Managing recurring payments—whether for household bills, subscriptions, or business invoices—can be time-consuming and prone to errors. Late payments, manual processing, and unpredictable cash flow can also create challenges for businesses and consumers.

A direct debit is a popular cashless payment method that simplifies payment transactions. According to Pew Research, roughly 4 in 10 Americans (41%) say none of their purchases in a typical week are paid for using cash, reflecting a growing preference for digital and automated payment methods.

In this article, you will learn what direct debits are, how they have changed over the years, how they’re different from bank transfers, and more.

What’s in this article?

- What is a direct debit?

- How have direct debits changed over the years?

- What are the benefits of direct debits?

- What is the difference between a direct debit and a bank transfer?

- How long does a customer have to refund a direct debit?

- What happens if a direct debit cannot be collected?

- How Stripe Payments can help

What is a direct debit?

A direct debit is a secure, cashless payment method that businesses can use to process payments. People often use the term “direct debit” to refer to SEPA Direct Debit payments.

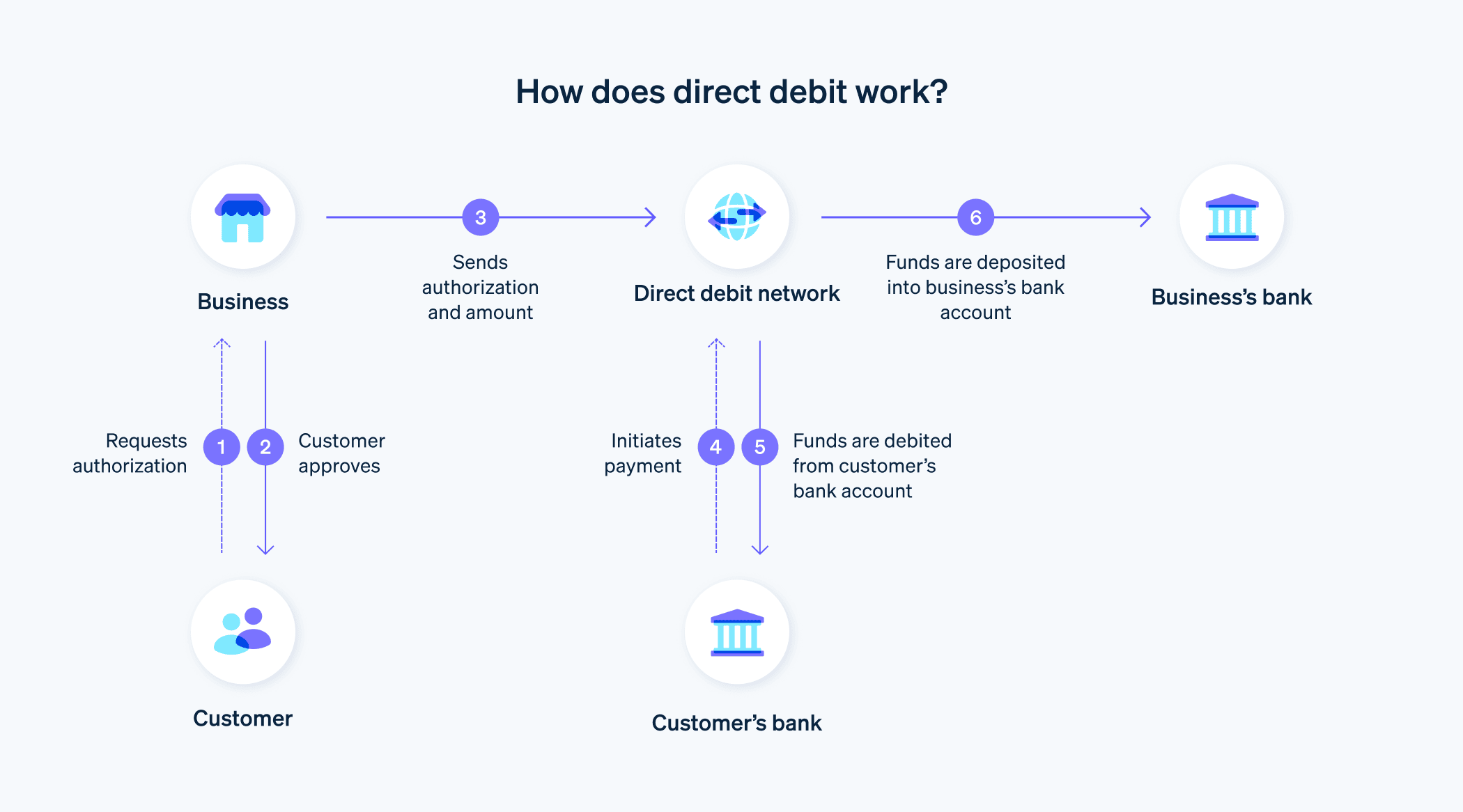

Direct debits allow businesses to collect payments from the customer’s bank account on a payment due date. Unlike other payment methods, where customers manually initiate transfers, a direct debit authorizes businesses to withdraw funds automatically, minimizing payment delays.

To process a direct debit transaction, businesses require a direct debit instruction, also known as the SEPA Direct Debit mandate. This represents the customer’s written consent for the amounts to be debited from the account. Direct debits give businesses the security that payments will be received on time, and they will not incur any costs.

Direct debit payments are particularly beneficial for recurring payments such as subscriptions or memberships. Automating direct debits speeds up the billing process, improves cash flow, reduces administrative workload, and makes the entire payment process more efficient.

How have direct debits changed over the years?

Before the SEPA Direct Debit scheme was introduced in 2009, direct debits were made by direct debit authority and debiting, often requiring paper forms for processing payments.

The launch of the SEPA Direct Debit Scheme enabled automated clearing house (ACH) debit transactions to be processed across multiple countries under a standardized framework. This allowed businesses to collect direct debit payments internationally for the first time, expanding the reach of payment services and improving efficiency.

Until February 1, 2014, direct debit authorization and manual debiting were still in use. However, at that point, the SEPA Direct Debit Scheme fully replaced these older methods. Existing direct debit instructions were automatically converted into SEPA Direct Debit mandates complying with open banking and financial regulations.

What are the benefits of direct debits?

Direct debits provide a secure and automated way for businesses to collect payments from their customers. Here’s how businesses benefit from this payment method:

- Cost-effective payment collection: Eliminates the need for manual invoicing, which reduces administrative costs and improves operations.

- Automated payments: Ensures payments are collected on the due date, reducing the risk of late or missed payments.

- Improved cash flow management: Payments are received on time, allowing businesses to plan finances more effectively.

- Simplified accounting: Transactions are automatically recorded, reducing the likelihood of errors and making reconciliation easier.

- Reduced workload: No need to process payments manually, send reminders, or follow up on unpaid invoices.

- Flexible payment acceptance: Compatible with credit and debit cards, bank transfers, and online banking services.

Customers also enjoy the convenience of automated, hassle-free payments with direct debits. Here’s how:

- Convenient and hassle-free payments: No need to remember payment due dates or manually initiate transfers for household bills, subscriptions, or memberships.

- Secure transactions: Bank account details are encrypted, reducing the risk of fraud or unauthorized access.

- Protection against unauthorized debits: Customers can monitor direct debit transactions and request chargebacks if any discrepancies arise.

- No need to re-enter payment details: Recurring payments are processed automatically.

- Efficient and reliable payment processing: Payments are handled seamlessly without the need for paper invoices or manual approvals.

By automating direct debit, businesses can optimize cash flow, reduce administrative burdens, and enhance financial security, while customers benefit from simpler, faster, and more reliable transactions.

What is the difference between a direct debit and a bank transfer?

The key difference between a direct debit and a bank transfer lies in who initiates the transaction.

For a bank transfer, the payer is responsible for manually initiating the payment. They must enter the recipient’s details, specify the payment amount, and authorize the transfer through their online banking system.

With direct debit, the payer authorizes the business to collect payments automatically. Once they have granted permission through a direct debit mandate, the business can withdraw the agreed-upon amounts without requiring further action from the customer.

How long does a customer have to refund a direct debit?

The timeframe for refunding a direct debit depends on whether the transaction is a core direct debit (between an individual and a business) or a business direct debit (between two businesses or self-employed individuals).

- Core direct debits: Customers have eight weeks from the debit date to request a refund—no justification needed.

- Extended refund period: If the customer did not receive prior notice of the debit, if incorrect account details were used, or if fraud is suspected, the refund window extends to 13 months.

- Business direct debits: Refunds are not automatically granted unless the mandate was invalid or fraudulent activity is suspected. In such cases, customers have 13 months to dispute the charge.

Chargebacks incur substantial costs for businesses and affect a company’s reputation. To avoid any problems, businesses should ensure that all information is correct for each debit and that they provide advance notice to the customer. This can prevent customers from refunding a direct debit without any reason.

What happens if a direct debit cannot be collected?

There may be several reasons why a direct debit was not successful, including:

- Insufficient funds in the customer’s account

- Bank errors or technical issues during the transfer process

- Incorrect or outdated account details

- Direct debit rejection due to account restrictions or fraud concerns

In such cases, businesses should act quickly and contact the customer to solve the problem. It may also be possible to arrange payment by bank transfer or other payment method.

How Stripe Payments can help

Stripe Payments provides a unified, global payments solution that helps any business—from scaling startups to global enterprises—accept payments online, in person, and around the world.

Stripe Payments can help you:

- Optimize your checkout experience: Create a frictionless customer experience and save thousands of engineering hours with prebuilt payment UIs, access to 125100+ payment methods, and Link, a wallet built by Stripe.

- Expand to new markets faster: Reach customers worldwide and reduce the complexity and cost of multicurrency management with cross-border payment options, available in 195 countries across 135+ currencies.

- Unify payments in person and online: Build a unified commerce experience across online and in-person channels to personalize interactions, reward loyalty, and grow revenue.

- Improve payments performance: Increase revenue with a range of customizable, easy-to-configure payment tools, including no-code fraud protection and advanced capabilities to improve authorization rates.

- Move faster with a flexible, reliable platform for growth: Build on a platform designed to scale with you, with 99.999% uptime and industry-leading reliability.

Learn more about how Stripe Payments can power your online and in-person payments, or get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.