Launching a business requires you to undergo all sorts of administrative procedures (read our article on how to create a sole proprietorship). This article examines how to establish an SAS, a company valued for its ease of incorporation and flexible management structure. You’ll also find the costs associated with creating an SAS at the end of this guide.

What’s in this article?

- What is an SAS?

- What formalities must be completed prior to starting an SAS?

- What are the steps for establishing an SAS?

- Drafting the articles of association

- Depositing the share capital

- Publishing a notice of incorporation

- Registering with the one-stop shop

- How much does it cost to set up an SAS?

What is an SAS?

The simplified joint-stock company, or SAS (société par actions simplifiée), is known for its substantial operation, development, and creation flexibility. It is formed with at least two partners, who could be individuals or legal entities. According to Insee, it was France’s most popular legal form in 2022.

The SAS suits most commercial, craft, liberal, and industrial activities, except certain regulated liberal professions. It is managed by a president who, as the head of the enterprise, is subject to civil and criminal liability. The partners in the company’s articles of association define the president’s powers.

Want to know how to set up an SAS? We’ll guide you through the key steps to choosing this legal structure and maximising its benefits.

What formalities must be completed prior to starting an SAS?

Before forming an SAS, it is important to outline your business project and identify the main tasks the company will carry out. You must meet the necessary training and qualification requirements for a craft or regulated activity, such as a specific diploma, good character, age, or financial guarantee.

Before creating your SAS, review your tax situation as an entrepreneur and explore any financial aid you qualify for.

What are the steps for establishing an SAS?

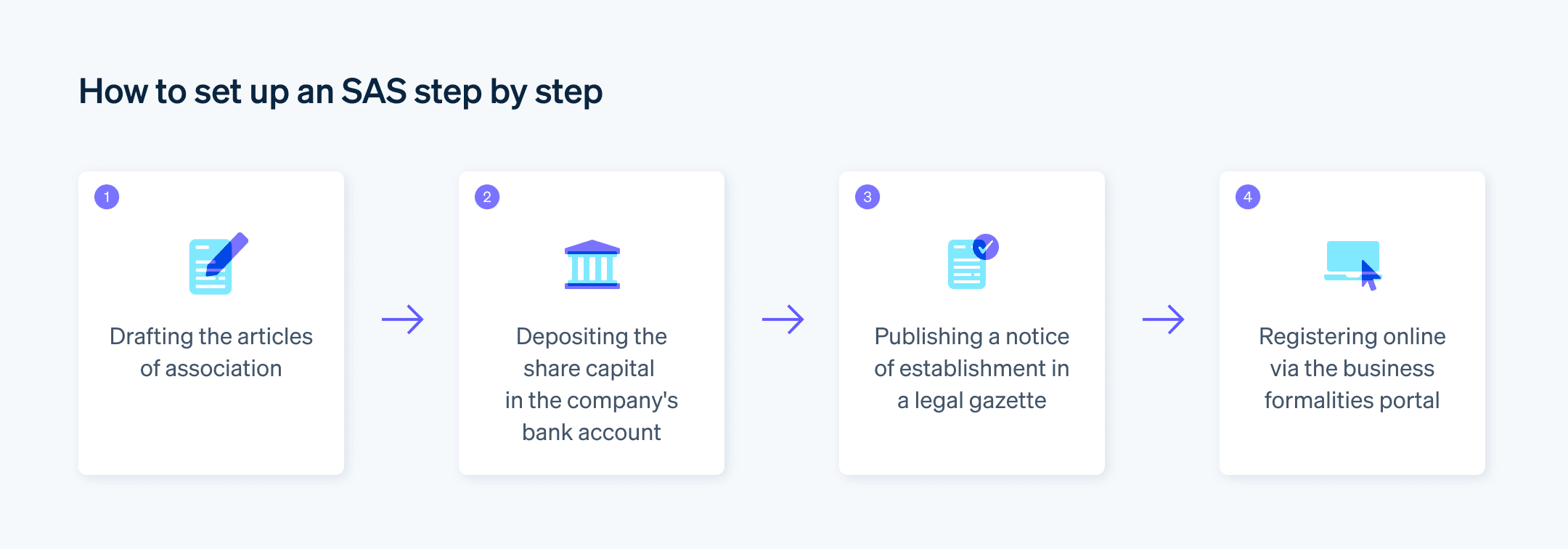

An SAS cannot be launched without certain mandatory procedures, including:

- Drafting the articles of association

- Depositing the share capital in the company’s bank account

- Publishing a notice of establishment in a French legal gazette, or JAL (journal d’annonces légales)

- Registering online via the business formalities portal

The image below illustrates the steps involved in creating an SAS:

Drafting the articles of association

Forming an SAS begins with drafting the articles of association, a document that defines the company’s operational, organisational, and management rules. The partners have considerable freedom in determining these rules, which makes SAS a very popular legal structure among entrepreneurs.

At a minimum, the articles of incorporation of an SAS must contain the following:

- Company name

- Company’s legal form (SAS)

- Registered office address

- Company’s purpose (main activities of the SAS)

- Amount of share capital and each shareholder’s contributions (in kind and cash)

- Duration of the SAS

The articles of association often also specify the president’s name and the decision-making rules for the governing bodies.

Choosing the company’s name

You need to check the availability of your chosen company name before assigning it using the free search tool provided by INPI (l’institut national de la propriété industrielle). Once registered, a unique company name is protected nationwide.

Choosing the registered office

You have several options for the domicile of your SAS. The registered office can be located at the president’s residence, in a business incubator, collective domicile entity, or commercial building.

Depositing the share capital

After drafting the articles of association, deposit the SAS’s share capital in the company’s business bank account. Pay half of the cash contribution during registration and the remaining half within five years.

Choosing a bank for the SAS business account is an important decision. Read our article on the best banks in France to learn more.

Valuation of contributions in kind

You must appoint a contributions auditor when a contribution in kind exceeds €30,000 and represents more than half of the share capital.

Publishing a notice of incorporation

After depositing the share capital in the business bank account of the SAS, you must publish a notice of incorporation in a JAL. This is used to inform third parties of the existence of the SAS.

To publish a notice of incorporation in a JAL, you need to provide the following information using the designated form:

- Company name

- Acronym (if applicable)

- Legal form (SAS)

- Corporate purpose

- Amount of share capital stated in the articles of association

- Duration

- Registered office address

- Surname, first name, and address of the president (and managing director, if any)

- Name and address of the appointed auditor (if any)

- Conditions for admission to meetings and exercise of voting rights

- Approval clause (if applicable)

- The register in which the SAS will be registered

You will receive a certificate of publication of the legal announcement, which will serve as proof of registration.

Registering with the one-stop shop

The final stage in founding an SAS is done online. You need to submit your registration file to the business formalities portal along with the required supporting documents:

- Signed articles of association

- Certificate of deposit of share capital in the company’s bank account

- Certificate of publication of the legal announcement

- A copy of the president’s identity document

- Proof of address

- Diplomas or proof of qualification (for a craft or regulated activity)

- Declaration of beneficial owners

Once registration is complete, you’ll receive a Kbis extract for your SAS. This document certifies the company’s record in the National Register of Companies (RNE) and confirms its legal existence.

Accelerate your time to market with Stripe Payments, a simplified payment system for start-ups and multinationals. With Stripe, you can access over 100 methods to accept transactions in more than 195 countries – all without writing any code.

How much does it cost to set up an SAS?

Establishing an SAS can be costly. Expect to pay the following:

- For drafting the articles of association: Between €1,500 and €2,000 to consult with a lawyer, around €200 for a legal platform, or €0 if you do the drafting yourself

- For hiring a contributions auditor (if necessary): Between €500 and €3,000

- For publication of the legal announcement: €193 in 2024

- For registration: €37.45 for a commercial activity, plus €15 for a craft activity

- For declaration of beneficial owners: €21.41

- For domiciliation: Cost varies depending on location

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.