我们定期邀请领先的创业者和投资者与 Stripe Atlas 社区分享他们的经验和专业见解。Andrew Chen 是 Andreessen Horowitz 的普通合伙人,主要投资消费类初创公司。此前,他曾在 Uber 负责乘客增长,专注于用户获取、新用户体验、流失、通知及邮件等领域。

为何是交易市场

Andrew Chen 有充分的理由看好交易市场。在加入 Uber 的发展团队后不久,该公司就创下了数年来的最高增长率。当时,该公司的注册人数已超过一亿,每年投入接近 10 亿美元用于增长。公司花了五年半时间才实现了第一个十亿次出行,而六个月后就实现了二十亿次出行。这种加速与规模扩张会激励任何专业人士,但它让他对交易市场这一类型的兴趣,与他对 Uber 作为一家公司产生的兴趣一样强烈。在加入 Uber 后的第一篇主要文章中,Chen 这样写道:

从用户体验的角度看,Uber 是“按一下按钮,车就来了”,但从商业角度看,它是一个由近 70 个国家数百个超本地交易市场组成的庞大集合体。每个交易市场都是双边的,包含乘客和司机,并拥有由接送时间、覆盖密度和利用率驱动的自身网络效应。

多年后,Chen 将自己视为交易市场的投资者、顾问和持续学习者。“过去十年间,许多最成功的公司(Airbnb、Uber、Etsy)都是交易市场。纵观整个领域,还有 eBay 以及亚马逊等已经发展成为交易市场的公司。”Chen 说道。“交易市场是过去几十年来最引人注目的行业,也是自互联网诞生以来最卓越的商业形态之一。我知道这设定了很高的期望,但作为一类商业模式,交易市场可以——而且已经——达到了这样的高度。”

Chen 曾撰写了大量关于交易市场的文章,及其核心驱动力:网络效应。网络效应是一种现象,即随着使用网络的人越来越多,网络对用户的价值也随之提升。正如许多初创公司所证明的那样,网络效应并非在线交易市场独有,但作为一种商业模式,交易市场天生就有更多内置的杠杆来驱动网络效应。Chen 认为,交易市场的核心网络效应杠杆有四点:

- 产品推广 = 交易市场推广:“从其本质来看,交易市场是一个允许商品和服务的买卖双方进行联系和交易的在线平台。无论你是在交易市场上销售佩兹自动售货机还是园艺服务,你在推广商品的同时,也在推广销售平台。”Chen 说道。“换句话说,从用户获取的角度来看,卖方有动力广泛宣传他们正在使用该平台。在这个过程中,交易市场会形成一个病毒式传播闭环,为平台带来免费的自然流量。”

- 共享体验 > 相同体验: 假设你使用智能手机。你可能与其他数十亿人拥有相同的产品体验,但这不是共享体验。“交易市场让你和其他用户一起体验市场产品。一般来说,产品或服务被同时同地体验得越多,网络效应就越强。”Chen 说道。“住房共享和拼车服务就是很好的例子。如果你和朋友一起乘车或租房,你们不仅体验了产品,还一起体验了产品。当你与交易市场的关系和你与朋友的关系融为一体时,这就是网络效应的一种形式——也是让交易市场真正具有长期生命力的原因。”

- 共享体验 > 拥有体验: “交易市场的建立基于这样一个事实,即我们拥有的许多物品都没有得到充分利用。这一原则的核心是相信这些物品与其自己拥有,不如与他人分享。”Chen 说道。“例如,有一家名为 Hipcamp 的公司不仅帮助户外运动爱好者在公共公园寻找露营地,还帮助他们在私人土地上寻找露营地。拥有物业,土地所有者就有成本,从税收到维护。通过将他们拥有的资产变成共享资产,他们可以通过与会享受和尊重土地的人共享土地来实现土地的更多价值。”

- 用户越多,产品越好: “对于许多公司来说,随着用户的增加,质量可能会受到影响。更多的用量和不同的使用场景往往会带来适应难题。但交易市场是一种罕见的业务,使用产品的人越多,实际体验就越好。”Chen 说道。“以 Wonderschool 为例,这是一个日托交易市场。托儿所越多,家长就能找到越多适合自己的选择,如蒙特梭利或语言沉浸式托儿所,以及离家近的托儿所。家长们会对这项服务更感兴趣,参与度更高,这有助于日托机构找到并获得更多客户。”

交易市场最被低估的方面

在 Chen 看来,交易市场最被低估的特性,是其促进服务的能力。“作为一种行业,科技在将物品从 A 点运到 B 点方面做得非常好。亚马逊、eBay 和 Shopify 等平台,可以在一周内、一天内,有时甚至是实时收到产品。”Chen 说道。“交易市场在促进服务交易方面还远未发挥应有的潜力。比如当我们要为孩子找保姆,或聘请高管教练时,我们仍主要依赖朋友或同事的推荐。实际上,交易市场完全能很好地促进这些服务,因为它们可以帮助标准化用户体验——有时甚至可以将体验产品化。我们已经看到交易市场帮助陌生人共享房屋和汽车,但这在所有服务领域还没有完全实现。”

“大多数交易市场都需要调整战略才能达到这一目标。一旦做到,它们将进入一个庞大的全球市场,仅在美国经济体中就有数万亿美元的市场份额。” Chen 表示。“为此,交易市场应满足用户对质量和信任的期望。那么,这究竟意味着什么呢?质量和信任来自一致性。在买家端,这包括创建完整的产品综合体系、提供保险政策、对卖方提供培训以及创建服务等级;在卖方端,这意味着将卖家装备成小型企业。如今,许多用户依靠交易市场建立了完整企业,他们需要在交易市场上做的事情越来越多。交易市场必须帮助卖家定价产品和服务、培训和管理员工队伍,获得寻找供应商的工具,并导入 CRM 系统以管理潜在客户。”

交易市场与建立在其上的企业形成了深度共生关系。“以入驻 Uber Eats 的一家快餐汉堡连锁店为例。就其自身而言,它可能依赖于人流量、本地广告或口碑。但世界正在发生变化。与三年前相比,外卖应用的下载量增长了近 400%。这一趋势正在改变餐厅营收模式,甚至改变他们的设计方式。” Chen 说道。“如果这家汉堡连锁店没有加入像 Uber Eats 这样的交易市场,它就必须成为开发 App 和推广下载的专家,才能突破本地固定客户的限制。而在交易市场上,它可以为更广泛的受众提供服务。例如,它可以拦截那些原本想吃披萨或法拉费(油炸鹰嘴豆饼)的用户,并说服他们改吃汉堡。”

从这种关系中受益的不仅仅是餐馆。“像 Uber Eats 这样的交易市场严重依赖于那些专业性强、运营能力强、自身已经拥有品牌化的餐厅。这些餐厅往往是人们最喜欢下单的对象,也是幂定律曲线的‘头部’。”Chen 说道。“外卖只是一个例子,类似的动态也出现在短租平台(如 Sonder 和 Lyric)以及本地服务平台(如 Thumbtack 或Care.com)。交易市场与专业供应方之间的这种关系,是整个科技行业中最互惠互利的关系之一。”

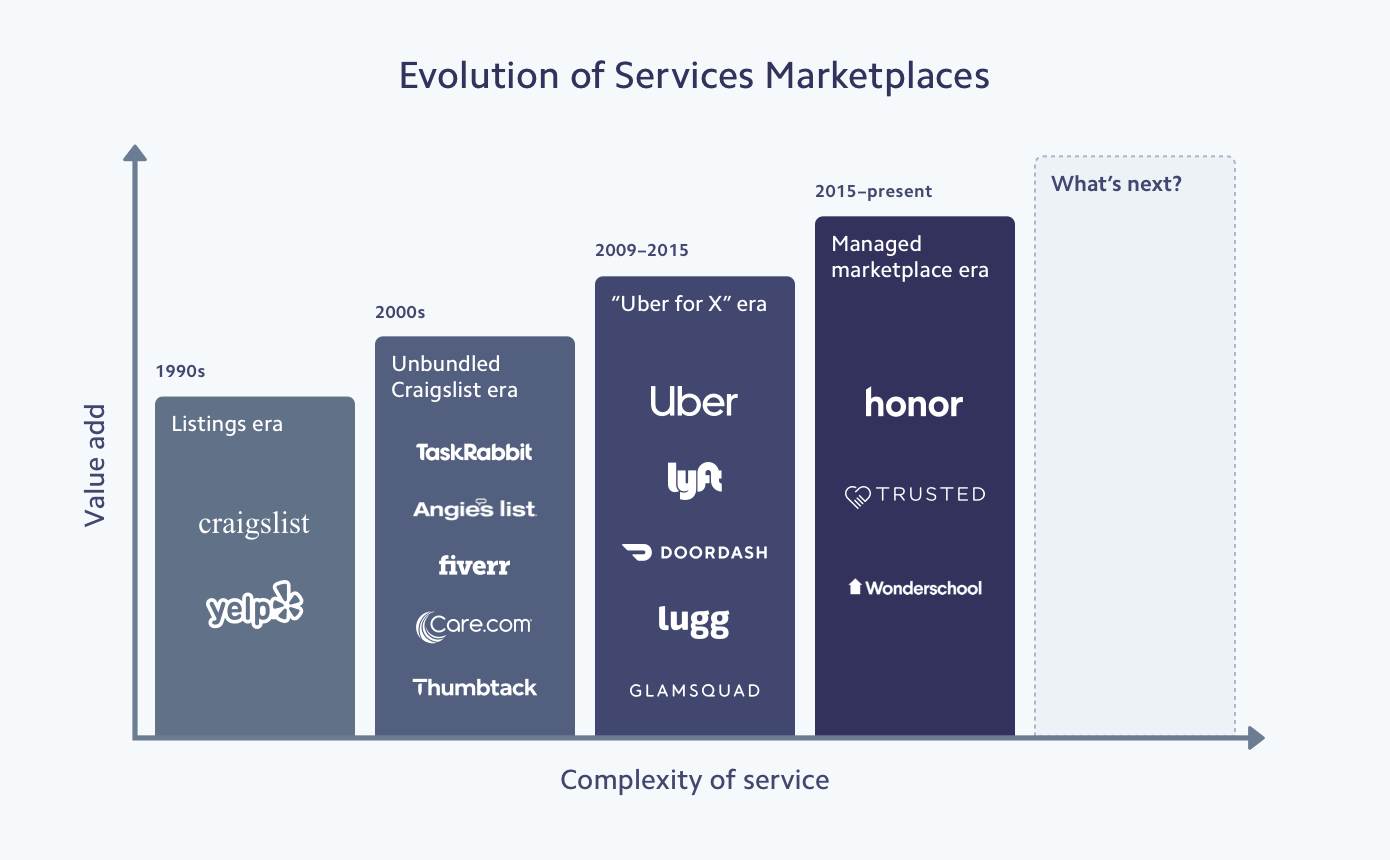

Chen 认为,交易市场向服务撮合领域的跨越式转变,不仅是一种机遇,更是一种必然。“仍有不少人认为,大多数交易市场不过是分类信息网站(如 Craigslist)各分类板块的升级版。要建立一个交易市场,公司只需要把分类信息网站的一个分类做得更好。十年前可能是这样,但如今早已不同。”Chen 表示,“作为投资人,我最看重的交易市场,是那些把持证专业服务行业平台化的创业项目。这不仅仅是卖方发布一个漂亮的商品页,而买家点击即可成交。可能还会有视频,帮助用户理解和直观感受他们即将获得的服务。或者是一个比我们所熟知的 1-5 星评分系统更深入的评价体系。我认为,这种向服务方向的进化,是构建市场平台时一个被严重低估的方面——它在博客或推特上很少被关注,但却是关键要素之一。”

图表内容由 Andrew Chen 和 Li Jin 提供。

交易市场最被夸大的方面

很多公司在路演的时候都会用‘某行业的 Uber’来形容自己,但市场平台里最被高估的一点是大家常常误以为,一种市场策略可以套用到所有市场。“那些把自己称作‘某行业的 Uber’的人,已经损失了数十亿美元。这种说法听起来很吸引人,但真正能做出出色的交易市场的人却少之又少。”Chen 说道。“像食品杂货、拼车、短租,这些领域有成功案例,但另一方面,按需按摩或者代客泊车就很难找到那种市场的‘最佳位置’。如果不了解这些机制为什么会成功,你就无法把一个市场的策略照搬到另一个市场。”

对任何类型的企业来说,重复使用其他业务类型的运营模式都是一种风险,但 Chen 认为这种情况在交易市场上更普遍,而且问题也更严重。“举两个与汽车有关的例子:拼车和代客泊车。事实证明,拼车之所以能作为按需市场顺利运作,是因为这是一项几乎每天都可以选择和使用的服务。不仅是通勤,还包括日常从 A 点到 B 点的出行。这大大提高了市场的流动性。”Chen 说道。“另一方面,代客泊车只针对有车的人或租车用户,市场规模远小于拼车用户。一天可能只用代客泊车两次:送车和取车。从供给方面来看,人们无法靠当全职代客泊车员维持生计。”

Chen 指出,很多人喜欢把交易市场归为一个行业,但实际上它们之间的差异远大于相似之处。“交易市场有很多细微差别。但每当出现热门公司或类别时,大多数人都会尝试着把所有模式套用过去,看看最终会产生什么结果。有时能奏效,但更多时候并不行。”他说:“交易市场并不像游戏那样构成一个行业。它们可以跨越酒店、交通、教育乃至娱乐等多个领域。它们各自属于不同的行业,不可能用一种通用的市场策略去适用。”

通过突破梅特卡夫定律的限制破解冷启动

交易市场面临的最大挑战之一是如何建立网络,以及从哪里开始。这通常被称为冷启动问题。“如果你还记得网络泡沫的历史,那么科技领域的许多早期举措都归因于所谓的梅特卡夫定律 (Metcalfe's Law)。该定律认为,随着网络节点的增加,节点之间的连接数会呈指数级增长。”Chen 说道。“如果将其绘制成图,看起来就像一条疯狂的指数增长曲线。这表明存在先发优势,因为如果你行动迅速,在别人之前获取节点,你的网络就会更强大。这个定律的动态已成为商业建议,和创业圈的常用词汇。”

问题是,实际情况并非如此。“任何在初创公司和交易市场工作的人都知道,事情根本不是这样的。”Chen 说道。“当你的网络介于零和逃逸速度所需的网络密度和规模之间时,你的网络就会不断自我毁灭。如果你不增加新用户——无论是买家还是卖家——你的网络就会归零。你的买家出现了,却看不到足够的商品可买;卖家看不到有人出价,就会选择撤离。只有当你的网络达到逃逸速度时,你才真正脱离这种‘反网络效应’的困境。”

Chen 认为,创始人破解冷启动难题、成功摆脱早期网络熵的巧妙方法有很多。以下是三个例子:

为工具而来,为网络而留。“Hipcamp 最初是一种寻找公共露营地的平台。他们收集并建立了露营地索引,这样人们就可以在一个地方找到所有信息。”Chen 说道:“他们整理了现有的列表,所以对供应端的整合并不费力。”这使得 Hipcamp 从一开始就能作为一个买方工具发挥作用,即使它从一开始还不能作为一个交易市场发挥作用。一旦证明它是一个有用的工具,需求端——露营者——就会出现,Hipcamp 便可以进一步推出预订功能。然后,逐步深化供应端,与私人露营地和物业签约。”

Chen 认为,命名这种技术的投资人 Chris Dixon 功不可没。“OpenTable 是这种冷启动方法的另一个著名例子。它从卖方端开始,作为帮助餐馆管理餐桌的工具,然后它开始拉动需求。Hipcamp 更像是从买方工具出发,最终推动供应端发展。”Chen 说道。“还有很多其他例子,但我们的核心策略是先构建一个库存管理工具,作为建立交易市场的中间步骤。很多时候,这个步骤是从卖方端开始的。”

将纸笔体验数字化。“Pietra 是一个珠宝定制交易市场。几位 Uber 前员工创办了这家公司,因此熟悉供需双方的动态。他们的想法是,从产品和购买体验来看,购买昂贵的珠宝已经过时,尤其是对于千禧一代。首先,人们发现珠宝的方式不同,很可能是从 Instagram 上的名人或制造商流媒体上了解他们的珠宝。其次,珠宝不是个性化或定制的。”Chen 说道:“你可能会喜欢一个手镯的设计,但希望加入自己的生日石或刻字。”Pietra 正在打造一个双边交易市场——如果算上网红,则是三边市场,连接客户和数千家非常小型的家庭珠宝店。”

与大型连锁店相比,这些小型珠宝店通常能以更优惠的价格定制珠宝,但其后台管理效率并不总是很高。“在款式、尺寸和购买等方面的偏好上,常常需要来回沟通。Pietra 将这些规格整合并存储在一个界面友好的应用中,这样,一个可能与 50 位潜在客户打交道的小珠宝商也不会错过或丢失任何信息。”Chen 说道。“这不仅让珠宝商和客户的流程更轻松,从业务模式的角度来看,由于客户的所有偏好都集中在一个地方,转到其他交易市场就有了障碍。”

为供应方设立最低保障。“很多交易市场——尤其是服务经济类子市场——都可以从一开始就提供最低保障的收入,会非常有帮助。例如,Uber 可能承诺,如果司机在一天内完成了最低限度的出行次数,就可以获得 25 美元/小时的报酬。Chen 说道:“这种可预测性不仅能为供应方带来更多稳定性,还能帮助企业快速建立供应方。当供应方的规模达到一定程度时,你就能获得足够的动力去建立需求方。一旦需求方建立起来,就会有更多的供应方签约。这样,飞轮效应就启动了。随着市场达到流动性水平,供应方的收入——比如说 Uber 司机——将逐渐接近保障水平,最终市场能够自然支撑这个保障。”

鉴于许多交易市场都在为供应问题而苦苦挣扎,这是一种非常有效的策略。“我认为,几乎所有最成功的交易市场公司最终都是供应受限,而不是需求受限。无论是教育、杂货还是老年人护理,基本上都有无限的需求,因为你可以与其他服务保持价格持平。”Chen 说道。“因此,通常的情况是,你最终会把大量时间花在考虑供应方面。我在 Uber 就注意到了这一点。当你逐个城市推出产品时,你会发现自己真正专注的是市场的供应方——而同样的挑战和思路会不断重复出现。”

供给—需求—供给—供给—供给 VS 需求—供给—需求—需求—需求

每个交易市场都必须评估供需双方的相对密度,以及哪一方的网络效应更好。Chen 已经观察到 C2C、B2B 和 B2C 公司的一种模式。归根结底是哪一方在注册时会遇到更多的阻力,而这往往与哪一方要做更多的工作相对应。

C2C 与 B2C:“在像共享出行这样的消费交易市场中,司机每天要工作数小时,而乘客可能只花 15-20 分钟在车上。或者是像 Wonderschool 这样的托幼及学前教育服务市场,机构必须取得许可,而家庭主要需要报名参与。”Chen 说道。“对于这些交易市场,挑战往往在于你能否获得足够的供给来参与,因为他们必须做更多的工作才能加入。因此,对于面向消费者的初创公司来说,首先要从供给入手,然后是需求。然后再加倍关注供应、供应、供应。”

B2B:“对于 B2B 交易市场而言,成功的公式正好相反。以 Convoy 这样的卡车运输公司或 Flexe 这样的仓储交易市场为例,这类业务类型往往更受制于需求,因为你的需求方很可能是财富 500 强企业。需求方不太关注价格,更注重质量和声誉。销售周期较长。交易市场初创公司会与这些公司接洽,提供服务,并获得意向书 (LOI)。他们将利用这些意向书筹集资金,并锁定供方。之后再继续向财富 500 强企业销售。”Chen 表示。“相较于消费者对价格高度敏感的消费型交易市场,在这种情况下,如果出现供过于求,只需适当降价,就能迅速拉动需求,从而实现市场的重新平衡。然而,在 B2B 交易市场中,情况正好相反。关注的焦点最终是需求、供给、需求、需求、需求。”

注意事项: 当然,这些模式只是经验之谈,还有其他元素在起作用。Chen 表示:“还存在季节性和地域性的差异。例如,拉斯维加斯的网约车市场常常供给过剩,因为当地司机较多,很多乘客会选择乘坐出租车。而在旧金山或纽约,网约车的供应则更为紧张。房屋租赁也是如此。Airbnb在旅游旺季(如夏季)会出现供不应求的情况,而在其他时间则会供过于求。还有其他因素。例如,一个人要参与这个交易市场是否容易?他是否需要拥有一套房产?是否必须持有执照?大约25%的美国劳动力从事的是需要持证的职业。这些因素都会对供需动态造成一定的影响。”

突破“逃逸速度”后的供需流失

交易市场即使获得了牵引力,也仍然需要面对供需两端的“流失”问题。“让我们再回到珠宝交易市场 Pietra 的例子。这很好地体现了这种动态:需求方的购买频率并不高。毕竟,你不会希望每年都买一枚订婚戒指,对吧?”Chen 说道。“如果你想让人们为自己购买,那可能会更频繁,但通常也与特定节日或纪念日有关。在这种情况下,需求方并不是流失,而只是不活跃。”

然后,我们的目标就是重新获客或让他们活跃起来。“如果看起来需求端出现流失,其实没关系——只要那只是用户阶段性的活跃与不活跃。只要企业有很好的可扩张性、低成本的获客方式,就不会有问题。对于某些企业来说,这可能是通过搜索引擎优化,让人们找到公司。”Chen 说道。“而另一端——供给端——理想情况下,你希望能为他们提供充足的工作与收益,让他们非常满意并且保持极高的粘性。经过多年对许多交易市场的观察,我发现你希望至少要确保有一端是有粘性的。不论是需求还是供给,但至少是其中一方。这样,你就可以随时降低供应端的价格,从而降低他们的粘性,但却能增加需求端的用量和频率。”

即使是成熟的交易市场,也会想方设法缓解供需流失。“我记得在 Uber 成立的头七年,每年一月都会进行一次降价。这是系统性应对流失的一种措施。这种降价每年都会使市场增长,直到司机的利用率已经饱和,再降价也无法提升使用率为止。”Chen 说道。“因此,回到 Pietra 来看,我们要牢记这一点:我不担心需求端的间歇性活跃。如果你能想出如何引导人们从订婚戒指、生日到其他时刻购买珠宝,那就再好不过了。但我真正关注的是:珠宝商是否满意?他们的业务有多少来自该平台?他们能否仅凭在 Pietra 上的销售就维持生计?这才是我最关心的。”

下一代大型交易市场背后的理念

Chen 渴望看到新型交易市场形态出现。他认为以下三种理念将推动下一代交易市场的发展。

每个人都可以做自己喜欢的事情,并从中获利。“理想的社会状态是,每个人都可以做自己喜欢的事情,并从中获利。如果热爱写作或博客创造,有Substack;如果喜欢制作,有Patreon;如果热爱教学,有VIPKid;如果热爱户外活动,有 Hipcamp。”Chen 说道。“这些交易市场的切入点与运输食品或人员不同。这些交易市场正在重新定义工作的未来。我认为,这些行业中会有更多最终发展成由多个交易市场组成的生态,而不是由集中化的雇佣型公司主导。”

许可证不是确保质量的唯一途径。“在政府必须确保所有产品的质量的世界里,许可证是有意义的。但它给我们经济中更大的一部分造成了很大的问题。它让人们——尤其是小时工——更难找到工作。”Chen 说道。“最近《纽约时报》一篇文章指出,像美容美发等领域的职业许可要求在学校花费数十个小时学习,并让人背负上万美元债务,结果在沙龙里只能拿最低工资。这是危机的开始。交易市场有机会利用软件、评级和评论来创造透明度,让人们不必经过繁琐的许可流程,也能找到工作。”

软件层是交易市场的基础设施。“交易市场的兴起不仅仅是以数字方式连接供需双方,它们还积极地在供需双方之间建立信任。这些全堆栈式‘托管交易市场’正在主动提升交易市场每一端的客户体验。”Chen 说道。“例如,Honor是一个居家护理管理交易市场。它不仅仅列出护理人员名单供客户选择,而是会在护理人员入驻前进行面试和筛选。Honor 还会为客户配备顾问,帮助设计个性化护理计划。在交易市场中,Honor 对于定义双方的客户体验以及在双方之间建立信任拥有自主权。”

交易市场的全面实现

Chen 帮助交易市场扫清冷启动障碍,因为这样公司就有机会在规模扩大时释放出巨大潜能。“Uber 教会了我什么是真正的增长。我在那里工作期间,产品/市场契合度非常高。公司的业务发展很快,而我的职责就是想办法让它发展得更快。那时,我们曾有几周每周新招聘超过 200 名员工,每年注册用户数超过全球人口的 3%。”Chen 说道。“但这种增长潜力在突破冷启动问题之前,都是潜伏的。只有当市场平台破解了冷启动难题,飞轮才能变成风车——成为能够持续为企业提供动力、支撑长期发展的机制。”

了解有关交易市场如何使用 Stripe 或查看 Stripe Sessions,聆听 Chen 的合伙人、OpenTable 前首席执行官 Jeff Jordan 讲述创新交易市场如何为卖方创造差异化体验。