If your business sells goods or services remotely to private customers in other European Union countries, you might be required to pay value-added tax (VAT). Handling VAT can be complicated, mainly if you operate in multiple EU countries. To simplify these transactions, the EU introduced the One Stop Shop (OSS) VAT system for selling goods and services to final consumers, allowing you to register, report, and pay it in a single member country rather than separately in each region where you have customers. This article examines the OSS scheme, how it works, who can benefit from it, and the steps to register.

What’s in this article?

- What is the OSS scheme?

- What are the advantages of the OSS scheme?

- Who is eligible for the OSS scheme?

- How does the OSS scheme function?

- What are the exclusions from the OSS scheme?

- How to register for the OSS regime

What is the OSS scheme?

The OSS scheme is an optional VAT arrangement for businesses selling services to final consumers (B2C) in other EU member countries. It covers intracommunity distance sales and goods supplied through electronic platforms. This special scheme simplifies VAT administration by allowing organisations to register, declare, and pay VAT in one member state (called the member state of identification) rather than register separately in each EU country where sales are made. It then distributes the amounts collected to the appropriate EU countries.

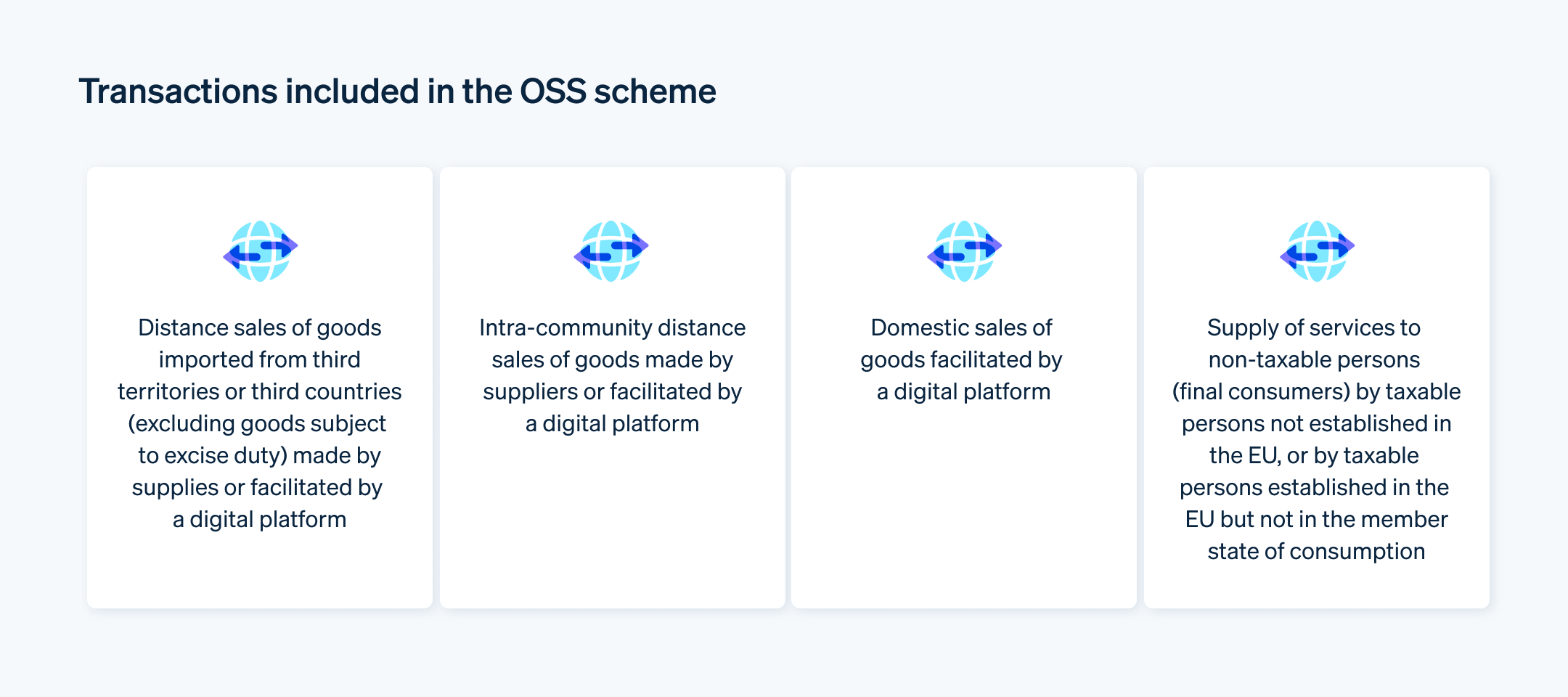

The OSS scheme extends the scope of the previous Mini One Stop Shop (MOSS), limited to electronic, telecommunications, and broadcasting services, to contain the following transactions:

The Import One Stop Shop (IOSS) special scheme is also available for B2C distance sales of products imported from third countries or territories, including sales through interfaces, where the value does not exceed €150. If the payer opts for the IOSS plan, the import VAT procedure is simplified. It also allows VAT due in several EU VAT jurisdictions to be accounted for through a single registration and IOSS return.

What are the advantages of the OSS scheme?

By joining the OSS program, you can take advantage of the following benefits:

Reduced administrative burden: You only need to register for VAT in one member state instead of dealing with separate VAT registrations in each EU country where you make transactions. This also allows you to trade in one language with the tax authorities of the member state where your company is registered for OSS, regardless of where your sales occur in the EU.

Simplified tax compliance: The ability to file a single OSS VAT return and make a single VAT payment for all goods and services makes it easier to ensure compliance, minimising the risk of errors and penalties.

Improved operational efficiency: With less time spent on paperwork, you can focus on growing your business.

International growth: By removing tax barriers, the OSS allows you to compete more easily across Europe, helping you to expand your customer base into new regions.

Who is eligible for the OSS scheme?

In this context, it’s important to distinguish between two types of OSS programmes: the EU OSS plan and the non-EU OSS plan.

EU OSS scheme

The following are eligible for the EU scheme:

- Taxpayers residing or developed on Italian territory who have not established their domicile abroad are responsible for all offerings provided in other EU member states to non-taxable customers (end consumers), for all intracommunity distance shipment of goods, and all supplies of goods made through electronic interfaces.

- Taxpayers domiciled or resident outside the EU but with a permanent establishment in Italy, and those located or residing outside the EU without an operational base in the EU who dispatch or transport products from Italy. Non-EU persons without a permanent establishment who dispatch or transport goods from Italy must appoint a tax representative to register for the programme.

The approach includes intracommunity distance sales of products made by suppliers or facilitated by a digital platform, domestic sales of goods facilitated by a digital platform, and supply of services to non-taxable persons (final consumers) by taxable persons not established in the EU or by those structured in the EU but not in the member state of consumption.

Non-EU OSS scheme

This scheme is specifically designed for economic activities that do not have a place of business or fixed establishment within the EU. Regardless of whether these operations are registered or required to register for VAT in a member state for offerings other than B2C transactions, they can still use the non-EU B2C option.

The system covers all offerings (including telecommunication, broadcasting, and electronic services [TTE]) supplied in the EU by the above taxable persons to final consumers. If the supplier opts for the non-EU scheme, they must use it to declare and pay VAT on all these B2C transactions within the EU.

How does the OSS scheme function?

Legislative Decree No. 83 of 25 May 2021, introduced an annual threshold of €10,000 (excluding VAT). Below this threshold, direct e-commerce transactions (such as digital and telecommunication services) and B2C distance sales to private buyers in other EU countries are subject to VAT in the member state where the supplier is established (country of origin). If this threshold is exceeded, VAT becomes taxable in the country of residence of the final consumer (another EU country). In this case, the payer has two options:

- Register in each EU country where sales are made, and declare and pay VAT separately in each country.

- Opt for the OSS VAT regime by registering in your country (e.g., Italy) and managing all VAT declarations and payments through a single process. In this case, the tax authority of the country of registration will be responsible for distributing the VAT paid to the respective customer destination countries.

VAT declaration under the OSS scheme

The OSS VAT return must be submitted to the Agenzia delle Entrate (Italian Revenue Agency) through the OSS portal quarterly, regardless of whether any dealings have occurred during the quarter. The deadlines are:

- 30 April for Q1 (covering 1 January to 31 March)

- 31 July for Q2 (covering 1 April to 30 June)

- 31 October for Q3 (covering 1 July to 30 September)

- 31 January for Q4 (Covering 1 October to 31 December)

EU OSS VAT declarations

The transactions to be included in the declaration depend on the OSS option chosen by the VAT holder and whether a digital platform is involved in facilitating the supply of goods:

- EU OSS entities formed in Italy must include in their declaration supplies of services to end consumers residing in a member state other than Italy and intracommunity distance sales of goods.

- Activities not established in the EU and registered with the EU OSS in Italy must declare only intracommunity sales of goods.

- Digital platforms (both EU–based and non-EU–based) that facilitate the supply of products and are registered with the EU OSS in Italy must include intracommunity distance sales of goods and certain domestic supplies of goods (where the products are located in Italy and the purchaser resides there) in their declaration.

Non-EU OSS VAT declarations

A taxable person established outside the EU and registered with the non-EU OSS must return all services supplied to final consumers residing in EU member states, including telecommunications, broadcasting, and electronic offerings, no matter if they are residents of Italy.

Services supplied to customers in a member state where the supplier is structured must be declared in that member state’s national VAT return, regardless of whether the permanent establishment is involved in the supply of the transactions.

All declarations must include the VAT ID number, reference period, currency used, and the amount (excluding VAT) of services provided during the reference quarter under the OSS programme, broken down by each member country of consumption and applicable rates.

The following information must be included in the declaration by companies with permanent establishments in other member states:

- The amount of digital services provided through a permanent establishment in each member state, other than the one in which the organisation is formed, wherein the purchasers are domiciled or resident

- The VAT ID or tax registration number of the permanent establishment

Paying VAT under the OSS scheme

To pay VAT under the OSS setup, log in to the reserved area of the Italian Revenue Agency website and access your dashboard by following the procedure outlined below:

- Go to the Services section and select “Applications, communications and certificates”

- Select “MOSS, OSS, IOSS”

- Click on “OSS”

- Select “OSS payment” and “Access payments”

- Select the year related to the statement in question and confirm

- Next, select the pending statement and choose the payment date

- It will notify you of the due date, after which you can click “Confirm” and proceed with the payment

Managing VAT compliance can be a challenge for your business, especially as you grow into new markets. Solutions such as Stripe Tax allow you to calculate and collect taxes worldwide through a single integration. In addition, Stripe Tax’s detailed summary reports meet the formatting requirements for tax returns in each location, making it straightforward to file and remit taxes either independently or with the help of your preferred accountant or partner.

What are the exclusions from the OSS scheme?

Businesses could be excluded from the special scheme if they notify that they no longer provide digital services, are presumed to have ceased providing the offerings, are no longer eligible for it, or continually fail to comply with the rules related to the special scheme.

How to register for the OSS regime

To register for the OSS regime, you must register electronically from your Italian Revenue Agency website dashboard under the “MOSS, OSS and IOSS VAT schemes” section. Here, you can select the setup you wish to register for, enter your VAT number, the start date, and whether you have permanent establishments in other member states (direct identification) or any “foreign tax identification” (indirect identification). You can ignore these fields if you have no other active VAT numbers abroad. Once registration is complete, the system will display a confirmation screen, and you can download a PDF file containing the registration receipt.

Electronic registration becomes effective on the first day of the next quarter after you notify the member state of your registration identification. For example, if you want to register for the OSS program in the current year’s third quarter (July to September), you must register by 30 June.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.