随着 2019 年 10 月减税制度的引入,以及 2022 年 1 月修订后的《电子记录保留法》的颁布,交易环境发生了很大变化。在会计业务日益复杂的情况下,税务发票保全系统(也称为“发票系统”)于 2023 年 10 月 1 日启动。

发票系统允许缴纳消费税的企业获得适当的购置税抵免。该系统的影响不仅限于卖家(收到订单并开具发票的卖方)。即使是买家(下订单并收到发票的人),您也应该牢记一些要点。

本指南将向您概述发票系统及其对您的业务的影响,以及 Stripe 如何支持您的企业简化运营。

什么是发票制度?

税务发票保全系统于 2023 年 10 月 1 日启动。税务发票保全系统通常称为“发票系统”,该系统的目的是允许支付消费税的企业通过开具和保留符合特定要求的“发票(税务发票)”来获得适当的购置税抵免。

税务发票项目和购置税抵免将在“发票系统的业务影响”部分讨论,而本节将介绍发票系统的用途。

发票系统的背景是 2019 年 10 月 1 日生效的《消费税法修正案》。由于该法案的修订,消费税从 8% 提高到 10%,同时引入了减税制度。消费税现在涉及两种不同税率的混合:标准税率 (10%) 和降低税率 (8%)。卖家必须根据这两个税率计算消费税,而买家可能很难找到确切的税额,因此会使双方的会计流程复杂化。针对这种情况,实施了发票系统,目的是通过单独记录适用的税率来计算准确的税款。

欧盟以前也采用了类似的计划,那里有多种税率。在由许多不同的欧洲国家组成的欧盟,相当于日本消费税的 VAT(增值税)税率不仅因国家而异,而且因商品或服务的种类而异。因此,发票系统的建立要求开具和保留带有特定增值税信息的电子发票,以明确税率,从而有可能获得税收抵免。

发票系统对企业的影响

发票系统于 2023 年 10 月 1 日推出后发生了哪些变化?

最重要的变化是购置税抵免的要求。利用发票系统,注册为税务发票开具者的企业经营者开具发票(税务发票)并将其保留在买家,以便买家获得相应的购置税抵免。

什么是消费税的购置税抵免?

在我们进一步讨论之前,我们先看看购置税抵免。

购置税抵免是指在支付包含消费税的款项时,从“从商业伙伴或消费者等处收到的消费税”中减去“购买时支付的消费税”而计算出的税款。

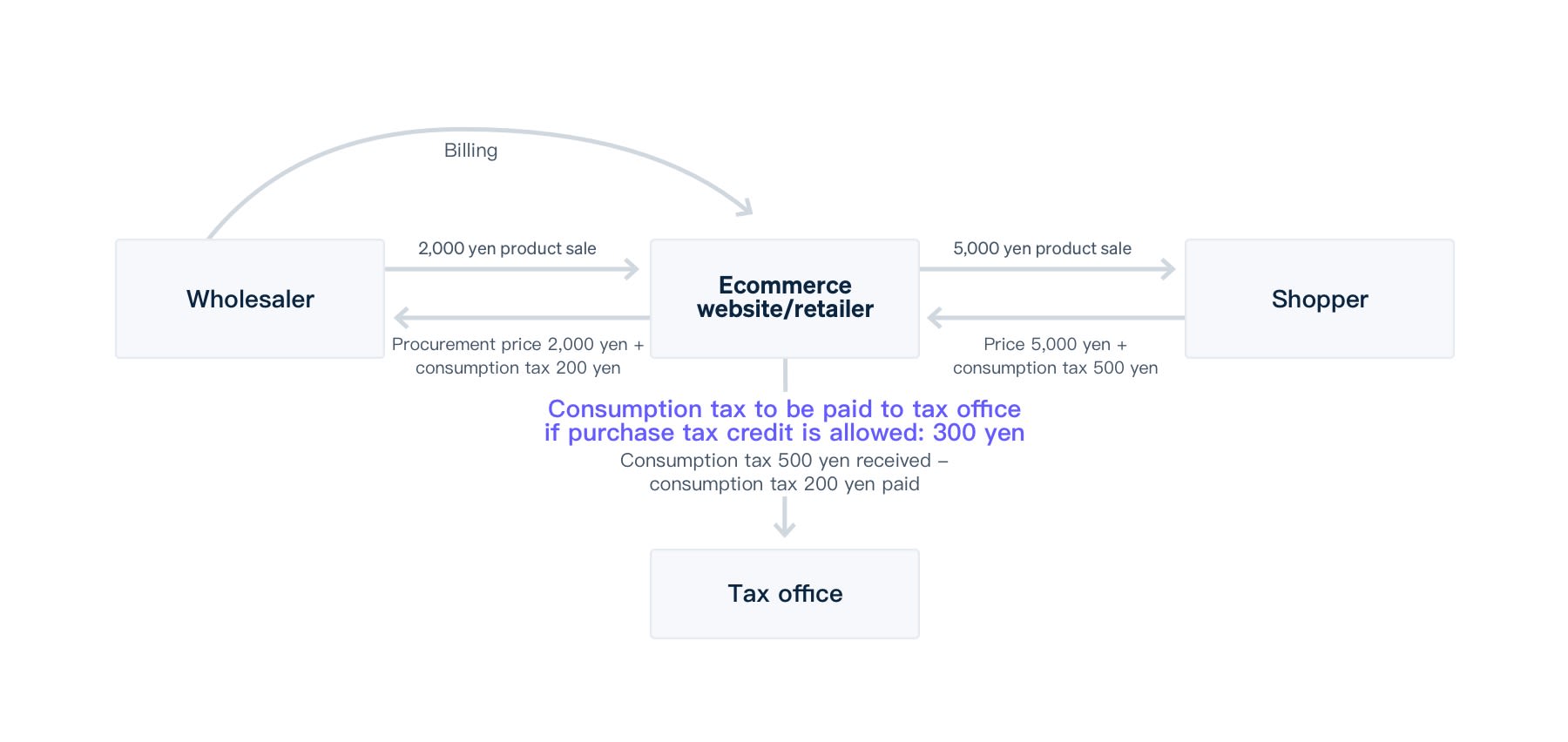

例如,假设您经营一个销售家具和家居用品的电子商务网站。假设您以含税 2,200 日元(购买价格:2,000 日元 + 消费税:200 日元)的价格从批发商处购买产品,然后在您的电子商务网站上以含税 5,500 日元的价格出售给客户(购买价格:5,000 日元 + 消费税:500 日元)。消费税由最终消费商品和服务的消费者承担,由企业向国家支付。但是,这并不意味着企业要全额缴纳从消费者那里收到的消费税。

在这个例子中,家具和家居用品零售商从消费者那里收到 500 日元作为消费税,但他们在从批发商那里购买产品时支付了 200 日元作为消费税,他们会从其收到的消费税中减去这笔费用。换句话说,他们缴纳了 300 日元的税款(500 日元 - 200 日元 = 300 日元)。这就是购置税抵免的运作方式。

发票系统下买卖双方的义务

随着发票系统的推出,需要开具和保留税务发票才能获得购置税抵免。因此,买家原则上要求卖家开具税务发票,买家必须保留账簿并保留税务发票等,才能获得购置税抵免。

在上面的示例中,批发商(卖家)与家具和家居用品零售商(买家)都将受到发票系统的影响。这是发票系统的主要功能之一。卖家(收到订单并开具发票的一方)和买家(下订单并收到发票的一方)都需要确定如何适应该系统。

- 卖家:根据买家的要求开具税务发票

- 买家:原则上,从卖家接收和保留税务发票,以满足购置税抵免要求

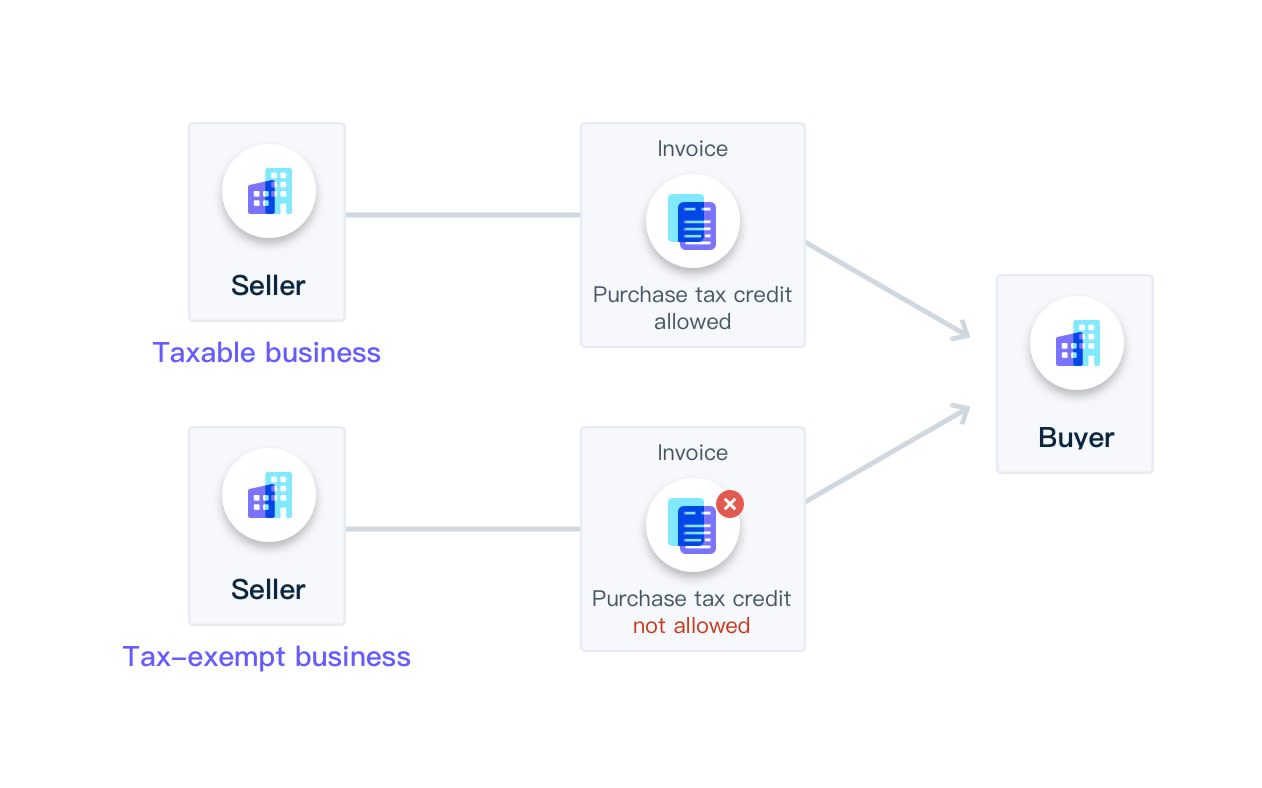

该系统的另一个重要方面是税务发票只能由税务发票开具者开具。反之,未登记的企业经营者不能开具税务发票。换句话说,如果卖家未注册,买家将无法收到税务发票,原则上也无法获得购置税抵免。因此,买家可能会面临更大的税收负担。

发票系统:行动要点

那么您需要做什么呢?

在处理发票系统时,有三个要点需要注意:“申请注册为税务发票等的开具者”、“开具符合规定要求的发票(税务发票)”和“保留发票(税务发票)”。

(1) 申请注册为税务发票等的开具者。

第一步是申请注册为税务发票等的开具者。

同样,为了开具税务发票,您必须是税务发票等的已注册开具者。申请时,您填写注册申请并将其提交给相应的税务机关。一旦申请获得批准,系统就会为税务发票等的开具者生成一个 13 个字符的注册号,以“T”开头(随后 12 个字符将是公司登记册上的公司注册证书编号)。

有关申请手续,请查看国税厅网站。

即使是应税销售额不超过 1 亿日元且免征消费税的个体经营者或自由职业者等免税企业经营者,仍然可以注册为税务发票等的开具者。但与此同时,这意味着您需要作为应税企业提交消费税申报表,因此您可以预期税收和行政负担会增加。配套措施等也已经到位,所以如果您正在考虑注册,那么请查看财政部网站:发票系统真的有配套措施吗?

(2) 开具符合要求的发票(税务发票)

在发票系统中,保留发票等的方法已从分类发票保全系统更改为税务发票保全系统,并在要求中增加了注册号、适用税率和按税率分类的消费税等附加信息。有必要在发票中添加新项目,更改布局,并为这个新系统准备会计与发票开具和接收系统。

面向不明确数量的客户经营的零售商、餐馆和出租车公司等也可以开具简化版税务发票:“简化税务发票(简单发票)。”有关详细信息,请参阅国税厅的“税务发票保全系统概述”。

本指南将详细介绍税务发票所需的信息。除了发票保全系统的常规项目类别外,税务发票还需要三个项目。

税务发票保全系统所需的项目(新添加的项目以粗体显示):

(1) 税务发票开具者的姓名或职务和注册号(以“T”开头的 13 个字符的注册号)

(2) 交易日期

(3) 交易明细(享受减免税率的资格)

(4) 按税率(不含税或含税)分类的总金额和适用税率

(5) 按税率等分类的消费税

(6) 文件收件人的姓名或职务

除税务发票外,如果退货,您还有义务开具“退税发票”,如果开具的发票包含错误,则需开具“修改后的税务发票”。

除了开具税务发票外,税务发票等的开具者也有义务保留已开具税务发票的副本。

(3) 发票(税务发票)的保留

作为发票系统中的一项购置税抵免要求,“发票留存”是一个关键点。

卖家必须应买家的要求开具税务发票,并将副本保留一段时间。另一方面,买家原则上也有义务将收到的任何税务发票保留一段时间,以便获得购置税抵免。需要注意的是,从未注册为税务发票等的开具者的卖家处收到的发票不能用于获得购置税抵免。(有关详细信息,请参阅国税厅的“税务发票保全系统概述”。)

虽然我们将解释范围缩小到三个要点,但也有必要考虑进行必要的确认检查所需的任务,例如检查业务合作伙伴的注册状态、确认收到的税务发票是否正确填写以及检查注册号是否正确。

发票系统,由 Stripe 支持

Stripe 提供了一个支付平台,配备了您需要的所有功能。随着发票系统的推出,我们提供了帮助您在管理平台上简单高效地开具发票的方法。我们还支持使用符合修订后的《电子记录保留法》的方法保留发票。

- Stripe Invoicing:Stripe Invoicing 是一款简单的在线创建和发送发票以及用于接收买家及时付款的工具。提供的功能包括发票创建、更改历史记录保留、防止意外删除已开票发票的安全功能、按金额或计费信息搜索的功能等。我们还支持创建税务发票。通过使用 Stripe Invoicing,您可以在管理平台上完成对发票信息的更改,以及创建和保留税务发票。

- Stripe Tax:Stripe Tax 是一种自动对 Stripe 交易征税的工具。Stripe Tax 始终计算并收取正确的税额。它支持数百种产品和服务,并了解最新的税收规则和税率变化。

- Stripe Billing:Stripe Billing 是一种轻松管理订阅、经常性开具发票和按月计费的工具。与 Stripe Invoicing 一样,我们支持创建税务发票,从而允许在管理平台上创建和保留税务发票。

- 易于实施:借助 Stripe Invoicing 和 Stripe Billing,您可以使用 Stripe 在线提供的发票,在几分钟内从管理平台完成创建、自定义和发送发票的过程。它需要零行代码。请访问此处,试用 Stripe 开具发票。

- 如果您不使用 Stripe Invoicing,希望将收据用作简化发票文件(日文为“適格簡易請求書”),您可以遵循我们的指南。

了解如何在税务审计期间提交文件,以及遵守《电子记录保留法》的要求,即使是使用 Stripe 创建和开具的发票以外的电子交易。

有关设置方法的更多信息,请参阅在日本设置发票的最佳做法。

参考:国税厅(网站)。“电子交易。”2023 年 5 月 26 日访问。https://www.nta.go.jp/law/joho-zeikaishaku/sonota/jirei/tokusetsu/01.htm

术语

- 发票(税务发票): 由卖方创建、向买方传达适用税率和确切税额的凭证。仅限经注册的税务发票开具方开具。

- 卖方: 在 B2B 交易中,已收到订单并将开具发票的商品或服务提供商。

- 买方: 在 B2B 交易中,商品或服务的接收者以及发票的接收者。

- 低税率制度: 2019 年 10 月 1 日推出的一种制度,将某些产品的税率设定为低于标准税率。

- 进项税额减免: 缴纳消费税时,是指从“从企业合作伙伴或消费者等处收到的消费税”中减去“购买时支付的消费税”计算得出的税款。

- 税务发票开具方: 经国税厅筛选后,获得注册编号、被认定具备开具税务发票资格的经营者。