Naar schatting worden elk jaar wereldwijd 468 miljard transacties verwerkt. Achter elk van deze transacties, die plaatsvinden wanneer een creditcard wordt gehaald, gescand of aangetikt, zijn er twee verschillende, maar verwante partijen: de uitgevende bank en de ontvangende bank.

Deze financiële instellingen werken achter de schermen om ervoor te zorgen dat er geld voor de aankoop beschikbaar is en om dit geld over te maken van de rekening van de koper naar de verkoper. Ze geven ook geld terug wanneer een terugbetaling nodig is. Hoewel de uitgevende bank en de ontvangende bank zich aan afzonderlijke zijden van een transactie bevinden, werken ze samen om het systeem te laten werken.

We behandelen wat je moet weten over ontvangers en uitgevers, waaronder wat ze zijn, hoe ze werken en wat het verschil tussen beide is.

Wat staat er in dit artikel?

- Wat is een uitgever?

- Wat is een ontvanger?

- Wat is het verschil tussen een ontvanger en een uitgever?

Wat is een uitgever?

De uitgever, ook wel de uitgevende bank of kaartuitgever genoemd, vertegenwoordigt de klant bij een transactie. De uitgevende bank is de financiële instelling die een persoon een betaalkaart verstrekt die wordt gebruikt om een transactie te starten. Een uitgever kan een bank, kredietvereniging of andere financiële instelling zijn.

Chase, Bank of America en Capital One zijn drie van de vijf grootste kaartuitgevers in de VS. Uitgevers kunnen ook lokale financiële instellingen zijn, zoals een regionale bank of een kleine kredietvereniging.

Kaartuitgevers zijn meestal niet Visa, Mastercard, Discovery of American Express. Hoewel deze bedrijven de netwerken leveren die betaalkaarttransacties verwerken, zijn ze niet betrokken bij individuele transacties of betalingen. De uitgever en de ontvanger handelen een bepaalde transactie af.

Bij deze transacties neemt de uitgever het risico op zich van het verstrekken van krediet aan een individu. Uitgevers moeten rekening houden met de kredietwaardigheid van een persoon op basis van een aantal factoren, waaronder kredietscore en financiële geschiedenis. Als een uitgever een klant goedkeurt, geeft deze een kaart uit waarmee de klant toegang heeft tot een kredietlijn.

In wezen zijn deze kredietlijnen leningen die aan de kaarthouder worden verstrekt. Het zijn meestal ongedekte leningen (wat betekent dat de geldschieter niet van de lener verlangt dat hij onderpand of zekerheid verstrekt om de terugbetaling van de lening te garanderen), en de uitgever int rente als leningen niet binnen een bepaalde deadline worden terugbetaald, meestal na 30 of 60 dagen. Als de kaarthouder de oorspronkelijke lening niet kan terugbetalen en in gebreke blijft, wordt de uitgever aansprakelijk voor de schuld en wordt de oorspronkelijke transactie de verantwoordelijkheid van de uitgever.

Uitgevers spelen ook een belangrijke rol bij een chargeback, waarbij een klant een terugvordering aanvraagt voor een betaling en verzoekt om het geld terug te betalen of de transactie te annuleren. In het geval van een terugvorderingsverzoek treedt de verstrekker op als arbiter en bepaalt hij of het verzoek van een consument om een transactie terug te boeken redelijk is. De uitgevende instelling heeft hier niet het laatste woord over, aangezien zijn beslissing kan worden aangevochten, maar de uitgevende instelling bepaalt wel of een terugvordering moet worden gehandhaafd of teruggedraaid.

Wat is een ontvangende partij?

Als we denken dat de uitgever de klant vertegenwoordigt bij de transactie, dan vertegenwoordigt de ontvanger, ook wel de ontavngende bank genoemd, het bedrijf. Ontvangers zijn banken of financiële instellingen die een bedrijf de tools bieden die nodig zijn om betalingen van uitgevers te innen. Ontvangers doen wat hun naam al aangeeft: ze ontvangen het geld van de uitgever en zorgen ervoor dat het op de rekening van het bedrijf wordt gestort, zodat de transactie kan worden verwerkt en voltooid. Ze voorzien het bedrijf ook van een unieke ID waarmee het kan communiceren met kaartnetwerken om deze transacties te voltooien.

Ontvangers fungeren soms als betalingsverwerker, maar meestal fungeren ze als tussenpersoon die ervoor zorgt dat een transactie het juiste kaartnetwerk bereikt en succesvol wordt voltooid. Meestal zijn ze lid van een kaartnetwerk en werken ze vaak met meerdere of alle grote kaartverwerkers. De ontvanger stuurt het geld dat door de uitgever wordt verstrekt naar de juiste rekening van de handelaar. Stripe biedt bijvoorbeeld zowel functies voor betalingsverwerking als voor ontvangers, waardoor bedrijven geen aparte handelaarsaccount of betaalgateway meer hoeven te beveiligen.

Net als uitgevers dragen ontvangers ook enig financieel risico. Zij zijn verantwoordelijk voor het implementeren van beveiligingsnormen die voldoen aan de eisen van de Payment Card Industry Data Security Standards Council. Als hij dit niet doet, verhoogt de aansprakelijkheid van de bank in het geval van een gegevenslek of wanneer informatie of kaarthoudergegevens die worden gestolen en gebruikt voor kwaadaardige doeleinden tijdens een transactie.

Bij een chargeback is de ontvanger aansprakelijk voor het terugbetalen van de uitgever, die het geld terugbetaalt aan de klant. Dit brengt kosten met zich mee voor de ontvanger in verband met de interne middelen die nodig zijn om chargebackverzoeken te beoordelen en af te handelen. Om dit te doen, kan een ontvanger een reserverekening aanhouden van waaruit chargebacks kunnen worden uitgevoerd, of een kredietlijn aanbieden aan het bedrijf om deze kosten te dekken. Als een bedrijf insolvent wordt en niet in staat is de om de ontvanger terug te betalen, moet de ontvanger het verlies accepteren.

Om deze potentiële aansprakelijkheid te beperken, werken ontvangers vaak met strikte normen voor elk bedrijf dat zij vertegenwoordigen. Om in aanmerking te komen, moeten bedrijven een doorlichtingsproces doorlopen dat hun risico beoordeelt, waarna een ontvanger zal beslissen of hij het bedrijf zal vertegenwoordigen.

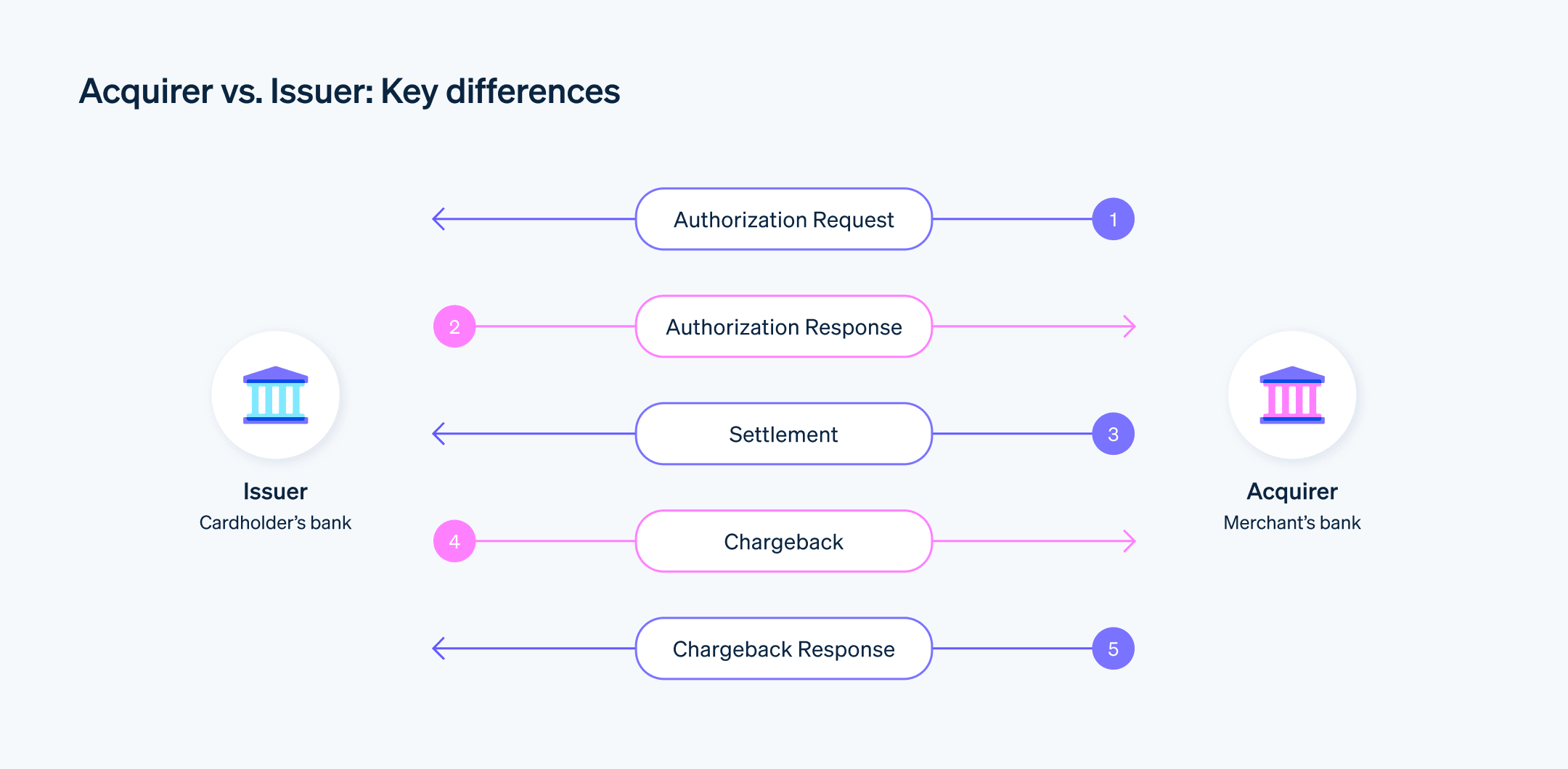

Wat is het verschil tussen een ontvanger en een uitgever?

Uitgevers beheren de debet- of kredietrekeningen van een kaarthouder en bieden kaarthouders toegang tot hun geld of een kredietlijn die kan worden gebruikt om betalingen te doen via een kaarttransactie, terwijl ontvangers dat geld aannemen en op de rekening van een bedrijf storten, terwijl ze transactiegegevens bijhouden en elk autorisatieverzoek doorsturen naar het relevante kaartnetwerk.

Zo werken deze banken samen tijdens een transactie:

- De klant initieert een betaling door met de kaart door de gleuf te halen of erop te tikken bij een POS-terminal (POS), zoals Stripe Terminal.

- De betalingsverwerker van het bedrijf stuurt de transactie-informatie naar de ontvanger, die deze doorstuurt naar de kaartnetwerken.

- De kaartnetwerken verwerken het verzoek en vragen de uitgever of het geld beschikbaar is, wat de uitgever goedkeurt of weigert na onderzoek van de rekeningen van de kaarthouder.

- Die informatie wordt naar het kaartnetwerk gestuurd, dat het goedkeurings- of afwijzingsbericht naar de ontvanger stuurt, die het bedrijf informeert over de status van de transactie.

- Indien goedgekeurd, gaat het geld van de uitgever naar de ontvanger om op de rekening van de handelaar te worden gestort.

Terwijl het bovenstaande voorbeeld een eenmalige, fysieke transactie betreft die plaatsvindt bij een POS terminal, blijft de werkrelatie tussen uitgevers en ontvangers hetzelfde wanneer de transactie terugkerend is, zoals in het geval van een maandelijks abonnement. Deze facturatieopties vereisen ook nauwe communicatie tussen de uitgever en de ontvanger, maar worden automatisch geïnitieerd op basis van een goedgekeurde terugkerende transactie. Een provider zoals Stripe kan deze verschillende soorten factureringsopties voor bedrijven beheren.

In het geval van een chargeback zijn de rollen van de ontvanger en de uitgever omgedraaid. Een kaarthouder dient het verzoek tot terugbetaling in en dient bij de kaartuitgever bewijsmateriaal in dat aantoont dat een terugbetaling moet worden uitgevoerd. De uitgever controleert die informatie en besluit of een chargeback al dan niet wordt verwerkt. Na goedkeuring vraagt de uitgever om teruggave van geld van het bedrijf door de chargeback met de ontvanger te delen. De ontvanger beoordeelt het verzoek en stuurt de chargeback uit, die vervolgens door het bedrijf moet worden betaald, hetzij via een reservefonds dat voor dergelijke kosten beschikbaar is, hetzij via een kredietlijn die door de ontvanger wordt aangeboden.

Kortom, de uitgever (klantgerichte bank) en de ontvanger (handelaargerichte bank) staan aan beide kanten van een transactie, maar werken samen om ervoor te zorgen dat een aankoop of retourzending succesvol wordt verwerkt.

De inhoud van dit artikel is uitsluitend bedoeld voor algemene informatieve en educatieve doeleinden en mag niet worden opgevat als juridisch of fiscaal advies. Stripe verklaart of garandeert niet dat de informatie in dit artikel nauwkeurig, volledig, adequaat of actueel is. Voor aanbevelingen voor jouw specifieke situatie moet je het advies inwinnen van een bekwame, in je rechtsgebied bevoegde advocaat of accountant.