The national, prefectural, and municipal governments provide public services, social capital development, social security, and welfare important for people to lead safe and prosperous lives. Taxes are the revenue that supports our daily routines.

The tax authority requires both corporations and sole proprietorships to pay various levies. Many find the Japanese fiscal system complicated to understand, and it can be difficult to grasp everything all at once. This article provides a detailed explanation on consumption tax and payment deadlines.

What’s in this article?

- Checking if you need to pay taxes

- Consumption tax filing and payment deadlines

- Considering when to pay consumption tax

Checking if you need to pay taxes

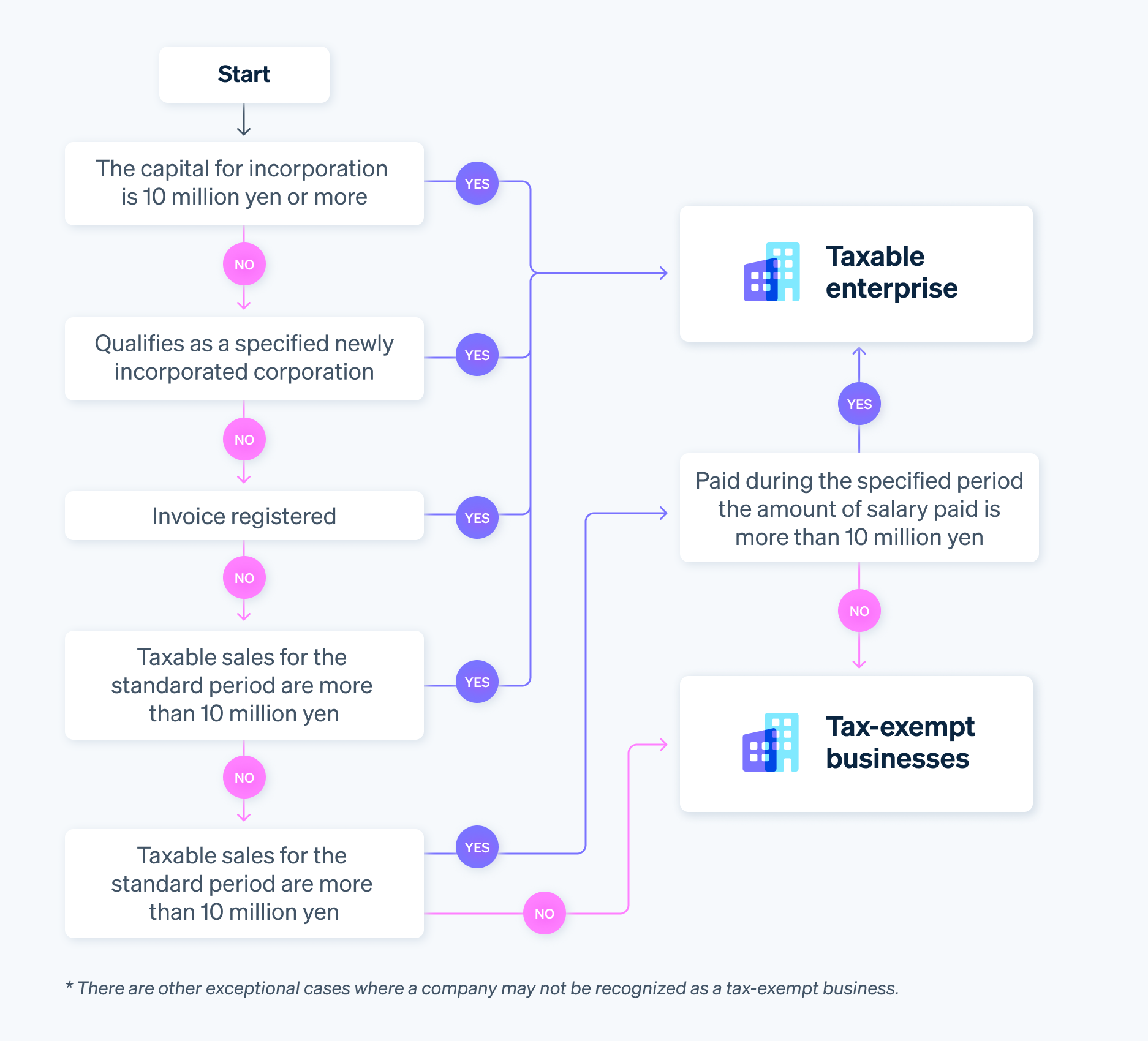

First, let’s explore how to determine if an entity has to pay consumption tax. In some cases, such as sole proprietors, corporations might also qualify as tax-exempt businesses and thus do not file consumption tax returns.

When you are not required to file a corporate consumption tax return

A corporation can become a tax-free vendor if it meets the following conditions:

- Taxable sales of ¥10 million or less for the standard and specified period, and the company elects to become a tax-exempt enterprise.

In other words, a newly established corporation is likely exempt from taxes since neither a standard nor specified duration exists.

However, even if an entity meets the above conditions, the tax authority will consider it a taxable enterprise from the first year of incorporation if it meets any of the following three conditions:

- Its capital at the time of incorporation exceeded ¥10 million.

- The company was specified as a newly established enterprise (e.g., a parent or group company substantially owned by a major corporation).

- Registered as a qualified invoice issuer

If you intend to take full advantage of being a tax-exempt business and pay no consumption tax, carefully choose the amount of capital at the time of incorporation and plan the establishment of your corporation accordingly.

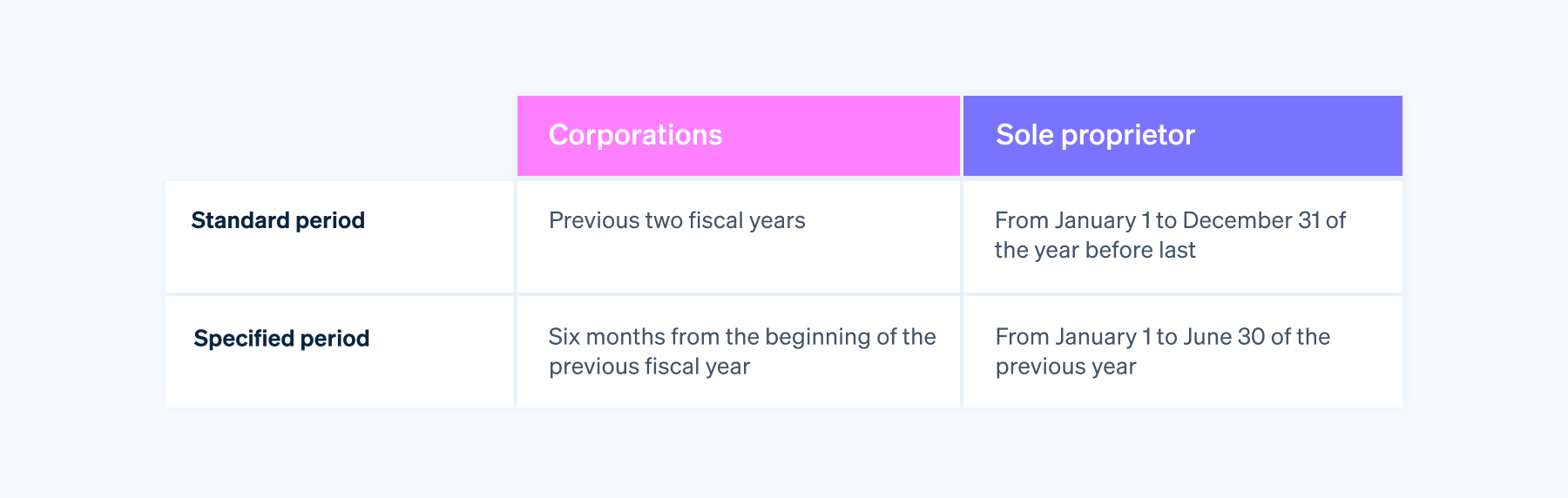

The standard and specified periods differ for corporations and sole proprietorships. Take your time to avoid any mistakes.

When you must file a corporate consumption tax return

Next, let’s look at when consumption tax liability arises.

The tax authority considers a corporation a taxable enterprise if any of the following cases apply:

- Taxable sales for the standard period exceed ¥10 million

- Taxable sales for the standard period are less than ¥10 million, but sales for the specified period or salaries paid during it exceed ¥10 million

- Registered as a qualified invoicing business

Notes: There are cases other than the above where you must file a consumption tax return as a taxable supplier, like when the amount of capital at the time of incorporation exceeds ¥10 million or when the company is a specified newly established corporation.

In some cases, if a business is eligible for a refund, for instance if it paid more consumption tax than it received, it might be better to elect to become a taxable business rather than remain a tax-exempt one.

If unsure whether your company qualifies as such, follow the steps below.

Consumption tax filing and payment deadlines

The tax authority requires that taxable enterprises file and pay consumption tax obligations.

Since you must settle it at the same time you file your tax return, the due date of the return and the payment are effectively the same. So, when should you pay your consumption tax?

Payment due date and taxable period for tax returns

A corporation’s fiscal year determines its taxable window, and can be decided within one year. For a new corporation, this begins on the date of incorporation and ends on the last day of the fiscal year. Its business entity must submit a final and local consumption tax return to the competent district director of the taxable area within two months from the day following the end of the period and pay the associated and local consumption tax.

The deadline is less flexible for sole proprietorships. This is because their taxable period is from January 1 through December 31.

For sole proprietors, tax returns are due on March 31 (or the following day if the due date falls on a Saturday, Sunday, or holiday).

- Business type: Payment due date for consumption tax finalization (statutory payment due date)

- Incorporated business: Within two months from the day following the end of the taxable period

- Sole proprietor: March 31 (or the following day if the due date is a Saturday, Sunday, or holiday)

In addition, if you are a sole proprietor and use tax transfer (automatic deduction from your account after completing the procedures), the National Tax Agency provides separate information on the date of consumption tax debit. Although you must file tax returns by March 31, the actual tax debits are due mid to late April, so there is no rush to get the funds in place.

Special Provisions for Taxable Periods

A corporation could also choose the exception to the taxable period, which divides each into three-month or one-month windows starting from the first day of the fiscal year and considers each duration one taxable period. In the case of a shorter tax window, you must still file your tax return and make your payment within two months of the end of the respective tax cycle.

For the quarterly taxable periods the following declaration and payment due date apply:

Incidentally, sole proprietorships get a notable exception to the taxable period. Suppose one reduces its window by three months. In that case, it can divide it into the following three-month to one-month periods if it is reduced by one month: January 1 to March 31, April 1 to June 30, July 1 to September 30, October 1 to December 31, and January 1. In this case, you could shorten the taxable duration by one month.

Please note that corporations and sole proprietorships that have elected to use the special exception to the taxable period might not discontinue it for two years, except in the case of business discontinuance.

Interim declarations

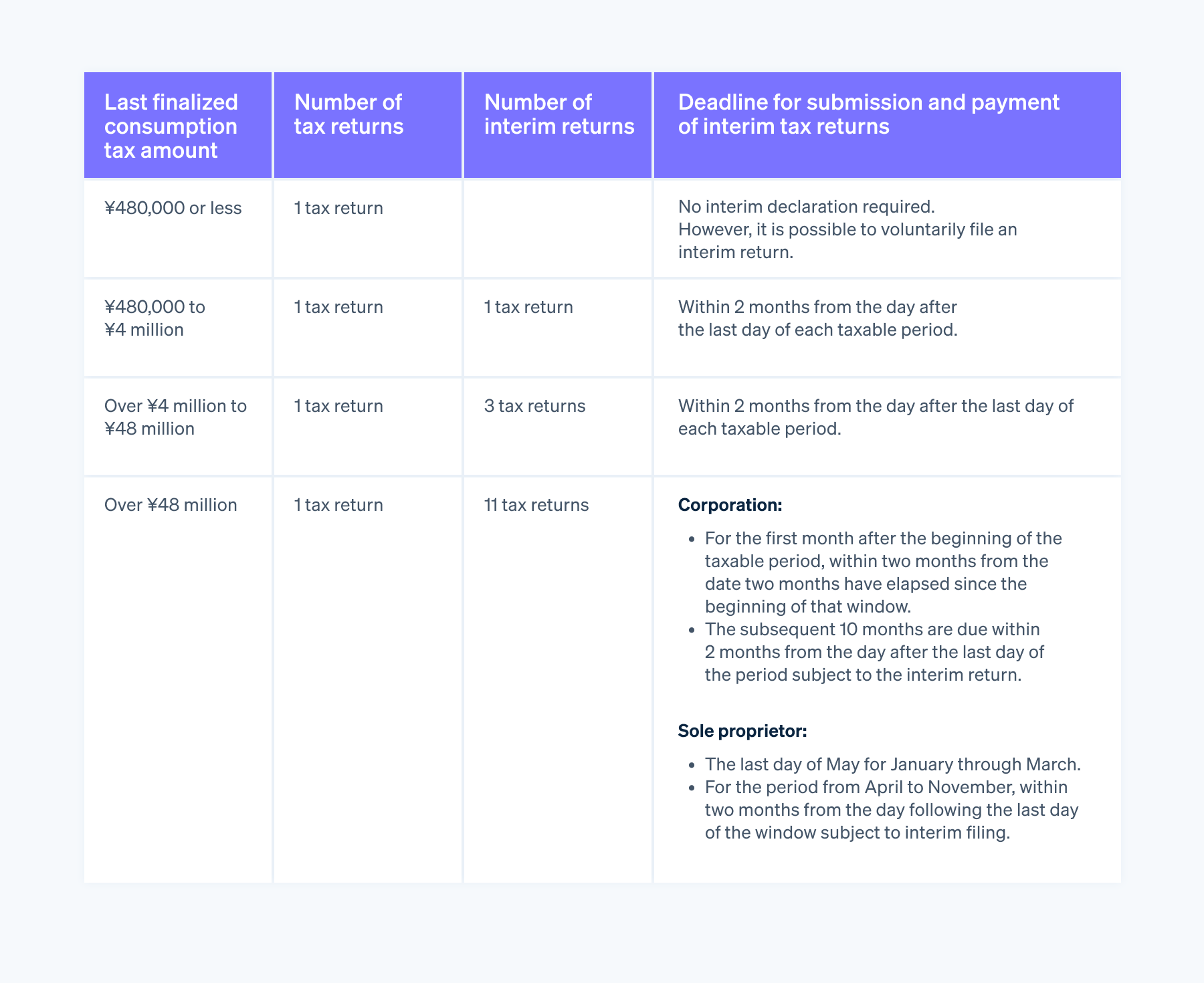

In principle, the taxable period for consumption tax is one year, but in the middle of a fiscal year, the tax authority might require an “interim tax return” to pay a portion of the tax.

You must file an interim return when the annual consumption tax amount for the previous fiscal year for corporations (or the last year for sole proprietors) exceeds ¥480,000. Please note that the number varies depending on the final consumption tax amount.

Considering when to pay consumption tax

Since a corporation uses its fiscal year to determine its taxable period and filing and payment deadlines, it is important to fully understand the consumption tax structure to ensure you pay your taxes on time.

For taxable businesses, you must pay sales tax regardless of whether your business is doing well. If you don’t settle consumption tax by the cutoff, you can request an extension, but you will have to pay a late fee.

Therefore, it is best to pay when your company’s funds are plentiful. Consider measures such as avoiding times when you have other expenses to cover, like insurance premiums or bonuses, and overlap with busy time frames to reduce the workload on the accounts department.

If you are trying to simplify your financial management as much as possible, consider installing accounting software with functions for closing accounts, filing consumption tax returns, and paying taxes.

For example, Stripe Tax covers the tax systems of over 50 countries, including Japan. With Stripe Tax, you can automate complex tax calculations and collections, allowing you to spend less time on tax compliance and more time growing your business.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.