VAT validation is key for controlling accounting and ensuring companies’ tax compliance. In this article, you will learn what VAT validation is and how it is performed. We will also explain whether there is a tolerance limit when calculating VAT and what companies need to do if they find discrepancies.

What’s in this article?

- What is VAT validation?

- How does VAT validation take place?

- Is there a tolerance limit for VAT validation?

- What to do if there are discrepancies in the VAT validation

What is VAT validation?

VAT validation is a method for checking the correct collection and payment of value-added tax in Germany. Validation ensures that a company’s accounting complies with the principles for the proper keeping and retention of books, records, and documents in electronic form (GoBD) under Section 147 of the German Fiscal Code (AO) and that the information reported to the tax office correctly reflects the legally owed VAT. For this purpose, the sales figures from the preliminary VAT returns are compared with the values in the annual financial statements.

The tax office can carry out a VAT validation as part of a business management exercise or by the companies themselves; it is not required by law and is not mandatory for the preparation of provisional VAT or annual returns. However, companies need to carry out regular VAT validations to ensure correct financial statements and detect accounting errors. Auditors recommend this method, especially for larger businesses.

Ideally, sales need to be reviewed monthly or quarterly. If this is not possible or desirable, for example, due to time constraints, VAT validation needs to be performed at least once a year before the annual VAT return filing. Regular VAT validation increases the quality of financial accounting and results in fewer corrections and changes to the annual VAT return. What’s more, validation can reduce costs for companies, such as fines for underpayment of VAT.

The VAT validation must be distinguished from the special VAT audit and review according to Section 27b of the German VAT Act (UStG). The former is a unique form of tax audit in which the tax authority focuses on specific VAT issues or periods. The VAT audit covers similar issues but is conducted without prior notice and gives the tax authorities additional rights, such as entering the business premises during working hours. The tax authority initiates both the special VAT audit and the VAT review, which, unlike the VAT audit, cannot be undertaken voluntarily by businesses.

How does VAT validation take place?

The specific implementation and calculation of the VAT validation do not derive from case law or administrative instructions. Instead, they are based on systematic relationships and economic conditions. VAT validation depends primarily on the company’s relevant taxation procedures. A distinction is made here between accrual-based and cash-based taxation.

In the case of accrual-based taxation, according to Section 16 of the UStG, the VAT liability arises when a company has issued the invoices, regardless of whether customers have already paid. This is key in the validation process, as sales and VAT amounts must be recorded according to the invoices issued, not after payment has been received. In Germany, all businesses that have not applied for a special scheme for accrual-based taxation are generally subject to cash-based taxation. Freelancers, sole proprietorships, partnerships, and companies required to keep accounts with an annual turnover of less than €500,000 might be subject to cash-based taxation. However, regardless of the legal formation, accrual-based taxation is mandatory for annual sales of more than €800,000 or a profit of €80,000.

Companies subject to accrual-based taxation must record their income separately (see Section 22 of the UStG). This requirement is the basis for validating sales. A distinction must be made between taxable and other goods and services, as well as taxable intracommunity acquisitions. Furthermore, sales must be divided into fee-based transactions and free transfers of value (see Section 3 of the UStG).

What is also important for VAT validation is who the tax debtors are for controllable and taxable services. In principle, these are the companies that provide the goods and services. However, the service recipients could also be liable for VAT as part of the reverse charge procedure.

Calculation of VAT validation

The calculation of VAT validation is based on the company’s monthly or annual profit and loss statements. By adding up all revenue, the actual sales revenue can be determined. It is key that, in addition to the proceeds from current business transactions, the calculation also considers advance payments already received, income from rental and leasing, and possible proceeds from the sale of assets.

The second step determines the base value for input tax validation. This is the sum of the cost of goods sold, the company’s expenses, and additions to fixed assets. Discounts, rebates, and bonuses must be deducted, as well as price refunds and nondeductible input tax on travel costs.

Since sales revenues and input tax-eligible expenses are the basis for VAT validation, it is important that these figures can be correctly recorded and read out. Companies need to be prepared with administrative expertise and technical resources: the more automated the processes, the lower the error rate. Stripe Tax can help with this by allowing you to calculate and collect taxes for global payments in a single integration. The correct tax amount is automatically determined every time. You also get access to comprehensive lists of your income and expenses, including all tax-relevant data. This speeds up and simplifies your VAT validation.

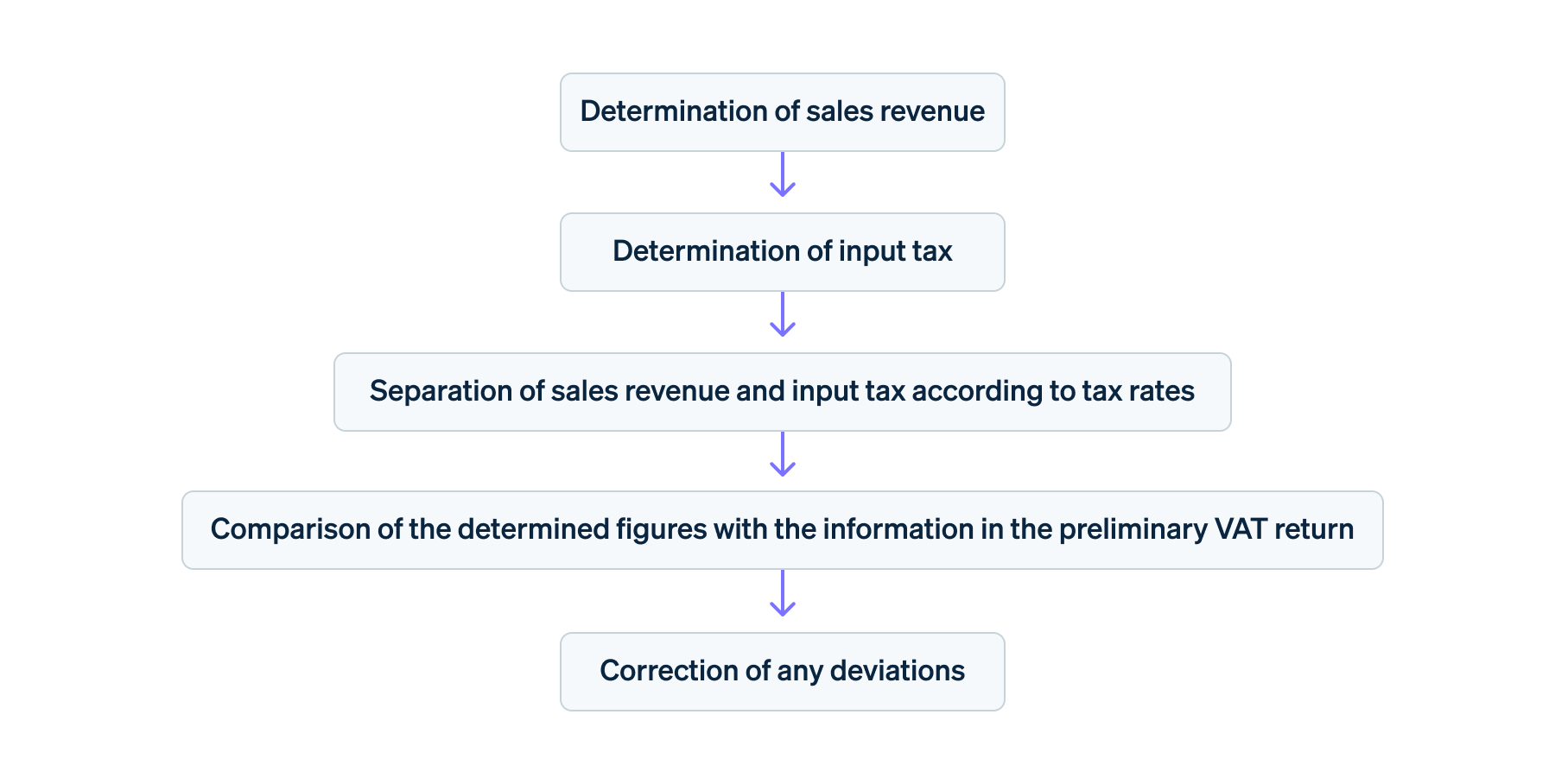

If a comprehensive overview of the sales divided into VAT and input tax is available, these can be separated again according to the respective VAT rates. It is important to distinguish when 19% or 7% rates apply. Finally, all sales revenue and input tax amounts are compared with the figures provided in the preliminary VAT return. In the best-case scenario, the numbers match. If deviations are discovered, this indicates potential errors in the accounting records.

VAT validation procedure

Is there a tolerance limit for VAT validation?

Tax authorities accept minor discrepancies in VAT validation and usually do not challenge them, as they can be caused by rounding differences, minor errors, and calculation inaccuracies, among other factors. Nevertheless, the causes need to be investigated and corrected, since they can also result from accounting errors. Action needs to be taken if the VAT validation shows differences of more than 0.5%.

What to do if there are discrepancies in the VAT validation

Companies must start troubleshooting if the VAT validation reveals a difference of more than 0.5%. In this case, any incorrect postings or tax assessments must be corrected in the annual VAT return. Otherwise, the tax office will conduct a criminal evaluation of the transactions and authorize an accusation of tax evasion. According to Section 370 of the AO, this could result in a fine or a prison sentence of up to five years.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.