O gerenciamento de pagamentos recorrentes, seja de contas residenciais, assinaturas ou faturas empresariais, pode ser demorado e sujeito a erros. Pagamentos atrasados, processamento manual e fluxo de caixa imprevisível também podem criar desafios para empresas e consumidores.

O débito automático é uma forma de pagamento cashless popular que simplifica as transações de pagamento. De acordo com a Pew Research, cerca de 4 em cada 10 americanos (41%) afirmam que nenhuma de suas compras em uma semana normal é paga usando dinheiro, refletindo uma preferência crescente por formas de pagamento digitais e automáticas.

Neste artigo, você aprenderá o que são débitos diretos, como eles mudaram ao longo dos anos, em que eles se diferenciam das transferências bancárias e muito mais.

Neste artigo:

- O que é um débito automático?

- Como os débitos automáticos mudaram ao longo dos anos?

- Quais são os benefícios do débito automático?

- Qual é a diferença entre débito automático e transferência bancária?

- Quanto tempo o cliente tem para reembolsar um débito automático?

- O que acontece se não for possível cobrar um débito automático?

- Como o Stripe Payments pode ajudar

O que é um débito automático?

O débito automático é uma forma de pagamento segura e simplificada que as empresas podem usar para processar pagamentos. Muitas vezes, as pessoas usam o termo "débito automático" para se referir a pagamentos com débito automático SEPA.

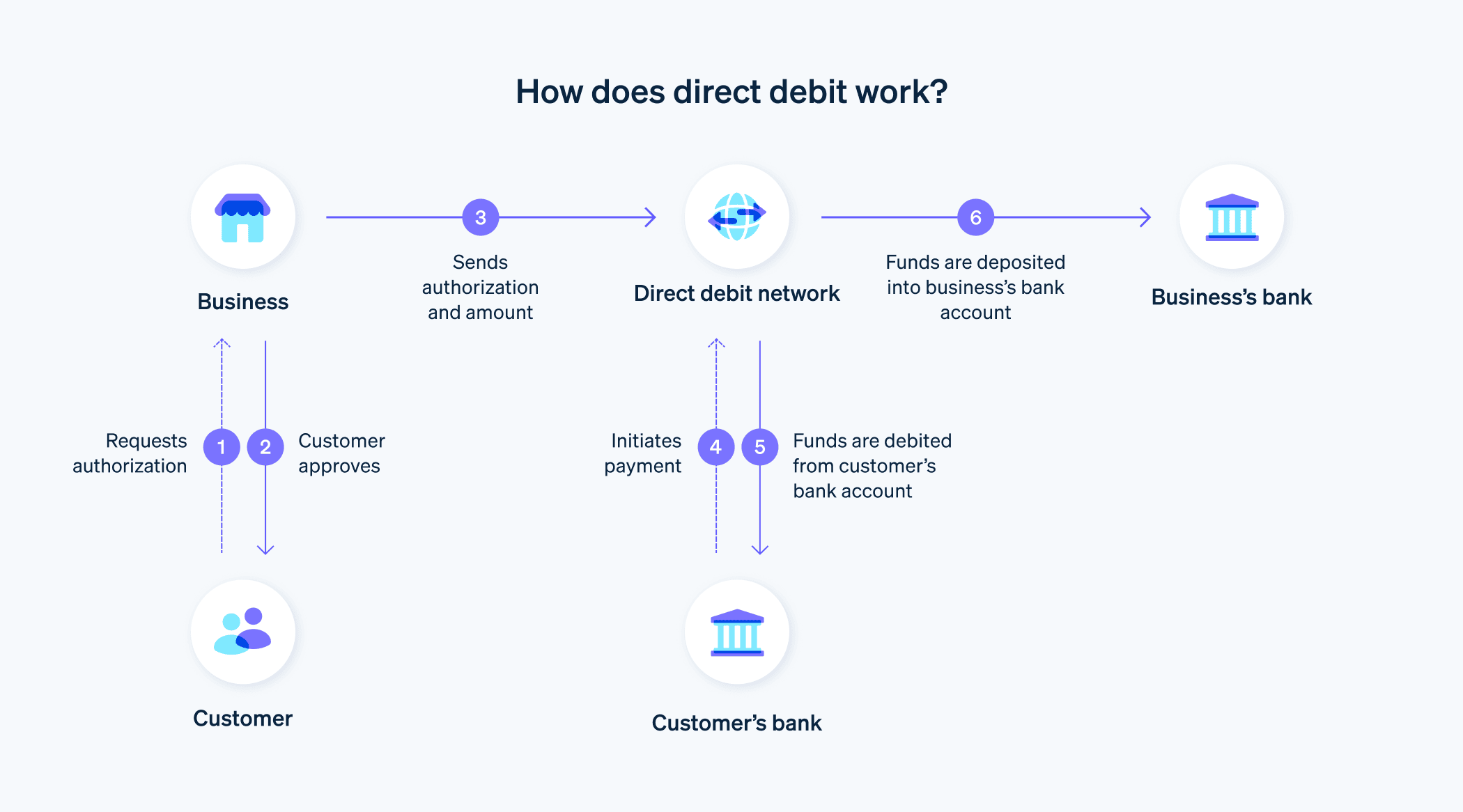

Os débitos automáticos permitem que as empresas recebam pagamentos da conta bancária do cliente na data de vencimento dos pagamentos. Ao contrário de outras formas de pagamento, em que os clientes iniciam manualmente as transferências, o débito automático autoriza as empresas a retirar automaticamente os fundos, minimizando os atrasos nos pagamentos.

Para processar uma transação de débito automático, as empresas precisam de uma instrução de débito automático, também conhecida como instrução de débito automático SEPA. Ela representa o consentimento por escrito do cliente com o débito dos valores em sua conta. O débito automático garante o recebimento pontual e sem custo adicional dos pagamentos.

Os pagamentos com débito automático são particularmente vantajosos para pagamentos recorrentes, como assinaturas ou associações. A automação de débitos automáticos acelera o processo de cobrança, melhora o fluxo de caixa, reduz a carga de trabalho administrativa e aumenta a eficiência de todo o processo de pagamento.

Como os débitos automáticos mudaram ao longo dos anos?

Antes da introdução do esquema de débito automático SEPA em 2009, os débitos automáticos eram realizados pela autoridade de débito automático, exigindo muitas vezes formulários impressos para o processamento dos pagamentos.

O lançamento do esquema de débito automático SEPA permitiu que as transações de débito da câmara de compensação automática (ACH) fossem processadas em vários países segundo uma estrutura padronizada. Esse recurso permitiu que as empresas recebessem pagamentos internacionais com débito automático, ampliando o alcance dos serviços de pagamento e melhorando a eficiência.

Até 1º de fevereiro de 2014, a autorização de débito automático e o débito manual ainda eram usados. No entanto, a partir dessa data, o esquema de débito automático SEPA substituiu totalmente essas formas mais antigas. As instruções de débito automático existentes foram automaticamente convertidas em instruções de débito automático SEPA em conformidade com as regulamentações financeiras e de open banking.

Quais são os benefícios do débito automático?

O débito automático é uma forma segura e automática de as empresas receberem pagamentos dos seus clientes. Veja como as empresas se beneficiam dessa forma de pagamento:

- Cobrança de pagamentos econômica: elimina a necessidade de faturamento manual, o que reduz custos administrativos e melhora as operações.

- Pagamentos automáticos: garantem que os pagamentos sejam recebidos na data de vencimento, reduzindo o risco de pagamentos atrasados ou inadimplentes.

- Melhoria no gerenciamento do fluxo de caixa: os pagamentos são recebidos pontualmente, permitindo que as empresas planejem as finanças com mais eficiência.

- Contabilidade simplificada: as transações são registradas automaticamente, reduzindo a probabilidade de erros e facilitando a reconciliação.

- Redução da carga de trabalho: não é preciso processar pagamentos manualmente, enviar lembretes ou acompanhar faturas não pagas.

- Flexibilidade na aceitação de pagamentos: compatível com cartões de crédito e débito, transferências bancárias e serviços de online banking.

Os clientes também desfrutam da conveniência de pagamentos automatizados e sem complicações com o débito automático. Veja como:

- Pagamentos convenientes e sem complicações: não é preciso lembrar datas de vencimento de pagamentos nem iniciar manualmente transferências para contas domésticas, assinaturas ou associações.

- Transações seguras: os dados das contas bancárias são criptografados, reduzindo o risco de fraudes ou acesso não autorizado.

- Proteção contra débitos não autorizados: os clientes podem monitorar transações de débito automático e solicitar estornos se houver discrepâncias.

- Não é preciso informar novamente os dados de pagamento: os pagamentos recorrentes são processados automaticamente.

- Processamento de pagamentos eficiente e confiável: os pagamentos são gerenciados de forma integrada, sem a necessidade de faturas impressas ou aprovações manuais.

Com a automação do débito automático, as empresas podem otimizar o fluxo de caixa, reduzir os encargos administrativos e aumentar a segurança financeira, enquanto os clientes se beneficiam de transações mais simples, rápidas e confiáveis.

Qual é a diferença entre débito automático e transferência bancária?

A principal diferença entre um débito automático e uma transferência bancária está em quem inicia a transação.

Na transferência bancária, o pagador é responsável por iniciar manualmente o pagamento. Ele precisa inserir os dados do beneficiário, especificar o valor do pagamento e autorizar a transferência pelo sistema de online banking.

Com o débito automático, o pagador autoriza a empresa a cobrar automaticamente os pagamentos. Depois de conceder permissão por meio de uma instrução de débito automático, a empresa poderá retirar os valores acordados sem exigir nenhuma outra ação do cliente.

Quanto tempo o cliente tem para reembolsar um débito automático?

O prazo para reembolsar um débito automático depende de a transação ser um débito automático principal (entre uma pessoa física e uma empresa) ou um débito automático comercial (entre duas empresas ou autônomos).

- Débitos automáticos principais: os clientes têm oito semanas a partir da data do débito para solicitar um reembolso, sem necessidade de justificativa.

- Período de reembolso prolongado: se o cliente não tiver sido notificado previamente sobre o débito, se forem usados dados incorretos da conta ou se houver suspeita de fraude, o prazo para obter um reembolso será ampliado para 13 meses.

- Débitos automáticos empresariais: os reembolsos não são concedidos automaticamente, a menos que a instrução seja inválida ou haja suspeita de atividades fraudulentas. Nesses casos, os clientes têm 13 meses para contestar a cobrança.

Os estornos geram custos substanciais e afetam a reputação da empresa. Para evitar problemas, as empresas devem garantir que todos os dados estejam corretos em cada débito e notificar o cliente com antecedência. Essas ações podem evitar que os clientes reembolsem um débito automático sem qualquer motivo.

O que acontece se não for possível cobrar um débito automático?

Pode haver vários motivos para a falha de um débito automático, como:

- Fundos insuficientes na conta do cliente

- Erros bancários ou problemas técnicos durante o processo de transferência

- Dados da conta incorretos ou desatualizados

- Recusa do débito automático por restrições da conta ou preocupações com fraude

Nesses casos, as empresas devem agir rapidamente e entrar em contato com o cliente para resolver o problema. Também pode ser possível fazer o pagamento por transferência bancária ou outra forma de pagamento.

Como o Stripe Payments pode ajudar

O Stripe Payments oferece uma solução global e unificada de pagamentos que auxilia empresas de qualquer porte, desde startups em expansão até grandes corporações, a aceitar pagamentos online, presencialmente e em qualquer parte do mundo.

O Stripe Payments pode ajudar você a:

- Otimizar sua experiência de checkout: Crie uma experiência sem atritos ao cliente e economize milhares de horas de engenharia com interfaces de pagamento pré-prontas, acesso a mais de 125100 formas de pagamento e o Link, uma carteira digital criada pela Stripe.

- Acessar novos mercados com mais agilidade: Alcance clientes ao redor do mundo e simplifique a gestão de pagamentos em múltiplas moedas, com soluções de pagamentos transfronteiriços disponíveis em 195 países e mais de 135 moedas.

- Unificar pagamentos online e presenciais: Desenvolva uma experiência de comércio unificada em canais digitais e físicos para personalizar interações, premiar fidelidade e ampliar a receita.

- Melhorar o desempenho dos pagamentos: aumente a receita com uma variedade de ferramentas configuráveis e simples, incluindo proteção contra fraudes no-code e recursos avançados para melhorar as taxas de autorização.

- Agir mais rápido com uma plataforma flexível e confiável para crescimento: Baseie-se em uma plataforma projetada para ser dimensionada junto com sua empresa, oferecendo 99,999% de disponibilidade e confiabilidade líder no setor.

Saiba mais sobre como o Stripe Payments pode potencializar seus pagamentos digitais e presenciais, ou comece hoje mesmo.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.