a range of serious considerations that might not be easy to accommodate. Here are some of the most common ones:

Compliance requirements

Financial transactions are heavily regulated. In particular, if you are handling credit card information, you'll need to comply with PCI DSS. This set of security standards is designed to make sure that all companies that accept, process, store or transmit credit card information do so within a secure environment. Achieving and maintaining this compliance can be complex and time-consuming.Security concerns

A payment gateway needs to be secure to protect sensitive customer data, such as credit card numbers. Implementing high-level security measures to prevent fraud and data breaches requires significant expertise and investment. These security measures should also be updated on a regular basis to counter emerging threats.Technical expertise

Building a payment gateway requires considerable technical knowledge. You'll need a team of experienced developers who understand not only how to build software, but also how to navigate the complexities of payment processing, such as dealing with multiple banking APIs and integration with various e-commerce platforms.Maintenance and support

Even after your payment gateway has been built, you'll still need to maintain it, troubleshoot issues and provide customer support. You'll also need to update the software continuously to meet evolving regulatory requirements, add new features and improve security. This ongoing commitment can be a significant drain on resources.Time and cost

Creating your own payment gateway can be costly and time-consuming. Aside from the initial development costs, there are also costs associated with compliance, security, maintenance and support. And it could take a significant amount of time to develop and deploy a payment gateway, which could delay other business initiatives.Financial partnerships

Building your own payment gateway usually involves establishing relationships with various financial institutions, such as banks and credit card companies. These partnerships can be challenging to form, particularly for smaller businesses, and often require navigating complex contractual agreements.

While creating a payment gateway offers many potential benefits, it's important to consider these potential roadblocks carefully. For many businesses, using an established third-party payment gateway may be a more practical and cost-effective solution. That said, it is also possible to create your own – and in the right circumstances, it can work well for some businesses.

How to create your own payment gateway

Building your own payment gateway is a complex task that involves several steps, each of which requires a significant investment of time, resources and technical expertise. Here's a rough outline of what the process entails:

1. Planning

First, you need to clearly define your business requirements. This includes identifying your target audience, understanding the transaction volumes you expect to handle and determining which payment methods and currencies you want to support, among other things.

2. Compliance and security

You will need to ensure that your gateway complies with all relevant financial regulations, including PCI DSS. This will likely involve obtaining certain certifications and regularly auditing your systems to ensure ongoing compliance. In addition, you'll need to implement robust security measures to protect sensitive customer data and prevent fraud.

3. Building relationships with financial institutions

Your payment gateway will need to integrate with various banks and credit card companies. This means forming partnerships with these institutions, which can involve lengthy negotiations and complex contractual agreements.

4. Software development

Next, you'll need to develop the software for your payment gateway. This will likely involve recruiting a team of experienced developers (which can be sourced in-house or from external resources) and could take a significant amount of time, depending on the complexity of your requirements.

5. Testing

Once the software has been developed, it will need to be rigorously tested to ensure that it works as expected and can handle the transaction volumes you anticipate. This stage may also involve resolving any bugs or issues that are identified.

6. Deployment and maintenance

After testing, you can deploy your payment gateway. However, your work doesn't end there. You'll need to constantly maintain and update the software, troubleshoot any issues that arise and provide customer support. A big part of building your own payment gateway is committing to its upkeep, which will continue to require bandwidth and internal resources over time.

While creating your own payment gateway can offer significant benefits, these steps highlight that it's not an easy or straightforward process. As a result, many businesses look for simpler, more cost-effective solutions. One such solution is Stripe's white-labelled payment facilitator (payfac) solution. This is a platform that allows businesses to handle online transactions without building their own payment gateway or forming partnerships with banks or credit card companies.

By using Stripe's payfac solution, businesses have access to Stripe's established, secure and compliant payment gateway. They can customise the user interface to match their branding, while Stripe handles the complexities of payment processing, compliance, security and maintenance. This means that businesses can have more control over the user experience and potential cost savings, without the associated challenges. And businesses can start processing transactions much more quickly than if they were to build their own gateway, allowing them to focus on their core business activities. To learn more and get started, go here.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.